UAE Vegetable Oil Market Size, Share, Trends and Forecast by Oil Type, Application, and Region, 2025-2033

UAE Vegetable Oil Market Overview:

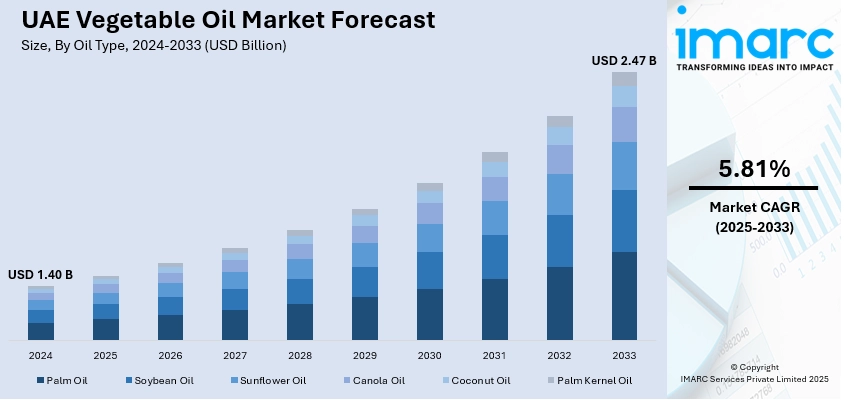

The UAE vegetable oil market size reached USD 1.40 Billion in 2024. Looking forward, the market is projected to reach USD 2.47 Billion by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033. The market is driven by robust consumption in the processed food and hospitality sectors, fueled by diverse culinary preferences and institutional demand. Strategic refining hubs and strong import infrastructure support both domestic stability and regional re-export capacity. Expanding industrial applications in cosmetics, wellness, and green fuel are further augmenting the UAE vegetable oil market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.40 Billion |

| Market Forecast in 2033 | USD 2.47 Billion |

| Market Growth Rate 2025-2033 | 5.81% |

UAE Vegetable Oil Market Trends:

Expanding Packaged Food Industry and Multicultural Dietary Needs

The UAE’s rapidly growing packaged food industry, driven by a multicultural consumer base and high per capita income, is a significant contributor to edible oil demand. Vegetable oils, especially sunflower, palm, corn, and soybean, are widely used in snacks, bakery items, frozen meals, and instant noodles. The country’s population diversity requires oils compatible with Arab, South Asian, Filipino, and Western cuisines, making versatility essential. Food manufacturers prioritize neutral-tasting, high-stability oils for consistent performance across diverse applications. Additionally, rising demand for Halal-certified and clean-label foods encourages sourcing of traceable, non-GMO oils that comply with religious and health requirements. Large-scale institutional kitchens, including hotels, airlines, and labor camps, also consume bulk cooking oils in high volumes for deep frying and sautéing. Domestic refineries and distributors are strengthening relationships with retail and foodservice buyers by offering custom blends and fortified variants. The growing demand for vegetable oils in the UAE is not just a result of domestic consumption but is also reflected in its expanding role in international markets. In 2023, EU imports of vegetable oils from the UAE reached €22 million, accounting for 27.7% of total agri-food imports. The trade saw a sharp increase in 2024, with imports surging by 107.2% to €45 million, highlighting growing demand for UAE vegetable oils in the EU market. This international growth aligns with the UAE's domestic shift toward more diverse and health-conscious oil options, further boosting its market presence. As health consciousness grows among UAE residents, consumer interest in canola and sunflower oils is increasing in the retail segment. This combination of industrial-scale demand and health-aligned consumer preference is a central pillar supporting UAE vegetable oil market growth across both B2B and B2C channels.

To get more information on this market, Request Sample

Heavy Import Reliance and Strategic Refining Infrastructure

The UAE imports nearly all its raw vegetable oil, primarily from Indonesia, Malaysia, Ukraine, and Argentina. According to recent industry reports, the United Arab Emirates imported 0.22 million tons of vegetable oil from Indonesia between January and August 2023, with Malaysia following at 52,800 tons. Overall imports reached 0.27 million tons during the same period. To reduce supply risk and enhance domestic value addition, local companies have invested in large-scale refining and bottling infrastructure at port-based industrial zones like Jebel Ali and Khalifa Industrial Zone Abu Dhabi (KIZAD). These integrated facilities enable the UAE to receive crude oils in bulk and refine, package, or re-export them across the GCC and MENA region. Companies such as IFFCO and United Foods maintain dedicated berths, storage tanks, and refining plants designed for palm, soybean, and sunflower oil processing. This import–refine–redistribute model supports both domestic consumption and regional trade leadership. The UAE’s logistics strength, regulatory clarity, and free zone benefits make it a strategic location for edible oil trade. Government support for food security, through initiatives like the National Food Security Strategy 2051, further encourages private sector investment in oil storage, blending, and supply continuity. These efforts ensure market resilience during global disruptions, while also enhancing the UAE’s role as a hub for value-added food processing. The country's infrastructure advantage is thus central to ensuring stable and efficient edible oil distribution.

UAE Vegetable Oil Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on oil type and application.

Oil Type Insights:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

The report has provided a detailed breakup and analysis of the market based on the oil type. This includes palm oil, soybean oil, sunflower oil, canola oil, coconut oil, and palm kernel oil.

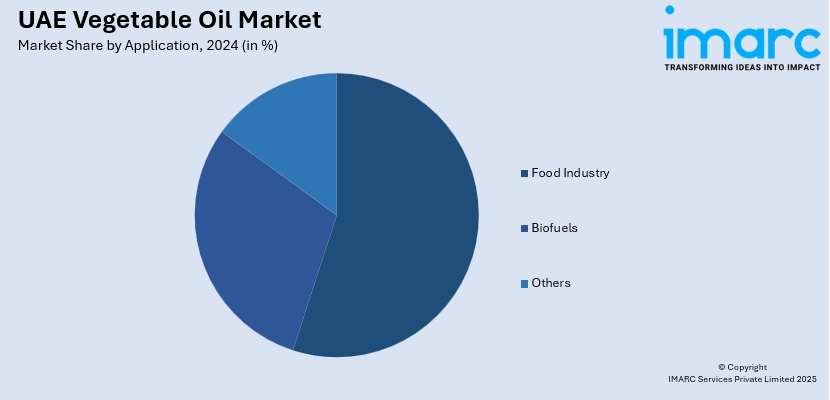

Application Insights:

- Food Industry

- Biofuels

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food industry, biofuels, and others.

Regional Insights:

- Dubai

- Abu Dhabi

- Sharjah

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Dubai, Abu Dhabi, Sharjah, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UAE Vegetable Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Oil Types Covered | Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil |

| Applications Covered | Food Industry, Biofuels, Others |

| Regions Covered | Dubai, Abu Dhabi, Sharjah, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UAE vegetable oil market performed so far and how will it perform in the coming years?

- What is the breakup of the UAE vegetable oil market on the basis of oil type?

- What is the breakup of the UAE vegetable oil market on the basis of application?

- What is the breakup of the UAE vegetable oil market on the basis of region?

- What are the various stages in the value chain of the UAE vegetable oil market?

- What are the key driving factors and challenges in the UAE vegetable oil market?

- What is the structure of the UAE vegetable oil market and who are the key players?

- What is the degree of competition in the UAE vegetable oil market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UAE vegetable oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UAE vegetable oil market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UAE vegetable oil industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)