UK Cheese Market Size, Share, Trends and Forecast by Source, Type, Product, Format, Distribution Channel, and Region, 2025-2033

UK Cheese Market Overview:

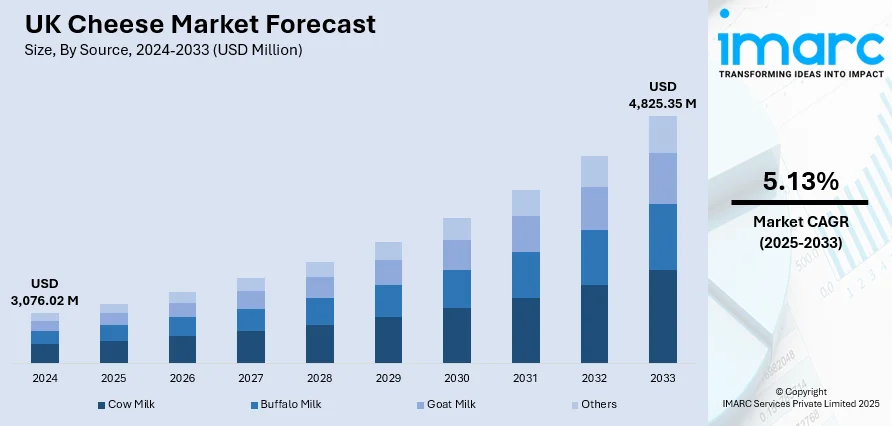

The UK cheese market size reached USD 3,076.02 Million in 2024. The market is projected to reach USD 4,825.35 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The market is growth-led, with ongoing expansion being fueled by changing consumer attitudes towards artisanal types, healthy alternatives, and easy-to-eat snacking formats. Growing demand for premium and functional cheeses mirrors larger trends in eating awareness, lifestyle shifts, and local food appreciation. Innovation in retail and growing product ranges are also boosting accessibility and variety by category. As eating habits change towards convenience and quality, producers are responding to meet advanced needs, contributing to a consistent increase in the UK cheese market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,076.02 Million |

| Market Forecast in 2033 | USD 4,825.35 Million |

| Market Growth Rate 2025-2033 | 5.13% |

UK Cheese Market Trends:

Increase in Specialty and Artisanal Cheese Consumption

The United Kingdom is experiencing a significant growth in consumption of specialty and artisanal cheeses, mirroring a more general trend away from cheap, mass-produced, and homogenous dairy products towards premium, local, and distinctive dairy offerings. Sophisticated consumers now are venturing out to discover varied textures and flavors other than classic cheddar, looking for alternatives like blue cheese, washed-rind types, and soft-ripened offerings. Demand is fueled by expanding appreciation for craftsmanship, region, and heritage in food consumption. For instance, in September 2024, Atalanta brought to market Cracking Good, a new British Isles cheese brand comprising Mature Irish Cheddar, Extra Mature Scottish Cheddar, and Vintage English Cheddar, all made from grass-fed milk and matured to perfection. Moreover, farmers' markets, food festivals, and specialty stores are helping lead the charge in boosting availability of these high-end offerings. In addition, food culture experiences and culinary travel are prompting consumers to appreciate different, hand-produced cheeses. This trend facilitates innovation and diversification in manufacturing and aligns with the increasing desire for traceable, ethically produced foods. Therefore, UK cheese market growth remains underpinned by the changing appetite for artisanal and differentiated cheese experiences.

To get more information on this market, Request Sample

Health and Wellness Trends Influencing Cheese Choices

Increasing health awareness among UK consumers is transforming the cheese market, and demand for low-fat, lower-salt, and lactose-free cheeses is on the rise. This is part of greater nutritional knowledge and trying to have your cake and eat it. Health-oriented innovations in cheese types now address particular dietary needs, such as protein-enriched and plant-based cheese alternatives. For example, in September 2024, Cathedral City launched its largest innovation of the year, a high-protein, half-fat cheddar family in block, sliced, grated, and mini formats, appealing to health-aware UK consumers looking for functional cheese solutions. Furthermore, in addition, functional claims and transparency labeling are driving consumer choice, with people actively looking for products that will have a positive impact on their well-being in general. Retailers and supermarkets are then broadening their lines to offer functional cheese products that appeal to these consumers without sacrificing taste and texture. These trends mirror wider dietary trends like flexitarianism and food demand for gut support. As healthy consumption continues to shape shopping habits, manufacturers are responding by developing their products to suit these demands. This shifting landscape reflects a major change in UK cheese market trends, with healthy consumption driving long-term growth and product segmentation.

Growth of Cheese in Convenience and Snacking Categories

Convenience has become a major driver in the UK cheese market, with growth in single-serve formats and snack portions of cheese. Contemporary lifestyles, which are dominated by hectic schedules and grab-and-go eating patterns, have necessitated easily consumable, convenient dairy products that do not need preparation. Bite-sized portions of cheese, snack packets, and pairing formats with crackers or fruit are fast gaining popularity with both adults and children. Such offerings provide a convenient and healthy alternative to conventional snack foods and help position cheese as a convenient option across meals and occasions. The convenience-led retail environment has responded with increased chilled departments and in-store-crafted ranges that focus on both indulgence and convenience. In addition, innovative packaging and resealable packaging formats improve usability and shelf life. This craving for on-the-go and time-saving continues to influence the UK cheese market, driving growth through convenient formats and affirming the market's pertinence in modern lifestyle consumption.

UK Cheese Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, type, product, format, and distribution channel.

Source Insights:

- Cow Milk

- Buffalo Milk

- Goat Milk

- Others

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow milk, buffalo milk, goat milk, and others.

Type Insights:

- Natural

- Processed

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes natural and processed.

Product Insights:

- Mozzarella

- Cheddar

- Feta

- Parmesan

- Roquefort

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes mozzarella, cheddar, feta, parmesan, roquefort, and others.

Format Insights:

- Slices

- Diced/Cubes

- Shredded

- Blocks

- Spreads

- Liquid

- Others

A detailed breakup and analysis of the market based on the format have also been provided in the report. This includes slices, diced/cubes, shredded, blocks, spreads, liquid, and others.

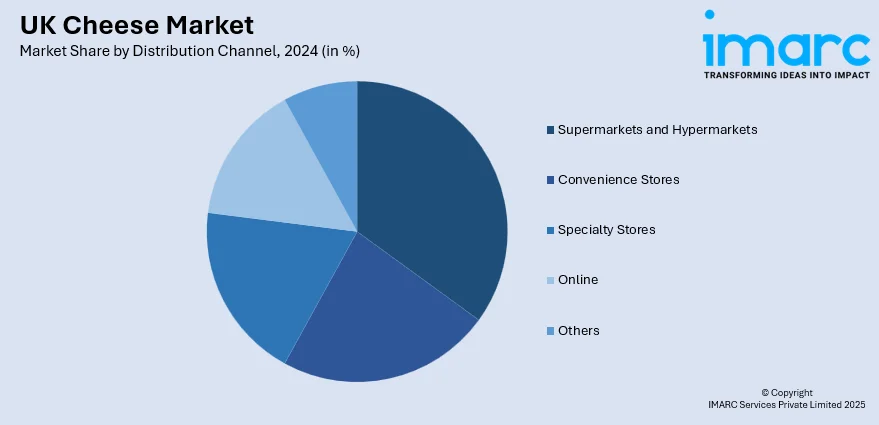

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Cheese Market News:

- In May 2025, the UK dairy sector witnessed significant launches such as Yeo Valley's Protein Snack Pots and Lactalis UK's Leerdammer Spreadable Cheese. These offerings demonstrate changing consumer demands for high-protein, on-the-go formats, that are complementing wider UK cheese market trends based around health, functionality, and lifestyle-led consumption patterns.

- In December 2024, Primula announced the release of its Cheese Dippers, which unite creamy cheese with crackers or breadsticks in an on-the-go format. Launching in Iceland stores in January 2025, the snack is directed at busy modern lives and growing demand for easy-to-carry, healthy snacks in the expanding UK cheese-based snack marketplace.

UK Cheese Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow Milk, Buffalo Milk, Goat Milk, Others |

| Types Covered | Natural, Processed |

| Products Covered | Mozzarella, Cheddar, Feta, Parmesan, Roquefort, Others |

| Formats Covered | Slices, Diced/Cubes, Shredded, Blocks, Spreads, Liquid, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK cheese market performed so far and how will it perform in the coming years?

- What is the breakup of the UK cheese market on the basis of source?

- What is the breakup of the UK cheese market on the basis of type?

- What is the breakup of the UK cheese market on the basis of product?

- What is the breakup of the UK cheese market on the basis of format?

- What is the breakup of the UK cheese market on the basis of distribution channel?

- What is the breakup of the UK cheese market on the basis of region?

- What are the various stages in the value chain of the UK cheese market?

- What are the key driving factors and challenges in the UK cheese?

- What is the structure of the UK cheese market and who are the key players?

- What is the degree of competition in the UK cheese market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK cheese market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK cheese market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK cheese industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)