UAE Toys Market Size, Share, Trends and Forecast by Product Type, Age Group, Sales Channel, and Region, 2025-2033

UAE Toys Market Overview:

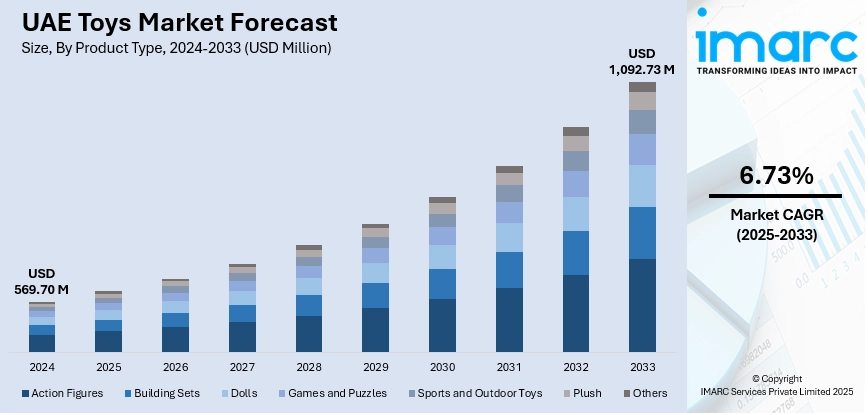

The UAE toys market size reached USD 569.70 Million in 2024. Looking forward, the market is expected to reach USD 1,092.73 Million by 2033, exhibiting a growth rate (CAGR) of 6.73% during 2025-2033. The market is driven by rising disposable incomes, growing demand for educational and tech-based toys, and expanding population of young families. E-commerce growth and the presence of global toy brands further enhance product accessibility and variety. These trends collectively contribute to evolving consumer preferences and competitive dynamics, fueling the overall UAE toys market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 569.70 Million |

| Market Forecast in 2033 | USD 1,092.73 Million |

| Market Growth Rate 2025-2033 | 6.73% |

UAE Toys Market Trends:

Rising Disposable Income and Growing Youth Population

The UAE's high per capita income and stable economic environment contribute significantly to increased spending on children's toys. Families are more willing to invest in premium, branded, and educational products that offer greater value. This demand is further driven by the growing population of young families and children, which makes the toy industry one of the most vibrant consumer markets in the country. Moreover, the large expatriate population creates variety in tastes, and retailers should stock all types of toys. Quality and safety are becoming the primary focus of parents, both in the local and expat communities, which is opening the door to introducing innovative products. The combination of this population and financial prowess boosts the demand and promotes the long-term development of the UAE toys market.

To get more information on this market, Request Sample

Growing Demand for Educational and Technology-Based Toys

UAE parents are increasingly prioritizing toys that promote learning, creativity, and skill development. Educational toys, especially those that focus on STEM (science, technology, engineering, and mathematics), are gaining strong traction. These are coding kits, robotics, puzzles, and science sets that allow children to develop logical thinking and problem-solving. Moreover, augmented reality (AR), artificial intelligence (AI), and app-connectivity are becoming increasingly popular as they appeal to the tech-forward families. This trend is also facilitated by schools and early learning centers, which use such toys in learning programs. This growing focus on development-based play, driven by tech integration and academic value, plays a central role in shaping purchasing decisions and is a key factor driving the UAE toys market growth.

Expansion of E-commerce and Global Toy Brand Presence

The rapid rise of e-commerce and the strong presence of international toy brands are major contributors to the UAE toys market's growth. Online platforms like Amazon UAE, FirstCry, and Mumzworld offer extensive toy selections with easy access, home delivery, and seasonal discounts, attracting busy urban families. Simultaneously, renowned global brands such as LEGO, Hasbro, and Mattel are strengthening their presence in physical stores and malls through branded outlets and franchise partnerships. The combination of online convenience and in-store experience allows consumers to explore and compare options easily. Retailers are also adopting omnichannel strategies to improve customer engagement. This dual growth in digital and physical retail has increased product visibility, accessibility, and competitiveness, key drivers in expanding the UAE toys market share.

UAE Toys Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and sales channel.

Product Type Insights:

- Action Figures

- Building Sets

- Dolls

- Games and Puzzles

- Sports and Outdoor Toys

- Plush

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes action figures, building sets, dolls, games and puzzles, sports and outdoor toys, plush, and others.

Age Group Insights:

- Up to 5 Years

- 5 to 10 Years

- Above 10 Years

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes up to 5 years, 5 to 10 years, and above 10 years.

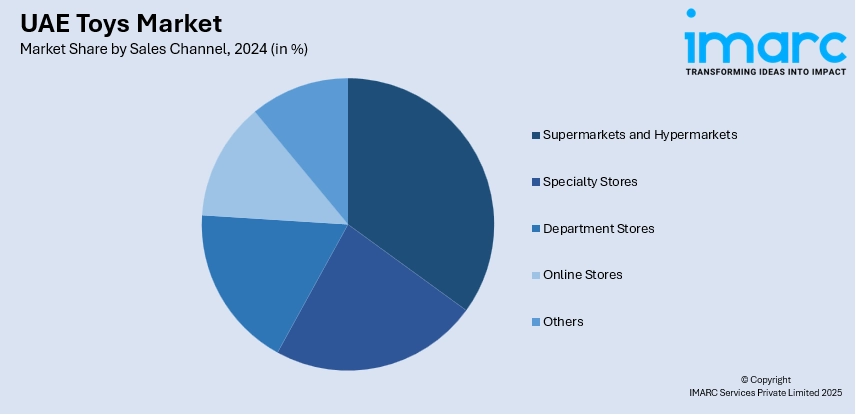

Sales Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Department Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, department stores, online stores, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Toys Market News:

- In April 2025, Teddy Mountain, the creator of the popular “Make-A-Bear” customizable plush toys, is strengthening its international footprint by launching a new outlet in the UAE. The brand, known for its interactive stuffed animal experience, is also inviting regional partners to explore its comprehensive product range. Beyond the store opening, Teddy Mountain will be showcasing its offerings at the upcoming Dubai Entertainment, Amusement, and Leisure (DEAL) Show, scheduled from April 8–10 at the Dubai World Trade Center (Stand Z5-186).

- In August 2024, UAE-headquartered retailer Brands For Less, known for its offerings in fashion, homeware, and toys, agreed to sell a 35% stake to TJX Companies. The deal, which places the company’s valuation at $1.2 billion, is set to strengthen BFL’s strategic direction. Through this collaboration, the retailer aims to leverage the expertise of the U.S.-based department store giant as it plans to expand its footprint beyond the Gulf Cooperation Council region.

UAE Toys Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Action Figures, Building Sets, Dolls, Games and Puzzles, Sports and Outdoor Toys, Plush, Others |

| Age Groups Covered | Up to 5 Years, 5 to 10 Years, Above 10 Years |

| Sales Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Department Stores, Online Stores, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE toys market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE toys market on the basis of product type?

- What is the breakup of the UAE toys market on the basis of age group?

- What is the breakup of the UAE toys market on the basis of sales channel?

- What is the breakup of the UAE toys market on the basis of region?

- What are the various stages in the value chain of the UAE toys market?

- What are the key driving factors and challenges in the UAE toys market?

- What is the structure of the UAE toys market and who are the key players?

- What is the degree of competition in the UAE toys market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE toys market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE toys market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE toys industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)