UHT Milk Market in India Market Size, Share, Trends and Forecast by Sales Channel and Region, 2025-2033

UHT Milk Market Size and Share:

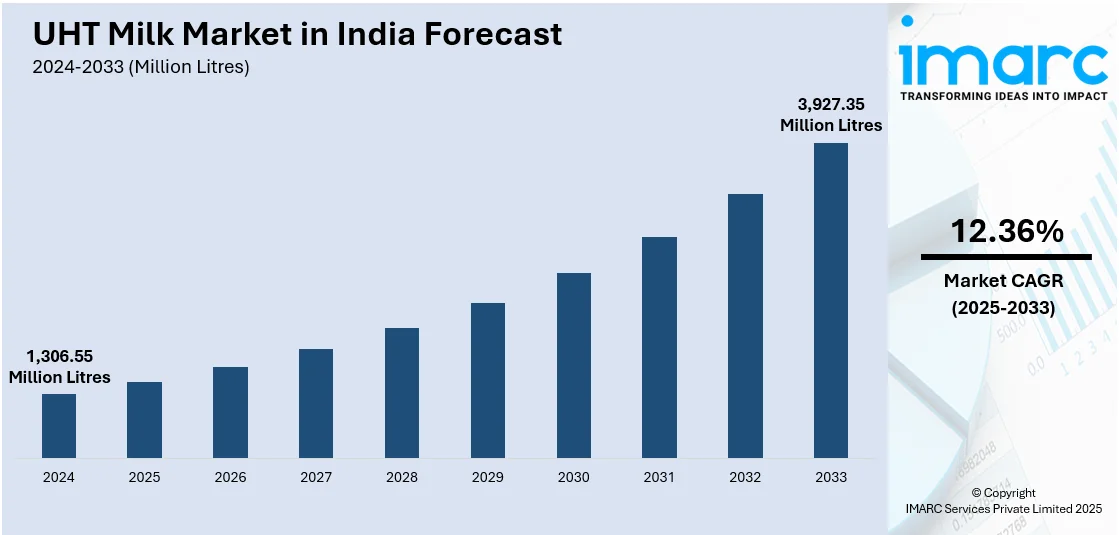

The UHT milk market in India market size was valued at 1,306.55 Million Litres in 2024. Looking forward, IMARC Group estimates the market to reach 3,927.35 Million Litres by 2033, exhibiting a CAGR of 12.36% from 2025-2033. The UHT milk market in India is driven by rising urbanization, increasing demand for convenient dairy products, and improved cold chain infrastructure. Growing health awareness, longer shelf life, and expanding retail distribution channels further support market growth. Additionally, rising disposable incomes and changing consumer lifestyles contribute to the increasing adoption of UHT milk.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

1,306.55 Million Litres |

|

Market Forecast in 2033

|

3,927.35 Million Litres |

| Market Growth Rate (2025-2033) | 12.36% |

India's rapid urbanization has profoundly influenced consumer habits, driving Ultra-High Temperature (UHT) milk demand. With more individuals moving into cities, leading busy lives, and having reduced family sizes, consumers are turning to convenient foods that require minimal storage and preparation. UHT milk's shelf life makes minimal refrigeration required until the pack is opened, making it an ideal product for city consumers. The rise of working professionals and nuclear families has further consolidated the call for easy-to-use dairy foods. Moreover, augmented availability of UHT milk from modern retail channels, e-commerce websites, and fast commerce channels has further spur its market penetration.

To get more information on this market, Request Sample

Rising India's cold chain infrastructure and modern retail networks has greatly stimulated the UHT milk market. Improved storage and transport infrastructure guarantee effective distribution of dairy products to urban and semi-urban areas. Supermarkets, hypermarkets, and online grocery stores make UHT milk easily accessible, enhancing market coverage. E-commerce has been instrumental in boosting sales, with doorstep delivery and bulk buying facilities. Moreover, intensive marketing campaigns and promotional activities by dairy companies have enhanced consumer awareness, further boosting demand. With improving logistics and supply chains, the availability and affordability of UHT milk will increase.

UHT Milk Market in India Market Trends:

Rising Consumer Preference for Long-Shelf-Life Dairy Products

Indian consumers are increasingly showing a preference for long-shelf-life dairy foods because of lifestyle changes and altering consumption habits. UHT milk, which does not require refrigeration until the time of opening and possesses a months-long shelf life, is increasingly being sought after as a first choice by homemakers, students, and working professionals. Convenience is the reason for this change, especially in urban settings where shopping at short intervals might not be feasible. In addition, rural areas with limited cold storage facilities are also adopting UHT milk as a convenient alternative to fresh milk. Increasing concern about food wastage and cost savings also contributes to the trend, as consumers choose products that reduce wastage while maintaining nutritional value and taste.

Expansion of E-Commerce and Quick Commerce Channels

Indian health-conscious consumers are driving growth for fortified and premium UHT milk variants with added nutritional benefits. Dairy players are introducing variants that are vitamin-, mineral-, and immunity-enhancing to cater to this segment. Lactose-free UHT milk is also gaining popularity among sufferers of dairy intolerance. Organic and A2 UHT milk are also being sought by consumers, who perceive them as healthier than normal variants. With rising disposable incomes and heightened awareness towards food selection, premiumization of the UHT milk segment is being a significant trend that is urging firms to innovate and introduce value-added dairy products in India.

Increasing Demand for Fortified and Premium UHT Milk Variants

Indian health-conscious consumers are propelling demand for fortified and premium UHT milk variants that provide enhanced nutritional value. Dairy companies are launching variants fortified with vitamins, minerals, and immunity-enhancing ingredients to appeal to this category. Lactose-free UHT milk is also picking up among dairy intolerance sufferers. Organic and A2 UHT milk are also of interest to consumers, who see them as healthier options compared to regular variants. With increasing disposable incomes and an enhanced consciousness towards food choices, premiumization of the UHT milk category is emerging as an important trend that is prompting companies to innovate and launch value-added dairy offerings in India.

UHT Milk Market in India Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UHT milk market in India market, along with forecasts at the country levels from 2025-2033. The market has been categorized based on sales channel.

Analysis by Sales Channel:

- Retail Sector

- Institutional Sector

The retail industry tops the market position for UHT milk in India with its robust distribution network and growing consumer attraction to packaged milk products. Easy access through supermarkets, hypermarkets, and convenience stores facilitates comprehensive availability in both urban and semi-urban areas. The sharp growth of e-commerce and speed commerce platforms fortifies retail control even further with doorstep delivery as well as subscription-based milk facilities. Moreover, contemporary retail formats enable brand exposure, promotional events, and price competitiveness, drawing more consumers. The increasing trend towards packaged, long shelf-life dairy foods, fueled by hectic lifestyles and nuclear families, boosts retail sales. With increasing organized retail, the market is driven further with a steady supply and convenience for the consumers.

Regional Insights:

- Karnataka

- Maharashtra

- Tamil Nadu

- Delhi

- Gujarat

- Andhra Pradesh and Telangana

- Uttar Pradesh

- West Bengal

- Kerala

- Haryana

- Punjab

- Rajasthan

- Madhya Pradesh

- Bihar

- Orissa

Karnataka has the largest market share of the UHT milk market in India because it has a well-established dairy sector, high rates of urbanization, and rising consumer demand for packaged milk. The state also has a good dairy infrastructure facilitated by cooperative and private sector developments that provide reliable milk production and supply. Bengaluru, being a large metropolitan city, is the prime driver of demand for UHT milk owing to its sizeable working population, increasing nuclear families, and affinity for easy-to-use, long-shelf-life dairy products. Moreover, the growth in modern retail, e-commerce, and quick commerce platforms in Karnataka increases product reach. Increasing health awareness and popularity of fortified dairy variants also boost market growth, making Karnataka the prime driver of the country's UHT milk market.

Competitive Landscape:

Indian UHT milk is a competitive market, with a mix of large dairy brands, regional companies, and private labels of retail chains. Players' competition is driven by product innovation, pricing strategies, and channels of distribution. Diversification for the brands involves introducing fortified variants, organic, and lactose-free varieties to suit changing consumers' preferences. Increasing e-commerce and fast commerce platforms have added to the competition, facilitating wider reach and convenience. Marketing efforts, including online marketing and in-store promotions, play a crucial role in brand positioning. Firms also focus on enhancing cold chain logistics and packaging innovations to enhance product shelf life and consumer pull, making the market dynamic and fast-paced.

The report provides a comprehensive analysis of the competitive landscape in the UHT Milk Market in India market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Hatsun Agro Product Ltd (HAP) purchased Milk Mantra Dairy and its 'Milky Moo' brand for ₹233 crore to strengthen its market position in Eastern India. It improves HAP's market share, distribution infrastructure, and Odisha processing strengths. Milk Mantra's entrepreneur, Srikumar Misra, described it as a strategy to scale up innovation, where HAP leadership would drive added value for the farmer and the consumer.

- In March 2024, Heritage Foods inaugurated a new UHT milk plant in Sampanbole Village, Shamirpet Mandal, Medchal District, Telangana, featuring advanced SIG packaging technology. The facility will produce UHT milk, flavored lassi, milkshakes, rich cold coffee, refreshing buttermilk, and a whey-based energy drink. With SIG’s flexible filling system, the plant can manufacture nine SKUs ranging from 80 to 200ml, catering to diverse consumer preferences and price segments.

UHT Milk Market in India Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Litres |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sales Channels Covered | Retail Sector, Institutional Sector |

| Regions Covered | Maharashtra, Uttar Pradesh, Andhra Pradesh and Telangana, Tamil Nadu, Gujarat, Rajasthan, Karnataka, Madhya Pradesh, West Bengal, Bihar, Delhi, Kerala, Punjab, Orissa, Haryana |

| Companies Covered | MRF Limited, CEAT Limited, JK Tyre & Industries Ltd. and Apollo Tyres Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UHT milk market in India market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UHT milk market in India market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UHT milk market in India industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market

Key Questions Answered in This Report

The UHT Milk Market in India market was valued at 1,306.55 Million Litres in 2024.

The UHT milk market in India market was valued at 3,927.35 Million Litres in 2033 exhibiting a CAGR of 12.36% during 2025-2033.

The growth of the UHT milk market in India is driven by increasing urbanization, demand for convenience, and expanding retail and e-commerce channels. Rising health awareness, preference for long-shelf-life dairy products, and improved cold chain infrastructure further support market expansion. Additionally, innovations in fortified and premium milk variants boost consumer demand.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)