UK Cement Market Size, Share, Trends and Forecast by Type, End-Use, and Region, 2025-2033

UK Cement Market Overview:

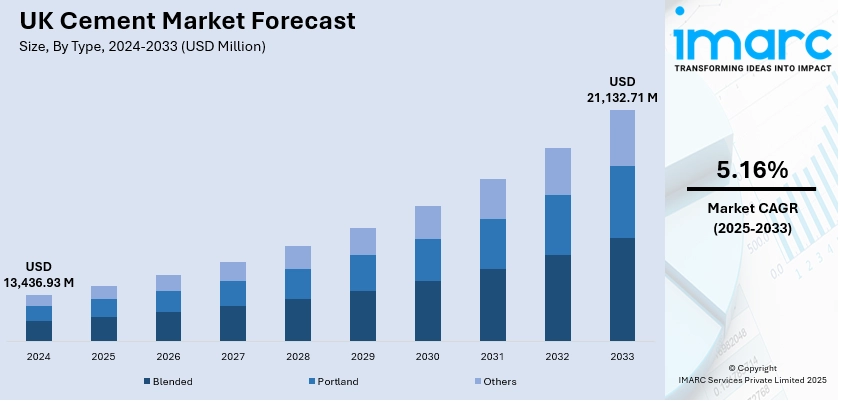

The UK cement market size reached USD 13,436.93 Million in 2024. The market is projected to reach USD 21,132.71 Million by 2033, exhibiting a growth rate (CAGR) of 5.16% during 2025-2033. The market is driven by increasing infrastructure investments, government initiatives for green construction, and rising demand in residential and commercial real estate. Additionally, innovations in cement formulations and carbon reduction strategies support industry expansion. These dynamics significantly influence the UK cement market share across diverse end-use sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13,436.93 Million |

| Market Forecast in 2033 | USD 21,132.71 Million |

| Market Growth Rate 2025-2033 | 5.16% |

UK Cement Market Trends:

Integration of Carbon Capture Technology

A significant trend shaping the UK cement market growth is the integration of carbon capture and storage (CCS) technologies within manufacturing operations. In response to stringent emissions regulations and the UK's net-zero targets, cement producers are actively deploying CCS solutions to reduce their carbon footprint. Companies are collaborating with technology firms and research institutions to implement scalable CCS at industrial sites, especially in cement kilns, which are primary sources of CO₂ emissions. This move is not only environmentally necessary but also critical to sustaining long-term profitability as regulatory compliance tightens. The implementation of CCS technology enhances operational sustainability and aligns with investor expectations for low-carbon production methods, thereby contributing to both environmental targets and sustained UK Cement market growth. For instance, in October 2024, Heidelberg Materials launched evoBuild in the UK, a global brand for low-carbon and circular construction products. EvoBuild products reduce CO₂ emissions by at least 30% or contain 30% recycled content. Alongside evoZero, the world’s first carbon-captured net-zero cement, they aim to drive sustainable construction and achieve 50% revenue from sustainable products by 2030.

To get more information on this market, Request Sample

Growth in Circular Economy Practices

The integration of circular economy principles is becoming increasingly central to the UK cement market growth. Leading companies are investing in processes that prioritize waste minimization, resource reuse, and energy efficiency. One key development is the replacement of traditional fossil fuels with alternative fuels derived from industrial and municipal waste. For instance, in June 2025, Holcim UK rolled out Fuelre4m’s clean fuel technology across more than 200 UK sites after three years of testing. The technology reduces fuel use by 15–20% and emissions by up to 23%, improving engine performance without operational disruption. This national deployment supports Holcim’s net-zero by 2050 goal and advances sustainable construction through innovative, scalable clean fuel solutions and digital monitoring. Additionally, innovations in cement composition now include recycled materials such as fly ash, slag, and construction debris, contributing to reduced environmental impact. The push for zero-waste manufacturing and reduced clinker content also supports compliance with evolving environmental standards. These circular strategies not only align with the UK's broader sustainability goals but also offer cost advantages and open new business opportunities, further propelling the UK cement market growth.

UK Cement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country/regional levels for 2025-2033. Our report has categorized the market based on type and end-use.

Type Insights:

- Blended

- Portland

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes blended, Portland, and others.

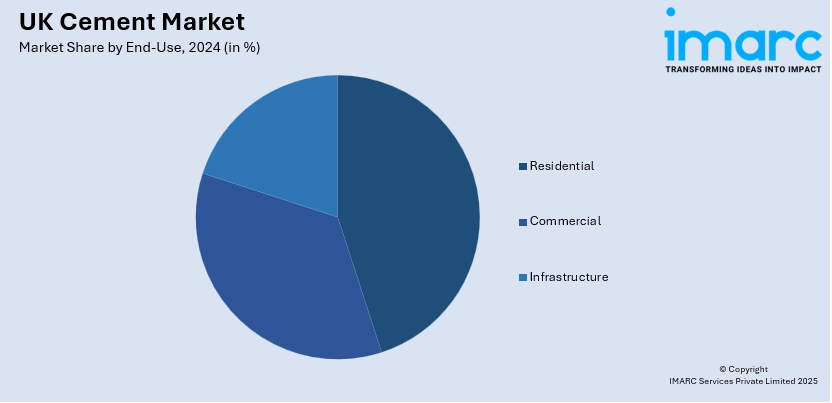

End-Use Insights:

- Residential

- Commercial

- Infrastructure

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes residential, commercial, and infrastructure.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Cement Market News:

- In June 2025, Holcim UK acquired an asphalt plant in Sharpness from Sharpness Asphalt Limited to expand its presence in Gloucester and the southwest region. The plant, positioned near the wharf, will undergo remedial works and reopen as a Holcim Express Asphalt site, offering 30-minute turnaround on small loads, tip-off services, and on-site amenities.

- In May 2025, Tarmac expanded supply of Portland limestone cement (PLC) across England and Wales following updates to BS 8500 standards. Produced at Tunstead and Aberthaw, PLC reduces carbon emissions by 7–9% compared to traditional cement. It is suited for ready-mixed and precast applications, supporting demand for low-carbon construction materials.

- In December 2024, Hoffmann Green Cement Technologies signed a licensing agreement with UK partner Cemblend Ltd to expand its clinker-free cement in the UK and Ireland. The deal includes up to €2 million in entry fees plus royalties. This supports UK decarbonisation goals, enabling local production of sustainable, 0% clinker cement solutions.

UK Cement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End-Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK cement market performed so far and how will it perform in the coming years?

- What is the breakup of the UK cement market on the basis of type?

- What is the breakup of the UK cement market on the basis of end-use?

- What is the breakup of the UK cement market on the basis of region?

- What are the various stages in the value chain of the UK cement market?

- What are the key driving factors and challenges in the UK cement?

- What is the structure of the UK cement market and who are the key players?

- What is the degree of competition in the UK cement market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK cement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK cement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)