UK Footwear Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End User, and Region, 2025-2033

UK Footwear Market Overview:

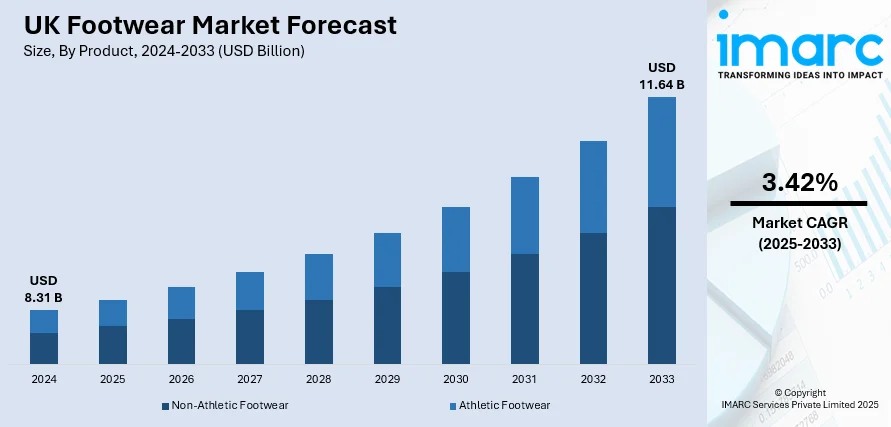

The UK footwear market size reached USD 8.31 Billion in 2024. The market is projected to reach USD 11.64 Billion by 2033, exhibiting a growth rate (CAGR) of 3.42% during 2025-2033. The market is fueled by shifting lifestyles of consumers, preference for sustainability, and retail innovation through technology. Increasing demand for moral production, online-first shopping habits, and utility fashion is driving new product categories and business models. Product innovation in terms of materials and design, along with a shift towards value-based purchases, is also expanding the reach of footwear as a category among segments. With these changing dynamics, players in the industry are adjusting to stay relevant and competitive, which ultimately contributes towards the growth of the UK footwear market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 8.31 Billion |

|

Market Forecast in 2033

|

USD 11.64 Billion |

| Market Growth Rate 2025-2033 | 3.42% |

UK Footwear Market Trends:

Heightening Demand for Ethical and Sustainable Footwear

The UK footwear industry is experiencing a notable boost in demand for sustainable and ethically produced footwear. People are more conscious of the green footprint of fashion and are actively looking for alternatives that cater to their environmental conscience. Footwear composed of biodegradable, recycled, or plant-based materials is becoming popular, as is appeal for locally produced products with transparent supply chains. Certifications guaranteeing fair labour practices and low-carbon production processes are also influencing purchasing behavior. Retailers are launching more environmentally friendly lines and highlighting their sustainability credentials, such as carbon-neutral shipping and recyclable packaging. The trend is most evident among young, urban customers who see their buying choices as activism. It is transforming retail strategies and product design throughout the industry. As sustainable values become mainstream, growth in the UK footwear market will increasingly be spearheaded by environmentally friendly practices, supporting trends around conscious consumption.

To get more information on this market, Request Sample

Growth of Digital and Omnichannel Retail Platforms

Digital disruption is transforming the UK footwear sector's landscape, with e-commerce and omnichannel strategies becoming increasingly prominent in consumer engagement. Online shopping continues to gain momentum through better mobile experiences, secure payment options, and advanced digital technologies like 3D shoe modeling and virtual trials. For example, in March 2025, Nike launched the Air Max Dn8 with Dynamic Air tech, reflecting rising UK footwear market trends favoring innovation, comfort, and lifestyle-athletic crossovers in premium performance sneakers. Furthermore, customers today demand effortless integration between offline and online stores, such as click-and-collect services, easy returns, and instant stock availability. Social commerce, driven by influencer-driven content and interactive promotions on Instagram and TikTok, has further incorporated digital interaction into the footwear purchasing process. Players are leveraging artificial intelligence (AI) powered chatbots, customized marketing, and data-based suggestions to foster customer loyalty. All these innovations are broadening access to footwear across different age groups and geographies. Consequently, digital integration is not only transforming retail experiences but also fueling overall UK footwear market growth and informing changing market trends.

Increase in Demand for Athleisure and Functional Footwear

The UK footwear industry is experiencing strong growth in athleisure and functional footwear, driven by lifestyle shifts that emphasize comfort, mobility, and health. Consumers are increasingly opting for footwear with athletic performance capabilities that combines athletic performance with everyday fashion appeal to allow freedom of movement across a range of settings like work, gym, and social activities. Footwear with functionalities such as ergonomic soles, breathable materials, and light weight is on the rise, especially among working professionals and health enthusiasts. The popularity of products such as these results from their practicality without affecting looks, which makes them both casual and semi-casual wearable. There is an boosting emphasis on footwear designed for individual activities such as walking, hiking, and low-impact exercises. For instance, in April 2024, UK-based INOV8 launched the MUDTALON SPEED trail shoe, marking its first major footwear rebrand in 20 years with enhanced grip, comfort, and foot-shaped fit for muddy terrains. Moreover, season collections now include sport-inspired styles even in trend-led categories. This shift towards crossover performance and lifestyle footwear is driving both brand distinction and consumer loyalty. The increasing demand for functionally fashionable choices mirrors wider UK footwear market trends and is expected to support continued market growth.

UK Footwear Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, distribution channel, pricing, and end user.

Product Insights:

- Non-Athletic Footwear

- Athletic Footwear

The report has provided a detailed breakup and analysis of the market based on the product. This includes non-athletic footwear and athletic footwear.

Material Insights:

- Rubber

- Leather

- Plastic

- Fabric

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes rubber, leather, plastic, fabric, and others.

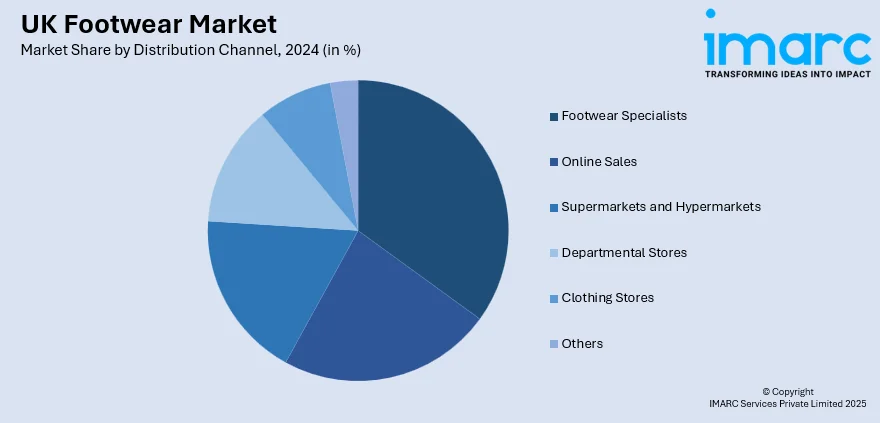

Distribution Channel Insights:

- Footwear Specialists

- Online Sales

- Supermarkets and Hypermarkets

- Departmental Stores

- Clothing Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes footwear specialists, online sales, supermarkets and hypermarkets, departmental stores, clothing stores, and others.

Pricing Insights:

- Premium

- Mass

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes premium and mass.

End User Insights:

- Men

- Women

- Kids

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and kids.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Footwear Market News:

- In January 2025, London-headquartered brand Sole Purpose launched its sustainable children's footwear range at the INDX Children's Footwear Show, featuring eco-friendly products constructed from LWG-certified leather, recycled product material, and recyclable packaging. The launch reinforces increasing demand for sustainable innovation within the expanding UK footwear sector.

- In March 2024, Vivobarefoot launched the world's first completely compostable shoe made with Balena's BioCir®flex, a bio-based industrially compostable material. Produced through on-demand 3D printing, the technology represents a major step forward in sustainable footwear that meets increasing consumer demand for environmentally friendly products in the rapidly developing UK footwear market.

UK Footwear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Non-Athletic Footwear, Athletic Footwear |

| Materials Covered | Rubber, Leather, Plastic, Fabric, Others |

| Distribution Channels Covered | Footwear Specialists, Online Sales, Supermarkets and Hypermarkets, Departmental Stores, Clothing Stores, Others |

| Pricings Covered | Premium, Mass |

| End Users Covered | Men, Women, Kids |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK footwear market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK footwear market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK footwear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The footwear market in UK was valued at USD 8.31 Billion in 2024.

The UK footwear market is projected to exhibit a (CAGR) of 3.42% during 2025-2033, reaching a value of USD 11.64 Billion by 2033.

The market is fuelled by changing fashion, growing health awareness, and growing consumer demand for fashionable yet comfortable products. E-commerce growth, celebrity partnerships, and sports-inspired footwear drives take-up. Premiumisation, eco-friendly materials, and bespoke capabilities are trending, while the nation's robust sporting culture continues to support athletic and informal footwear consumption amongst a wide range of consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)