UK Ecotourism Market Size, Share, Trends and Forecast by Traveler Type, Age Group, Sales Channel, and Region, 2025-2033

UK Ecotourism Market Overview:

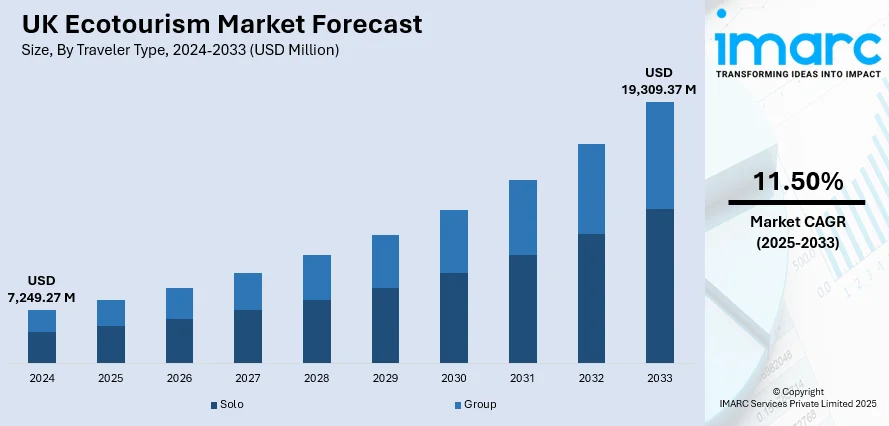

The UK ecotourism market size reached USD 7,249.27 Million in 2024. The market is projected to reach USD 19,309.37 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is driven by expanding consumer demand for sustainable tourism experiences and greater environmental awareness. Apart from this, heightened government initiatives, certifications, and investments in green tourism initiatives further push operators towards the use of environmentally friendly methods. Additionally, high domestic and international tourist demand for nature-based vacations and environmentally friendly accommodations throughout the nation further augments the UK ecotourism share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,249.27 Million |

| Market Forecast in 2033 | USD 19,309.37 Million |

| Market Growth Rate 2025-2033 | 11.50% |

UK Ecotourism Market Trends:

Rising Consumer Awareness and Sustainable Travel Preferences

Greater public understanding of climate change, carbon footprints, and biodiversity loss has reshaped travel priorities across the UK. According to industry reports, the UK is among the most nature-impoverished countries worldwide, with approximately 1 in 6 species, about 15%, at risk of extinction. Scientists at the Natural History Museum have found that only around 53% of the UK’s natural biodiversity remains compared to historical levels. This stark reality has pushed sustainability to the forefront of the country’s travel sector, encouraging operators to design offerings that protect fragile ecosystems. In line with this, many travellers now weigh the environmental impact of holidays before booking, opting for experiences that align with personal values. Moreover, there is a high preference for certified eco-lodges, carbon-neutral transport options, and locally sourced food to minimise negative effects on the places of visit. This heightened awareness has given rise to niche offerings, from low-emission adventure trips in national parks to wildlife safaris that directly fund conservation. Besides, travel companies highlight transparent sustainability practices, publish carbon offset data, and actively promote community-based tourism to appeal to this segment. Younger demographics, in particular, show strong loyalty to brands that demonstrate authentic green credentials, driving operators to adopt rigorous environmental standards and certifications. Furthermore, the influence of social media amplifies this trend, with travellers sharing responsible travel stories, recommendations, and reviews that shape others’ choices.

To get more information on this market, Request Sample

Government Initiatives and Infrastructure Development

Policy support and investment in green infrastructure continue to fuel the UK ecotourism market growth. Government bodies at local and national levels promote low-impact tourism through grants, tax incentives, and funding for eco-certification programmes. There has been significant investment in protecting and enhancing national parks, coastal paths, and reserves, ensuring that visitor facilities meet sustainability standards. Infrastructure improvements like electric vehicle charging points in rural areas, upgraded cycle routes, and low-carbon public transport connections. As per industry reports, the UK government has plans to expand the country’s electric vehicle charging network significantly through a EUR 1.6 Billion (USD 1.71 Billion) Electric Vehicle Infrastructure Strategy led by the Department for Transport (DfT). The goal is to increase the number of public charging stations to 300,000 by the year 2030, representing a tenfold increase to meet rising demand. These developments are expected to make low-impact travel more practical for visitors. Moreover, strategic plans from councils and regional development bodies include training programmes for local businesses on sustainable operations, helping small providers adapt to changing visitor expectations. Also, collaboration between policymakers, conservation charities, and community groups has helped create tourism frameworks that protect habitats while bringing income to underfunded rural economies. Government backing remains a strong force for market resilience and growth.

UK Ecotourism Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on traveler type, age group, and sales channel.

Traveler Type Insights:

- Solo

- Group

The report has provided a detailed breakup and analysis of the market based on the traveler type. This includes solo and group.

Age Group Insights:

- Generation X

- Generation Y

- Generation Z

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes generation X, generation Y, and generation Z.

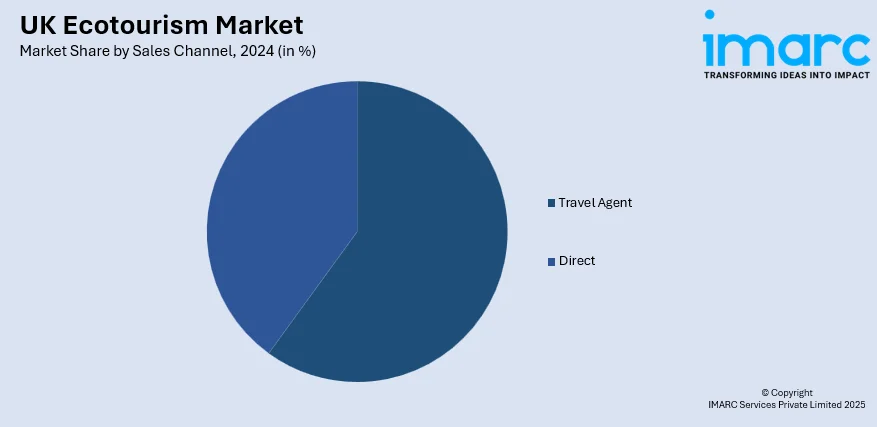

Sales Channel Insights:

- Travel Agent

- Direct

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes travel agent and direct.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Ecotourism Market News:

- On January 7, 2025, the Naturesave Trust announced the opening of its Spring 2025 funding round, offering grants of up to EUR 5,000 (about USD 5898.13) to support sustainable and active travel initiatives across the UK. The funding targets projects that promote eco-friendly transport solutions, including electric and hybrid vehicles, low-carbon infrastructure, renewable energy adoption, and active travel methods such as walking, cycling, and scootering.

UK Ecotourism Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Traveler Types Covered | Solo, Group |

| Age Groups Covered | Generation X, Generation Y, Generation Z |

| Sales Channels Covered | Travel Agent, Direct |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK ecotourism market performed so far and how will it perform in the coming years?

- What is the breakup of the UK ecotourism market on the basis of traveler type?

- What is the breakup of the UK ecotourism market on the basis of age group?

- What is the breakup of the UK ecotourism market on the basis of sales channel?

- What is the breakup of the UK ecotourism market on the basis of region?

- What are the various stages in the value chain of the UK ecotourism market?

- What are the key driving factors and challenges in the UK ecotourism market?

- What is the structure of the UK ecotourism market and who are the key players?

- What is the degree of competition in the UK ecotourism market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK ecotourism market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK ecotourism market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK ecotourism industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)