UAE Textile Recycling Market Report by Product Type (Cotton Recycling, Wool Recycling, Polyester and Polyester Fiber Recycling, Nylon and Nylon Fiber Recycling, and Others), Textile Waste (Pre-consumer Textile, Post-consumer Textile), Process (Mechanical, Chemical), End Use (Apparel, Industrial, Home Furnishings, and Others), and Region 2025-2033

UAE Textile Recycling Market Overview:

The UAE textile recycling market size reached USD 26.1 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 36.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.94% during 2025-2033. There are several factors that are driving the market, which include rising production of textiles, changing fashion trends and lifestyles of individuals due to population growth, and favorable government initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.1 Million |

| Market Forecast in 2033 | USD 36.9 Million |

| Market Growth Rate 2025-2033 | 3.94% |

UAE Textile Recycling Market Trends:

Rising Production of Textiles

The growing focus on textile recycling due to the increasing textile production is positively influencing the market. Textile recycling provides a solution by diverting used textiles from landfills and reintroducing them into the production cycle. This helps to offset the environmental impact of overproduction and reduces the need for raw materials. Textile recycling helps conserve various natural resources by extending the lifespan of textiles and lowering the demand for new materials. By recycling textiles, the industry can minimize its ecological footprint and move towards more sustainable production practices. In addition, the focus on textile recycling aligns with the principles of the circular economy, where resources are kept in use for as long as possible through recycling, reuse, and regeneration. Furthermore, with the rising awareness about environmental issues, individuals are seeking out sustainable and eco-friendly products. The focus on textile recycling allows brands to meet user expectations for sustainability while also differentiating themselves in the market. The IMARC Group claims that the GCC textile market size is anticipated to exhibit a growth rate (CAGR) of 5% during 2024-2032.

Changing Living Trends Due to Population Growth

As per Worldometer, there are around 9,585,217 population as of 30 May 2024 in the UAE. Changing fashion trends and lifestyles of individuals due to population growth are catalyzing the demand for textile recycling in the UAE. As the population grows, there is a corresponding shift in user behavior towards more sustainable and responsible consumption practices. Individuals are becoming more conscious about the environmental and social implications of their purchasing decisions, including the impact of clothing production and disposal. This awareness drives demand for sustainable alternatives such as recycled textiles, driving the textile recycling market. Additionally, textile recycling provides a way to cater to diverse fashion tastes while minimizing waste. By recycling textiles, individuals can access a wide range of clothing options, which is contributing to a more diverse and sustainable fashion landscape.

UAE Textile Recycling Market News:

- 8 December 2023: Tadweer, Abu Dhabi waste management company, announced an ‘Integrated Textile Circularity Initiative’ that was established across the UAE. It is designed to increase individuals’ awareness and foster collective efforts among public-private partners throughout the entire value chain. This contributes significantly to the global dialogue on sustainable practices in the textile industry.

- 6 February 2023: TOMRA’s AUTOSORT™ sensor-based sorting technology is helping to recover high-quality, high-purity value recyclates at FARZ, the first automated material recover facility (MRF) in the United Arab Emirates. TOMRA AUTOSORT™ units in each line separate a mixed plastics fraction for further processing into three target fractions, such as three-dimensional (3D) bottles and plastic containers, two-dimensional (2D) film, cardboard, foil and textiles, and fines.

UAE Textile Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, textile waste, process, and end use.

Product Type Insights:

- Cotton Recycling

- Wool Recycling

- Polyester and Polyester Fiber Recycling

- Nylon and Nylon Fiber Recycling

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cotton recycling, wool recycling, polyester and polyester fiber recycling, nylon and nylon fiber recycling, and others.

Textile Waste Insights:

- Pre-consumer Textile

- Post-consumer Textile

A detailed breakup and analysis of the market based on the textile waste have also been provided in the report. This includes pre-consumer textile and post-consumer textile.

Process Insights:

- Mechanical

- Chemical

The report has provided a detailed breakup and analysis of the market based on the process. This includes mechanical and chemical.

End Use Insights:

- Apparel

- Industrial

- Home Furnishings

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes apparel, industrial, home furnishings, and others.

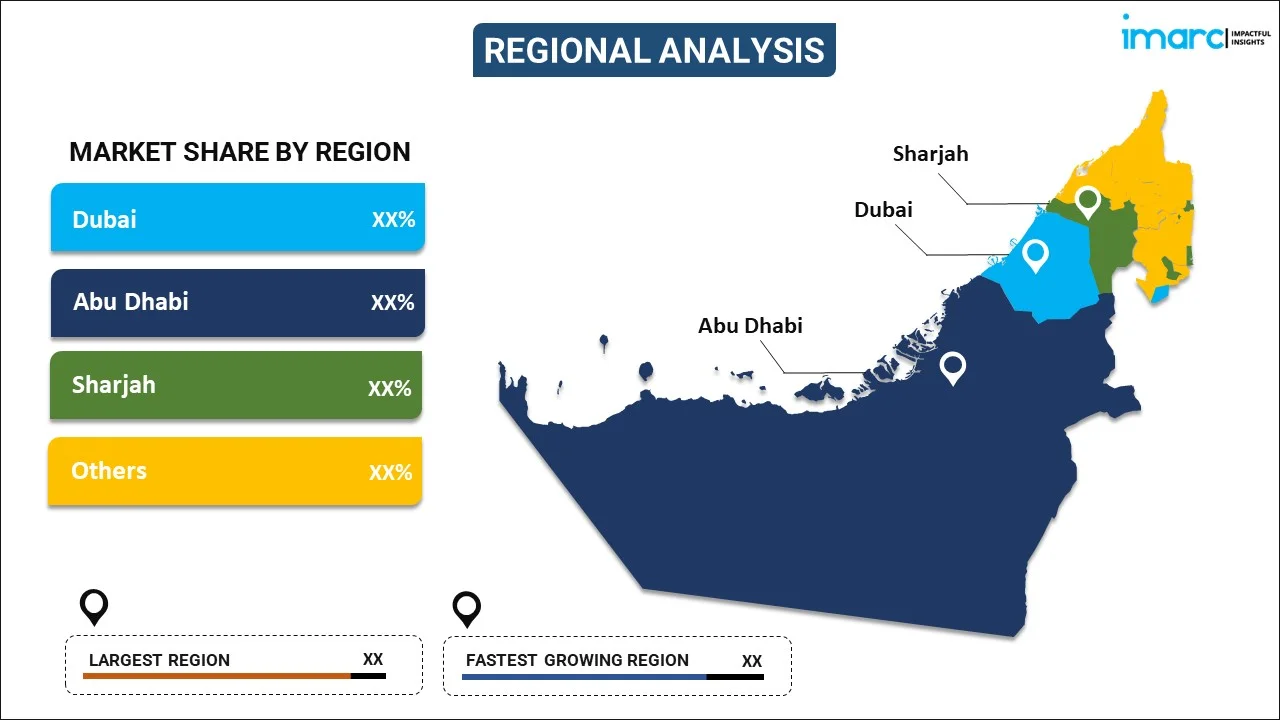

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Textile Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Product Types Covered | Cotton Recycling, Wool Recycling, Polyester and Polyester Fiber Recycling, Nylon and Nylon Fiber Recycling, Others |

| Textile Wastes Covered | Pre-consumer Textile, Post-consumer Textile |

| Process Covered | Mechanical, Chemical |

| End Uses Covered | Apparel, Industrial, Home Furnishings, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE textile recycling market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the UAE textile recycling market?

- What is the breakup of the UAE textile recycling market on the basis of product type?

- What is the breakup of the UAE textile recycling market on the basis of textile waste?

- What is the breakup of the UAE textile recycling market on the basis of process?

- What is the breakup of the UAE textile recycling market on the basis of end use?

- What are the various stages in the value chain of the UAE textile recycling market?

- What are the key driving factors and challenges in the UAE textile recycling?

- What is the structure of the UAE textile recycling market and who are the key players?

- What is the degree of competition in the UAE textile recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE textile recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE textile recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE textile recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)