UK E-Commerce Platforms Market Size, Share, Trends and Forecast by Deployment, Application, and Region, 2025-2033

UK E-Commerce Platforms Market Overview:

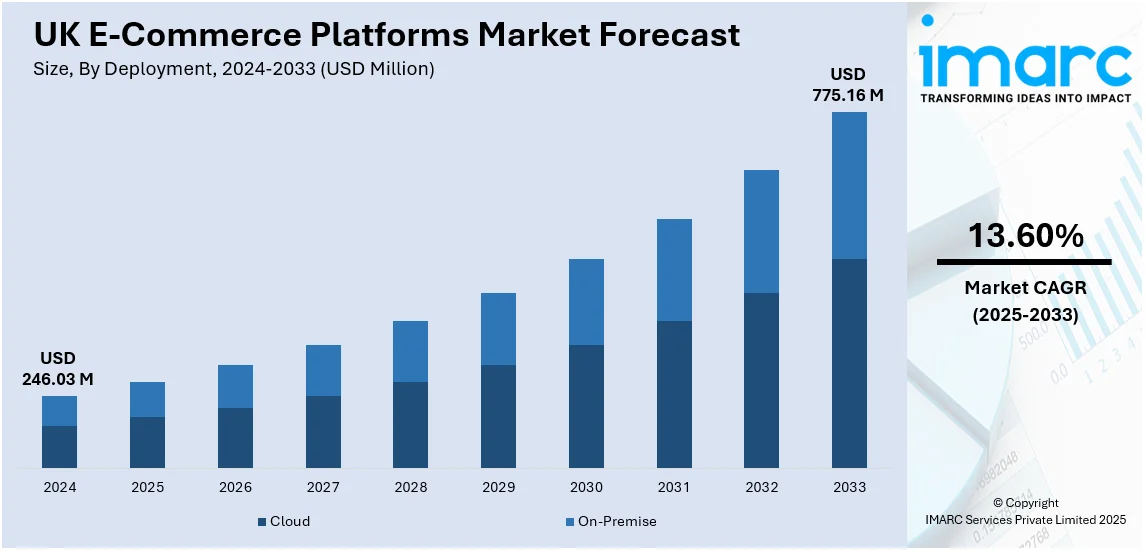

The UK e-commerce platforms market size reached USD 246.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 775.16 Million by 2033, exhibiting a growth rate (CAGR) of 13.60% during 2025-2033. The market is growing because of advancements in payment and logistics infrastructure, improving transaction efficiency and last-mile delivery. Embedded logistics solutions streamline fulfillment, enhancing speed and accuracy. The rise of direct-to-consumer (DTC) brands and niche markets strengthens client engagement, personalization, and brand control, are further supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 246.03 Million |

| Market Forecast in 2033 | USD 775.16 Million |

| Market Growth Rate (2025-2033) | 13.60% |

UK E-Commerce Platforms Market Trends:

Advancements in Payment and Logistics Infrastructure

The growth of digital wallets, buy-now-pay-later (BNPL) services, and contactless payments is making online shopping easier, boosting conversion rates for merchants. Platforms are incorporating various payment options, such as cryptocurrencies and open banking, to meet changing user preferences. For example, in 2025, Affirm broadened its collaboration with Shopify to provide its Shop Pay Installments service in the UK. This enables qualifying Shopify merchants to provide customers with flexible payment installment choices. Simultaneously, enhancements in logistics and fulfillment services are tackling challenges related to last-mile delivery. Businesses are putting money into automation, artificial intelligence-powered inventory management, and same-day or next-day delivery systems to improve efficiency. The rise of micro-fulfillment centers and city warehouses is aiding e-commerce platforms in lowering delivery times and expenses. These developments are boosting client confidence and promoting increased order frequencies.

Incorporation of Embedded Logistics Solutions

The incorporation of embedded logistics solutions is reshaping the UK e-commerce platforms sector by optimizing shipping processes for retailers. Sophisticated shipping application programming interfaces (APIs) and ready-made web components enable platforms to provide smooth fulfillment services without the need for extensive custom development. Address verification, price comparison, and automatic label generation boost shipping precision, cut expenses, and accelerate delivery times. These solutions remove manual inefficiencies, allowing businesses to expand operations while ensuring service reliability. By directly integrating into e-commerce systems, embedded logistics solutions offer merchants access to multi-carrier networks, real-time monitoring, and enhanced shipping rates. This method improves customer satisfaction by providing quicker, clearer delivery processes. Moreover, automated shipping solutions assist companies in managing the complexities of cross-border logistics, adhering to regulatory requirements, and overcoming last-mile delivery obstacles. In 2024, ShipEngine introduced ShipEngine for Platforms in the UK, allowing e-commerce platforms to integrate sophisticated shipping capabilities directly into their offerings. This product enabled platforms to provide smooth and affordable shipping solutions to merchants without the need for custom development. It offered functionalities such as address verification, price comparison, and label generation via easily integrable web elements.

Rise of Direct-to-Consumer (DTC) Brands and Niche Market Growth

The UK e-commerce platforms market is experiencing a surge in direct-to-consumer (DTC) brands, avoiding conventional retail pathways to establish direct connections with customers. This model allows brands to control pricing, user experience, and data insights without relying on third-party retailers. Niche brands are thriving in categories like organic skincare, plant-based foods, and fast fashion, leveraging digital marketing and influencer collaborations to attract loyal clients. Personalization, limited-edition drops, and community-driven engagement strategies are strengthening client retention. As competition intensifies, e-commerce platforms are enhancing capabilities for brand storytelling, analytics, and omnichannel integration to support DTC business growth and customer engagement. In 2024, Next launched Seasons, a premium e-commerce platform offering luxury fashion brands like Paul Smith, A.P.C., and Tory Burch. The platform aimed to tap into the underserved UK luxury market following recent industry changes.

UK E-Commerce Platforms Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on deployment and application.

Deployment Insights:

- Cloud

- On-Premise

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud and on-premise.

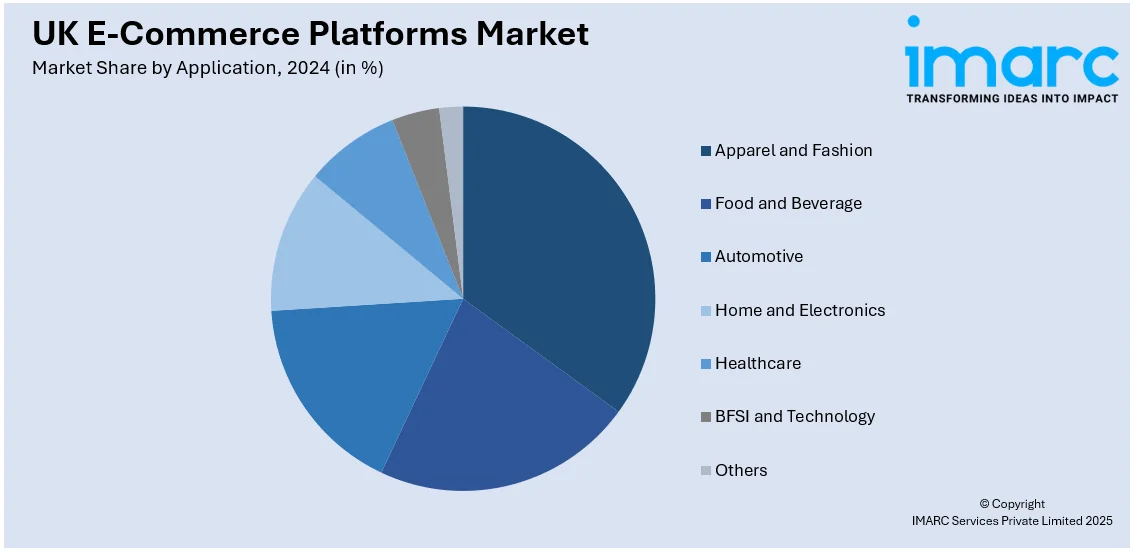

Application Insights:

- Apparel and Fashion

- Food and Beverage

- Automotive

- Home and Electronics

- Healthcare

- BFSI and Technology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes apparel and fashion, food and beverage, automotive, home and electronics, healthcare, BFSI and technology, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK E-Commerce Platforms Market News:

- In February 2025, DiPerk launched an integrated e-commerce platform for accessing genuine Perkins parts in the UK and Ireland. The platform aims to improve customer experience with 24/7 access, real-time pricing, and increased availability of parts.

- In October 2024, Vinyl Group launched its e-commerce platform, Vinyl.com, in the UK, following the acquisition of Serenade. The platform aimed to be a leading destination for vinyl enthusiasts, leveraging the UK market's growth in vinyl sales. This expansion was supported by existing infrastructure and relationships from Serenade's UK subsidiary.

UK E-Commerce Platforms Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Cloud, On-Premise |

| Applications Covered | Apparel and Fashion, Food and Beverage, Automotive, Home and Electronics, Healthcare, BFSI and Technology, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK e-commerce platforms market performed so far and how will it perform in the coming years?

- What is the breakup of the UK e-commerce platforms market on the basis of deployment?

- What is the breakup of the UK e-commerce platforms market on the basis of application?

- What is the breakup of the UK e-commerce platforms market on the basis of region?

- What are the various stages in the value chain of the UK e-commerce platforms market?

- What are the key driving factors and challenges in the UK e-commerce platforms market?

- What is the structure of the UK e-commerce platforms market and who are the key players?

- What is the degree of competition in the UK e-commerce platforms market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK e-commerce platforms market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK e-commerce platforms market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK e-commerce platforms industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)