UK Corporate Training Market Report by Training Service (Customer Management, Technical Training, Soft Skills, and Others), Deployment (On-Site, Off-Site), Mode of Learning (Instructor Led Classroom Only, Blended Learning, Online or Computer-Based Methods, Mobile and Social Learning, and Others), Industry Vertical (IT and Telecom, BFSI, Automobile, Manufacturing, Healthcare, and Others), and Region 2025-2033

UK Corporate Training Market Overview:

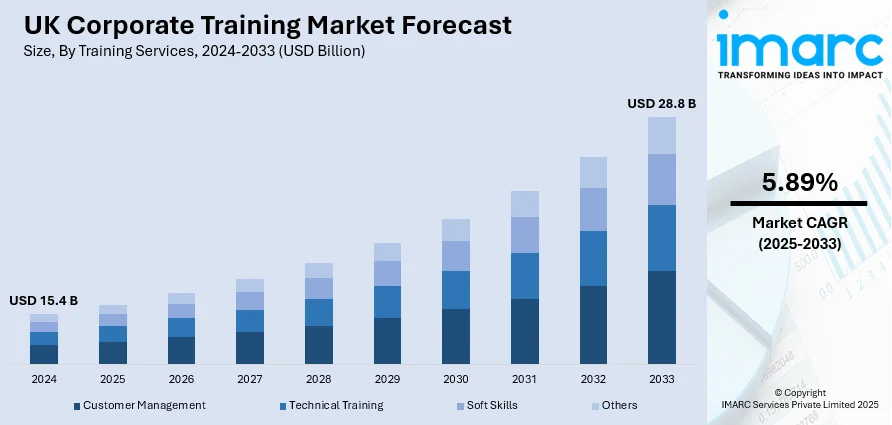

The UK corporate training market size reached USD 15.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 28.8 Billion by 2033, exhibiting a growth rate (CAGR) of 5.89% during 2025-2033. The rising demand for employee upskilling, significant technological improvements, the expanding requirement for compliance and regulatory training, and a surging emphasis on improving organizational efficiency and productivity are some of the key factors influencing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.4 Billion |

|

Market Forecast in 2033

|

USD 28.8 Billion |

| Market Growth Rate 2025-2033 | 5.89% |

UK Corporate Training Market Trends:

Technological Advancements

Technological advancements are significantly influencing the UK personal training segment. The rise of digital learning platforms, including learning management systems (LMS) and e-learning solutions, has transformed traditional training methods. Companies are increasingly adopting these technologies to deliver training that is more flexible, interactive, and scalable. Virtual reality (VR) and augmented reality (AR) are also emerging trends, providing immersive training experiences that enhance employee engagement and retention. These technologies allow for realistic simulations and hands-on practice in a controlled environment, which is particularly valuable for complex skills and safety training. Additionally, artificial intelligence (AI) is being leveraged to create personalized learning experiences, analyze training effectiveness, and identify skill gaps. This shift towards digital and tech-driven solutions is enabling organizations to offer more tailored and efficient training programs, thus driving market growth.

To get more information on this market, Request Sample

Increasing Focus on Employee Upskilling and Reskilling

The emphasis on continuous employee upskilling and reskilling is another major trend shaping the training industry UK. As industries evolve and new technologies emerge, companies are recognizing the need to equip their workforce with the latest skills and knowledge. This trend is driven by the rapid pace of technological change and the need for organizations to remain competitive. Training programs are increasingly focused on developing both technical skills and soft skills, such as leadership and communication, to prepare employees for future roles and responsibilities. Companies are investing in comprehensive training programs that include online courses, workshops, and seminars to ensure their employees stay relevant and proficient. This focus on upskilling and reskilling not only enhances employee performance but also supports organizational growth and adaptability, contributing to the expansion of the corporate blended learning market.

Demand for Compliance and Regulatory Training

The increased need for compliance and regulatory training is a key trend propelling the UK corporate training market. Organizations must give training to guarantee compliance with legal and industry-specific requirements. This covers training on health and safety, data protection, anti-corruption, and other regulatory issues. Businesses prioritize compliance training because it helps them reduce risks, avoid legal fines, and keep industry certifications. Companies are investing in extensive training programs to keep personnel aware and prepared as rules become more complicated and the potential ramifications of noncompliance increase. This trend emphasizes the need for training in risk management and regulatory compliance, resulting in increased development in the corporate training UK industry.

Microlearning Accelerates Growth in the UK

The UK e-learning market is experiencing rapid growth in microlearning, with the sector expanding by 18% year-over-year. This trend is accelerating as organizations aim to maximize employee learning through bite-sized, directed learning modules. Microlearning provides a flexible and efficient training opportunity that is well-distributed for busy professionals requiring fast, actionable learning free from lengthy, time-consuming sessions. By dividing complicated content into smaller, bite-sized pieces, microlearning makes it possible for employees to learn critical concepts and implement them instantly in their work. This method not only increases retention of knowledge but also increases engagement since employees can learn in their own time. Most companies are now integrating microlearning with their digital channels, enabling on-demand access as well as monitoring of progress. As the need for continuous upskilling grows in the competitive e-learning market, microlearning’s efficiency and effectiveness make it a core driver in shaping the future of sales training market.

Gamification Elevates Employee Engagement in Training Programs

Corporate training report shows that gamification is transforming the way companies in the UK approach corporate training by enhancing employee participation and improving learning outcomes. Integrating elements like scores, achievements, and challenges into training programs creates an interactive and competitive environment, making learning more enjoyable and motivating employees to engage fully. This approach not only makes training more fun but also encourages a deeper connection to the material. Employees are more likely to complete training modules, as the gamified elements offer immediate rewards and recognition for their progress. Moreover, gamification provides continuous feedback, allowing individuals to track their performance and compete with peers in a supportive way. This has proven to be particularly effective for soft skills, customer service, and sales training, where consistent practice and improvement are essential. As a result, gamification is quickly becoming a vital tool in the UK leadership development market, fostering better engagement, skill development, and overall employee performance.

UK Corporate Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on training services, deployment, mode of learning, and industry vertical.

Training Services Insights:

- Customer Management

- Technical Training

- Soft Skills

- Others

The report has provided a detailed breakup and analysis of the market based on the training services. This includes customer management, technical training, soft skills, and others.

Deployment Insights:

- On-Site

- Off-Site

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-site, and off-site.

Mode of Learning Insights:

- Instructor Led Classroom Only

- Blended Learning

- Online or Computer Based Methods

- Mobile and Social Learning

- Others

The report has provided a detailed breakup and analysis of the market based on the mode of learning. This includes instructor led classroom only, blended learning, online or computer-based methods, mobile and social learning, and others.

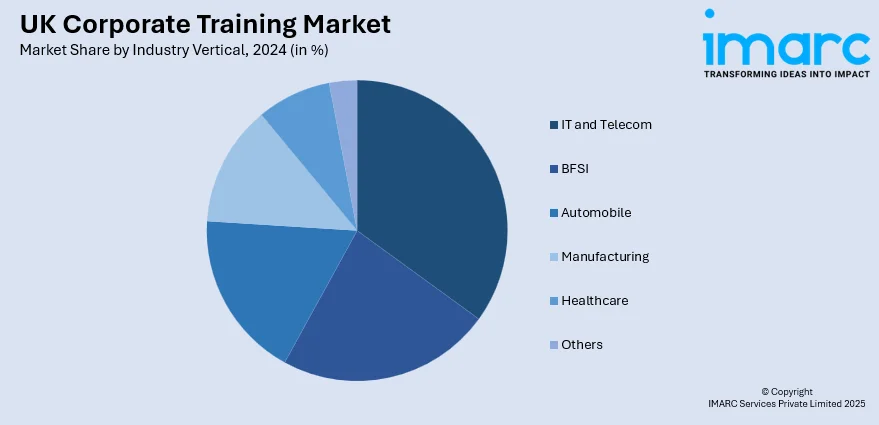

Industry Vertical Insights:

- IT and Telecom

- BFSI

- Automobile

- Manufacturing

- Healthcare

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes IT and telecom, BFSI, automobile, manufacturing, healthcare, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top UK Companies for Corporate Training:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Corporate Training Market News:

- In August 2024, Crown Estate launched an AI employee training programme to enhance its digital capabilities. The AI for Business Value programme apprenticeship aims to equip team members across the organisation with advanced AI and machine learning capabilities. Delivered by tech-first company Multiverse, the programme trains apprentices to identify business value gains through AI and execute ethical AI projects.

- In July 2024, LinkedIn launched an AI-driven mentorship matching platform for UK corporates, revolutionizing corporate training. This innovation enabled companies to connect employees with personalized mentors based on skills and career goals. The move significantly enhanced employee development, fostering stronger organizational growth and boosting the corporate training market.

- In July 2024, UK Prime Minister Keir Starmer unveiled a new skills training organization, Skills England, to reduce the UK's long-term reliance on overseas workers. The new body aims to transform the relationship between business and education systems and address skills gaps. It will work with the Migration Advisory Committee to identify and address skills gaps, bringing together central and local government, businesses, training providers, and unions.

- In May 2022, the UK government allocated £50 Million to establish the Smart Manufacturing Data Hub, aimed at helping SMEs adopt digital technologies. This initiative boosted corporate training by providing manufacturers with data-driven insights, virtual testbeds, and digital innovation grants, significantly enhancing workforce skills and productivity.

UK Corporate Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Training Services Covered | Customer Management, Technical Training, Soft Skills, Others |

| Deployments Covered | On-Site, Off-Site |

| Mode of Learnings Covered | Instructor Led Classroom Only, Blended Learning, Online or Computer-Based Methods, Mobile and Social Learning, Others |

| Industry Verticals Covered | IT and Telecom, BFSI, Automobile, Manufacturing, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK corporate training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK corporate training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK corporate training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK corporate training market is expected to grow at a CAGR of 5.89% during 2025-2033.

The UK corporate training market is fueled by the growing need for employee skill enhancement, technological advancements, and compliance training. Additionally, the rise of remote work, the adoption of AI, and personalized learning solutions are key factors propelling the demand for training services.

COVID-19 led to a rapid transition to digital learning in the UK, as businesses shifted to remote work. The adoption of online training platforms, virtual classrooms, and e-learning tools became essential for maintaining workforce development, significantly reshaping the landscape of corporate training.

Based on the training services, the UK corporate training market has been segmented into customer management, technical training, soft skills, and others.

Based on the deployment, the UK corporate training market has been segmented into on-site and off-site.

Based on the mode of learning, the UK corporate training market has been segmented into instructor led classroom only, blended learning, online or computer-based methods, mobile and social learning, and others.

Based on the industry vertical, the UK corporate training market has been segmented into IT and telecom, BFSI, automobile, manufacturing, healthcare, and others.

On a regional level, the UK corporate training market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)