UK Fintech Market Report by Deployment Mode (On-premises, Cloud-based), Technology (Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, and Others), Application (Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, and Others), End User (Banking, Insurance, Securities, and Others), and Region 2025-2033

UK Fintech Market Size:

UK fintech market size reached USD 7,216.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 16,876.2 Million by 2033, exhibiting a growth rate (CAGR) of 9.9% during 2025-2033. A supportive regulatory environment, high digital adoption rates, strong government support, a thriving startup ecosystem, ample venture capital investment, availability of a skilled workforce, shifting focus on cybersecurity, and partnerships between traditional banks and fintech firms are some of the factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,216.0 Million |

| Market Forecast in 2033 | USD 16,876.2 Million |

| Market Growth Rate (2025-2033) | 9.9% |

UK Fintech Market Analysis:

- Major Market Drivers: One of the contributing factors boosting the regional market is a supportive and innovative regulatory environment. Additionally, the availability of venture capital and investment funds has institutionalized the funding aspect for start-ups, further supporting market growth. Another crucial factor is the introduction of new technologies, which challenge existing business models, especially among financial institutions in Europe (EU) and the UK, giving a strong push to the United Kingdom fintech market. Moreover, high internet penetration, mobile subscriptions, and a skilled workforce in tech and finance are fostering a positive outlook for fintech services trends and overall financial industry trends in the region.

- Key Market Trends: Some of the major trends in fintech industry in the UK include the growing presence of digital-only banks competing with traditional banking models. The increasing use of smart contracts and cryptocurrencies is sparking innovation in transactions and investments. The adoption of AI and machine learning to personalize and streamline customer experience is also driving market growth. Furthermore, the growing need to combat cyber threats has pushed fintech firms to implement robust data security measures, contributing to evolving financial services industry trends.

- Geographical Trends: London leads the United Kingdom fintech market due to its status as a global financial center, backed by a high concentration of financial institutions, fintech start-ups, and regulatory bodies. Cities like Manchester and Edinburgh are also emerging as fintech hubs, driven by strong digital infrastructure and a robust financial services ecosystem. Notably, the rise of UK green fintech initiatives in these regions reflects the country’s growing focus on sustainability and innovation in financial technology.

- Competitive Landscape: The competitive landscape of the market has been examined in the report, along with the detailed profiles of the major players operating in the industry.

- Challenges and Opportunities: The market is currently navigating challenges such as regulatory uncertainty post-Brexit, increasing cyber risks, and intensified competition. However, these hurdles present growth opportunities—particularly in under-penetrated areas like SME financing, financial inclusion, and sustainability-focused services, which are becoming prominent components of broader fintech industry trends.

UK Fintech Market Trends:

Robust Regulatory Environment

A secure regulatory framework, driven primarily by the Financial Conduct Authority The Financial Conduct Authority (FCA) is a massive advantage for the UK fintech market. The FCA is renowned for its commitment to innovation and stringent assurance standards and is one of the few regulators globally to offer such comprehensive oversight, which is further propelling market growth. It offers policies that promote innovation in fintech, including the Regulatory Sandbox, which enables companies to test new ideas without facing usual regulatory measures. The UK places a strong emphasis on regulatory compliance, transparency, and quality anti-money laundering practices to instill consumer confidence into the fintech sector, aligning with evolving fintech trends and strengthening the UK’s position as a global fintech leader.

UK as a Global Financial Hub

The UK is home to a booming fintech market due to its status as an international financial services hub. There is a huge chamber of financial institutions in London, from the ordinary high street banks to savvy investment firms or insurance corporations. There is existing infrastructure that also helps support fintech operations, including top legal and accounting services. In addition, the UK's significant international relationships enable it to act as a gateway for European and global markets, where fintech fms may easily enter and expand past their national borders. Moreover, a wide and well-developed financial ecosystem also tends to encourage collaboration between traditional institutions, such as banks, aligning with financial services trends that emphasize innovation, integration, and cross-sector partnerships, which is further facilitating the market growth.

High Level of Digital Adoption

A high level of digital adoption among consumers in the UK significantly drives the growth of the fintech market. With a tech-savvy population that is increasingly comfortable with digital interactions, there is a strong demand for innovative financial products and services. Consumers in the UK have shown a growing preference for digital banking, mobile payments, and online investment platforms, which has encouraged fintech companies to develop user-friendly and accessible solutions. The widespread use of smartphones and high-speed internet access facilitates the seamless integration of digital financial services into daily life, making it easier for consumers to manage their finances on the go. These shifts reflect broader trends in the financial sector, where digital-first approaches and customer-centric solutions are becoming the norm.

UK Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Breakup by Deployment Mode:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

The on-premises segment is driven by the need for greater control, security, and customization among UK fintech companies. Many firms prefer on-premises solutions to manage sensitive financial data internally, ensuring compliance with stringent data protection regulations like GDPR. Additionally, on-premises setups provide firms with direct oversight over their data and operations, reducing reliance on third-party vendors and mitigating risks associated with data breaches and external cyber threats.

The cloud-based segment is driven by the increasing need for flexibility, scalability, and cost-effectiveness in the UK fintech market. Cloud solutions allow fintech firms to rapidly deploy new services and scale their operations in response to growing customer demands without the need for substantial upfront investments in hardware or infrastructure. Additionally, cloud-based platforms offer enhanced collaboration and remote accessibility, crucial for businesses in a rapidly evolving digital landscape.

Breakup by Technology:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

The application programming interface (API) segment is driven by the UK’s open banking regulations, which mandate that banks share customer data securely with third-party providers. This has spurred the development of APIs, allowing fintech companies to integrate services and offer innovative products easily. Additionally, consumer demand for seamless, personalized experiences in digital finance has increased the need for robust API frameworks. Collaboration between traditional financial institutions and fintech’s has also accelerated API adoption, as they seek to enhance service delivery and operational efficiency.

The artificial intelligence (AI) segment is driven by the increasing need for personalized financial services and enhanced customer experience. AI technologies enable fintech firms to analyze vast amounts of data to provide customized solutions, such as tailored investment advice and automated customer support. The UK’s highly competitive fintech market encourages companies to adopt AI to differentiate themselves and offer superior services.

The blockchain segment is driven by the demand for secure, transparent, and efficient financial transactions in the UK fintech market. Blockchain technology's potential to reduce transaction costs and improve speed and security has attracted attention from both startups and established financial institutions. The UK’s regulatory environment, which supports innovation while ensuring compliance, fosters blockchain adoption in areas such as cross-border payments, smart contracts, and digital asset management.

The robotic process automation (RPA) segment is driven by the need for increased operational efficiency and cost reduction in the UK fintech sector. RPA technology enables financial institutions and fintech companies to automate repetitive tasks, such as data entry and customer onboarding, leading to faster processes and reduced human error. The competitive landscape of the UK market pushes firms to adopt RPA to maintain a competitive edge through streamlined operations.

The data analytics segment is driven by the growing importance of data-driven decision-making in the UK fintech market. Fintech companies leverage data analytics to gain insights into customer behavior, optimize product offerings, and enhance user experiences. The abundance of digital data and the increasing complexity of financial transactions require sophisticated analytics tools to manage and interpret information effectively. Regulatory requirements around data protection and transparency also drive the need for robust data analytics capabilities.

Other segments, including cybersecurity and RegTech, are driven by the need for robust security and compliance solutions in the UK’s highly regulated financial environment. Cybersecurity technologies protect against the increasing threat of digital fraud and data breaches, essential in maintaining consumer trust. Moreover, RegTech solutions streamline compliance processes, helping fintech companies navigate complex regulatory landscapes efficiently.

Breakup by Application:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

The payment and fund transfer segment are driven by the increasing demand for faster, more convenient, and cost-effective transaction solutions. Consumers and businesses alike are seeking seamless, real-time payment options that traditional banking systems often cannot provide. The rise of digital wallets, contactless payments, and mobile banking apps reflects this trend. Additionally, the push towards a cashless society and the integration of technologies like blockchain and biometric authentication are further enhancing security and efficiency.

The loans segment is driven by a growing demand for accessible and flexible credit options, particularly among underserved populations and small businesses. Fintech companies are leveraging advanced algorithms and big data analytics to assess creditworthiness more accurately and quickly than traditional lenders. This technology-driven approach enables personalized loan offerings and faster approval processes. Moreover, peer-to-peer lending platforms and digital-only banks are disrupting traditional models by providing competitive interest rates and more transparent terms.

The insurance and personal finance segment is driven by the need for personalized, on-demand financial solutions that traditional insurance companies and financial advisors often lack. Fintech firms use artificial intelligence and machine learning to provide tailored insurance products, automate claims processing, and offer personalized financial advice. Digital platforms make it easier for consumers to compare and purchase insurance products, enhancing transparency and competition. Additionally, mobile apps that track spending and savings habits empower users to manage their personal finances more effectively.

The wealth management segment is driven by the demand for affordable, accessible investment options and personalized financial advice. Fintech companies in this space use robo-advisors and automated investment platforms to democratize wealth management, making it accessible to a broader audience beyond high-net-worth individuals. These platforms offer low fees, user-friendly interfaces, and customized portfolios based on an individual’s risk tolerance and financial goals. Moreover, the integration of advanced data analytics and AI helps provide more accurate and timely investment advice.

The other segments of the UK fintech market, including blockchain technology, regtech, and cybersecurity, are driven by the need for enhanced security, compliance, and operational efficiency. Blockchain technology is revolutionizing transactions and data management with its decentralized, transparent, and secure framework, attracting interest from sectors beyond finance. Regtech firms are leveraging technology to help companies comply with complex regulations more efficiently, reducing costs and risks associated with non-compliance.

Breakup by End User:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes banking, insurance, securities, and others.

The banking segment is driven by the demand for digital-first services, open banking regulations, and increased competition from digital challengers. Consumers are seeking more convenient, personalized, and accessible banking solutions, prompting traditional banks to innovate and integrate fintech capabilities. Additionally, the rise of digital-only banks and payment solutions pushes established banks to adopt new technologies, enhance customer experience, and improve operational efficiency, ensuring they remain competitive in an increasingly digital and customer-focused financial landscape.

The insurance segment is driven by the need for digital transformation, consumer demand for personalized products, and advancements in data analytics. Insurtech companies are leveraging technology to streamline processes, reduce costs, and enhance customer experiences through faster claims processing and personalized policy offerings. Consumers are increasingly looking for tailored insurance products that meet their specific needs, driving insurers to adopt technologies like artificial intelligence and machine learning for better risk assessment and customized solutions.

The securities segment is driven by the growing demand for digital investment platforms, real-time trading capabilities, and innovative financial products. Investors are increasingly turning to fintech solutions that provide greater accessibility, lower costs, and more control over their investments. Furthermore, advancements in technology such as algorithmic trading and robo-advisors are democratizing access to sophisticated investment strategies, enabling more individuals to participate in the securities market.

The other segments in the UK fintech market are driven by diverse needs across areas such as peer-to-peer lending, crowdfunding, and wealth management. Peer-to-peer lending platforms have grown due to a demand for alternative financing options that offer competitive returns to investors and flexible borrowing terms to consumers. Crowdfunding has gained traction as an innovative way for startups and projects to secure funding directly from the public.

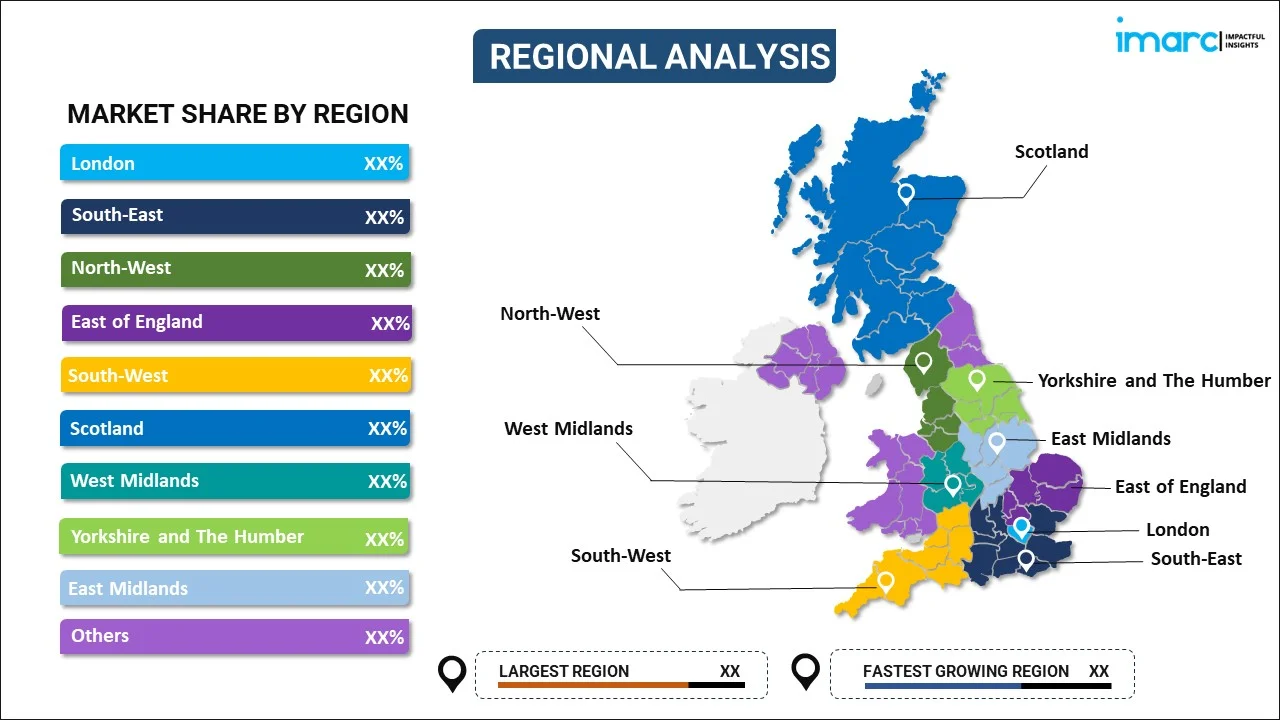

Breakup by Region:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

The London fintech market is driven by its status as a global financial center, offering a concentration of banks, investors, and financial talent. The city benefits from a diverse ecosystem of startups, accelerators, and innovation hubs that foster collaboration and growth. London’s strong regulatory framework, supportive of fintech innovation, along with access to international markets and substantial venture capital, further accelerates development. High digital adoption rates among consumers and businesses also promote the rapid uptake of fintech solutions.

The South East fintech market is driven by its proximity to London, providing access to capital, talent, and a network of financial services. This region benefits from a highly educated workforce and strong links with leading universities, fostering innovation and development in fintech. The presence of several technology parks and incubators supports startups and small businesses in scaling up. Moreover, a focus on digital infrastructure and connectivity makes it an attractive location for fintech firms looking to leverage technology to disrupt traditional financial services.

The North West fintech market is driven by a combination of strong regional economic growth and a focus on innovation. Cities like Manchester and Liverpool offer a lower cost of living and doing business compared to London, attracting fintech startups and talent. The presence of key universities and research institutions provides access to a skilled workforce and opportunities for collaboration in technology and finance. The region’s commitment to digital innovation, supported by local government initiatives, enhances its attractiveness for fintech investments.

The East of England fintech market is driven by its proximity to Cambridge, a global technology and innovation hub, and a strong academic presence that fuels research and development. The region benefits from a high concentration of tech startups and established companies, offering a collaborative environment for fintech innovation. Strong government support and investment in digital infrastructure enhance the region's appeal for fintech firms. Additionally, the area's growing pool of tech-savvy professionals and entrepreneurs helps drive new fintech solutions.

The South West fintech market is driven by a combination of a burgeoning tech community and strong support from local governments to foster innovation. Bristol and Exeter, key cities in the region, are emerging as tech hubs, providing a fertile ground for fintech startups. The region benefits from a high quality of life, attracting skilled talent, and offers a lower cost of operation than London. Universities in the South West contribute to a steady stream of tech graduates and research partnerships.

The Scotland fintech market is driven by a strong financial services sector, particularly in Edinburgh and Glasgow, which are home to major banks and insurance companies. The region benefits from a supportive government stance on fintech innovation, with initiatives like FinTech Scotland providing a collaborative environment. Access to a skilled workforce, thanks to leading universities, and a growing tech community foster an ecosystem conducive to fintech growth. Scotland’s commitment to digital infrastructure and cybersecurity also supports the development of fintech solutions.

The West Midlands fintech market is driven by a strategic focus on becoming a technology and financial services hub, leveraging Birmingham’s position as the UK’s second-largest city. The region benefits from a diverse economy, strong transport links, and a relatively lower cost of living and business operation compared to London. Universities in the West Midlands produce a steady stream of graduates in technology and finance, contributing to a skilled workforce.

The Yorkshire and The Humber fintech market is driven by a strong industrial heritage and a growing focus on technology and innovation. Leeds, a key city in the region, is a financial services hub, home to major banking, legal, and accounting firms, providing a rich network for fintech collaborations. The region benefits from a skilled workforce and lower operational costs compared to London, attracting fintech startups and investments. Universities in Yorkshire contribute to the talent pool and foster partnerships in technology and finance.

The East Midlands fintech market is driven by a mix of traditional financial services and a growing technology sector, particularly in cities like Nottingham and Leicester. The region benefits from a strong educational infrastructure, with universities producing graduates in technology and finance, supporting a skilled workforce. Lower costs of living and business operations make the East Midlands attractive for fintech startups and investors. Additionally, the local government’s focus on digital economy initiatives and infrastructure investment fosters a supportive environment for fintech companies looking to innovate and expand.

The fintech market in other regions of the UK is driven by a combination of local strengths and opportunities, including access to regional talent pools, lower operational costs, and strong support from local governments and universities. Regions like Wales and Northern Ireland offer unique advantages such as specialized skills in cybersecurity and data analytics, supported by dedicated research centers and academic institutions.

List of UK Fintech Companies:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

- Key players in the fintech industry in the UK are actively expanding their services and product offerings to maintain a competitive edge and capture a larger market share. They are investing heavily in technology, particularly in artificial intelligence (AI), machine learning (ML), and blockchain, to enhance their service capabilities and deliver more personalized and efficient solutions to customers. Additionally, key UK fintech companies are leveraging data analytics to offer tailored financial products, such as customized lending solutions, investment advice, and risk management services. Collaboration is also a significant trend, with fintech companies forming partnerships with traditional financial institutions, technology firms, and even other fintech startups to enhance their offerings and access new customer segments. These partnerships allow for the integration of innovative technologies into existing financial systems, enhancing the customer experience and expanding the reach of digital financial services.

UK Fintech Market News:

- In June 2025, Zellis Group, a UK-based HR and payroll solutions provider, acquired Hastee, a platform offering earned wage access, to enhance its employee financial wellbeing offerings. Hastee allows employees to access wages before payday and is backed by IDC Ventures. The acquisition expands Zellis’s services with financial tools and supports its focus on wellness and retention. Zellis, owned by Apax Funds, includes Benifex, Moorepay, and Zellis, serving both SMEs and large employers.

- In June 2025, UK lender Oakbrook Finance partnered with ClearScore to enhance debt consolidation offerings using ClearScore’s Clearer technology. This tool enables direct repayment of borrowers’ debts to creditors. Available on ClearScore’s marketplace and via API integration, Clearer will also launch on lenders’ direct channels later in 2025. Backed by £3.4 million from Fair4All Finance, the partnership helps broaden access to credit for underserved borrowers. Oakbrook aims to scale lending through this expanded collaboration in embedded finance and personal lending solutions.

- In June 2025, Remittance platform LemFi acquired UK-based credit scoring fintech Pillar, founded by Revolut alumni, to expand into immigrant-focused credit services. The deal includes Pillar’s tech and credit license. LemFi aims to enhance its LemFi Credit offering, which already provides revolving credit and virtual cards. The platform plans to launch physical Visa cards and integrate home-country credit data. The acquisition follows LemFi’s $53M Series B funding and supports its mission to serve underbanked immigrant populations across North America and Europe.

- In June 2025, Former Equals Group execs launched Stable, a UK-based fintech platform aimed at simplifying financial access for SMEs. Acting as a strategic layer between small businesses and fintech providers, Stable aggregates services in payments, collections, and lending. It has partnered with Finesta, Equals Money, Spark Finance, Stored, and Navro to offer features like multi-currency IBANs, merchant loans, invoice financing, and in-store collections. Stable plans to expand with request-to-pay capabilities, addressing the underserved needs of UK SMEs with integrated fintech solutions.

- In 2024, Funding Circle announced a new lending partnership with Barclays Bank and TPG's Angelo Gordon to provide increased funding to small businesses across the UK. This collaboration aims to leverage Funding Circle’s advanced technology platform and extensive small business network, combined with Barclays' financial resources and TPG's investment expertise, to enhance access to finance for SMEs. By integrating Barclays’ banking capabilities and Funding Circle’s lending platform, the partnership is designed to streamline the loan application process and deliver quicker funding decisions, ultimately supporting the growth and expansion of small businesses in the UK.

UK Fintech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK fintech market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK fintech industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech market in UK was valued at USD 7,216.0 Million in 2024.

The UK fintech market is projected to exhibit a CAGR of 9.9% during 2025-2033, reaching a value of USD 16,876.2 Million by 2033.

The UK fintech market is driven by supportive regulations fostering innovation, growing adoption of digital banking and payment solutions, and strong collaboration between startups, banks, and technology firms. Advances in AI, blockchain, and personalized financial services, along with an evolving consumer preference for convenient, tech-driven solutions, continue to boost market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)