UK Craft Beer Market Size, Share, Trends and Forecast by Product Type, Age Group, Distribution Channel, and Region, 2025-2033

UK Craft Beer Market Overview:

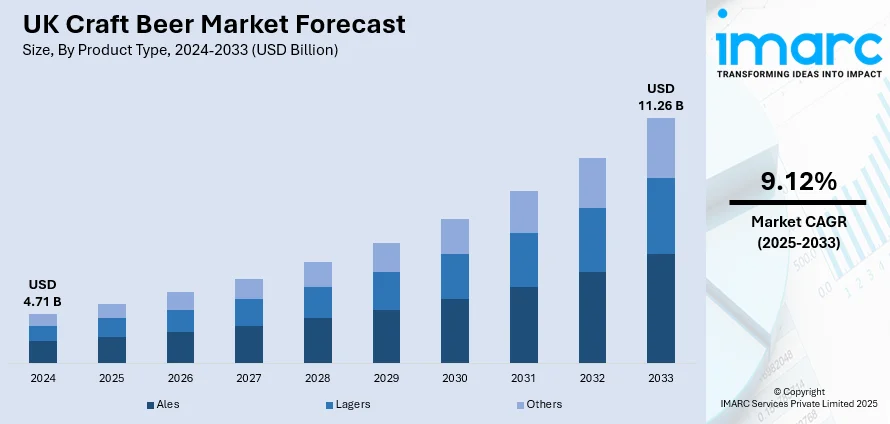

The UK craft beer market size reached USD 4.71 Billion in 2024. The market is projected to reach USD 11.26 Billion by 2033, exhibiting a growth rate (CAGR) of 9.12% during 2025-2033. The market is growing steadily, fueled by changing consumer tastes, an upsurge in artisanal brewing, and growing demand for distinctive flavour profiles. The younger population is most influential in shaping the market, with more enthusiasm for premium and locally made drinks. Retail and web channels of distribution are growing, providing greater access to wide varieties of craft beers. With the maturing of the market, regional branding and product innovation are further consolidating the UK craft beer market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.71 Billion |

| Market Forecast in 2033 | USD 11.26 Billion |

| Market Growth Rate 2025-2033 | 9.12% |

UK Craft Beer Market Trends:

Flavor & Innovation Reignite Craft Identity

UK breweries are reigniting interest in traditional beer styles while infusing them with bold flavor innovations. Consumers increasingly value authenticity and creativity which includes a renewed focus on cask ales alongside experimentation with barrel-aged stouts and fruit-infused ales. Market insights from early 2024 show stout was the only segment to grow within craft beer, recording nearly double the volume sales compared to the previous year, demonstrating consumer appetite for richer, artisanal products. Taproom events and beer festivals serve as key channels for showcasing such creations, driving engagement through storytelling and ingredient exploration. Brewers are also expanding into blended styles that combine malt-forward bases with hops or fruit adjuncts, appealing to a sophisticated cohort of drinker. This dynamic reflects evolving UK craft beer market trends, where heritage and innovation converge. By celebrating traditional styles while embracing experimentation, the craft beer community is cultivating brand loyalty and ensuring relevance in a changing beer landscape.

To get more information on this market, Request Sample

Festival & Taproom Growth Fuel Market Expansion

The proliferation of craft beer festivals and taprooms across the UK has accelerated notably in 2024, signaling rising consumer enthusiasm and a maturing market landscape. Major events held in cities such as Manchester, Edinburgh, and Bristol have experienced significant attendance growth, underpinned by the wider cultural shift towards experiential consumption and community engagement. These festivals and taproom experiences provide vital platforms for breweries to showcase a wide variety of beer styles while educating attendees about brewing processes and flavor profiles. They also serve as interactive spaces for consumer feedback, enabling brewers to innovate in response. Alongside festival growth, craft beer sales in on-trade venues, including specialist pubs and brewpubs, have seen a strong resurgence, helping microbrewers establish deeper connections with local communities. This upsurge in both festivals and taproom visibility directly supports UK craft beer market growth by expanding distribution channels and fostering a vibrant craft culture. The trend toward regional festival expansion further democratizes access to craft beer, encouraging inclusivity and sustaining the sector’s long-term vitality.

Sustainability & Health-Conscious Brewing Defines Future

The 2025 UK craft beer market increasingly prioritizes sustainability and wellness-focused innovation as key drivers shaping consumer preferences. A significant rise in the popularity of non-alcoholic and low-alcohol beers reflects a growing societal shift toward healthier lifestyle choices and mindful drinking habits. Alongside this, breweries are actively adopting environmentally responsible practices such as water recycling, the use of renewable energy sources, biodegradable packaging materials, and comprehensive waste reduction programs throughout their production processes. These efforts demonstrate a commitment to minimizing environmental impact while maintaining product quality. Additionally, digital innovations such as virtual tasting events, QR code-enabled traceability, and transparent storytelling about breweries’ environmental and social initiatives are enhancing consumer trust and deepening brand engagement. These developments collectively embody a critical shift in the UK craft beer market, showcasing how the sector is evolving to meet increasing demands for ethical production and corporate social responsibility. This convergence of craftsmanship, sustainability, and health-consciousness is positioning the industry for sustainable, long-term growth, while strengthening consumer loyalty through authenticity and shared values.

UK Craft Beer Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, and distribution channel.

Product Type Insights:

- Ales

- Lagers

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes ales, lagers, and others.

Age Group Insights:

- 21–35 Years Old

- 40–54 Years Old

- 55 Years and Above

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes 21–35 years old, 40–54 years old, and 55 years and above.

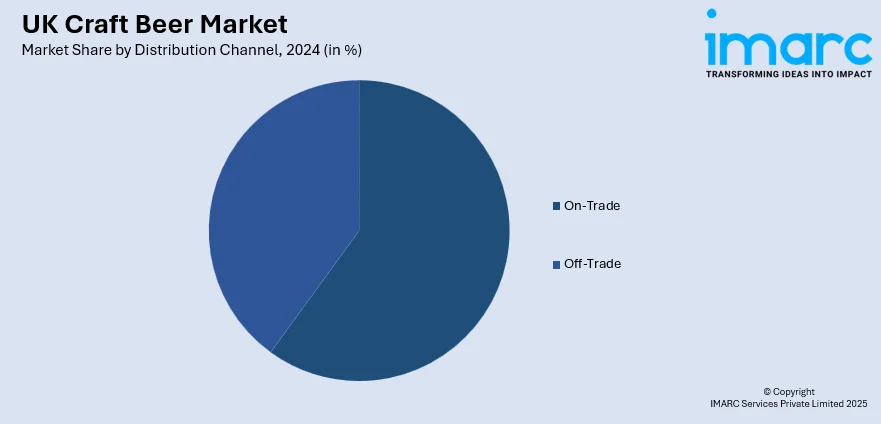

Distribution Channel Insights:

- On-Trade

- Off-Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes on-trade and off-trade.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Craft Beer Market News:

June 2025: BrewDog, the Scottish craft beer company headquartered in Ellon, Aberdeenshire, has expanded its presence in Australia, increasing global revenues by £12 million. The UK government supported this growth by showcasing BrewDog's products at diplomatic events in Brisbane, Sydney, Melbourne, and Perth. This strategic collaboration highlights BrewDog's commitment to international expansion and the UK's support for its domestic businesses. The initiative underscores the growing demand for British craft beer in international markets. This success contributes to BrewDog's increasing global footprint.

UK Craft Beer Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ales, Lagers, Others |

| Age Groups Covered | 21–35 Years Old, 40–54 Years Old, 55 Years and Above |

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK craft beer market performed so far and how will it perform in the coming years?

- What is the breakup of the UK craft beer market on the basis of product type?

- What is the breakup of the UK craft beer market on the basis of age group?

- What is the breakup of the UK craft beer market on the basis of distribution channel?

- What is the breakup of the UK craft beer market on the basis of region?

- What are the various stages in the value chain of the UK craft beer market?

- What are the key driving factors and challenges in the UK craft beer?

- What is the structure of the UK craft beer market and who are the key players?

- What is the degree of competition in the UK craft beer market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK craft beer market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK craft beer market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK craft beer industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)