UK Biotechnology Market Size, Share, Trends and Forecast by Product Type, Technology, Application, and Region, 2025-2033

UK Biotechnology Market Size and Share:

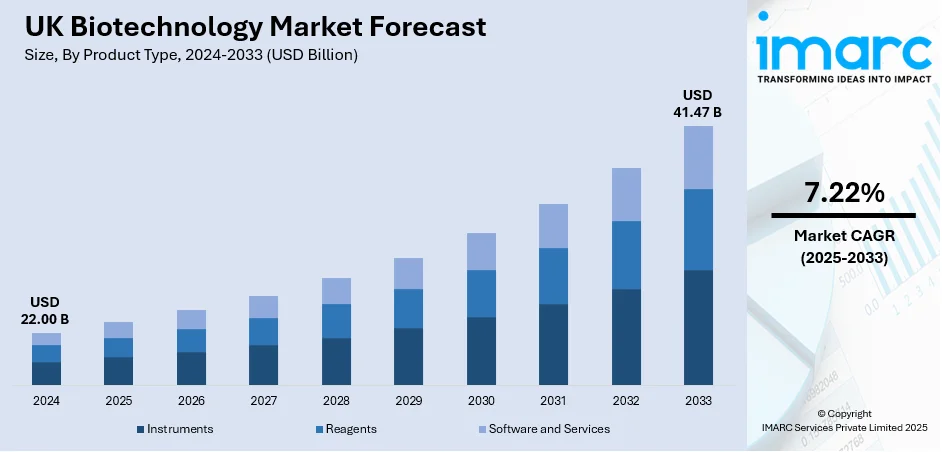

The UK biotechnology market size was valued at USD 22.00 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.47 Billion by 2033, exhibiting a CAGR of 7.22% from 2025-2033. The industry is fueled by the growing incidence of chronic diseases is driving demand for new treatments, while data analytics and bioinformatics improvements boost research productivity. Increased investment in biotech startups encourages innovation, underpinned by robust government support and research and development (R&D) incentives. Furthermore, biotechnology's increasing application in agriculture enhances crop yields and efficiency thus impelling the UK biotechnology market share. Ongoing advances in genomics and gene-editing tools, including CRISPR, drive drug development, personalized medicine, and precision health solutions faster throughout the industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.00 Billion |

| Market Forecast in 2033 | USD 41.47 Billion |

| Market Growth Rate 2025-2033 | 7.22% |

The UK biotechnology market benefits immensely from strong governmental support, which fuels its growth and innovation potential. Public funding through bodies like UK Research and Innovation (UKRI) and Innovate UK provides crucial capital for early-stage biotech ventures and research institutions. Notably, Innovate UK operates with an annual £1.1 billion budget and supports over 450,000 innovators each year, generating £3.61 in private-sector investment for every £1 spent—highlighting its effectiveness in leveraging additional funding. Government-backed initiatives such as the Life Sciences Vision 2030 and R&D tax incentives further encourage private investment in biopharma and medical technology. Additionally, the development of science parks and strong university-industry collaborations reinforces the ecosystem. This supportive environment enables the translation of advanced scientific research into market-ready therapies, strengthening the UK’s leadership in genomics, personalized medicine, and synthetic biology.

To get more information on this market, Request Sample

The rising demand for personalized medicine and genomics is a key driver of the UK biotechnology market. Technological progress in genome sequencing, bioinformatics, and data analytics has enabled the development of tailored therapies based on individual genetic profiles. The NHS Genomic Medicine Service exemplifies this growth, processing over 810,000 genomic tests in 2024—a notable 8% increase from the previous year—demonstrating expanding clinical adoption of genomic technologies. Initiatives like the 100,000 Genomes Project have further strengthened the UK’s position as a leader in precision healthcare innovation. This growing emphasis on personalized treatments is attracting significant investments in biotech firms specializing in cell and gene therapies, rare disease solutions, and molecular diagnostics. As demand rises, UK companies are increasingly focused on developing cutting-edge solutions to address complex genetic and molecular conditions.

UK Biotechnology Market Trends:

Increasing incidences of target diseases

Increased incidence of target diseases and genetic disorders, continuous technological improvements in Polymerase Chain Reaction (PCR) technologies, development of portable miniaturized instruments, and the use of robotics, combined with growth in research investments, funds, and grants, are increasing the biotechnology market growth in the forecast period. The UK Government estimates that roughly 80% of rare conditions are caused by genetics, and the NHS Genomic Medicine Service (GMS) currently offers genomically guided care and treatment within England, highlighting the significance of biotechnology in precision medicine. In the past ten years, genomic analytical methods like microbial identification and genetic change detection have found extensive applications in the diagnosis of significant infectious diseases like HIV, malaria, and tuberculosis, and genetic disorders. Apart from this, the higher R&D investments in innovative genomic technologies like cell-based assays and polymerase chain reaction (PCR), are likely to boost significant growth in developing nations. In developed nations like the UK, growth in the biotechnology market will be fueled by rising healthcare expenditure, development of healthcare infrastructure, and falling procedural costs for disease diagnosis methods.

Growing need for sustainable agriculture solutions

The increased demand for sustainable agricultural solutions is driving the UK biotechnology market growth. With the farming industry subjected to increasing stresses from climate change, resource shortages, and the requirement to produce food for an ever-increasing global population, there is growing demand for new and sustainable techniques. Biotechnology provides numerous solutions that complement these demands by enhancing yields of crops, minimizing environmental effect, and maximizing resource use. One such area in which biotechnology is asserting its presence is in the creation of genetically modified (GM) crops that are more robust in resisting pests, diseases, and climatic extremities. Such crops help in curtailing the use of chemical pesticides and fertilizers, which in turn reduces environmental pollution and helps to maintain soil integrity. Interestingly, British public opinion is increasingly supportive of food security innovation. A recent survey points out that 69% of British adults highly favour gene editing as a means to ensure a sustainable and resilient future for British agriculture. Moreover, advances in bioinformatics and genomics are making it possible to develop crops with optimized nutrient content and better growth traits. Also, biotechnology is helping towards sustainable agriculture by developing bio-based fertilizers and biopesticides. Such products are made to be less harmful to the environment compared to the conventional chemical inputs, to enhance soil quality and decrease water contamination risks.

Advancements in Gene and Cell Therapy

One important trend influencing the UK biotechnology market is the fast-paced development of gene and cell therapies. These new therapeutic strategies have the promise to cure, and in certain instances, cure genetic diseases, cancers, and orphan diseases that used to be deemed incurable. The UK is now a center for the development of gene and cell therapy, fueled by government programs, dedicated manufacturing facilities, and a strong regulatory environment that supports clinical innovation. The Cell and Gene Therapy Catapult, a government-funded innovation center, is a key driver of the rapid translation of early-stage research into commercially relevant treatments. Elevating approvals for gene therapies and broadening clinical trials demonstrate increased faith in these technologies. This trend is likely to witness substantial investment, R&D efforts, and healthcare reformation in the near future.

UK Biotechnology Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK Biotechnology market, along with forecast at the regional, and country levels from 2025-2033. The market has been categorized based on product type, technology, and application.

Analysis by Product Type:

- Instruments

- Reagents

- Software and Services

Based on the UK biotechnology market forecast, the reagents account for the largest share of 45.8% in the UK biotechnology market, primarily driven by their essential role across various applications such as drug discovery, diagnostics, genomics, proteomics, and research studies. These substances are crucial for enabling accurate biochemical reactions, cell culture processes, and molecular biology experiments, making them indispensable in laboratory workflows. The growing demand for personalized medicine, advanced genetic testing, and high-throughput screening has further fueled the need for specialized and high-quality reagents. Additionally, continuous innovations in reagent formulations, such as enzyme-linked reagents and PCR kits, have enhanced research efficiency and sensitivity. The expansion of academic and clinical research activities, coupled with increasing investments in R&D, also contributes significantly to the dominance of reagents in the market.

Analysis by Technology:

- Nanobiotechnology

- Tissue Engineering and Regeneration

- DNA Sequencing

- Cell-Based Assays

- Fermentation

- PCR Technology

- Chromatography

- Others

DNA sequencing holds the largest segment in the UK biotechnology market with a 36.8% share, driven by its critical role in genomics, personalized medicine, and molecular diagnostics. The widespread adoption of next-generation sequencing (NGS) technologies has made DNA sequencing faster, more accurate, and cost-effective, supporting large-scale projects like the UK’s 100,000 Genomes Project. Its applications span disease gene identification, cancer diagnostics, rare disease research, and drug development. The increasing focus on precision medicine and tailored therapies relies heavily on DNA sequencing to decode individual genetic information. Furthermore, advancements in bioinformatics tools have simplified the analysis of complex genomic data, enhancing its clinical utility. Growing research in fields such as synthetic biology and agricultural biotechnology also boosts the demand for DNA sequencing.

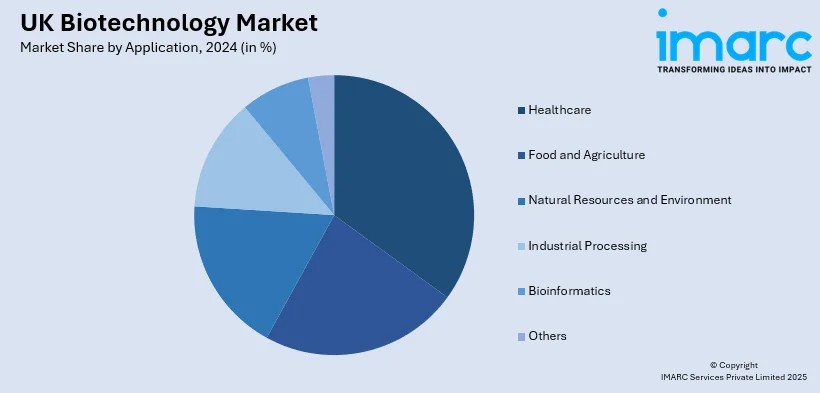

Analysis by Application:

- Healthcare

- Food and Agriculture

- Natural Resources and Environment

- Industrial Processing

- Bioinformatics

- Others

Healthcare dominates the UK biotechnology market with a 49.6% share, largely due to the rising prevalence of chronic and genetic diseases, an aging population, and increasing demand for advanced therapeutic solutions. Biotechnological innovations are extensively applied in drug discovery, gene therapy, personalized medicine, and molecular diagnostics to address complex health conditions such as cancer, cardiovascular diseases (CVD), and rare genetic disorders. The development of biopharmaceuticals, including monoclonal antibodies, vaccines, and cell therapies, further strengthens this segment’s growth. Additionally, government-backed genomic initiatives and strong collaborations between biotech firms and healthcare providers enhance the sector’s potential. The integration of bioinformatics and AI into healthcare biotechnology accelerates drug development timelines and improves diagnostic accuracy, contributing UK biotechnology market outlook.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London is at the forefront of the UK biotechnology market due to its world-class research universities, advanced healthcare infrastructure, and numerous biotech startups and incubators. Strong government funding, private investments, and access to skilled talent foster innovation in genomics, diagnostics, and personalized medicine, making London a central hub for biotech development.

In Line with this, the South East region benefits from proximity to London and renowned research institutions. It houses several science parks and R&D centers, supporting pharmaceutical and biotech collaborations. Its vibrant startup ecosystem, combined with strong academic-industry partnerships, enhances regional biotechnology innovation, particularly in drug discovery, biopharmaceuticals, and regenerative medicine.

Additionally, the North West has a growing biotechnology presence supported by established manufacturing facilities, research institutions, and NHS partnerships. The region focuses on bioprocessing, pharmaceuticals, and healthcare-related biotech advancements. Its skilled workforce and collaborative R&D environment contribute to its emergence as a competitive biotech cluster in the UK.

In line with this, the East of England is recognized for its robust life sciences sector, hosting prestigious universities and research parks. The region excels in genomics, agricultural biotechnology, and biosciences, driven by cutting-edge R&D initiatives. Its supportive innovation ecosystem attracts investments and promotes breakthroughs in therapeutic development and biotechnology tools.

Besides this, the South West features a developing biotechnology market, emphasizing agricultural biotech, environmental sustainability, and marine biotechnology. Collaboration between universities, research centers, and local businesses supports innovation in bio-based materials, food technology, and healthcare solutions. Growing infrastructure and funding enhance the region’s potential in specialized biotech sectors.

Along with this, the Scotland boasts a dynamic biotech sector focused on precision medicine, industrial biotechnology, and healthtech innovations. Supported by strong academic research, government grants, and industrial partnerships, the region is advancing biomanufacturing and biologics development. Scotland’s emphasis on sustainable technologies and biosciences strengthens its competitive position in the UK market.

Also, the West Midlands biotechnology market benefits from its expanding healthcare sector, academic research capabilities, and focus on medical device development. The region fosters innovation through university partnerships and government-backed life sciences initiatives. Its strategic location and skilled workforce support biotechnology advancements, particularly in diagnostics and regenerative medicine.

Likewise, the Yorkshire and The Humber support a growing biotech industry specializing in biopharmaceuticals, diagnostics, and agricultural technology. The region’s academic institutions and business parks encourage R&D collaborations, driving advancements in healthcare biotech. Government support and regional initiatives foster innovation, helping the area emerge as a promising biotechnology hub.

Moreover, the East Midlands region emphasizes pharmaceutical manufacturing, medical biotechnology, and healthcare R&D. Home to key universities and research centers, it promotes innovations in drug delivery systems and bioengineering. Industrial partnerships and public funding further enhance its biotechnology potential, supporting the development of new therapeutics and healthcare technologies.

Apart from this, the other UK regions contribute to the biotechnology market through niche specializations in environmental biotechnology, industrial bioprocessing, and sustainable technologies. Smaller biotech firms, research institutions, and university collaborations drive localized innovation. Although less concentrated than major hubs, these regions play a valuable role in diversifying the UK biotech landscape.

Competitive Landscape:

The competitive environment is extremely dynamic and innovation-centric, with a blend of established firms, start-ups, research organizations, and academic partnerships. Competition involves the quest to create next-generation therapeutics, diagnostics, and agri-biotechnology products, with emphasis on precision medicine, genomics, and synthetic biology. Firms compete by utilizing state-of-the-art technologies like CRISPR gene editing, artificial intelligence-based drug discovery, and bioinformatics platforms. Strategic alliances, mergers, and acquisitions are frequent, with the objectives of broadening technological capabilities and geographical reach. World-class research facilities and government-funded innovation centers encourage collaboration and knowledge sharing. Market players, in general, compete on differentiation based on proprietary technologies, robust intellectual property positions, and quick translation of research into marketable products.

The report provides a comprehensive analysis of the competitive landscape in the UK Biotechnology market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Celex Oncology unveiled a novel investigational treatment targeting sodium overload in tumor cells to control metastatic cancer. Presented at Bio-Europe Spring 2025, the approach involved VGSC inhibitors and monoclonal antibodies. Supported by preclinical data, the treatment aimed to transform cancer into a manageable condition, enhancing survival and quality of life.

- February 2025: Biocon Ltd launched Liraglutide in the UK under the brands Liraglutide Biocon and Biolide for diabetes and obesity management, following MHRA approval. As the first generics company to gain such approval, Biocon offered a cost-effective alternative and planned expansion into other European markets, the US, and select regions.

- February 2025: Sortera Bio spun out of the MRC Laboratory of Molecular Biology to commercialize Deep Screening, an AI-powered high-throughput platform enabling rapid biological discovery. Developed by Ben Porebski and Philipp Holliger, the technology screened up to 3 billion candidates in days, accelerating therapeutic discovery and attracting support from AstraZeneca.

- February 2025: Tropic prepared to launch non-browning bananas and extended shelf-life bananas by year-end using CRISPR. It expanded TR4-resistant banana trials with GEiGS technology and secured regulatory approvals globally. The innovations aimed to reduce food waste, enhance exports, and lower costs while attracting licensing deals and USD 80 Million in funding.

- January 2025: Verdiva Bio launched as a clinical-stage biopharmaceutical company focused on obesity and cardiometabolic therapies. It secured a USD 411 Million Series A financing, the largest ever in the UK/EU, co-led by Forbion and General Atlantic. The company has advanced a portfolio of next-generation oral and injectable treatments with first- or best-in-class potential.

UK Biotechnology Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Instruments, Reagents, Software and Services |

| Technologies Covered | Nanobiotechnology, Tissue Engineering and Regeneration, DNA Sequencing, Cell-Based Assays, Fermentation, PCR Technology, Chromatography, Others |

| Applications Covered | Healthcare, Food and Agriculture, Natural Resources and Environment, Industrial Processing, Bioinformatics, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK biotechnology market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK biotechnology market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK biotechnology industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK biotechnology market was valued at USD 22.00 Billion in 2024.

The UK biotechnology market is projected to exhibit a CAGR of 7.22% during 2025-2033, reaching a value of USD 41.47 Billion by 2033.

Key factors driving the UK biotechnology market include rising demand for personalized medicine, advancements in genomics and gene editing, increased R&D funding, and strong government support. Additionally, technological innovations in bioinformatics, sustainable agriculture solutions, and growing applications in healthcare and pharmaceuticals significantly boost market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)