UK Fintech Software Market Size, Share, Trends and Forecast by Deployment, End-User, and Region, 2025-2033

UK Fintech Software Market Overview:

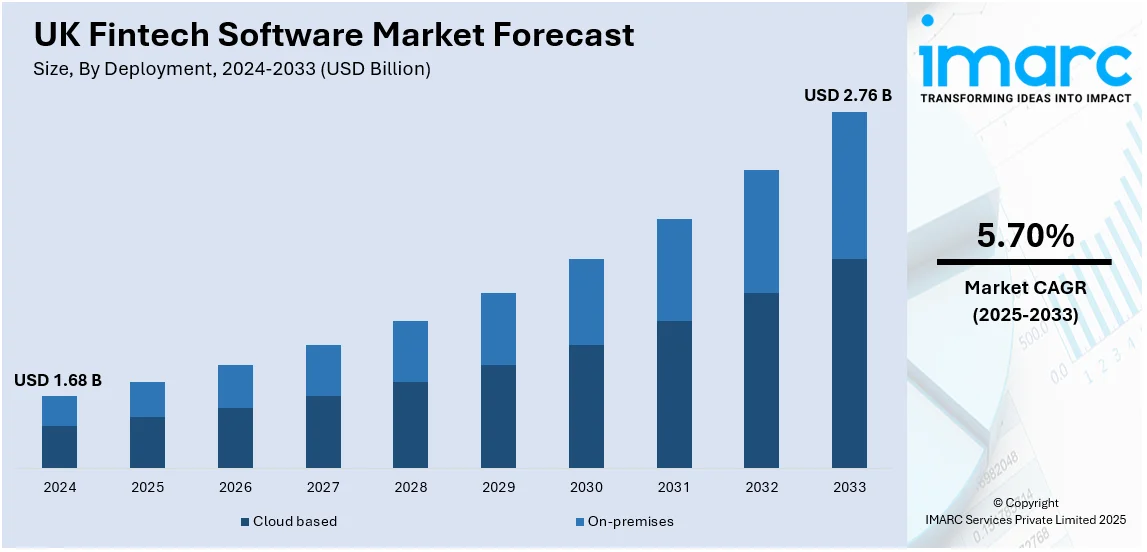

The UK fintech software market size reached USD 1.68 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.76 Billion by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The increasing adoption of digital banking, rising demand for financial inclusion, advancements in artificial intelligence (AI) and blockchain, enhanced regulatory support, the expansion of mobile payment solutions, and a shift towards cashless transactions driven by customer preferences for seamless and secure digital financial services are some of the key factors supporting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.68 Billion |

| Market Forecast in 2033 | USD 2.76 Billion |

| Market Growth Rate (2025-2033) | 5.70% |

UK Fintech Software Market Trends:

Increasing Adoption of Digital Banking

The extensive adoption of digital banking is a key trend driving the fintech software market in the United Kingdom. In a changing financial landscape, conventional banks are increasingly adopting digital platforms to enhance customer experiences and maintain competitiveness. Fintech software allows banks to deliver customized services, enhance processes, and provide round-the-clock banking access via mobile applications and web platforms. People can conduct different financial activities, including payments, transfers, and investments, without needing to visit banks in person. The transition to digital banking, driven by the emergence of neobanks and challenger banks providing fully online services, usually with reduced fees and quicker transaction times, is supporting the growth of the market. In 2024, digital bank Zopa raised €80 Billion (£68 Billion) in an equity funding round led by A.P. Moller Holding to increase growth ahead of its 2025 current account launch. The funds were set to support Zopa’s expansion, including launching a GenAI proposition and enhancing financial products.

Advancements in Technology

Ongoing advancements in artificial intelligence (AI) and blockchain technology are also propelling the UK fintech software market. Tools powered by AI are transforming financial services through improved automation, fraud detection, and customer insights. Machine learning (ML) algorithms enable fintech companies to examine large volumes of data to recognize patterns, forecast user behavior, and provide customized financial products. AI is utilized to enhance user service with chatbots and virtual assistants that offer immediate assistance and cut down response times. Moreover, blockchain technology is transforming financial transactions through the establishment of secure, transparent, and decentralized systems. Moreover, prominent fintech firms are expediting the integration of AI-powered solutions to improve efficiency in structured finance. In 2025, Semeris, a fintech startup located in London, secured €4 Billion to grow its platform and address the increasing need for AI-enhanced solutions in structured finance. The firm offers AI-driven tools for examining legal documents in structured finance markets, with the goal of improving efficiency and minimizing turnaround times in the review process.

Rise of Mobile Payment Solutions

With the rising usage of smartphones and the increasing preference for cashless transactions, mobile payments are becoming an essential part of the financial ecosystem. Fintech firms are creating groundbreaking payment apps and platforms that allow users to make seamless and secure transactions through their mobile devices. Contactless payments, digital wallets, and peer-to-peer payment solutions are becoming more popular, especially among younger individuals who prefer convenience and speed. This shift towards mobile payments is enhancing user experiences and creating opportunities for fintech software providers to develop new and advanced solutions, thereby providing an impetus to the market growth. In 2024, Revolut, a fintech company based in the UK, introduced its mobile wallets feature to simplify international money transfers. The function enables users to transfer money by simply using the recipient's phone number or email, removing the necessity for intricate bank information and guaranteeing faster, more convenient transactions.

UK Fintech Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on deployment and end-user.

Deployment Insights:

- Cloud based

- On-premises

The report has provided a detailed breakup and analysis of the market based on the deployment. This includes cloud based and on-premises.

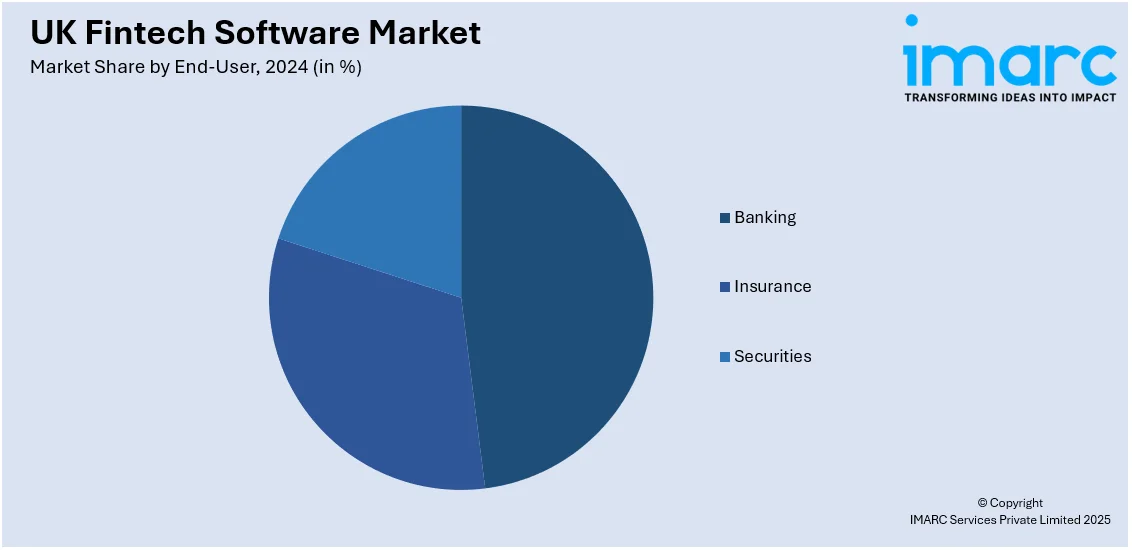

End-User Insights:

- Banking

- Insurance

- Securities

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes banking, insurance, and securities.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Fintech Software Market News:

- In January 2025, iplicit, a London-based cloud accounting software platform secured €29.7 Billion in investment from One Peak to accelerate product development and growth. Investment will help iplicit in strengthening its status as a top cloud accounting solution for the UK mid-market.

- In August 2023, UK FinTech Growth Partners LLP launched the FinTech Growth Fund, backed by industry leaders like Barclays, NatWest, and Mastercard, to support UK fintech companies in scaling from Series B to pre-IPO stages. With a focus on equity and equity-linked securities, the fund was expected to deploy capital starting in Q4 2023 and make minority investments in four to eight fintechs each year, ranging from £10 to $100 Billion.

UK Fintech Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Cloud based, On-premises |

| End-Users Covered | Banking, Insurance, Securities |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK fintech software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK fintech software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK fintech software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The fintech software market in UK was valued at USD 1.68 Billion in 2024.

The UK fintech software market is projected to exhibit a CAGR of 5.70% during 2025-2033, reaching a value of USD 2.76 Billion by 2033.

The market is driven by rising demand for digital financial services, growing emphasis on automation and efficiency, and the shift from traditional banking models. Financial institutions seek advanced software to manage risks, ensure compliance, and enhance customer experience. Increasing use of data analytics further supports fintech adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)