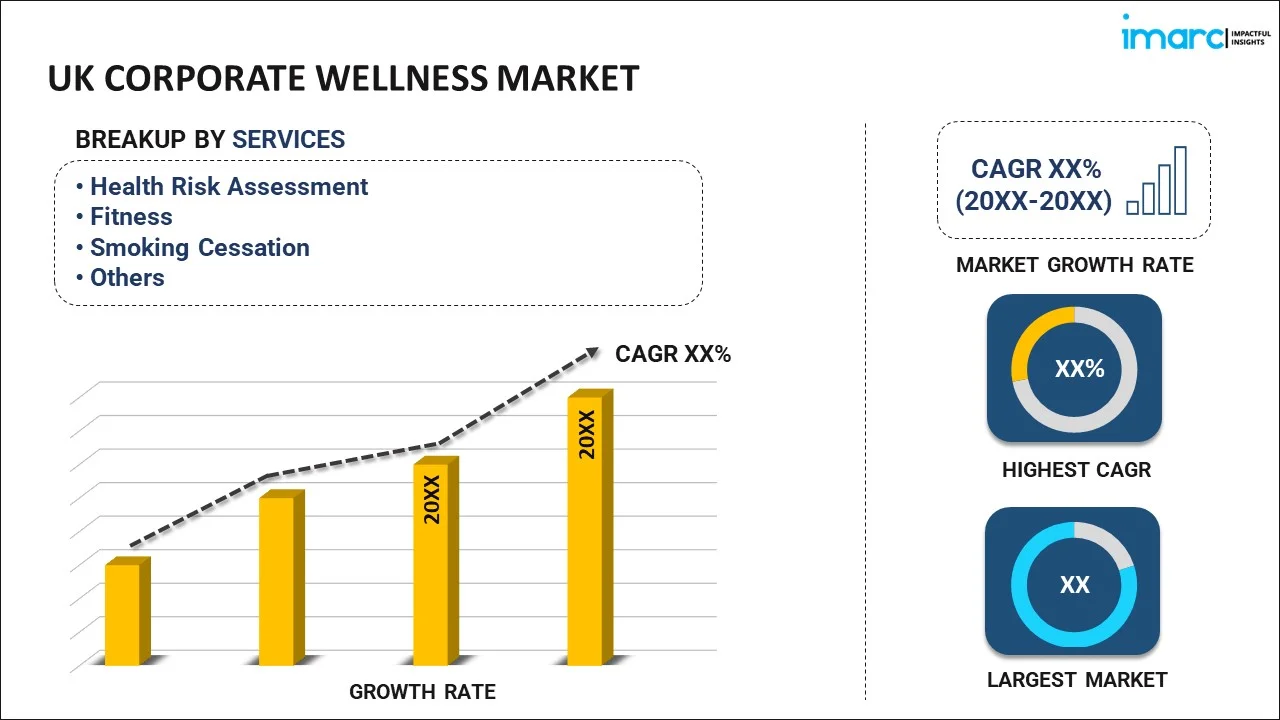

UK Corporate Wellness Market Report by Service (Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, and Others), Category (Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers), Delivery (Onsite, Offsite), Organization Size (Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations), and Region 2025-2033

UK Corporate Wellness Market Summary:

UK corporate wellness market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033, exhibiting a growth rate (CAGR) of 4.7% during 2025-2033. The workplace wellness market is growing as technology, such as wearable devices and health apps, makes it easier for employers to run wellness programs. Companies now focus more on mental health initiatives, including counseling and stress management. Hybrid workplace wellness programs have also become essential, providing flexible solutions for remote and on-site staff. This combination of tech tools, mental health support, and hybrid-friendly options enhances employee well-being, promotes healthier habits, and fosters increased engagement across diverse work environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.8 Billion |

| Market Forecast in 2033 | USD 4.5 Billion |

| Market Growth Rate (2025-2033) | 4.7% |

Corporate wellness programs refers to an initiatives implemented by businesses to promote the overall health and well-being of their employees. These programs typically encompass a range of activities and services aimed at improving physical fitness, mental health, and overall lifestyle habits among the workforces. Workplace wellness initiatives may include fitness challenges, nutritional counseling, stress management workshops, and access to gym facilities. The goal is to create a healthier and more productive work environment by addressing various aspects of employee well-being. Companies invest in employee wellness programs wellness not only to enhance employee health and job satisfaction but also to reduce healthcare costs and absenteeism and improve overall productivity. These initiatives acknowledge the interconnectedness of employee health and organizational success, fostering a culture that prioritizes the holistic well-being of the workforce.

UK Corporate Wellness Market Trends:

The corporate wellness market in the UK is witnessing unprecedented growth, primarily driven by a confluence of factors that underscore the rising importance of employee well-being. Firstly, in today's competitive business landscape, organizations recognize that a healthy workforce is a productive workforce. Consequently, companies are increasingly investing in comprehensive company wellness programs to enhance employee health and performance. Moreover, the growing awareness of the link between employee well-being and overall business success is steering corporations toward adopting proactive corporate health and wellness programs. In addition to this, the shift towards remote and flexible work arrangements has accentuated the need for holistic wellness solutions. As employees navigate the challenges of remote work, companies are implementing wellness programs to address physical and mental health concerns. Furthermore, the regional focus on preventive healthcare is fostering a conducive environment for the corporate wellness market. Organizations are embracing wellness as a strategic imperative, not only to reduce healthcare costs but also to attract and retain top talent. The integration of technology into wellness programs, such as wearable devices and health-tracking apps, is yet another driver propelling the corporate wellness market forward. These tech-driven solutions provide personalized insights, empowering employees to take charge of their health. In conclusion, the corporate wellness market in the UK is flourishing due to a synergistic interplay.

UK Corporate Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service, category, delivery, and organization size.

Service Insights:

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition and Weight Management

- Stress Management

- Others

The report has provided a detailed breakup and analysis of the market based on the service. This includes health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

Category Insights:

- Fitness and Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes fitness and nutrition consultants, psychological therapists, and organizations/employers.

Delivery Insights:

- Onsite

- Offsite

The report has provided a detailed breakup and analysis of the market based on the delivery. This includes onsite and offsite.

Organization Size Insights:

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small scale organizations, medium scale organizations, and large scale organizations.

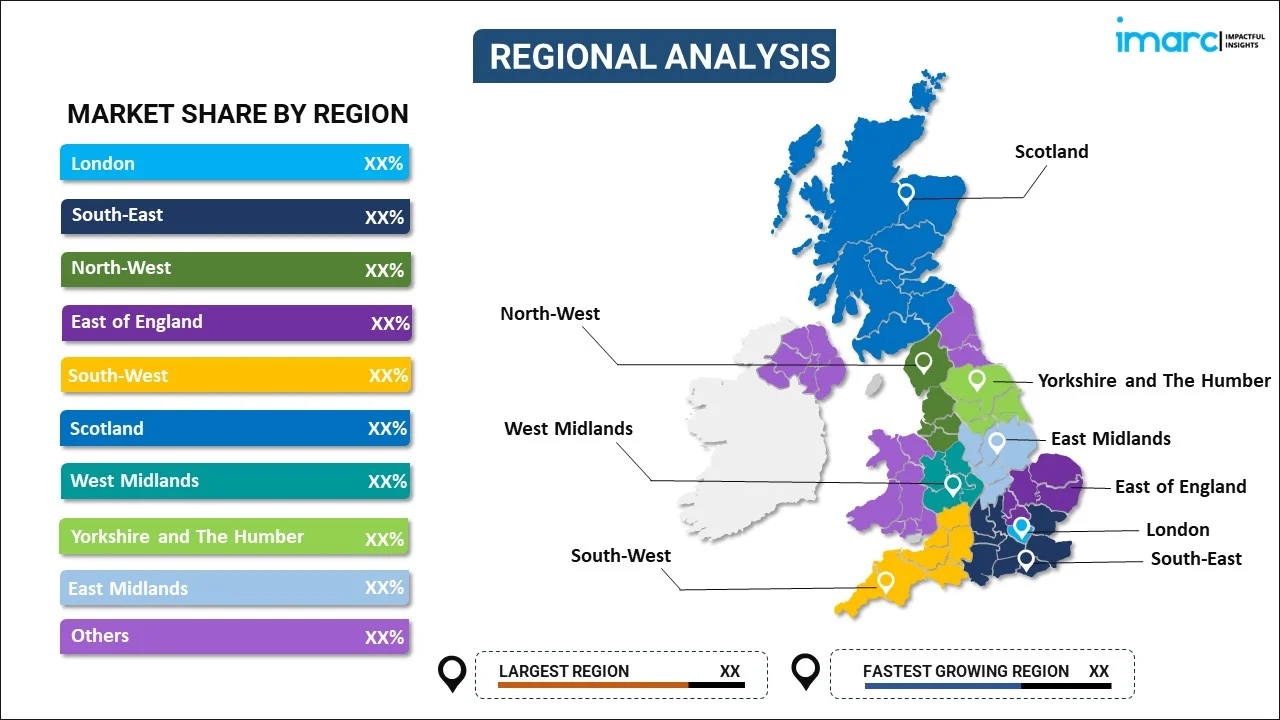

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top Corporate Wellness Companies in UK:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Corporate Wellness Recent News:

- May 2025: Virgin Media O2 partnered with Money Wellness to enhance support for financially vulnerable customers, aligning with corporate wellness goals. This collaboration enabled Virgin Media O2 agents to identify early signs of financial distress, offering tailored financial advice, thereby positively impacting the UK corporate wellness market by prioritizing employee financial well-being.

- May 2025: Vantage Circle launched its Cycle-to-Work Challenge to promote employee wellness, aligning with its broader corporate wellness goals. This initiative encouraged healthier lifestyle choices and environmental responsibility. The move enhanced employee engagement, fostering a positive impact on the UK corporate wellness market by driving sustainable workplace practices.

- March 2025: Sun Life became a strategic Workday Wellness partner, enhancing the benefits management experience for employers. Through improved data connectivity and seamless integration, the partnership streamlined wellness and benefits administration, positively impacting the corporate wellness market by increasing efficiency and access to health services.

- September 2024: Storytel partnered with Wellhub to expand corporate wellness offerings by integrating audiobooks into Wellhub’s platform. This collaboration allowed Wellhub’s three million subscribers across 18,000 companies in Latin America and Europe to access Storytel Unlimited, enhancing employee well-being and boosting engagement in the corporate wellness market.

UK Corporate Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Health Risk Assessment, Fitness, Smoking Cessation, Health Screening, Nutrition and Weight Management, Stress Management, Others |

| Categories Covered | Fitness and Nutrition Consultants, Psychological Therapists, Organizations/Employers |

| Deliveries Covered | Onsite, Offsite |

| Organization Sizes Covered | Small Scale Organizations, Medium Scale Organizations, Large Scale Organizations |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK corporate wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK corporate wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK corporate wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK corporate wellness market size reached USD 2.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.5 Billion by 2033.

The UK corporate wellness market is expected to grow at a CAGR of 4.7% during 2025-2033.

The UK corporate wellness market is expanding due to a growing focus on employee mental health and well-being. As remote work becomes more common, businesses are investing in wellness programs to improve employee engagement, reduce stress, and foster a healthier, more productive workforce.

The COVID-19 pandemic has heightened the need for corporate wellness training in the UK, as organizations adapted to remote work environments. Skills like effective communication, resilience, and team collaboration have become essential, pushing businesses to invest more in these areas for employee development.

Based on the service, the UK corporate wellness market has been segmented into health risk assessment, fitness, smoking cessation, health screening, nutrition and weight management, stress management, and others.

Based on the category, the UK corporate wellness market has been segmented into fitness and nutrition consultants, psychological therapists, and organizations/employers.

Based on the delivery, the UK corporate wellness market has been segmented into onsite and offsite.

Based on the organization size, the UK corporate wellness market has been segmented into small scale organizations, medium scale organizations, and large scale organizations.

On a regional level, the UK corporate wellness market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)