UK Diaper Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UK Diaper Market Overview:

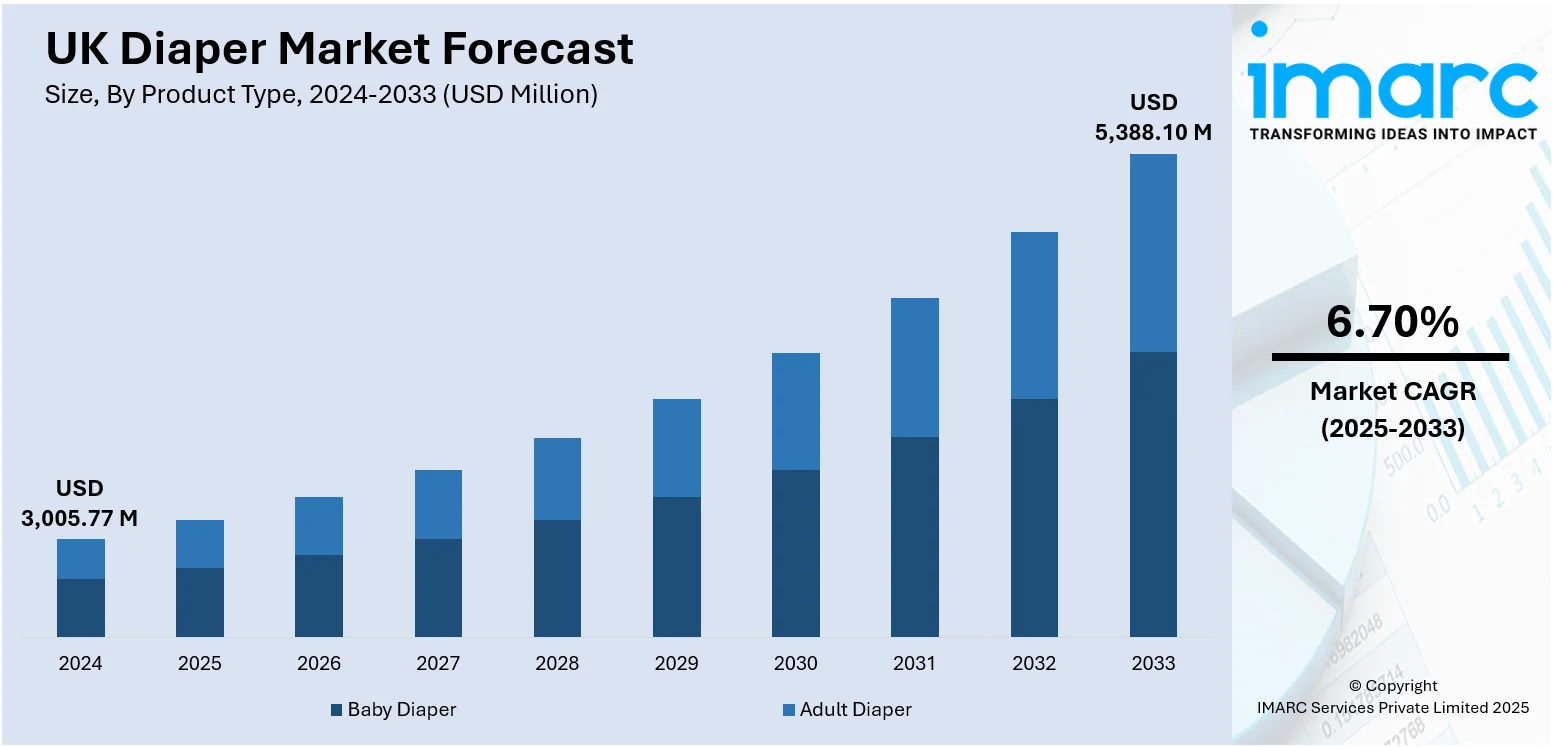

The UK diaper market size reached USD 3,005.77 Million in 2024. The market is projected to reach USD 5,388.10 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The is experiencing stable growth, driven by rising awareness of infant hygiene, increasing demand for eco-friendly and skin-sensitive products, and innovations in absorbent technologies. Consumers are shifting toward biodegradable and reusable diaper options, supported by government sustainability initiatives. Online retail and subscription services are gaining popularity due to convenience and customization. Major brands continue to invest in product development to meet evolving parental preferences. These factors collectively contribute to the expansion of the UK diaper market share in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,005.77 Million |

| Market Forecast in 2033 | USD 5,388.10 Million |

| Market Growth Rate 2025-2033 | 6.70% |

UK Diaper Market Trends:

Sustainability and Biodegradable Innovation

The UK diaper market is experiencing a significant shift as eco-conscious parenting continues to influence purchasing decisions. In April 2025, UK-based startup Planet Smart introduced PlanetSorb, the hygiene industry’s first naturally biodegradable super-absorbent polymer (bioSAP), designed to eliminate microplastics while ensuring high absorbency and effective leak protection. This advancement has positioned Planet Smart at the forefront of sustainable diaper technology. Concurrently, a growing number of diaper brands are integrating plant-based liners, compostable components, and recyclable packaging, contributing to the mainstream adoption of environmentally friendly products.Retailers are actively promoting these products through dedicated sustainability sections both in stores and online, helping consumers easily identify environmentally responsible choices. Subscription and e-commerce platforms further support this trend by offering convenient, regular deliveries, making it easier for families to choose greener alternatives. Although biodegradable diapers often carry a premium price, increasing competition is making them more accessible. As regulations around single-use plastics become stricter, sustainability-focused innovations are playing a pivotal role in shaping UK diaper market trends.

To get more information on this market, Request Sample

Digital Convenience and Subscription Services

UK parents are increasingly turning to digital platforms for diaper purchases, valuing seamless convenience and customization. In a 2024 industry report, the widespread availability of subscription options was explicitly linked to increased diaper delivery adoption across the UK market. These services typically offer flexible monthly delivery, customizable bundle sizes, and auto-renewal options features that provide reassurance during hectic parenting phases such as newborn care and nighttime routines. Backed by efficient logistics networks offering quick dispatch and eco-friendly packaging, such programs have redefined convenience for modern families. Retailers and subscription providers leverage anonymized usage data to predict size changes, optimize inventory, and enhance customer loyalty. Beyond consumer convenience, digital platforms offer operational advantages including minimized stock shortages and more efficient supply chains. As a result, digital convenience and tailored subscription models are now a prominent force in shaping UK diaper market growth.

Introduction of Premium Comfort and Advanced Protection Diapers

UK families are increasingly investing in diapers that prioritize both comfort and skin health. In September 2024, Pampers UK introduced its Premium Protection line, featuring advanced DermaComfort technology designed to draw moisture away from delicate skin, significantly reducing the risk of irritation. This range also incorporates dual leak-guard barriers, ultra-soft breathable materials, ergonomic fit, and a wetness indicator, providing comprehensive protection throughout the day and night. The product’s skin-friendly design has earned endorsement from the British Skin Foundation, further strengthening consumer confidence. Retailers actively promote these premium features both in-store and across digital platforms, often emphasizing benefits like overnight dryness, rash prevention, and comfort for sensitive skin types. Parental feedback consistently highlights the noticeable improvement in skin condition, leak prevention, and overall user experience, making the slightly higher price point widely acceptable. As competition intensifies, other brands are rapidly integrating similar innovations, raising product standards and driving the premiumization of UK diaper market

UK Diaper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Baby Diaper

- Disposable Diaper

- Training Diaper

- Cloth Diaper

- Swim Pants

- Biodegradable Diaper

- Adult Diaper

- Pad Type

- Flat Type

- Pant Type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes baby diapers (disposable diaper, training diaper, cloth diaper, swim pants, and biodegradable diaper) and adult diapers (pad type, flat type, and pant type).

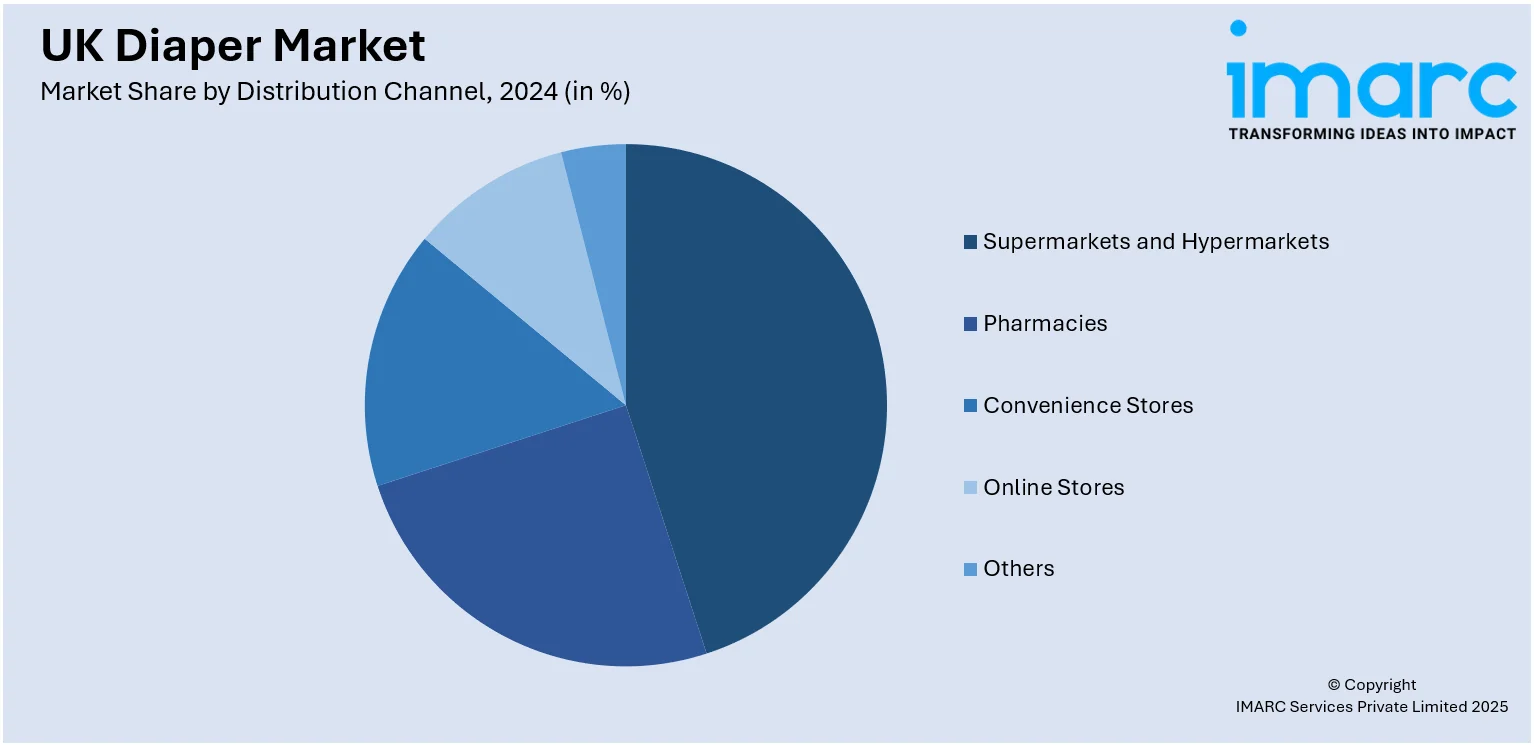

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Pharmacies

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, pharmacies, convenience stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Diaper Market News:

- September 2024: Pampers has expanded their product range in the UK with the launch of Premium Protection diapers. This move aims to strengthen the brand's position in the competitive UK diaper market by meeting the rising demand for superior baby care products. The introduction reflects Pampers’ strategy to cater to parents seeking trusted, high-quality options. By launching in the UK, the company continues to focus on enhancing its market presence and addressing evolving consumer preferences.

- February 2025: UK-based Henry Diaper is set to open its first metal storage warehouse in Hong Kong, marking a key step in its global expansion. The company is close to finalizing an agreement with local logistics partners, with regulatory approval expected soon. Choosing Hong Kong allows Henry Diaper to strengthen its position in Asia’s growing metals market, taking advantage of the city’s recent inclusion as an approved delivery point by the London Metal Exchange.

UK Diaper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Supermarkets and Hypermarkets, Pharmacies, Convenience Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK diaper market performed so far and how will it perform in the coming years?

- What is the breakup of the UK diaper market on the basis of product type?

- What is the breakup of the UK diaper market on the basis of distribution channel?

- What is the breakup of the UK diaper market on the basis of region?

- What are the various stages in the value chain of the UK diaper market?

- What are the key driving factors and challenges in the UK diaper?

- What is the structure of the UK diaper market and who are the key players?

- What is the degree of competition in the UK diaper market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK diaper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK diaper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK diaper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)