UK Edutainment Market Size, Share, Trends and Forecast by Gaming Type, Facility Size, Revenue Source, Visitor Demographics, and Region, 2025-2033

UK Edutainment Market Overview:

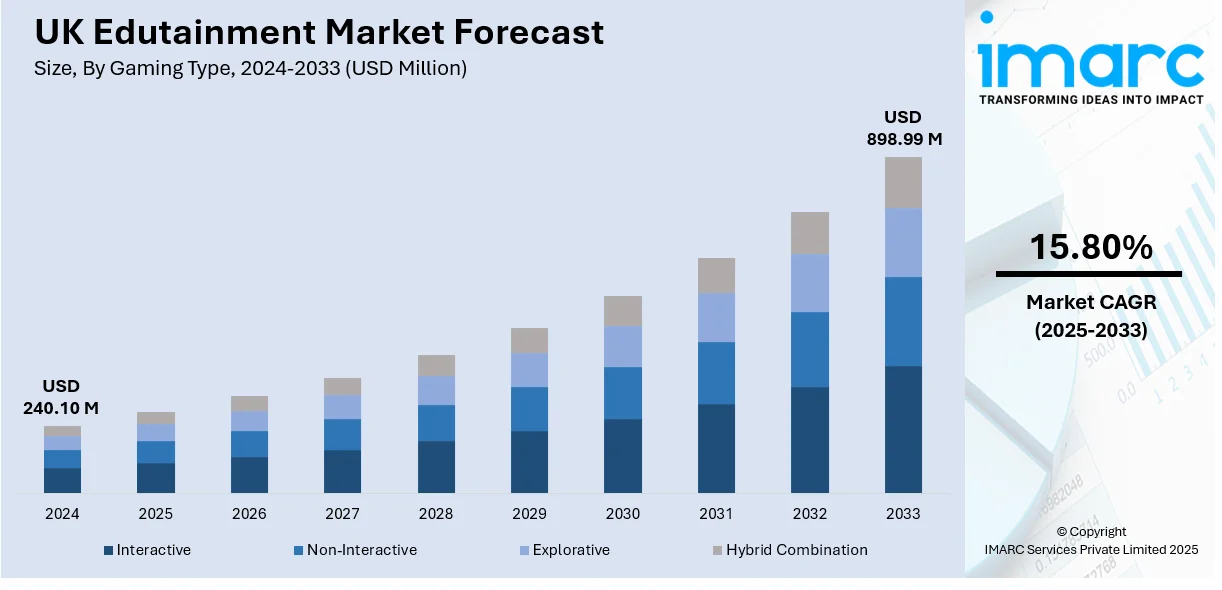

The UK edutainment market size reached USD 240.10 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 898.99 Million by 2033, exhibiting a growth rate (CAGR) of 15.80% during 2025-2033. The market is propelled by the growing demand for interactive learning experiences, increasing integration of technology in education, rising popularity of educational entertainment apps and platforms, and government initiatives supporting digital learning.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 240.10 Million |

| Market Forecast in 2033 | USD 898.99 Million |

| Market Growth Rate 2025-2033 | 15.80% |

UK Edutainment Market Trends:

Increasing Adoption of Digital Learning Technologies

The increase in digital learning technologies has been the principal factor influencing the UK edutainment market outlook. Since technological advancement is changing the education space, interactive digital tools in learning environments are becoming more favored. Schools, educational institutions, and parents increasingly use apps, games, and interactive platforms to facilitate learning and make it more interesting. It is also becoming a common trend for children to use mobile devices and tablets for both entertainment and learning. Edutainment merges education with entertainment, making it an enticing vehicle for teaching core subjects by means of gamification, multimedia, and interactive content. Additionally, the popularity of these solutions are increasing as they became a necessity for remote and hybrid learning due to the COVID-19 pandemic, thereby garnering investments into digital platforms that blend learning with entertainment. As per the UK Parliament, during the COVID-19 pandemic, 64% of schools introduced, expanded, or modernized their educational technology. The further development of digital infrastructure in the UK is making access to high-quality digital educational tools possible, which contributes significantly to the overall growth of the industry.

Rising Focus on Skill Development and Early Learning

There is also a growing focus on the development of skills and early learning within the UK, which is particularly impacting the edutainment sector. Educators and parents are increasingly becoming aware of the need to begin education at a young age and develop key skills in small children. Edutainment sites have a lot of different tools of learning that are particularly tailored towards early childhood education, targeting areas such as language learning, cognitive abilities, problem-solving, and creativity. These sites employ interactive games, animations, and puzzles to instruct children in elementary skills in an enjoyable and interactive way. Further, edutainment assists in the development of critical thinking and communication skills, which are crucial for school success in the future. As education becomes more competitive and there is more emphasis on school preparation for children, the need for edutainment products specifically for early learners has increased. Parents have also become increasingly likely to spend on learning content that gives their children an edge in their school journey while making learning fun, influencing the growth of the UK edutainment market share.

Government Initiatives and Support for Digital Education

UK government efforts toward increasing digital education are playing a vital role in boosting the edutainment industry. The UK government has been spending on education technology to improve learning outcomes and make education accessible to children across various backgrounds. According to the Department for Business & Trade, 41% of all the education technology investments being directed to Europe are to the UK. Initiatives like the "EdTech Strategy" are included in efforts that encourage technology in the classroom as well as the manufacture of digital learning tools. The efforts aim to modernize the school system and educate students with state-of-the-art digital skills. This is where edutainment platforms come in, offering convenient and entertaining methods for teaching various categories. Additionally, government incentives for the inclusion of technology in the national curriculum and the provision of digital content to rural places have also aided the expansion of edutainment solutions, which is further propelling the UK edutainment market growth.

UK Edutainment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on gaming type, facility size, revenue source, and visitor demographics.

Gaming Type Insights:

- Interactive

- Non-Interactive

- Explorative

- Hybrid Combination

The report has provided a detailed breakup and analysis of the market based on the gaming type. This includes interactive, non-interactive, explorative, and hybrid combination.

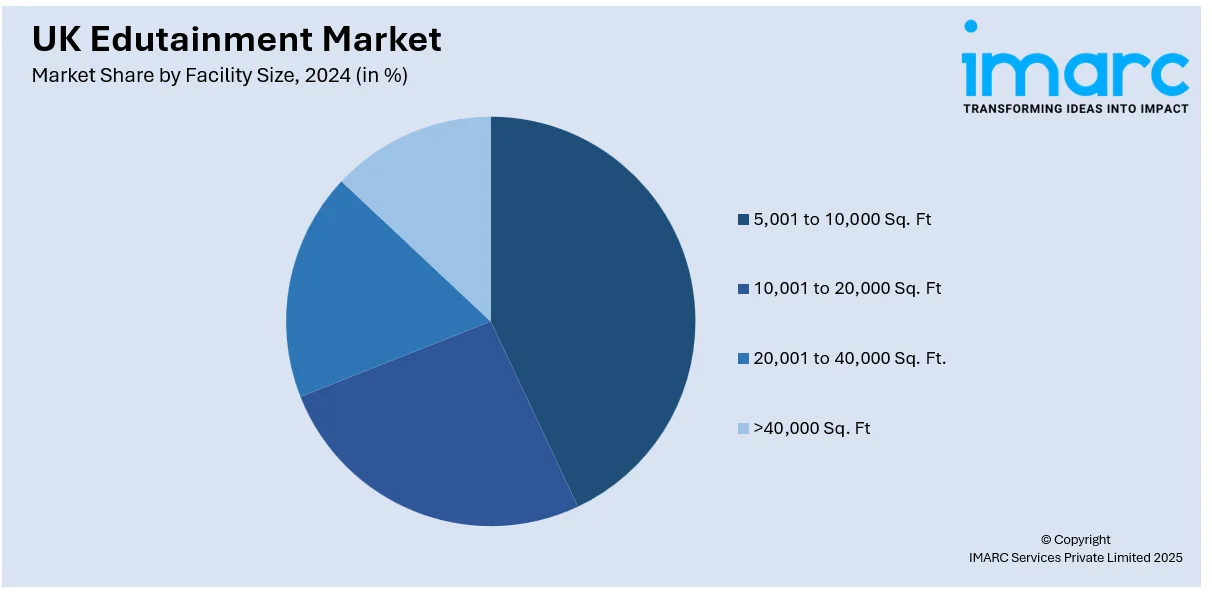

Facility Size Insights:

- 5,001 to 10,000 Sq. Ft

- 10,001 to 20,000 Sq. Ft

- 20,001 to 40,000 Sq. Ft.

- >40,000 Sq. Ft

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes 5,001 to 10,000 Sq. Ft, 10,001 to 20,000 Sq. Ft, 20,001 to 40,000 Sq. Ft., and >40,000 Sq. Ft.

Revenue Source Insights:

- Entry Fees & Tickets

- Food & Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees & tickets, food & beverages, merchandising, advertising, and others.

Visitor Demographics Insights:

- Children (0 to 12)

- Teenager (13 to 18)

- Young Adult (19 to 25)

- Adult (25+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes children (0 to 12), teenager (13 to 18), young adult (19 to 25), and adult (25+).

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Edutainment Market News:

- 22 February 2024: Edtech company ARC Technology, which offers educational software tools to academic institutions in the UK, has been acquired by UK-based Software Circle. The deal has been concluded with a £2 Million cash transaction for ARC Technology.

- 15 April 2024: Sandbox Group has launched a new free ad-supported (FAST) channel, including PlayKids TV, on Netgem TV. PlayKids TV will be distributed in the UK and Ireland through Netgem’s ISP partners including TalkTalk TV, Community Fibre TV and BetterTV. PlayKids TV focuses on providing educational entertainment with curated videos organized for children around key moments of the day such as morning routines, afternoon play and bedtime, and to engage them throughout the day.

UK Edutainment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Gaming Types Covered | Interactive, Non-Interactive, Explorative, Hybrid Combination |

| Facility Sizes Covered | 5,001 to 10,000 Sq. Ft, 10,001 to 20,000 Sq. Ft, 20,001 to 40,000 Sq. Ft., >40,000 Sq. Ft |

| Revenue Sources Covered | Entry Fees & Tickets, Food & Beverages, Merchandising, Advertising, Others |

| Visitor Demographics Covered | Children (0 to 12), Teenager (13 to 18), Young Adult (19 to 25), Adult (25+) |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK edutainment market performed so far and how will it perform in the coming years?

- What is the breakup of the UK edutainment market on the basis of edutainment type?

- What is the breakup of the UK edutainment market on the basis of enterprise size?

- What is the breakup of the UK edutainment market on the basis of deployment mode?

- What is the breakup of the UK edutainment market on the basis of industry vertical?

- What is the breakup of the UK edutainment market on the basis of region?

- What are the various stages in the value chain of the UK edutainment market?

- What are the key driving factors and challenges in the UK edutainment market?

- What is the structure of the UK edutainment market and who are the key players?

- What is the degree of competition in the UK edutainment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK edutainment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK edutainment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK edutainment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)