UK Animal Health Market Size, Share, Trends and Forecast by Animal Type, Product Type, and Region, 2025-2033

UK Animal Health Market Overview:

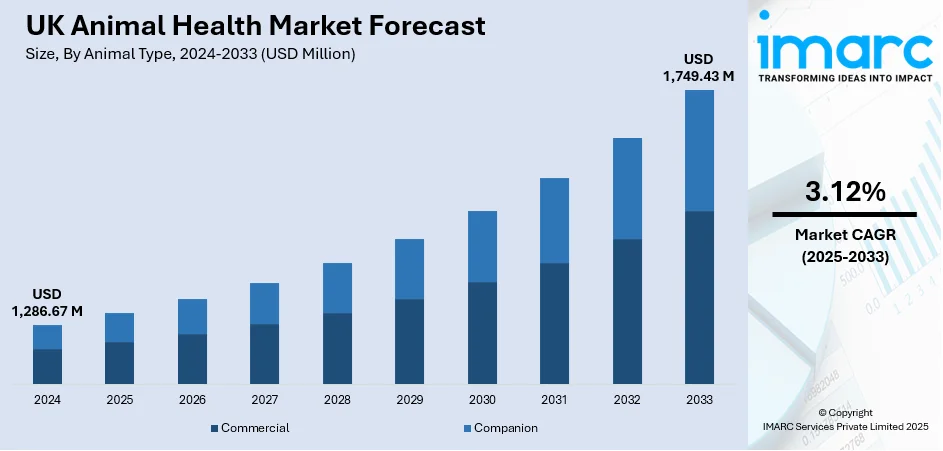

The UK animal health market size reached USD 1,286.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,749.43 Million by 2033, exhibiting a growth rate (CAGR) of 3.12% during 2025-2033. At present, demand for veterinary services, pet medicines, and health supplements is growing. Moreover, research and development (R&D) in veterinary medicine through technology for launching new vaccines, diagnostic equipment, and treatment modalities are supporting the market growth. Apart from this, the rising emphasis on animal welfare and ethical treatment is expanding the UK animal health market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,286.67 Million |

| Market Forecast in 2033 | USD 1,749.43 Million |

| Market Growth Rate 2025-2033 | 3.12% |

UK Animal Health Market Trends:

Growing Demand for Pet Ownership and Veterinary Services

The UK animal health industry is being influenced considerably by the growing preference for having pets. With more people and households taking in pets, especially dogs and cats, the demand for veterinary services, pet medicines, and health supplements is growing. Pet parents are becoming increasingly aware about their pets' health, and they are opting for regular check-ups, vaccination, and treatment for chronic diseases. This trend is driving the need for comprehensive pet healthcare services, such as pet pharmacies and wellness products. Pet parents are also choosing preventive interventions, such as vaccination, flea and tick management, and dietary supplements. Pet insurance is also on the rise due to increasing awareness, which is catalyzing the demand for animal health services and products. The presence of these factors is creating a strong backdrop for the development of the UK animal health market. As per an article by GlobalPETS, in 2024, 60% of households in Britain had non-aquatic pets, amounting to 17.2 million homes and 36 million pets. London topped pet ownership, with 46% of households owning a dog and 44% a cat. This heightened pet-parenting tendency among the masses further increased the need for proper veterinary services.

To get more information on this market, Request Sample

Veterinary Medicine and Technology Advances

Advances in veterinary medicine through technology are supporting the UK animal health market growth. Continued research and development (R&D) in the industry are culminating in the launching of new vaccines, diagnostic equipment, and treatment modalities, which are increasing the efficacy of animal healthcare. Innovations like telemedicine, wearable health monitors, and advanced diagnostic imaging are revolutionizing veterinary practice. These technologies are facilitating faster, more precise diagnoses and customized treatments for animals, leading to better overall health outcomes. The coupling of artificial intelligence (AI) and data analytics is also improving predictive health modeling and treatment planning, resulting in improved disease management. Veterinary experts are embracing these instruments in order to enhance the effectiveness of care, as well as offer a better quality of service to pet parents. Through this, these innovations are propelling the need for advanced veterinary services and defining the future of the UK animal health market. In 2025, Dial A Vet, Australia’s premier telehealth veterinary service, entered Canada, the USA, and the UK, offering affordable, expert pet care to pet owners globally. With a cost of $49 CAD, $35 USD, and £30 GBP for each consultation, this launch provided round-the-clock access to top-notch Australian veterinarians at a significantly lower price than conventional rates.

Increasing Emphasis on Animal Welfare and Ethical Standards

The growing emphasis on animal welfare and ethical treatment is impacting the UK animal health sector. There is an increase in awareness among the public about the ethical treatment of animals, and people are increasingly giving importance to humane methods of treating animals in companion animal and livestock farming. This change is driving the demand for cruelty-free products, organic feeds, and medicines that are sustainably produced. The government of the UK is also enacting tighter animal welfare standards, promoting the use of products and methods that are high on ethics. In addition to this, there is a rise in demand for natural and holistic methods in animal health, which is encouraging companies to research and apply alternative therapies like herbal medicine, probiotics, and homeopathic. These trends are impacting the behavior of people, as pet parents and farmers similarly demonstrate a greater inclination toward products consistent with their values.

UK Animal Health Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on animal type and product type.

Animal Type Insights:

- Commercial

- Companion

The report has provided a detailed breakup and analysis of the market based on the animal type. This includes commercial and companion.

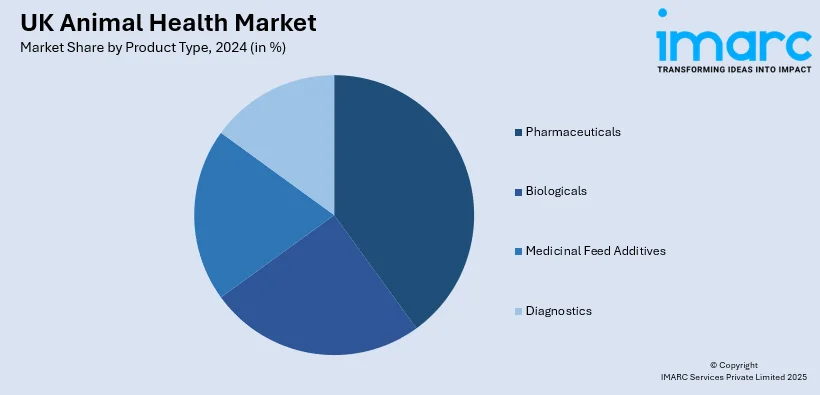

Product Type Insights:

- Pharmaceuticals

- Biologicals

- Medicinal Feed Additives

- Diagnostics

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes pharmaceuticals, biologicals, medicinal feed additives, and diagnostics.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Animal Health Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Animal Types Covered | Commercial, Companion |

| Product Types Covered | Pharmaceuticals, Biologicals, Medicinal Feed Additives, Diagnostics |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK animal health market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK animal health market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK animal health industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK animal health market was valued at USD 1,286.67 Million in 2024.

The UK animal health market is projected to exhibit a CAGR of 3.12% during 2025-2033, reaching a value of USD 1,749.43 Million by 2033.

The UK animal health market is driven by growing pet ownership, increased spending on veterinary care, and rising awareness about animal welfare. Advances in diagnostics, vaccines, and preventive treatments also support market growth. Livestock health management and demand for high-quality animal products further contribute to expanding healthcare solutions across the sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)