UK Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

UK Board Games Market Overview:

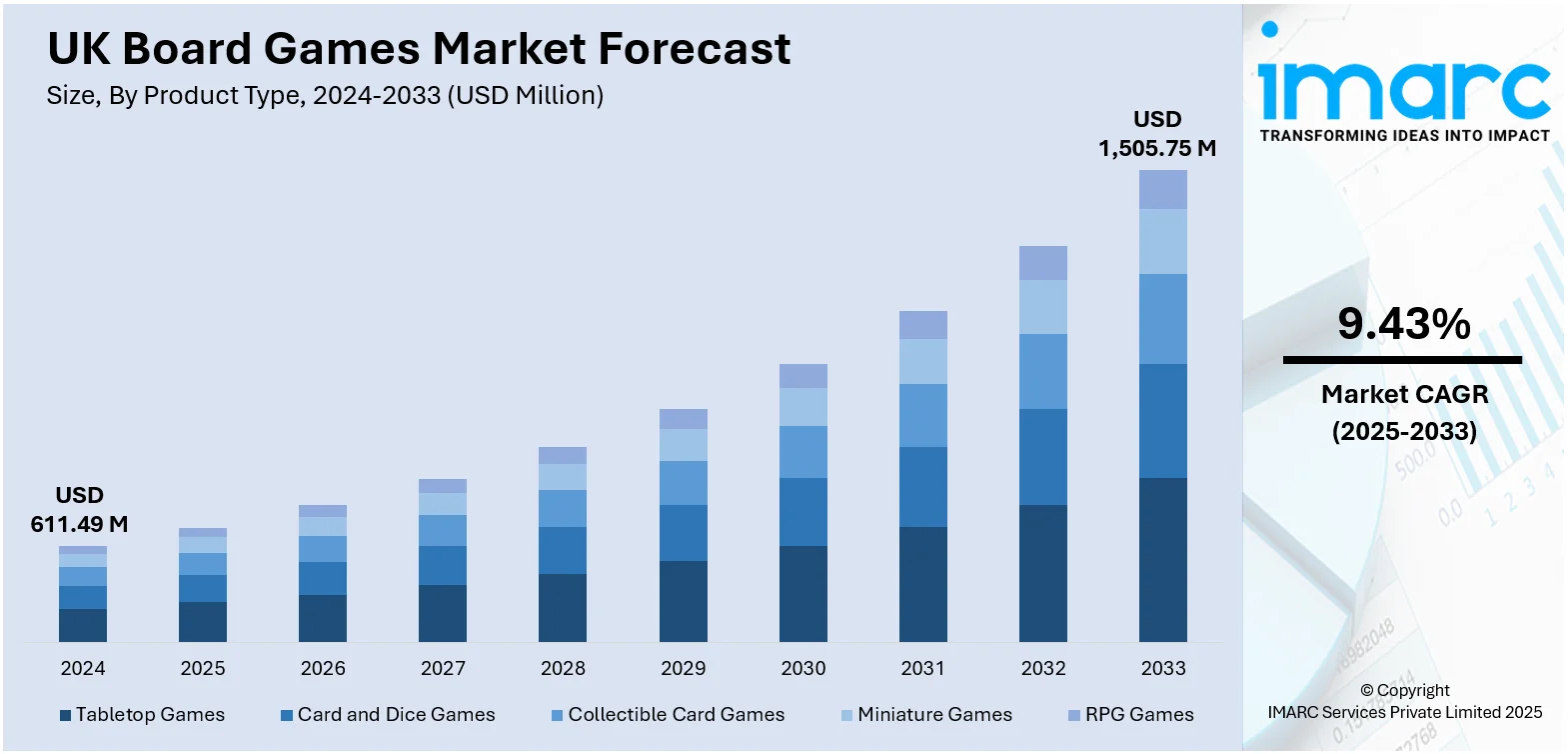

The UK board games market size reached USD 611.49 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,505.75 Million by 2033, exhibiting a growth rate (CAGR) of 9.43% during 2025-2033. Strong community engagement and expanding online retail access are driving the board games market in UK by connecting players socially and making purchases more convenient. Together, these factors attract new audiences, encourage repeat buying, sustain year-round interest, and contribute to the expansion of the UK board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 611.49 Million |

| Market Forecast in 2033 | USD 1,505.75 Million |

| Market Growth Rate 2025-2033 | 9.43% |

UK Board Games Market Trends:

Strengthening of Community Engagement Initiatives

Community-driven initiatives are becoming a strong catalyst for the rising popularity of board games in the UK. By encouraging local gatherings, casual tournaments, and social spaces dedicated to tabletop gaming, these efforts deepen player loyalty and attract new participants who might not otherwise engage with the hobby. Board game cafés, in particular, are emerging as inviting venues where enthusiasts can try new titles, meet like-minded people, and enjoy guided sessions without committing to an immediate purchase. This type of setting transforms board games from a private, at-home pastime into a shared experience that builds social ties and repeat visits. Hosting themed nights, launch events, and special promotions further expands the reach of new releases, as players discover fresh titles in an interactive and relaxed environment. Community partnerships also strengthen connections between local retailers and independent publishers, providing valuable exposure for smaller brands and unique games that may not feature in larger chains. By investing in local gaming spaces, industry stakeholders nurture vibrant social hubs that keep interest alive year-round. In 2025, Asmodee UK announced a Board Game Café initiative to support over 60 cafés across the UK, aiming to connect communities through games. Events began in late February and ran through March, showcasing new titles like Azul Duel and Lord of the Rings: Trick Taking. Participants received exclusive Hobby Next expansions as free gifts.

To get more information on this market, Request Sample

Expansion of Digital Retail Infrastructure

The rising number of e-commerce platforms that provide easy access to various board games is impelling the UK board games market growth. The UK e-commerce market reached a value of USD 297.0 billion in 2024 and is projected to increase substantially to USD 1,483.7 billion by 2033, reflecting a compound annual growth rate (CAGR) of 18.1% from 2025 to 2033, as reported by the IMARC Group. This remarkable growth trajectory presents opportunities for board game publishers and retailers to reach broader buyer segments beyond traditional brick-and-mortar outlets. The convenience of online shopping, swift delivery options, and secure digital transactions are making it easier for people to explore and purchase a diverse range of board games from the comfort of their homes. Smaller publishers, in particular, benefit from reduced overheads and the ability to reach niche audiences through dedicated online platforms and major marketplaces alike. Enhanced digital marketing, targeted advertisements, and social media campaigns further increase visibility and drive the demand across varied age groups. Moreover, the presence of online reviews and influencer recommendations increases consumer confidence in trying new titles. The synergy between an expanding digital retail landscape and evolving individual buying habits continues to support the growth in board game sales, firmly positioning e-commerce as a key driver in this market.

UK Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

A detailed breakup and analysis of the market based on the game type have also been provided in the report. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

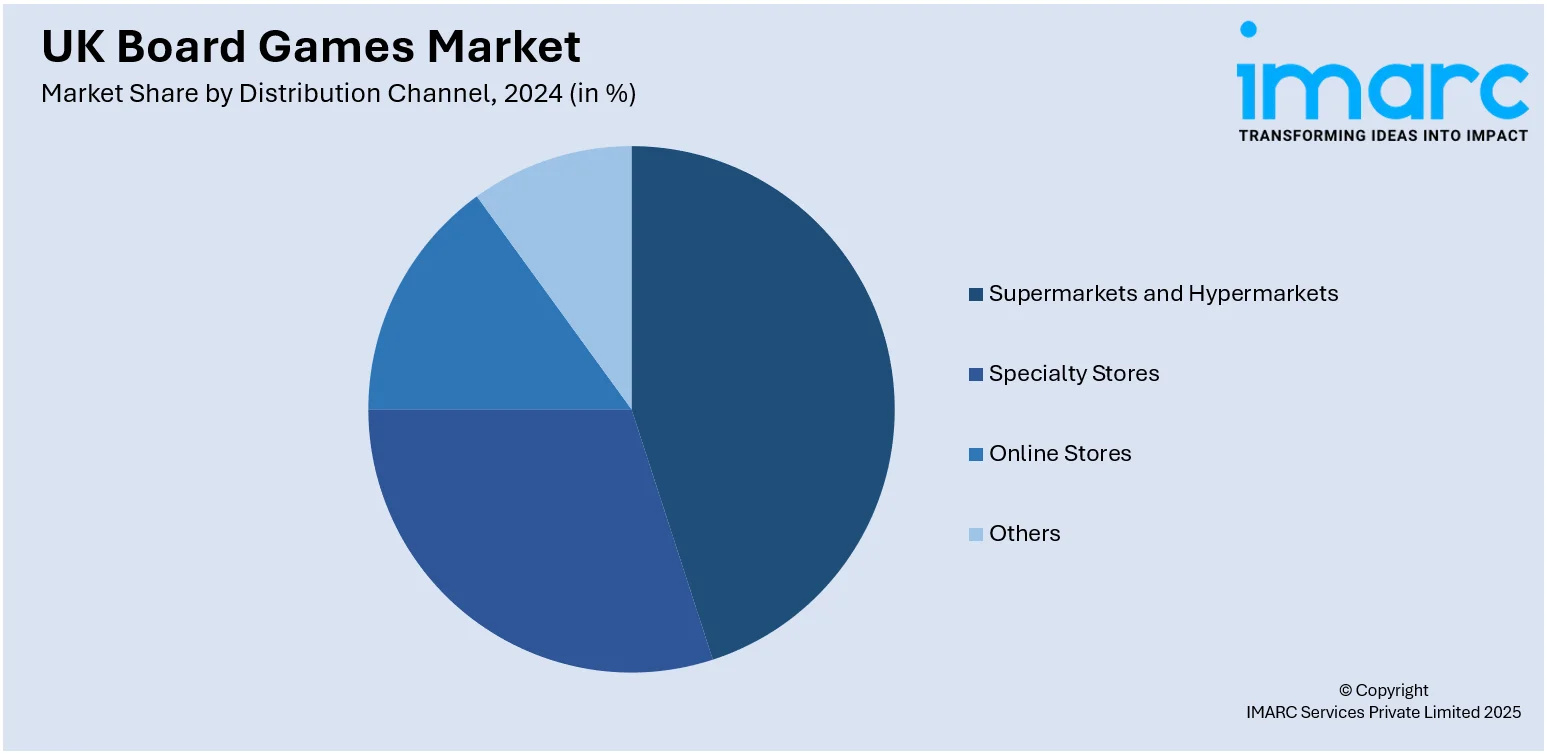

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Board Games Market News:

- In June 2025, a new teaser trailer revealed that The Sims Board Game will officially release in the US, with a UK release set for September 18. The game lets 2–5 players earn Aspiration Points while managing their Sims' needs. Pre-orders are open at Amazon (UK).

- In May 2025, Wargamer shared their top five most-anticipated titles for UK Games Expo 2025, including Revenant, Ofrenda, Molly House, Luthier, and Line of Fire: Burnt Moon. These games stand out for innovative mechanics, unique themes, and striking visuals. Honorable mentions include Popcorn, Barbecubes, and SETI: Space Agencies.

UK Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK board games market performed so far and how will it perform in the coming years?

- What is the breakup of the UK board games market on the basis of product type?

- What is the breakup of the UK board games market on the basis of game type?

- What is the breakup of the UK board games market on the basis of age group?

- What is the breakup of the UK board games market on the basis of distribution channel?

- What is the breakup of the UK board games market on the basis of region?

- What are the various stages in the value chain of the UK board games market?

- What are the key driving factors and challenges in the UK board games market?

- What is the structure of the UK board games market and who are the key players?

- What is the degree of competition in the UK board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)