UK Digital Signage Market Size, Share, Trends and Forecast by Type, Component, Technology, Application, Location, Size, and Region, 2025-2033

UK Digital Signage Market Overview:

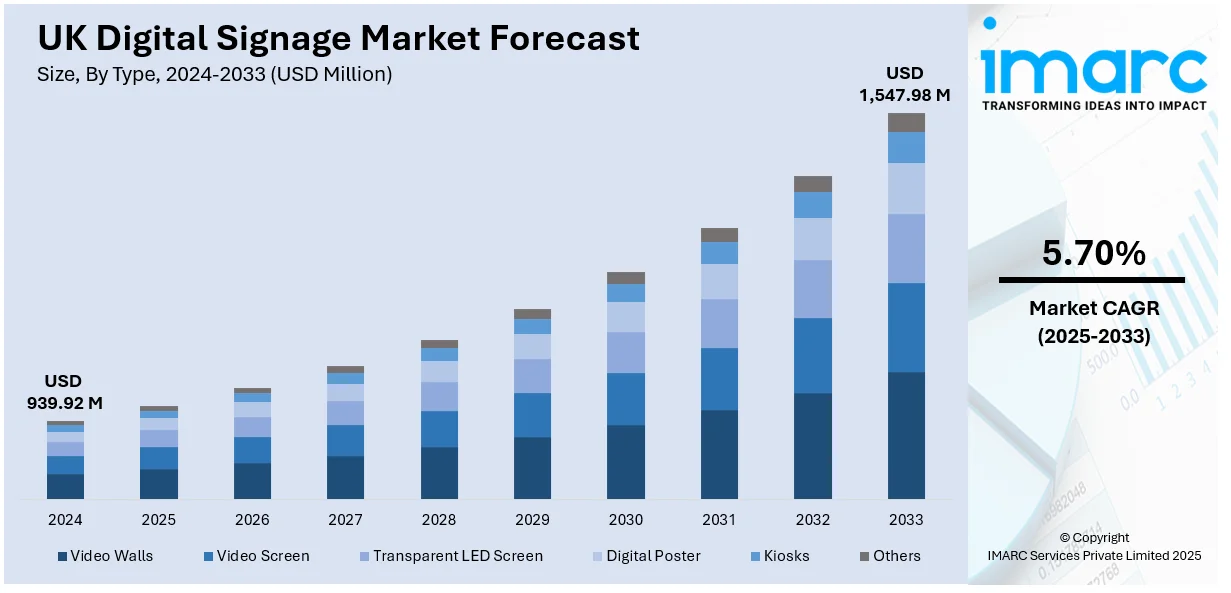

The UK digital signage market size reached USD 939.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,547.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The market is primarily driven by the increasing spending on advertising, growing social media influence, favorable government initiatives, improvements in display technologies, and rising adoption in the education sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 939.92 Million |

| Market Forecast in 2033 | USD 1,547.98 Million |

| Market Growth Rate (2025-2033) | 5.70% |

UK Digital Signage Market Trends:

Rising Spending on Advertising

According to a report of Advertising Association and WARC Expenditure UK advertising spend increased by 15.9% to a total of £9.6 billion for the period July to September 2023. The growing demand for digital signage on account of the rising spending on advertising in various sectors is offering a favorable UK digital signage market outlook. Companies across industries such as retail, hospitality, healthcare and transportation are increasing their marketing budgets to capture consumer attention more effectively. Digital signage offers an innovative and eye-catching way to deliver tailored messages in high-traffic areas making it an ideal choice for advertisers looking to maximize the impact of their campaigns. Digital signage can display dynamic and real time content which can be easily updated to reflect new promotions, products or events. This flexibility allows businesses to adapt their advertising strategies based on changing consumer preferences. UK digital signage market share is expanding as increasing advertising expenditure drives demand for dynamic, real-time content displays, enabling businesses to enhance engagement, adapt strategies and maximize campaign impact in high-traffic areas.

Increasing Adoption in the Education Sector

On 16 September 2024, TrilbyTV, a digital signage solution provider released a video and case study showcasing its work in establishing educational digital signage at 26 U.K.-based schools within the Transform Trust. The group ‘Transform Trust’ offers support to member institutions including digital signage guidance. The rising adoption of digital signage in the education sector for better communication is contributing to the market growth. Schools, colleges and universities are increasingly adopting digital displays to enhance engagement among students, staff and visitors. These digital platforms are used to display real time updates, event schedules, important announcements, emergency alerts and wayfinding information which streamline communication across campuses. Digital signage also allows educational institutions to create a more interactive and dynamic learning environment by displaying educational content, student achievements and social media feeds. These factors are collectively driving the UK digital signage market growth as educational institutions increasingly adopt digital displays for real-time communication, interactive learning and campus-wide engagement enhancing overall operational efficiency.

UK Digital Signage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, component, technology, application, location, and size.

Type Insights:

- Video Walls

- Video Screen

- Transparent LED Screen

- Digital Poster

- Kiosks

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes video walls, video screen, transparent led screen, digital poster, kiosks and others.

Component Insights:

- Hardware

- Software

- Service

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware, software and service.

Technology Insights:

- LCD/LED

- Projection

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes LCD/LED, projection and others.

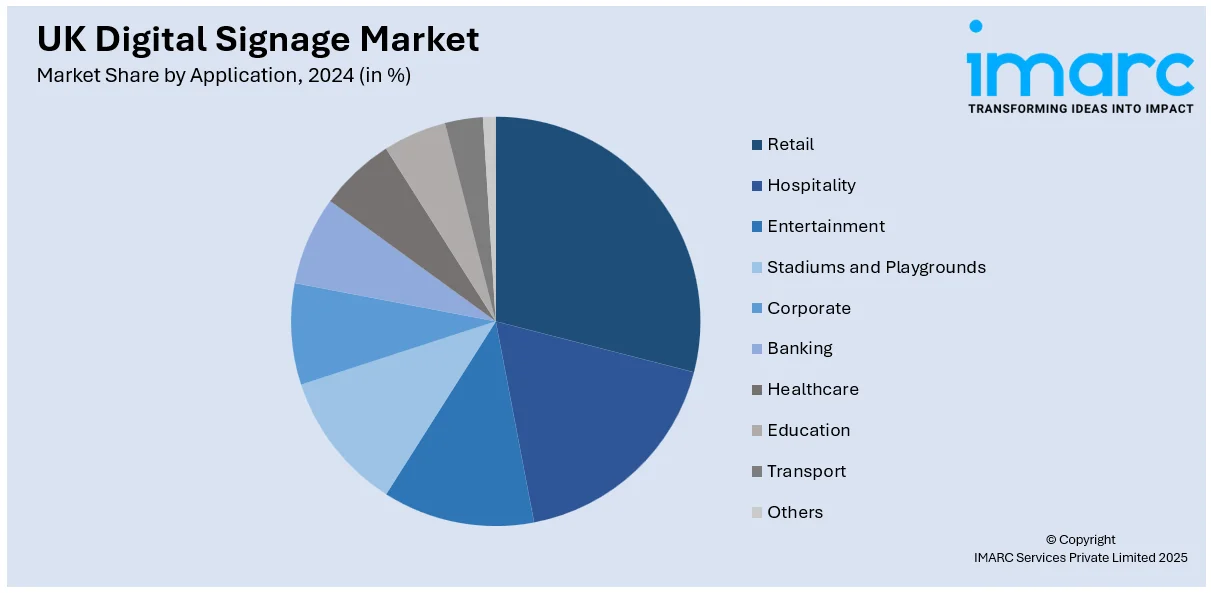

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transport

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, transport and others.

Location Insights:

- Indoor

- Outdoor

A detailed breakup and analysis of the market based on the location have also been provided in the report. This includes indoor and outdoor.

Size Insights:

- Below 32 Inches

- 32 to 52 Inches

- More than 52 Inches

A detailed breakup and analysis of the market based on the size have also been provided in the report. This includes below 32 inches, 32 to 52 inches and more than 52 inches.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Digital Signage Market News:

- 15 August 2024: JCDecaux UK, a leading global outdoor advertising firm, announced the introduction of new National Drive locations in the lively cities of Edinburgh, Leeds, and Manchester. The newly established sites on Bridgewater Way increase Manchester's total to six National Drive locations. Leeds, renowned for its architecture, has added a new screen on Kirkstall Road, bringing its total to seven National Drive sites. This digital expansion highlights JCDecaux UK's dedication to investing in major cities throughout the UK.

- 31 July 2024: Bletchley Park in the UK is preparing to unveil a new interactive installation featuring a life-size representation of computer scientist Alan Turing, powered by artificial intelligence (AI). This project is a partnership between Bletchley Park Trust and the AI firm 1956 Individuals, which asserts that the life-size digital character can engage in natural conversations with visitors in multiple languages. The displays will incorporate facial recognition technology, allowing them to adjust their interactions based on whether they are speaking to an individual, a group, or even children.

UK Digital Signage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Video Walls, Video Screen, Transparent LED Screen, Digital Poster, Kiosks, Others |

| Components Covered | Hardware, Software, Service |

| Technologies Covered | LCD/LED, Projection, Others |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transport, Others |

| Locations Covered | Indoor, Outdoor |

| Sizes Covered | Below 32 Inches, 32 to 52 Inches, More than 52 Inches |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK digital signage market performed so far and how will it perform in the coming years?

- What is the breakup of the UK digital signage market on the basis of type?

- What is the breakup of the UK digital signage market on the basis of component?

- What is the breakup of the UK digital signage market on the basis of technology?

- What is the breakup of the UK digital signage market on the basis of application?

- What is the breakup of the UK digital signage market on the basis of location?

- What is the breakup of the UK digital signage market on the basis of size?

- What is the breakup of the UK digital signage market on the basis of region?

- What are the various stages in the value chain of the UK digital signage market?

- What are the key driving factors and challenges in the UK digital signage market?

- What is the structure of the UK digital signage market and who are the key players?

- What is the degree of competition in the UK digital signage market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK digital signage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK digital signage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK digital signage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)