UK Duty-Free and Travel Retail Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

UK Duty-Free and Travel Retail Market Overview:

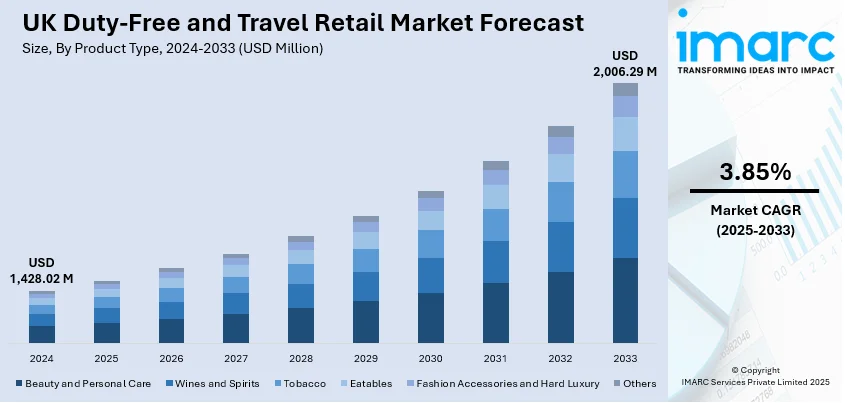

The UK duty-free and travel retail market size reached USD 1,428.02 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,006.29 Million by 2033, exhibiting a growth rate (CAGR) of 3.85% during 2025-2033. Strong international tourism, airport expansion, premium product demand, rising disposable incomes, favorable tax regulations, growth in low-cost airlines, high-margin luxury sales, frequent flyer programs, consumer appetite for exclusivity, and strategic brand partnerships are some of the factors contributing to the UK duty-free and travel retail market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,428.02 Million |

| Market Forecast in 2033 | USD 2,006.29 Million |

| Market Growth Rate 2025-2033 | 3.85% |

UK Duty-Free and Travel Retail Market Trends:

Luxury Whisky Elevating Airport Retail Appeal

High-end spirits are gaining traction in UK travel retail, with luxury whisky launches tapping into airport footfall to reach affluent consumers. A recent debut in a London terminal spotlighted an American whisky tied to a global pop icon, backed by a major drinks conglomerate. The rollout featured interactive tastings and sensory-led displays, aiming to create a deeper connection with travelers. This approach signals a shift toward immersive retail, where the airport becomes more than a point of sale; it becomes part of the brand experience. Premium whisky is being introduced as a lifestyle product, not just a commodity, with airports serving as testbeds for high-visibility launches targeting international customers in a captive, high-spend environment. These factors are intensifying the UK duty-free and travel retail market growth. For example, in April 2025, Heathrow Terminal 3 hosted the exclusive EMEA debut of SirDavis, an American whisky created by Beyoncé Knowles-Carter with Moët Hennessy. The launch activation inside Avolta’s World Duty Free offers travellers a hands-on experience with interactive tastings and sensory-led displays. This early reveal signals Moët Hennessy’s focus on luxury spirit rollouts in major airports, positioning SirDavis as a premium new entrant in the UK’s travel retail whisky offering.

To get more information on this market, Request Sample

Whisky Innovation Blending Heritage with Global Influence

UK duty-free is seeing a rise in curated whisky collections designed specifically for international travelers. A recent airport-exclusive launch highlights how distillers are experimenting with regional wine cask finishes to appeal to collectors and connoisseurs. By integrating Islay whisky with notes from celebrated wine regions like Bordeaux and Burgundy, producers are creating hybrid profiles that stand out on duty-free shelves. These limited editions are supported by high-impact terminal activations, aimed at reinforcing luxury appeal and storytelling. The focus is on offering something distinct from domestic markets, bottles that are not just premium, but also rare and culturally layered. This approach is strengthening the role of UK airports as key points for global spirit debuts and exclusive category growth. For instance, in November 2024, Suntory Global Spirits introduced the Bowmore Appellations Collection exclusively in travel retail, with a major activation at Heathrow Airport in partnership with Avolta. The new whisky range reflects collaborations with top wine regions, including Burgundy, Bordeaux, and the Douro Valley, blending Islay heritage with European influences. This Heathrow launch supports Bowmore’s premium positioning in UK duty-free, aligning with its global rollout strategy.

UK Duty-Free and Travel Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Beauty and Personal Care

- Wines and Spirits

- Tobacco

- Eatables

- Fashion Accessories and Hard Luxury

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes beauty and personal care, wines and spirits, tobacco, eatables, fashion accessories and hard luxury, and others.

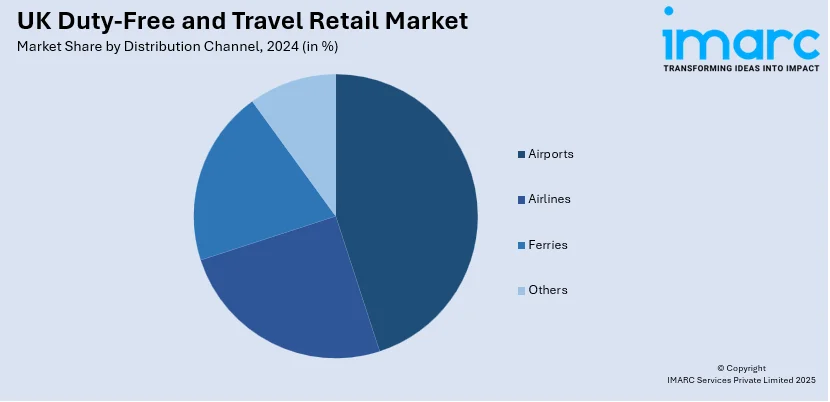

Distribution Channel Insights:

- Airports

- Airlines

- Ferries

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes airports, airlines, ferries, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Duty-Free and Travel Retail Market News:

- In April 2025, Della Vite Prosecco launched its first travel retail activation at Heathrow Terminal 5 with Avolta, transforming the liquor area into a home-style bar from April 3–30. Backed by its ‘Cheat on Champagne’ campaign, the stylish pop-up marks the brand’s rollout across Avolta’s World Duty Free stores in Heathrow and four other UK airports. The activation was unveiled by Poppy and Chloe Delevingne, emphasizing Della Vite’s growing UK duty-free presence.

UK Duty-Free and Travel Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Beauty and Personal Care, Wines and Spirits, Tobacco, Eatables, Fashion Accessories and Hard Luxury, Others |

| Distribution Channels Covered | Airports, Airlines, Ferries, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK duty-free and travel retail market performed so far and how will it perform in the coming years?

- What is the breakup of the UK duty-free and travel retail market on the basis of product type?

- What is the breakup of the UK duty-free and travel retail market on the basis of distribution channel?

- What is the breakup of the UK duty-free and travel retail market on the basis of region?

- What are the various stages in the value chain of the UK duty-free and travel retail market?

- What are the key driving factors and challenges in the UK duty-free and travel retail market?

- What is the structure of the UK duty-free and travel retail market and who are the key players?

- What is the degree of competition in the UK duty-free and travel retail market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK duty-free and travel retail market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK duty-free and travel retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK duty-free and travel retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)