UK FMCG Market Report by Type (Food and Beverage, Personal Care and Cosmetics, Health Care, Home Care, Footwear, and Others), Distribution Channel (Supermarkets and Hypermarkets, Grocery Stores, Specialty Stores, E-Commerce, and Others), and Region 2025-2033

UK FMCG Market Overview:

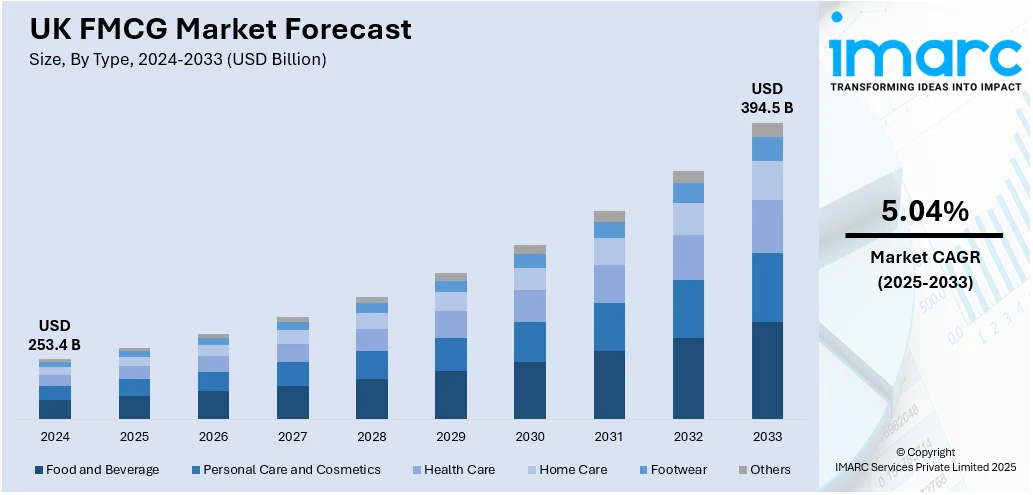

- The UK FMCG market size was valued at USD 253.4 Billion in 2024 and is projected to reach USD 394.5 Billion by 2033.

- The market is estimated to grow at a CAGR of 5.04% from 2025-2033.

- The FMCG market in UK is driven by changing consumer habits, demand for healthier and sustainable goods, digital shopping growth, strong private label offerings, and convenience-focused trends.

- In terms of type, the market is segmented into food and beverage, personal care and cosmetics, health care, home care, footwear, and others.

- The UK’s FMCG sector is the country’s biggest manufacturing segment, making up about 14% of total manufacturing output.

To get more information on this market, Request Sample

UK FMCG Market Trends:

Rising Penetration of E-Commerce

The burgeoning FMCG Industry in the UK is positively influencing the market in the UK, owing to the increasing preferences for online purchasing on account of convenience offered. Brands are growing their digital presence by investing in user-friendly websites and apps that improve the purchasing experience. Retailers are improving their supply networks to assure speedier delivery times, fulfilling consumer demand for speedy service. As people are utilizing online platforms, they are seeking subscription services that give regular deliveries of necessities, making life easier. Companies are also leveraging data analytics to understand consumer behavior and personalize their offers for specific requirements and preferences. This customization is enhancing consumer loyalty and encouraging repeat purchases as individuals feel more connected to the businesses they choose. In addition, influencers on social media are promoting products and increasing direct sales through social platforms, which is contributing to the market growth. Brands are taking advantage of this trend by launching specific advertising campaigns and interacting with customers through engaging content. Furthermore, advancements in payment technology, such as mobile wallets, buy now, pay later options, and one-click checkout services, are streamlining the checkout procedure, allowing consumers to easily finish their purchases. With the growing awareness among shoppers about online shopping habits has led FMCG Logistics players sharpening digital strategies to capture this opportunity. According to the IMARC Group’s Report, the UK e-commerce market is projected to exhibit a growth rate (CAGR) of 18.50% from 2024 to 2032.

Increasing Focus on Health and Wellness:

As per the Soil Association Certification’s Organic Market Report 2023, shoppers spend almost £8.5 Million on organic products in FMCG UK space. The increasing popularity of organic, gluten-free, and plant-based products is driving the demand for health-conscious options. Consumers are becoming more selective, seeking clarity in ingredients and nutritional details. Brands are adapting by changing their products to lower sugar, salt, and artificial additives, as well as improving nutritional content. Besides this, the rising trend of wellness-oriented lifestyles is catalyzing the demand for functional foods that provide additional health benefits, including probiotics, vitamins, and superfoods. Companies are responding by introducing cleaner labels, emphasizing natural ingredients and ethical sourcing to ensure transparency. This shift is encouraging the elimination of artificial additives and preservatives and simplification of ingredient lists, enabling consumers to comprehend the contents of the products they are purchasing. Moreover, the growing awareness among the masses about dietary restrictions and limitations is encouraging people to purchase gluten-free, dairy-free, and allergen-friendly choices. Retailers are incorporating health and wellness concepts into their marketing plans by using social media to connect with health-conscious customers and advertise lifestyle-related products. In line with this, innovations in food products like pre-prepared meals with improved nutrition are gaining traction. Numerous brands are also collaborating with health professionals and dietitians to develop products that match current lifestyle trends, thereby offering a favorable market outlook in the country.

Store Brands Win More Shelves

In the UK, store brands are capturing a larger share in the UK retail as consumers seek ways to stretch their budgets. Many supermarkets now stock a wider range of own-brand groceries, cleaning supplies, and bathroom essentials that rival leading brands in terms of quality and value. Shoppers feeling the pinch from higher living costs are more open to swapping branded products for trusted supermarket versions. Discounters play a key role in driving this change, utilizing strong private label ranges to attract families who seek good value without compromising on quality. Some retailers now offer premium store-brand lines, healthier food options, and packaging that meets eco-friendly standards. Customers see their brands as reliable, not just cheap. Local suppliers gain new opportunities to produce goods under supermarket labels, providing smaller producers a foothold in national chains. Private labels are shaking up how brands compete, keeping prices in check, and giving shoppers better-value options every week.

Self-Care Boosts Daily Essentials Spend

The UK’s personal care shelves have seen steady gains, with spending climbing over 10.7% as people focus more on FMCG products. Haircare, skincare, and grooming products remain in high demand as shoppers pick up new routines at home. Interest in cleaner ingredients, cruelty-free formulas, and natural options pushes brands to refresh products and packaging. Smaller companies stand out with unique lines, while big names expand ranges to stay relevant. Digital shopping and social media continue to drive this momentum, enabling buyers to discover new brands and special offers quickly. Subscription boxes and direct online sales provide people with easy ways to try new products every month. Supermarkets and chemists now stock more shelf space with specialist skincare and men’s grooming lines. Influencer posts and targeted ads make trends spread quickly. This solid growth in everyday care means more sales for makers and keeps retailers updating aisles to match what shoppers want.

UK FMCG Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Food and Beverage

- Personal Care and Cosmetics

- Health Care

- Home Care

- Footwear

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes food and beverage, personal care and cosmetics, health care, home care, footwear, and others.

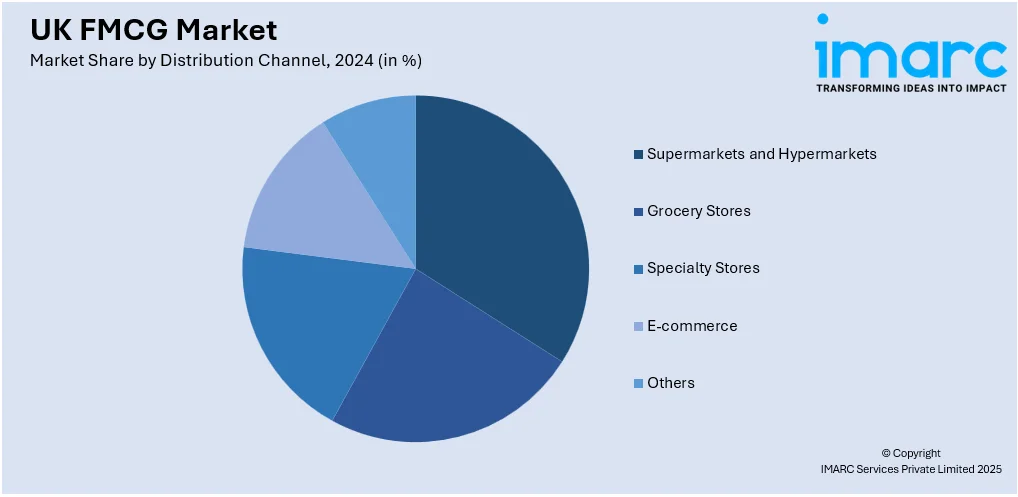

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Specialty Stores

- E-commerce

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, grocery stores, specialty stores, e-commerce, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top FMCG Companies in UK:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK FMCG Market Recent News:

- June 2025: Tesco’s UK like-for-like sales rose 5.1% in a fiercely competitive grocery sector. Improved value, quality, and service helped it gain market share, lifting its grocery share to 28%. This growth reflected stronger demand in stores and higher online purchases of FMCG products.

- March 2025: BBC Studios expanded Bluey’s presence in UK supermarkets through new FMCG deals with Kellogg’s, Hero, Child Farm, and Nature Aid. These launches strengthened Bluey’s reach in cereals, snacks, bath products, and kids’ vitamins, boosting licensed family goods across grocery and personal care aisles.

- September 2024: AWS reported that its cloud services boosted UK productivity, with over 70% of online FMCG sales from SMEs using Amazon’s tools. This support helped small brands scale more quickly, launch new ranges like Nestlé’s 2024 plant-based line, and efficiently reach wider markets.

- June 2024: Uber’s advertising division in the UK launched Sponsored Items on Uber Eats, partnering with PepsiCo and powered by Criteo to offer FMCG brands new advertising opportunities directly within the app.

- May 2024: Bakkavor Group plc, a leading provider of fresh prepared food, acquired Moorish, one of the most recognizable hummus brands in the UK, to enhance its existing dips business with high-quality, innovative products.

- November 2023: Nestlé grew its UK FMCG range with Garden Gourmet’s plant-based white fish fillets, nuggets made from wheat and pea protein, and Vrimp, a vegan shrimp made with seaweed and konjac. These launches supported rising demand for sustainable, seafood-style alternatives.

UK FMCG Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Food and Beverage, Personal Care and Cosmetics, Health Care, Home Care, Footwear, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Specialty Stores, E-Commerce, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK FMCG market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK FMCG market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK FMCG industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK FMCG market is expected to grow at a CAGR of 5.04% during 2025-2033.

The UK FMCG market was valued at USD 253.4 Billion in 2024.

FMCG means everyday products that sell quickly for a low price. In Britain, this covers food, drinks, cleaning supplies, toiletries the usual supermarket basket. Shops and online platforms keep these goods moving fast from shelf to customer.

People want healthier choices, greener packaging, and easy online buying. Supermarkets push own-brand ranges to compete on price. Shoppers look for promotions and loyalty deals. This mix of trends keeps companies tweaking what they offer to stay competitive.

The pandemic changed shopping overnight. People stocked up on groceries, cooked at home more, and switched to bigger packs. Online deliveries jumped and have stuck around. Cleaning products, pantry staples, and frozen food all saw bigger demand during that period.

Based on the type, the UK FMCG market has been segmented into food and beverage, personal care and cosmetics, health care, home care, footwear, and others.

Based on the distribution channel, the UK FMCG market has been segmented into supermarkets and hypermarkets, grocery stores, specialty stores, e-commerce, and others.

On a regional level, the UK FMCG market has been segmented into London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)