UK Freight Forwarding Market Size, Share, Trends and Forecast by Service Type, Transport Mode, Customer Type, End-User, and Region, 2025-2033

UK Freight Forwarding Market Size and Share:

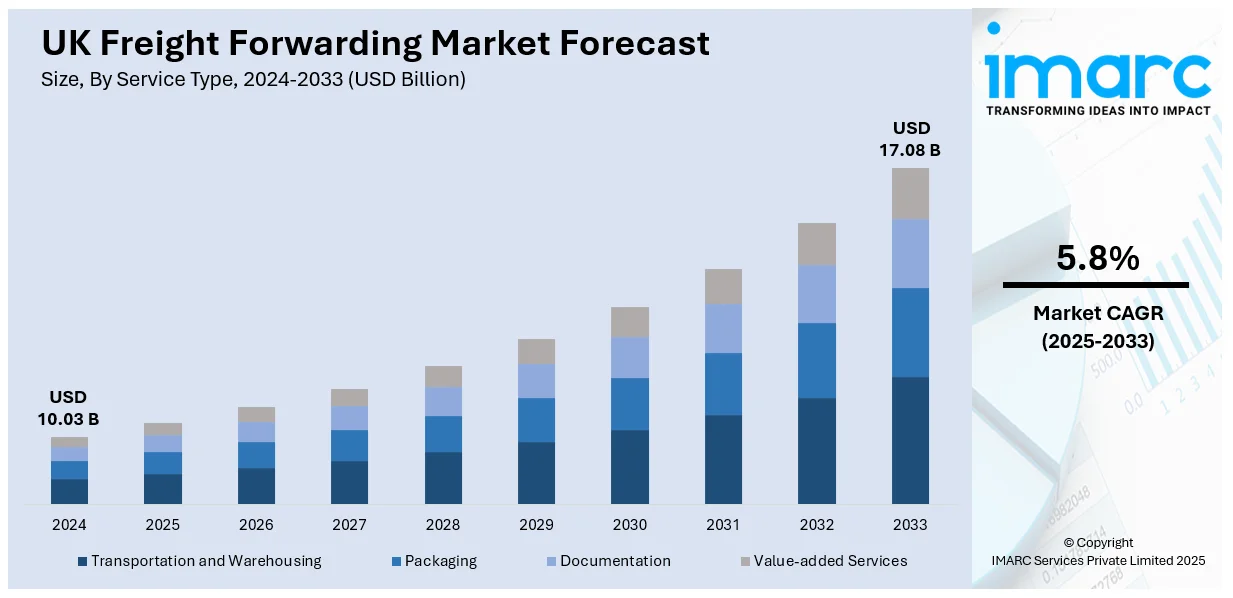

The UK freight forwarding market size reached USD 10.03 Billion in 2024 and is projected to reach USD 17.08 Billion by 2033, with a CAGR of 5.8% during 2025-2033. South East dominated the market in 2024. E-commerce development, international trade expansion, logistics operation digitalization, increased demand for integrated supply chain solutions, and post-Brexit trade adjustments are all driving the UK freight forwarding industry forward. Increased imports, exports, and consumer expectations for faster deliveries further boost freight forwarding service demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.03 Billion |

| Market Forecast in 2033 | USD 17.08 Billion |

| Market Growth Rate 2025-2033 | 5.8% |

UK freight forwarders are increasingly coping with the rising demand for customs clearance and compliance services. More businesses are incorporating transportation management systems and real-time tracking as computerized tools become more affordable. The increasing growth of e-commerce is sustaining demand for express delivery and last-mile logistics. Meanwhile, there is a discernible trend towards more environmentally friendly practices, with increased investment in sustainable transport modes and carbon-free logistics. Multimodal transport, particularly rail-road combinations, is becoming increasingly popular as a means of addressing driver shortages and fuel cost management. To stay ahead of international trade and evolving customer demands, numerous freight companies are collaborating or merging to increase their presence and streamline operations. In general, the sector is moving towards more intelligent, more networked, and greener logistics options.

The freight forwarding companies in the UK are investing in new logistics technology to automate processes and enhance supply chain management. Increasing focus on digital technologies to enhance effectiveness, coordination, and quality of service in freight forwarding services is demonstrating a trend towards more integrated and technology-based logistics solutions. For example, in May 2024, Davies Turner, the Cardinal Partnership, and Woodland Group, three independent UK freight forwarding firms, purchased UK-based freight software company Forward Solutions. The deal is to further strengthen their supply chain management services by making processes smoother through high-end freight software to enhance efficiency and services.

UK Freight Forwarding Market Trends:

Rise of E-Commerce

The rapidly growing e-commerce industry has had a significant impact on the freight forwarding market in the UK. Online shopping, fueled by customer demand for convenience and rapid delivery, has seen more goods being transported around the country and abroad. A recent study showed that UK internet sales amounted to GBP 127.41 billion for the year December 2024, up by 3.4% from GBP 123.3 billion in 2023. Online retail sales over the last ten years have doubled more than two times, increasing by 199.1%, now accounting for 30% of UK retail sales compared to 21.6% in 2019. Online shopping requires up-to-date logistics services such as last-mile delivery, warehousing, and stock control. Freight forwarders are being driven to offer diversified services that provide integrated solutions that address the particular demands of e-merchants, e.g., quicker transit times as well as real-time tracking of cargo. Higher cross-border e-commerce is driving demand for international freight forwarding services; thus, managing customs and international trade regulations is an essential competitive distinction.

Digitalization and Automation

Applications of digital technology are transforming operating processes within the sector. In the United Kingdom, the deployment of digital freight platforms and automation solutions has enhanced operational efficiency by lowering human error levels and enabling superior supply chain coordination. AI, blockchain, and cloud computing are helping optimize route planning, monitoring shipments in real-time, and streamlining administration processes such as customs declaration and billing. It is hence, through a GBP 1 Million initiative, PALLETS, the lead undertaken by RoboK and the University of Essex to augment AI-enhanced logistics across UK ports. This project was UK Research and Innovation funded to specifically concentrate on safety, efficiency, and openness. Automated warehousing and cargo handling are also improving speed and precision in the movement of goods. Digital platforms offering transparency, tracking, and data analysis are becoming more and more central to shippers, allowing them to make data-driven decisions from real-time information. The growing application of these technologies by freight forwarders to control the complexities of modern logistics and meet the rising demand for seamless digital solutions is fueling the UK freight forwarding market growth.

Sustainability in Logistics

The United Kingdom freight forwarding and logistics business has more and more emphasized sustainability. Businesses are facing increased pressure to reduce their carbon footprints as consumers become more aware of environmental issues. A 2024 survey of the industry found that 45% of UK online consumers prefer retailers who offer sustainable delivery options. Additionally, 13.6% consider the environmental cost of shipping very important, and 31% find it important. Freight forwarders are being called to embrace cleaner approaches, such as routing optimization for fuel saving, driving hybrid or electric cars, and joining carbon offset schemes. Additionally, there is a growing trend toward using more environmentally friendly modes of transportation, such as rail and seafreight, which emit fewer greenhouse gases than road and air freight. Regulatory frameworks, such as the UK's pledge to achieve net-zero emissions by 2050, are making freight forwarders invest and develop green logistics solutions, which is also driving the market growth.

UK Freight Forwarding Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK freight forwarding market, along with forecasts at the regional levels from 2025-2033. The market has been categorized based on service type, transport mode, customer type, and end-user.

Analysis by Service Type:

- Transportation and Warehousing

- Packaging

- Documentation

- Value-added Services

Based on the UK freight forwarding market forecast, transportation and warehousing stood as the largest component in 2024, holding around 58.4% of the market due to their essential role in enabling smooth logistics operations across the supply chain. With growing e-commerce activity, demand for efficient goods movement and storage has surged. Transportation ensures the timely delivery of cargo across domestic and international routes, while warehousing supports inventory management, consolidation, and distribution. The UK’s investment in modern storage facilities and high-capacity transport networks boosts operational efficiency. Advanced tracking systems, multimodal transport options, and strategically located warehouses have further strengthened service reliability and responsiveness.

Analysis by Transport Mode:

- Ocean Freight Forwarding

- Air Freight Forwarding

- Road Freight Forwarding

- Rail Freight Forwarding

Road freight forwarding led the market with around 45.0% of market share in 2024, owing to its flexibility, extensive reach, and suitability for short to medium-haul deliveries. It plays a central role in domestic logistics, connecting ports, airports, warehouses, and final destinations across the country. The UK's well-developed motorway network supports efficient movement of goods, particularly for time-sensitive and retail shipments. Road freight also enables door-to-door service, reducing handling costs and delivery times. With the rise of e-commerce and just-in-time delivery models, demand for reliable and fast ground transport has surged.

Analysis by Customer Type:

- B2B

- B2C

As per the freight forwarding market outlook in the UK, B2B led the market with around 78.8% of market share in 2024, as business-to-business commerce is the foundation of commercial and industrial logistics. Manufacturing, retail, automotive, pharmaceuticals, and other industries need substantial scheduled and bulk cargo movements and thus fuel steady demand for freight forwarding services. Such deals entail enormous volumes, long-term agreements, and intricate supply chains that necessitate expert coordination and guaranteed schedule delivery. B2B customers require customized services like customs clearance, inventory control, and multi-modal transportation, which increase demand for specialist freight services. Growing demand for supply chain transparency, cost savings, and worldwide trade integration further supports B2B freight forwarding as a primary factor in driving UK market growth within the logistics sector.

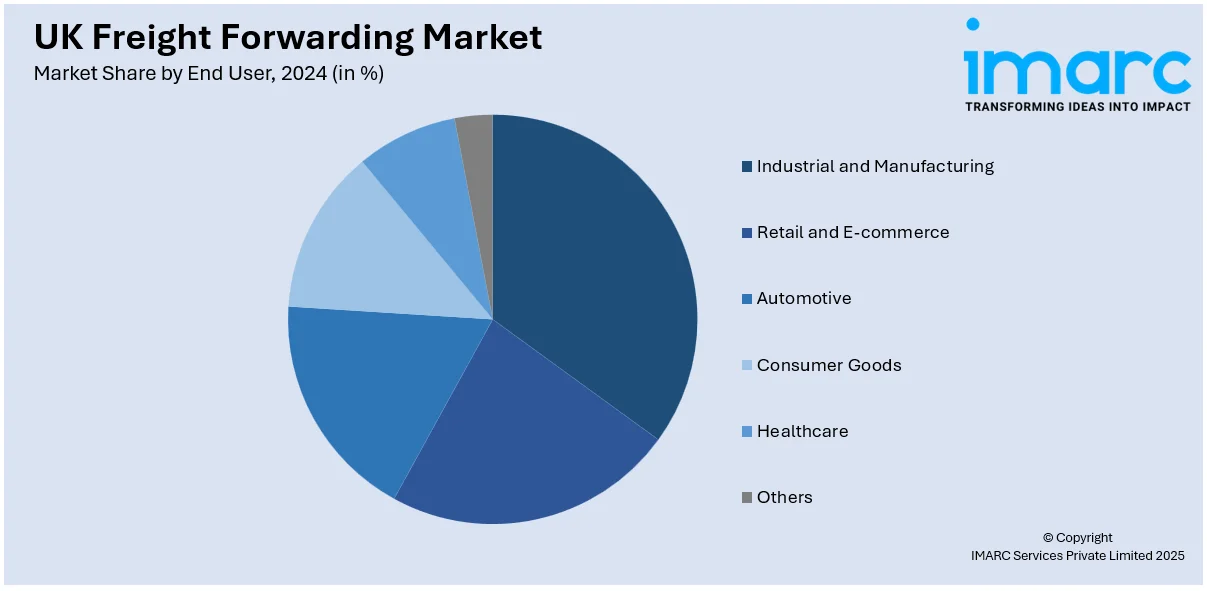

Analysis by End User:

- Industrial and Manufacturing

- Retail and E-commerce

- Automotive

- Consumer Goods

- Healthcare

- Others

Industrial and manufacturing propel the UK freight forwarding industry by creating consistent demand for finished goods exports and raw material imports. Both of these industries rely on solid logistics for worldwide and domestic distribution, particularly heavy and time-sensitive freight. Retail and e-commerce spur market activity with high-frequency, small-parcel flows and increasing consumer expectations for rapid delivery. The transition to e-commerce has raised the demand for last-mile logistics, real-time tracking, and warehouse fulfillment. Automotive adds through the transportation of components, assemblies, and finished vehicles, frequently needing just-in-time logistics and specialized care. Global sourcing and exports also propel cross-border freight volumes.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

In 2024, South East accounted for the largest UK freight forwarding market share because of its robust logistical network and strong connectivity. It has key ports like Southampton and Dover, which are important gateways for global trade. Having well-established road and rail connectivity also adds value to the movement of goods on domestic and European routes. Being close to London also stimulates more trade volumes because of higher consumption and business activity. The area is conducive to a high population density of logistics parks and distribution centers, with it being an area of freight consolidation and a transportation hub. These combined factors place the South East as an essential force for the industry, facilitating efficiency, speed, and reliability in handling cargo.

Competitive Landscape:

Activity in partnerships, government-supported initiatives, and tech-based collaborations is on the rise in the UK freight forwarding sector. Through joint ventures and research, companies are focusing on digitalization, environmental sustainability, and efficient supply chains. Green logistics innovation and digital infrastructure are being driven by government assistance. Funding & product development are occurring, but infrequently versus strategic partnerships / public-private partnerships. The current trend is to create streamlined operations, enhance last-mile connectivity, and come up with smart logistics solutions. Out of all the developments, collaboration and participation in government-driven innovation programs are the most frequently seen practices in the present time.

Latest News and Developments:

- February 2025: Livingston International expanded its UK offerings to include customs solutions and worldwide freight forwarding. This move helps firms dealing with trade disruption, regulatory hurdles, and altered trade patterns by providing customs clearance, freight optimization, and global trade management services to improve supply chain efficiency and reduce risks.

- September 2024: CNS announced the launch of CNS Enterprise, a cloud-based platform that integrates customs, logistics, and CRM services. It incorporates digital freight forwarding, real-time tracking, and financial management to improve supply chain operations.

- May 2024: Toga Freight Services acquired Irish Sea Logistics Ltd, a London-based specialty freight forwarder that operates between Great Britain and Ireland. This acquisition enhances access to unique freight routes in Europe and the UK.

- April 2024: Europa Air & Sea introduced a weekly consolidated maritime freight service between the UK and the Gulf Cooperation Council (GCC), providing cost-effective transport for less-than-container loads (LCL).

UK Freight Forwarding Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | Transportation and Warehousing, Packaging, Documentation, Value-Added Services |

| Transport Modes Covered | Ocean Freight Forwarding, Air Freight Forwarding, Road Freight Forwarding, Rail Freight Forwarding |

| Customer Types Covered | B2B, B2C |

| End-Users Covered | Industrial and Manufacturing, Retail and E-Commerce, Automotive, Consumer Goods, Healthcare, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK freight forwarding market from 2019-2033.

- The UK freight forwarding market research report provides the latest information on the market drivers, challenges, and opportunities in the market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK freight forwarding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight forwarding market in the UK was valued at USD 10.03 Billion in 2024.

Key drivers of the UK freight forwarding market include growing e-commerce demand, increasing international trade, digitization of logistics operations, and rising demand for efficient supply chain solutions. Post-Brexit customs complexities and demand for multimodal transport solutions are also pushing logistics providers to expand services.

The freight forwarding market is projected to exhibit a CAGR of 5.8% during 2025-2033, reaching a value of USD 17.08 Billion by 2033.

Transportation and warehousing accounted for the largest share, holding around 58.4% of the market in 2024.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)