UK E-Invoicing Market Size, Share, Trends and Forecast by Channel, Deployment Type, Application, and Region, 2026-2034

UK E-Invoicing Market Summary:

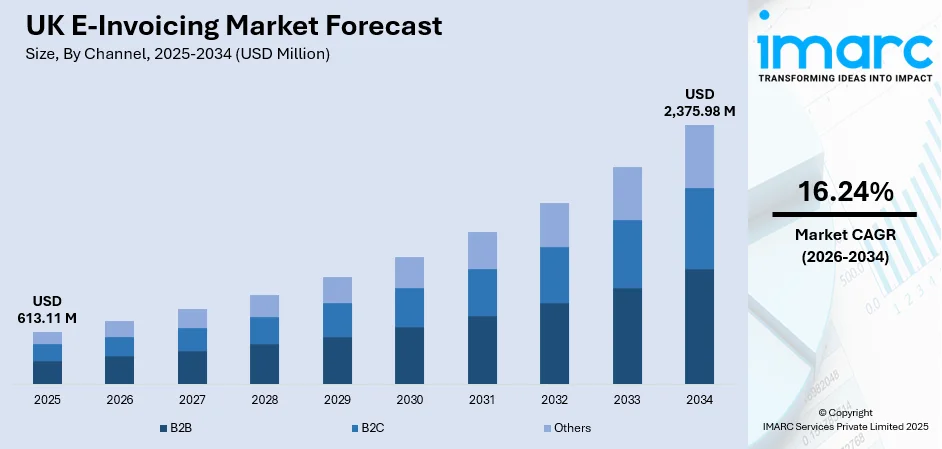

The UK e-invoicing market size was valued at USD 613.11 Million in 2025 and is projected to reach USD 2,375.98 Million by 2034, growing at a compound annual growth rate of 16.24% from 2026-2034.

The UK e-invoicing market is experiencing accelerated growth driven by government digitalization initiatives and regulatory reforms aimed at improving tax compliance and business efficiency. The market benefits from strong adoption across financial services, retail, and manufacturing sectors, with businesses increasingly recognizing the operational advantages of automated invoice processing. Rising demand for streamlined B2B transactions, enhanced cash flow management, and reduced administrative burdens continues to propel market expansion across enterprises of all sizes.

Key Takeaways and Insights:

- By Channel: B2B dominates the market with a share of 66.16% in 2025, driven by increasing digital transformation across supply chains, mandatory compliance requirements for large enterprises, and the growing need for efficient inter-business transaction processing.

- By Deployment Type: Cloud-based leads the market with a share of 75.24% in 2025, owing to scalability advantages, lower upfront costs, real-time accessibility, and seamless integration capabilities with existing enterprise resource planning systems.

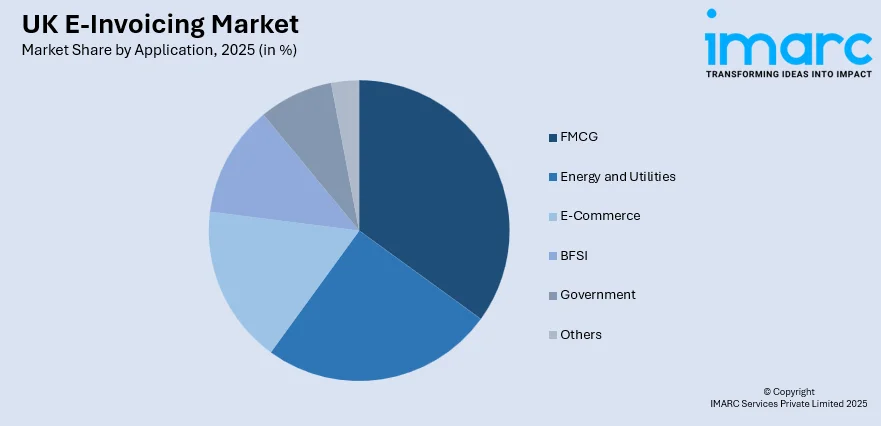

- By Application: FMCG represents the largest segment with a market share of 20.31% in 2025, attributed to high transaction volumes, complex supply chain networks, and the sector's need for rapid invoice processing to maintain cash flow efficiency.

- Key Players: The UK e-invoicing market exhibits a moderately fragmented competitive landscape, featuring established domestic software providers alongside international technology corporations. Competition is characterized by continuous innovation in automation capabilities, compliance features, and integration flexibility to meet diverse business requirements.

To get more information on this market Request Sample

The UK e-invoicing market is undergoing significant transformation as the government implements comprehensive digitalization strategies to modernize tax administration and enhance business productivity. Following the Budget 2025 announcement, the UK will require mandatory e-invoicing for all VAT invoices for business-to-business and business-to-government transactions from April 2029. According to the UK government consultation response published in November 2025, industry research indicates that e-invoicing adoption can reduce late payments by 20%, equating to annual savings of approximately eleven thousand three hundred pounds for small firms and boosting labour productivity by three percent in finance-heavy sectors. This regulatory momentum, combined with increasing adoption of cloud-based solutions and artificial intelligence integration, positions the UK market for sustained expansion throughout the forecast period.

UK E-Invoicing Market Trends:

Government-Led Digital Transformation Initiatives

The UK government has embarked on comprehensive digital transformation of its tax system, with e-invoicing serving as a cornerstone initiative. The HMRC and Department for Business and Trade launched a twelve-week public consultation in February 2025 to gather stakeholder input on e-invoicing implementation strategies. The government's commitment to publishing an implementation roadmap at Budget 2026 demonstrates sustained policy momentum. In February 2025, Exchequer Secretary James Murray visited software developer Sage's Newcastle headquarters to discuss government support for small businesses and HMRC's digital priorities, signalling strong public-private collaboration in advancing e-invoicing adoption.

Integration of Artificial Intelligence and Automation Technologies

E-invoicing platforms are progressively incorporating cutting-edge technology like machine learning and artificial intelligence, which allow for predictive analytics, intelligent validation, and automated data extraction. These innovations significantly reduce manual processing errors and accelerate invoice cycle times. In 2023, Xero was the first significant provider of accounting software for small businesses to introduce electronic invoicing, starting with businesses receiving their monthly subscription bills as e-invoices through the Peppol network. This technological evolution positions UK businesses to benefit from enhanced accuracy, reduced fraud risk, and improved compliance with evolving tax regulations through intelligent automation features.

Late Payment Crackdown Driving E-Invoicing Adoption

The UK government's intensified focus on addressing late payments is accelerating e-invoicing adoption across business sectors. In July 2025, the government announced the toughest crackdown on late payments in a generation as part of its small business growth strategy. The new Fair Payment Code establishes tiered awards for businesses based on payment performance, with Gold status requiring payment of 95% of invoices within thirty days. Combined with enhanced powers for the Small Business Commissioner and mandatory payment reporting requirements, these initiatives create compelling incentives for businesses to adopt e-invoicing solutions that streamline payment processes.

Market Outlook 2026-2034:

The UK e-invoicing market outlook remains strongly positive as regulatory mandates, technological advancements, and business efficiency imperatives converge to drive widespread adoption. The confirmed mandatory e-invoicing requirement for VAT invoices from April 2029 provides clear direction for market participants and software providers. Research from Sage indicates that adopting e-invoicing can lead to significant annual savings of approximately €13,500 for small businesses by nearly halving the time spent processing invoices. The market generated a revenue of USD 613.11 Million in 2025 and is projected to reach a revenue of USD 2,375.98 Million by 2034, growing at a compound annual growth rate of 16.24% from 2026-2034.

UK E-Invoicing Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Channel | B2B | 66.16% |

| Deployment Type | Cloud-based | 75.24% |

| Application | FMCG | 20.31% |

Channel Insights:

- B2B

- B2C

- Others

The B2B segment dominates with a market share of 66.16% of the total UK e-invoicing market in 2025.

The business-to-business channel maintains clear dominance in the UK e-invoicing landscape, reflecting the extensive adoption of digital invoice processing across corporate supply chains and commercial transactions. UK businesses are increasingly implementing e-invoicing solutions to streamline procurement processes, enhance supplier relationships, and improve working capital management. The segment benefits from regulatory drivers including the mandatory e-invoicing requirement for VAT invoices announced in Budget 2025, which specifically targets B2B and business-to-government transactions from April 2029.

The B2B segment's growth trajectory is further strengthened by the UK government's late payment crackdown initiatives. According to the Procurement Policy Note published in 2024, companies bidding for government contracts over £5 million annually will be excluded from the procurement process if they do not pay their suppliers within an average of 45 days, effective from October 2025. This regulatory pressure is compelling large enterprises to adopt e-invoicing solutions that enable faster payment processing and compliance monitoring across their supplier networks.

Deployment Type Insights:

- Cloud-based

- On-premises

The Cloud-based segment leads with a share of 75.24% of the total UK e-invoicing market in 2025.

Cloud-based e-invoicing solutions have established commanding market leadership in the UK, driven by the compelling advantages of scalability, cost-effectiveness, and real-time accessibility that align with modern business requirements. Small and medium enterprises particularly favour cloud deployment due to lower upfront investment requirements and the elimination of complex IT infrastructure management. The segment benefits from seamless integration capabilities with enterprise resource planning systems, accounting software, and other business applications.

The UK SaaS market has demonstrated robust expansion, growing from six point four billion pounds in 2020 to eleven point two billion pounds in 2023, representing approximately seventy-five percent growth over three years. By 2029, the UK software as a service (SaaS) market is projected to reach to reach USD 51.4 Billion by 2033, exhibiting a growth rate (CAGR) of 13.49% during 2025-2033, driven by increasing integration of AI-powered solutions and continued digital transformation across business sectors. Cloud-based e-invoicing platforms leverage this SaaS infrastructure to deliver automated invoice generation, validation, and submission capabilities while ensuring compliance with dynamic tax regulations across multiple jurisdictions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Energy and Utilities

- FMCG

- E-Commerce

- BFSI

- Government

- Others

The FMCG segment exhibits a clear dominance with a 20.31% share of the total UK e-invoicing market in 2025.

The fast-moving consumer goods sector leads application segments in the UK e-invoicing market, reflecting the industry's characteristically high transaction volumes and complex multi-tier supply chain networks. FMCG companies process thousands of invoices daily across relationships with suppliers, distributors, and retail partners, creating compelling requirements for automated invoice processing solutions. The sector's thin profit margins and rapid inventory turnover necessitate precise financial management and accelerated payment cycles that e-invoicing efficiently enables.

The UK FMCG market size is anticipated to reach USD 394.5 Billion by 2033 and is projected to grow at a CAGR of 5.04% from 2025-2033. UK FMCG companies are at the forefront of supply chain digitalization, with major corporations implementing cloud-based transportation management systems and integrated e-invoicing platforms. According to industry analysis, eighty-eight percent of supply chain executives expressed intention to invest over one trillion dollars in digital transformation initiatives in 2024, with invoice automation representing a priority investment area for operational efficiency gains.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The demand for e-invoicing is high in London as the nation's financial and commercial hub, hosting major banking institutions, corporate headquarters, and technology companies driving advanced digital invoicing solution adoption across diverse business sectors.

The South East represents a significant e-invoicing market driven by proximity to London, strong presence of professional services firms, manufacturing enterprises, and logistics companies requiring efficient automated invoice processing solutions.

North West exhibits robust e-invoicing growth fueled by Manchester's thriving fintech ecosystem, established manufacturing base, and expanding digital economy initiatives supporting small and medium enterprise adoption of cloud-based invoicing platforms.

East of England demonstrates steady e-invoicing adoption driven by agricultural processing industries, life sciences clusters around Cambridge, and growing technology corridors requiring streamlined B2B transaction processing and compliance capabilities.

South West maintains moderate e-invoicing market presence supported by aerospace and defence industries, tourism sector businesses, and growing digital economy hubs in Bristol driving cloud-based invoicing solution implementation across enterprises.

Scotland exhibits expanding e-invoicing adoption through Edinburgh's financial services concentration, Aberdeen's energy sector requirements, and Glasgow's diversified commercial base embracing digital transformation initiatives for enhanced operational efficiency and compliance.

West Midlands demonstrates strong e-invoicing growth propelled by Birmingham's status as a major commercial centre, automotive manufacturing supply chains, and logistics networks requiring automated invoice processing across complex supplier relationships.

Yorkshire and The Humber shows increasing e-invoicing uptake driven by financial services in Leeds, manufacturing clusters, and retail distribution centres implementing digital invoicing solutions to improve payment cycles and supplier management.

East Midlands maintains growing e-invoicing market presence supported by distribution and logistics hubs, manufacturing operations, and food processing industries adopting automated invoicing systems for enhanced supply chain efficiency and compliance.

Market Dynamics:

Growth Drivers:

Why is the UK E-Invoicing Market Growing?

Regulatory Mandate for Mandatory E-Invoicing by 2029

The UK government's announcement of mandatory e-invoicing for all VAT invoices from April 2029 represents a transformative regulatory catalyst for market growth. This mandate encompasses business-to-business and business-to-government transactions, requiring comprehensive adoption across the economy. The government's approach follows successful implementations in other jurisdictions and reflects recognition that voluntary adoption alone cannot achieve sufficient uptake for businesses to benefit from network effects. The regulatory certainty provided by this mandate enables businesses and software providers to plan investments and implementation strategies with confidence.

Operational Efficiency and Cost Reduction Benefits

E-invoicing delivers substantial operational efficiency gains that drive market adoption across business sectors. Research demonstrates that e-invoicing can reduce invoice processing times by up to forty-four percent while simultaneously improving accuracy and reducing error-related disputes. The elimination of manual data entry, paper handling, and physical storage requirements generates measurable cost savings for organizations of all sizes. Finance teams liberated from repetitive administrative tasks can redirect efforts toward strategic financial planning and analysis activities, enhancing overall organizational productivity and value creation.

Late Payment Reduction and Improved Cash Flow Management

The chronic challenge of late payments affecting UK businesses creates compelling incentives for e-invoicing adoption. Industry data indicates that fifty-two percent of small firms suffer from late payments quarterly, with the average small business owed approximately twenty-two thousand pounds in overdue invoices. E-invoicing directly addresses this challenge by accelerating invoice delivery, reducing processing delays, and enabling faster payment cycles. The automated tracking and reminder capabilities integrated into e-invoicing platforms further support timely collections, improving working capital positions and reducing the financial strain that late payments impose on smaller enterprises.

Market Restraints:

What Challenges the UK E-Invoicing Market is Facing?

Implementation Costs and Complexity for Small Businesses

Small and medium enterprises face significant challenges in implementing e-invoicing solutions due to initial investment requirements and technical complexity. Limited financial resources and IT expertise can constrain smaller organizations' ability to adopt and integrate new digital invoicing systems with existing business processes. The transition from familiar paper-based or basic digital processes to structured e-invoicing requires staff training and workflow adjustments that represent additional hidden costs beyond software licensing fees.

Interoperability and Standards Fragmentation

The absence of a single mandated e-invoicing standard in the UK creates interoperability challenges for businesses operating across multiple platforms and networks. While standards such as PEPPOL and EN16931 provide frameworks for structured e-invoicing, variations in implementation and interpretation can complicate cross-system communication. Businesses trading internationally face additional complexity navigating differing national requirements and format specifications, potentially requiring multiple solutions to maintain compliance across jurisdictions.

Cybersecurity and Data Privacy Concerns

The digital nature of e-invoicing introduces cybersecurity vulnerabilities that concern businesses handling sensitive financial data. Invoice fraud schemes including business email compromise and invoice redirection attacks represent growing threats that sophisticated e-invoicing systems must address. Ensuring robust authentication, encryption, and access controls adds complexity and cost to e-invoicing implementations while requiring ongoing vigilance and security updates to address evolving threat landscapes.

Competitive Landscape:

The UK e-invoicing market exhibits a moderately fragmented competitive landscape characterized by the presence of established domestic software providers, international enterprise solution vendors, and emerging fintech innovators. Competition centres on technological differentiation through artificial intelligence capabilities, integration flexibility, compliance expertise, and user experience optimization. Market participants pursue varied strategies including vertical market specialization, ecosystem partnerships, and continuous feature enhancement to capture market share. The regulatory momentum toward mandatory e-invoicing has intensified competitive activity as providers position for expanded market opportunity. Strategic acquisitions and partnerships are reshaping the competitive landscape as larger players seek to enhance capabilities and geographic coverage while smaller innovators bring specialized solutions to underserved market segments.

Recent Developments:

- In November 2025, the UK government published Budget 2025 confirming mandatory e-invoicing for all VAT invoices for business-to-business and business-to-government transactions from April 1, 2029, with a detailed implementation roadmap to be published at Budget 2026.

UK E-Invoicing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Channels Covered | B2B, B2C, Others |

| Deployment Types Covered | Cloud-based, On-premises |

| Applications Covered | Energy and Utilities, FMCG, E-Commerce, BFSI, Government, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK e-invoicing market size was valued at USD 613.11 Million in 2025.

The UK e-invoicing market is expected to grow at a compound annual growth rate of 16.24% 2026-2034 to reach USD 2,375.98 Million by 2034.

The B2B segment dominated the UK e-invoicing market with a 66.16% share in 2025, driven by increasing digital transformation across supply chains, mandatory compliance requirements for large enterprises, and the upcoming regulatory mandate requiring e-invoicing for all VAT invoices from April 2029.

Key factors driving the UK e-invoicing market include the government's mandatory e-invoicing requirement from April 2029, operational efficiency gains through automation, late payment reduction benefits evidencing twenty percent improvement upon adoption, integration of artificial intelligence technologies, and increasing cloud-based solution adoption.

Major challenges include implementation costs and complexity for small businesses, interoperability issues arising from standards fragmentation, cybersecurity and data privacy concerns, resistance to change among traditional businesses, and the need for staff training and workflow adjustments during transition from paper-based processes.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)