UK Electric Motorcycles Market Size, Share, Trends and Forecast by Drive Type, Battery Type, End-Use, and Region, 2025-2033

UK Electric Motorcycles Market Overview:

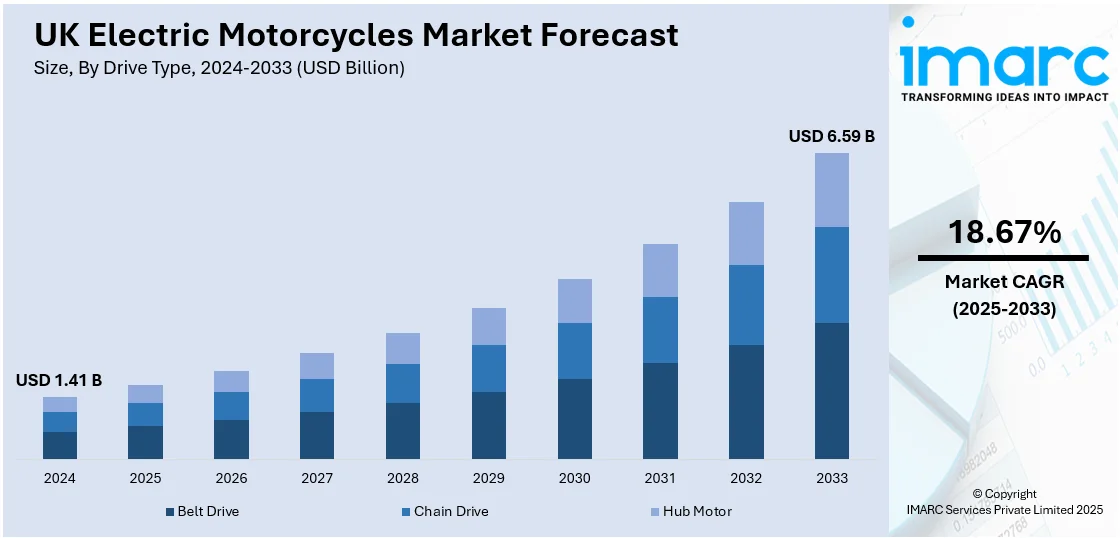

The UK electric motorcycles market size reached USD 1.41 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.59 Billion by 2033, exhibiting a growth rate (CAGR) of 18.67% during 2025-2033. The market is driven by the rising demand for sustainable transportation, supported by government incentives such as grants and tax reductions. Technological advancements in battery efficiency, range, and smart features are enhancing appeal. Expanding charging infrastructure and lower running costs further enhances adoption, attracting eco-conscious commuters and tech-savvy riders.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.41 Billion |

| Market Forecast in 2033 | USD 6.59 Billion |

| Market Growth Rate 2025-2033 | 18.67% |

UK Electric Motorcycles Market Trends:

Rising Demand for Sustainable Transportation

The increasing consumer demand for sustainable transportation solutions is positively influencing the UK electric motorcycles market share. As environmental concerns and carbon emission regulations tighten, more riders are opting for electric motorcycles as an eco-friendly alternative to traditional petrol-powered bikes. Government incentives, such as grants for electric vehicle purchases and reduced road taxes, are further encouraging this shift. On 25th February 2025, the United Kingdom government announced a £120 Million (approximately USD 0.12 Billion) investment to accelerate the transition to electric vehicles (EVs). This involves grants of £500 (around USD 520.68) for electric bikes and £4,000 (about USD 4165.46) for taxi drivers switching to zero-emission vehicles. Over 382,000 EVs were sold in 2024, an increase of 20% over 2023. The UK is also implementing a more charging infrastructure, with 74,000 chargers installed and over £200 Million (around USD 0.2 Billion) for development. The initiative is intended to help cut emissions, create jobs, and find ways to make EVs more affordable and accessible. Additionally, the expansion of charging infrastructure across the UK is making electric motorcycles more practical for everyday use. Urban commuters, in particular, are drawn to their lower running costs, reduced noise pollution, and ease of navigation in congested city areas. With major manufacturers entering the electric motorcycle space, the market is poised for continued expansion, catering to both eco-conscious consumers and tech-savvy riders seeking cutting-edge innovation.

Technological Advancements and Improved Performance

Technological advancements are reshaping the UK electric motorcycle market outlook, with manufacturers focusing on enhancing battery efficiency, range, and overall performance. Modern electric motorcycles now offer longer ranges, often exceeding 100 miles on a single charge, addressing one of the primary concerns of potential buyers. Innovations in battery technology, such as faster charging times and lighter materials, are also making electric motorcycles more appealing. The UK's charging network experienced a remarkable 38% growth in 2024, adding 20,000 new public charging points and taking the total number of public charging points to 73,699, as per latest industry reports. Ultra-rapid chargers saw the biggest growth at 83%, ending the year with 7,021 charge points, while rapid chargers grew 19% to a total of 7,450. It is this expansion that is helping enable the increased adoption of electric vehicles, even motorcycles. Although regional differences apply, the UK is set to meet its 2030 goal of having 300,000 charging points, as an average of 1,650 installations per day is planned throughout the year 2024. Furthermore, smart features including app connectivity, GPS navigation, and regenerative braking systems are attracting a younger, tech-oriented demographic. The growing popularity of high-performance electric models, such as those from Zero Motorcycles and Energica, is also challenging the perception that electric bikes lack power or excitement. As these advancements are transforming, the UK market is witnessing increased adoption among both casual riders and motorcycle enthusiasts, solidifying electric motorcycles as a viable and attractive option in the two-wheeler segment. Therefore, this is positively influencing the UK electric motorcycles market growth.

UK Electric Motorcycles Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on drive type, battery type, and end-use.

Drive Type Insights:

- Belt Drive

- Chain Drive

- Hub Motor

The report has provided a detailed breakup and analysis of the market based on the drive type. This includes belt drive, chain drive, and hub motor.

Battery Type Insights:

- Lithium-ion

- Lead Acid

- Others

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion, lead acid, and others.

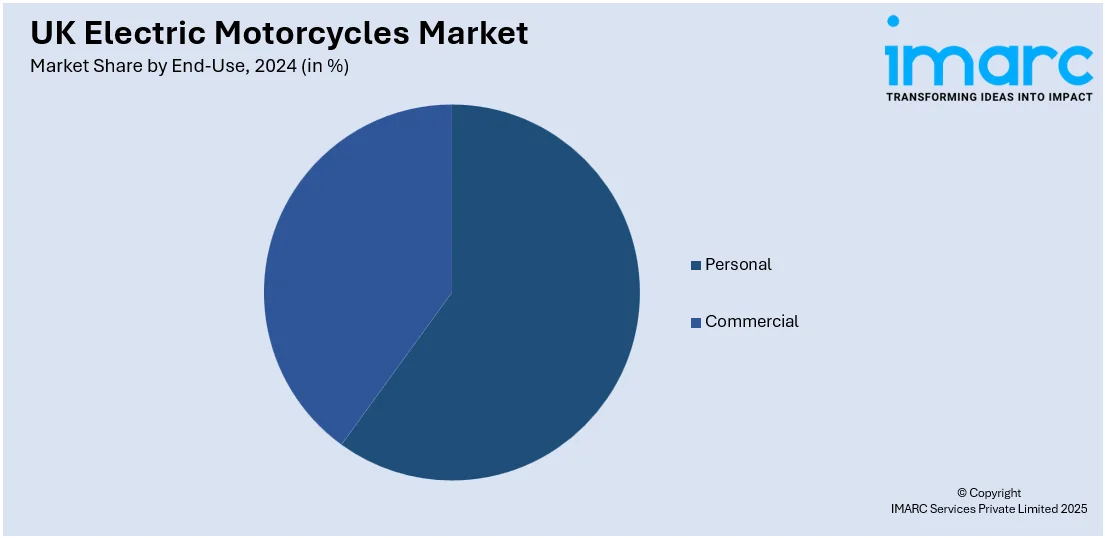

End-Use Insights:

- Personal

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes personal and commercial.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Electric Motorcycles Market News:

- November 5, 2024, Royal Enfield has announced its new electric sub-brand called Flying Flea, with the debut of the Flying Flea C6 electric motorcycle at EICMA in Milan. As per its name, the C6 is built on a 96V L-platform and features a retro theme with a range of 120-150 km, specifically targeting city conditions. It is set to begin production in 2025 and is expected to be launched in India in the spring 2026. This UK-built model, which is inspired by the historic WD/RE military bikes, is expected to have a scrambler variant, the S6, available as well, later in its career.

- September 19, 2024, Hero MotoCorp, the largest motorcycle maker in India, announced the plans to launch its Vida electric scooters in the United Kingdom, France, and Spain by the middle of 2025, marking its first foray into developed markets. India's updated emission regulations enable international exports and this move comes in line with advances in the UK-India free trade agreement. Hero is also considering exporting high-performance petrol motorcycles such as the Mavrick to the UK and Europe, while import of its Harley-Davidson collaboration motorcycles will be exclusive to the Indian subcontinent.

- September 09, 2024, The WMC300E+ of White Motorcycle Concepts (WMC), a UK-based company, designated the first electric motorcycle specifically for fleets and first responders. This new motorcycle has a 100-mile range and charges quickly in less than 15 minutes. There is also patented V-Duct technology that reduces drag and enhances stability, so the motorcycle can accelerate to the 100s of mph even with heavy pannier setup. Co-developed with the help of the UK’s Advanced Propulsion Centre, the WMC300E+ is aimed at meeting the high availability demands of emergency services and fleet operators.

UK Electric Motorcycles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drive Types Covered | Belt Drive, Chain Drive, Hub Motor |

| Battery Types Covered | Lithium-ion, Lead Acid, Others |

| End-Uses Covered | Personal, Commercial |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK electric motorcycles market performed so far and how will it perform in the coming years?

- What is the breakup of the UK electric motorcycles market on the basis of drive type?

- What is the breakup of the UK electric motorcycles market on the basis of battery type?

- What is the breakup of the UK electric motorcycles market on the basis of end-use?

- What is the breakup of the UK electric motorcycles market on the basis of region?

- What are the various stages in the value chain of the UK electric motorcycles market?

- What are the key driving factors and challenges in the UK electric motorcycles market?

- What is the structure of the UK electric motorcycles market and who are the key players?

- What is the degree of competition in the UK electric motorcycles market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK electric motorcycles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK electric motorcycles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK electric motorcycles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)