UK Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

UK Business Process Management Market Overview:

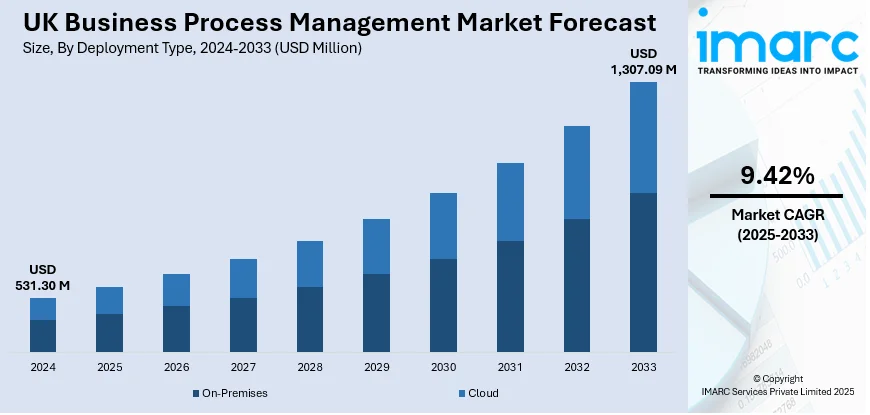

The UK business process management market size reached USD 531.30 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,307.09 Million by 2033, exhibiting a growth rate (CAGR) of 9.42% during 2025-2033. At present, firms are looking to enhance operational effectiveness in the UK. Moreover, the rising adoption of sophisticated technologies like robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML) is supporting the market growth. Apart from this, the increasing emphasis on regulatory compliance and risk management is expanding the UK business process management (BPM) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 531.30 Million |

| Market Forecast in 2033 | USD 1,307.09 Million |

| Market Growth Rate 2025-2033 | 9.42% |

UK Business Process Management Market Trends:

Rising Demand for Operational Efficiency Across Enterprises

The UK business process management (BPM) market is experiencing growth as firms are looking to enhance operational effectiveness. Organizations from different industries, such as banking, retail, healthcare, and manufacturing, are actively deploying BPM solutions to automate procedures, eliminate redundancies, and minimize mistakes in processes. BPM tools are also employed by them to automate routine processes and tasks so that employees can be utilized in more strategic functions. As per SAP’s report, in 2025, 39% of companies are focusing on artificial intelligence (AI)-dependent automation. Moreover, 1 out of 2 are strictly investing in advanced analytics to improve decision-making processes. Companies are increasingly spending on BPM software to synchronize internal processes with changing customer expectations, particularly in the context of global competition and financial strain. Furthermore, companies are focusing on cost reduction initiatives and compliance with regulations, both of which are tackled by BPM systems through constant monitoring and reporting capabilities.

To get more information on this market, Request Sample

Increased Integration of Sophisticated Technologies

The UK BPM market is driven by the increasing adoption of sophisticated technologies like robotic process automation (RPA), artificial intelligence (AI), and machine learning (ML). These technologies are being increasingly integrated into BPM systems to facilitate better real-time decision-making, minimize manual interventions, and accelerate processes. AI-based algorithms are being employed to forecast process clogs, while RPA robots are automating rule-based and data-driven tasks between departments. Firms are also using ML to find patterns in business processes, which aids in ongoing process improvement. This technological advancement is allowing businesses to work more intelligently, predictively, and customer-focused. Furthermore, cloud-based BPM systems with AI and RPA drive them to scale, cost-effectiveness, and cross-functional coordination, thereby supporting the UK business process management (BPM) market growth. Since UK businesses are in the process of digital transformation, they keep searching for BPM software that facilitates these innovations and thus helps drive the market. The IMARC group predicts that the UK AI market is predicted to reach USD 20.5 Billion by 2033.

Increasing Emphasis on Regulatory Compliance and Risk Management

UK companies are increasingly implementing BPM solutions as an active strategy to oversee compliance responsibilities and avoid operational risks. The escalating regulation complexity, spanning data protection regulations to sector-specific rules in finance and healthcare, is motivating organizations to adopt compliance management as an inherent aspect of business processes. Organizations are employing BPM tools to capture workflows, impose rule-based controls, and create audit trails that facilitate transparent processes. This is a key consideration in industries like banking and the pharmaceutical industry, where non-compliance can have serious financial penalties. BPM systems are also being used to carry out risk assessments and simulate various business scenarios to enable businesses to anticipate vulnerabilities and take corrective measures in advance. Since regulatory environments in the UK are changing, companies are always relying on BPM technologies to be agile, accountable, and resilient in their operations.

UK Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

The report has provided a detailed breakup and analysis of the market based on the component. This includes IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT service (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes SMEs and large enterprises.

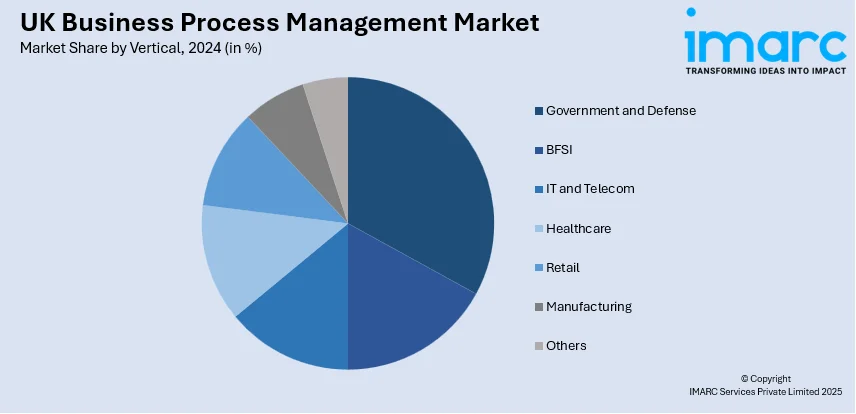

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the UK business process management market on the basis of deployment type?

- What is the breakup of the UK business process management market on the basis of component?

- What is the breakup of the UK business process management market on the basis of business function?

- What is the breakup of the UK business process management market on the basis of organization size?

- What is the breakup of the UK business process management market on the basis of vertical?

- What is the breakup of the UK business process management market on the basis of region?

- What are the various stages in the value chain of the UK business process management market?

- What are the key driving factors and challenges in the UK business process management market?

- What is the structure of the UK business process management market and who are the key players?

- What is the degree of competition in the UK business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)