UK Banking as a Service Market Size, Share, Trends and Forecast by Component, Product Type, Enterprise Size, End-User, and Region, 2025-2033

UK Banking as a Service Market Size and Share:

The UK banking as a service market size reached USD 1.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.14 Billion by 2033, exhibiting a growth rate (CAGR) of 12.60% during 2025-2033. The growing need for embedded finance because more businesses aim to offer financial services as part of their client experience, an enhanced focus on improved compliance and risk management, and increasing incorporation of advanced payment technologies are some of the factors impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.10 Billion |

| Market Forecast in 2033 | USD 3.14 Billion |

| Market Growth Rate (2025-2033) | 12.60% |

UK Banking as a Service Market Trends:

Growing Demand for Embedded Finance

The rising need for embedded finance, as more companies, especially in e-commerce and retail sectors, aim to provide financial services as a component of their client service offerings, is bolstering the market growth in the UK. Banking as a service (BaaS) platforms enable businesses to incorporate services like loans, payments, and insurance into their current ecosystems. This shift is changing how individuals engage with financial services, allowing them to access these services directly through non-banking applications and websites. The flexibility and scalability provided by BaaS platforms enable businesses to meet this demand, encouraging more companies to adopt embedded financial services to enhance user engagement and satisfaction. In 2024, the UK bank Griffin introduced "Foundations," a banking program for UK businesses to incorporate financial products via BaaS solutions. The platform gives access to all of Griffin's tools, including savings accounts and client money protection, through its full-stack system. Selected individuals will also be provided with guidance from professionals in the banking and technology industries.

.webp)

Increasing Focus on Real-Time Payment Solutions

BaaS platforms are incorporating advanced payment technologies like single Euro payments area (SEPA) instant and faster payments to meet the increasing user demand for quicker and smoother payment options. These solutions enable companies to provide immediate, international transactions that enhance client satisfaction and operational effectiveness. The ability to provide real-time payment services is especially crucial for businesses operating in the digital economy, where speed and convenience are paramount. These solutions allow businesses to offer instant, cross-border transactions, improving the BaaS providers that offer embedded financial services, including virtual international bank account numbers (IBANs) and faster payment options. This focus on real-time payments is encouraging more companies to adopt BaaS platforms to meet user expectations and stay competitive in a rapidly evolving financial landscape. In 2024, Wirex announced partnership with OpenPayd, a leading BaaS platform, to launch embedded virtual IBAN accounts for its clients across the UK and European Economic Area (EEA). This partnership allows Wirex users to make real-time payments through SEPA instant and faster payments, enhancing client experience.

UK Banking as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on component, product type, enterprise size, and end-user.

Component Insights:

- Platform

- Service

- Professional Service

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes platform and service (professional service and managed service).

Product Type Insights:

- API based BaaS

- Cloud-based BaaS

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes API based BaaS and cloud-based BaaS.

Enterprise Size Insights:

- Large Enterprise

- Small and Medium Enterprise

The report has provided a detailed breakup and analysis of the market based on the component. This includes large enterprise and small and medium enterprise.

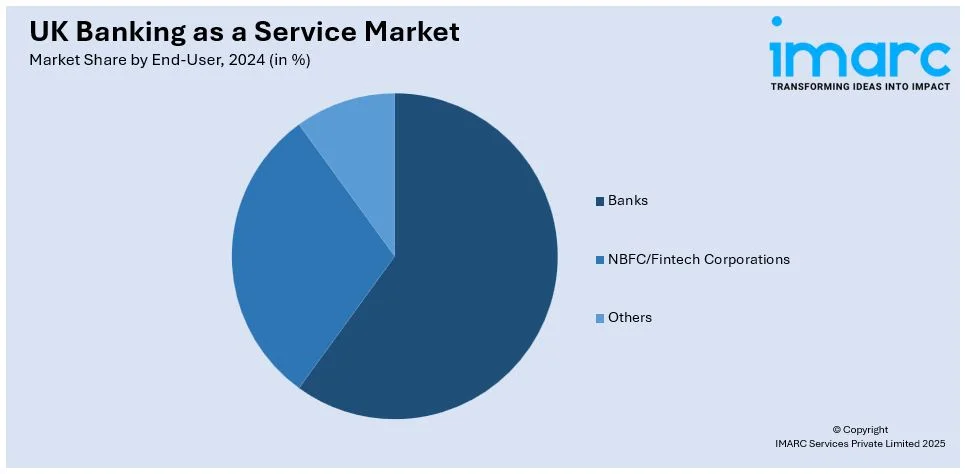

End-User Insights:

- Banks

- NBFC/Fintech Corporations

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes banks, NBFC/fintech corporations, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Banking as a Service Market News:

- March 2024: Griffin Bank, headquartered in the UK and established by Allen Rohner and David Jarvis, announced obtaining a complete banking license, enabling it to exit mobilization and function as a fully operational bank.

- June 2023: Bankable, a UK provider of BaaS, purchased Arex Markets, an embedded finance platform. This acquisition allowed Bankable to incorporate credit and working capital solutions, such as invoice financing and corporate credit cards, into its API-driven platform, improving services for fintech and multinational brands.

UK Banking as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Product Types Covered | API based BaaS, Cloud-based BaaS |

| Enterprise Sizes Covered | Large Enterprise, Small and Medium Enterprise |

| End-Users Covered | Banks, NBFC/Fintech Corporations, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK banking as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the UK banking as a service market on the basis of component?

- What is the breakup of the UK banking as a service market on the basis of product type?

- What is the breakup of the UK banking as a service market on the basis of enterprise size?

- What is the breakup of the UK banking as a service market on the basis of end-user?

- What is the breakup of the UK banking as a service market on the basis of region?

- What are the various stages in the value chain of the UK banking as a service market?

- What are the key driving factors and challenges in the UK banking as a service market?

- What is the structure of the UK banking as a service market and who are the key players?

- What is the degree of competition in the UK banking as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK banking as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK banking as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK banking as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)