UK ATM Market Size, Share, Trends and Forecast by Solution, Screen Size, Application, ATM Type, and Region, 2026-2034

UK ATM Market Overview:

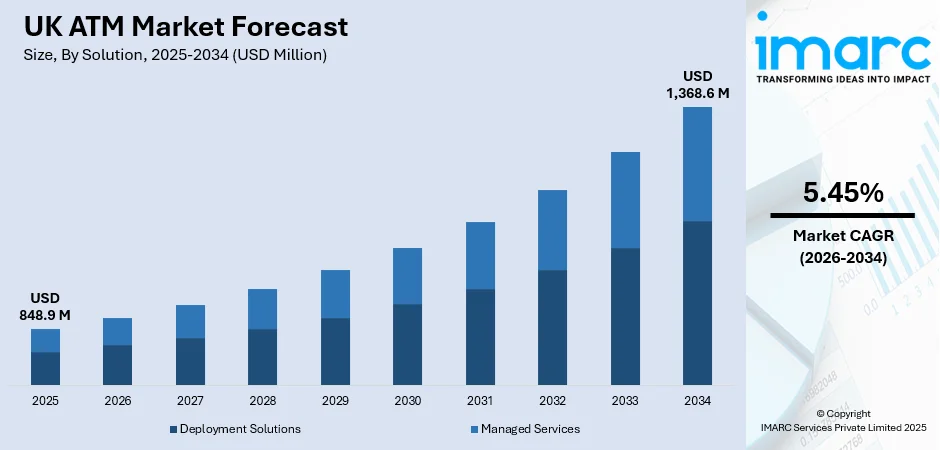

The UK ATM market size reached USD 848.9 Million in 2025. The market is projected to reach USD 1,368.6 Million by 2034, exhibiting a growth rate (CAGR) of 5.45% during 2026-2034. The market is adapting to digital trends, with increased adoption of contactless features, mobile wallet integration, and cash recycling technologies. Although cash usage is declining, ATMs remain essential in rural and underserved communities. Independent ATM deployers are expanding their footprint as traditional banks reduce branch networks. Regulatory efforts are focused on maintaining access to cash while encouraging innovation. As a result, competition and consolidation are shaping the UK ATM market share across both bank-operated and independent networks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 848.9 Million |

| Market Forecast in 2034 | USD 1,368.6 Million |

| Market Growth Rate 2026-2034 | 5.45% |

UK ATM Market Trends:

Strengthening Cash Accessibility with Regulatory Support

While digital payments dominate many transactions, cash remains an essential part of daily life in the UK, particularly for vulnerable and older populations. In 2024, consumers still withdrew close to £80 billion from ATMs, highlighting cash’s enduring role. Recognizing this, UK regulators introduced updated guidelines and mandates in September 2024, requiring banks and ATM operators, including LINK, to assess community cash access before closing any facilities. This led to a steady rollout of shared “banking hubs” across the country, with over 160 operational hubs by the end of 2024, hosted in local Post Offices and community centers. These hubs offer full banking services, including free-to-use ATMs, staffed teller services, and financial advice, ensuring cash remains easily accessible even as traditional branches decline. Remote monitoring tools enhance ATM uptime and security. This government-backed approach continues to play a critical role in UK ATM market growth, supporting financial inclusion and preserving equitable access to physical currency.

To get more information on this market, Request Sample

Growth of Contactless and Cardless ATM Withdrawals

ATMs in the UK are undergoing a major shift toward contactless and cardless withdrawal options to align with evolving consumer preferences. In late 2023 and through 2024, LINK began widely enabling NFC “tap-and-go” cash withdrawals at ATMs allowing users to conveniently withdraw cash using smartphones, wearables, or contactless cards without needing a PIN in many cases. The adoption of cardless withdrawals, facilitated by mobile banking apps that generate secure one-time codes, further reduces dependence on physical cards and enhances transaction security. This evolution mirrors broader payment trends: as of mid-2024, digital wallets were used by around one-third of UK adults monthly, while contactless transactions including mobile and card accounted for more than 50% of all payment volumes. ATM operators are also deploying real-time fraud detection and biometric safeguards to ensure secure contactless transactions. As contactless ATM functionality spreads beyond metropolitan centers, this seamless blend of digital convenience and cash access is becoming a central pillar of UK ATM market trends, reinforcing both modernization and consumer trust across service channels.

Expansion of Multi-Bank Deposit “Super‑ATMs”

In 2024, the UK witnessed the rollout of “super‑ATMs” advanced terminals enabling customers from multiple banks to deposit and withdraw cash, change PINs, and check balances in underserved areas. By June 2024, the first pilot machines had been launched in towns such as Atherstone, Swanage, and Heathfield, offering fee-free services across major banking networks and responding to widespread branch closures. Supported by industry-wide collaboration and guidance from Cash Access UK and LINK, these multi-bank endpoints are typically located within supermarkets and high-footfall community locations. Beyond deposits and withdrawals, they reinforce the integrity of the cash ecosystem by providing access to services that reflect wider banking hub models. Installed alongside banking hubs, these machines help maintain essential services where physical branches have disappeared. With a full deployment of over 100 machines planned by the end of 2024, super‑ATMs are emerging as a key pillar of UK ATM market reinforcing financial inclusion while modernizing the ATM landscape.

UK ATM Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on solution, screen size, application, and ATM type.

Solution Insights:

- Deployment Solutions

- Onsite ATMs

- Offsite ATMs

- Work Site ATMs

- Mobile ATMs

- Managed Services

The report has provided a detailed breakup and analysis of the market based on the solution. This includes deployment solutions (onsite ATMs, offsite ATMs, work site ATMs, and mobile ATMs) and managed services.

Screen Size Insights:

- 15" and Below

- Above 15"

A detailed breakup and analysis of the market based on the screen size have also been provided in the report. This includes 15" and below and above 15".

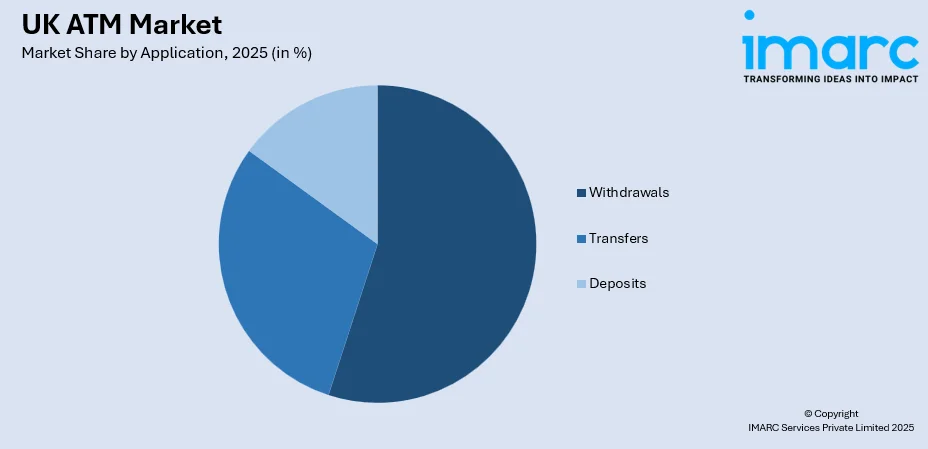

Application Insights:

- Withdrawals

- Transfers

- Deposits

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes withdrawals, transfers, and deposits.

ATM Type Insights:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

A detailed breakup and analysis of the market based on the ATM type have also been provided in the report. This includes conventional/bank ATMs, brown label ATMs, white label ATMs, smart ATMs, and cash dispensers.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK ATM Market News:

- June 2024: NCR Atleos has launched the UK’s first multi‑bank ATM cash‑deposit service, debuting at a Co‑op Food store in Ormskirk and joining the LINK network. The rollout continues to Dover, Heathfield, Swanage, and additional UK locations in the coming weeks. As bank branches close, this initiative ensures communities retain vital access to cash deposits and withdrawals across major retailers. Connected to Britain’s national ATM infrastructure, the service enhances convenience for consumers needing after‑hours cash services.

- September 2024: British supermarket chain Sainsbury’s has sold its ATM business, comprising approximately 1,370 machines, to NoteMachine, a subsidiary of Brink’s, as part of its strategy to streamline banking operations and reduce costs. The deal, expected to close by May 2025, ensures all ATMs will remain in their current locations and continue offering free cash access. Sainsbury’s will retain a share of commission income under a long-term partnership. This move aligns with the company’s ongoing exit from core banking to enhance its focus on its retail business.

UK ATM Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Solutions Covered |

|

| Screen Sizes Covered | 15" and Below, Above 15" |

| Applications Covered | Withdrawals, Transfers, Deposits |

| ATM Types Covered | Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK ATM market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK ATM market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK ATM industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ATM market in the UK was valued at USD 848.9 Million in 2025.

The UK ATM market is projected to exhibit a CAGR of 5.45% during 2026-2034, reaching a value of USD 1,368.6 Million by 2034.

Regulatory support maintaining cash accessibility for vulnerable populations, rollout of shared banking hubs, increased adoption of contactless and cardless withdrawal features, NFC tap-and-go functionality, mobile wallet integration, expansion of multi-bank deposit "super-ATMs" in underserved areas, and independent ATM deployer expansion are driving the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)