UK Generative AI Market Size, Share, Trends and Forecast by Offering Type, Technology Type, Application, and Region, 2025-2033

UK Generative AI Market Overview:

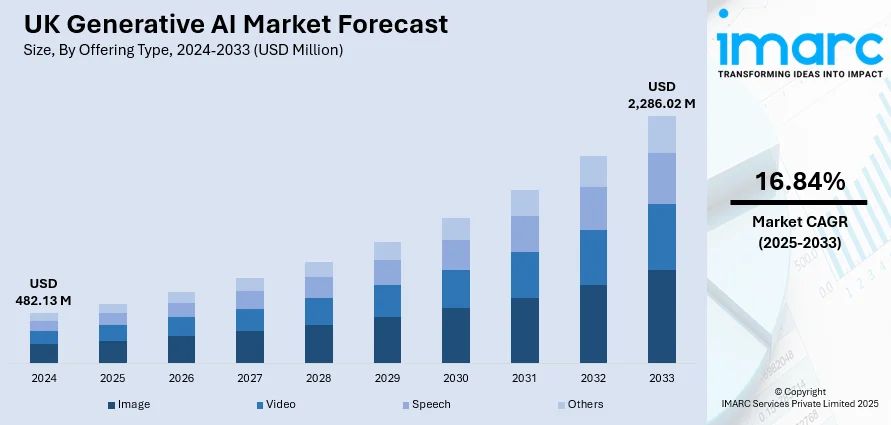

The UK generative AI market size reached USD 482.13 Million in 2024. The market is projected to reach USD 2,286.02 Million by 2033, exhibiting a growth rate (CAGR) of 16.84% during 2025-2033. The market is propelled by increasing investments from both public and private sectors in artificial intelligence research and applications. Along with this, government-backed initiatives, including funding for AI innovation and integration into public services, have accelerated adoption across industries such as healthcare, finance, and manufacturing. Moreover, growing demand for content automation and productivity tools among enterprises is further augmenting the UK generative AI market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 482.13 Million |

| Market Forecast in 2033 | USD 2,286.02 Million |

| Market Growth Rate 2025-2033 | 16.84% |

UK Generative AI Market Trends:

Enterprise-Grade Deployment and Customization

UK enterprises are increasingly prioritizing generative AI models that can be tailored to their sector-specific requirements and data security standards. According to industry reports, approximately seven million individuals in the UK have incorporated generative AI into their professional activities. Additionally, large organizations, especially in finance, legal, and healthcare, are adopting fine-tuned versions of foundation models integrated with proprietary data and workflows. This shift is driven by concerns around compliance with GDPR and sector-specific regulatory frameworks, necessitating models that can be hosted on-premise or within secure cloud environments. Apart from this, many firms are also building internal teams for AI model governance, ensuring version control, prompt audit trails, and mitigation of hallucinations. Furthermore, the demand for platforms offering scalable APIs, model orchestration, and real-time monitoring is growing, with integration into existing enterprise software stacks being a key priority. British firms are not simply experimenting with off-the-shelf chatbots but embedding domain-specific models into CRM systems, HR tools, and knowledge management platforms. As enterprises demand reliability, explainability, and risk mitigation, the market is moving toward vertically integrated solutions with controlled data flows, human-in-the-loop feedback, and rigorous testing protocols. This, in turn, is positively impacting the UK generative AI market growth.

To get more information on this market, Request Sample

Expansion of AI-generated content in Media, Publishing, and Advertising

Generative AI is reshaping creative industries in the UK, particularly in advertising, publishing, and digital media. The UK boasts a robust creative technology ecosystem, with more than 13,000 companies operating in the sector, positioning its screen industry to effectively navigate and embrace emerging technological changes. Additionally, a 2023 survey involving 70 producers based in the UK revealed that 17% had already integrated generative AI into their production workflows, while 40% expressed intentions to adopt it in the future. Agencies and content studios are using AI to generate marketing copy, social media content, visual assets, and video scripts, allowing for quicker campaign rollouts and higher content volumes at lower costs. Furthermore, UK-based broadcasters and streaming platforms are deploying AI tools for content summarisation, subtitle generation, and scene tagging, enhancing viewer accessibility and improving backend workflows. Along with this, publishers are piloting generative models to assist journalists with research synthesis, first-draft writing, and headline generation, though editorial oversight remains critical. Regulatory scrutiny and copyright concerns are influencing how these tools are adopted, with many firms developing internal policies on AI usage and attribution. Moreover, strategic partnerships between media companies and generative AI vendors are emerging, focused on fine-tuning models using proprietary corpora. As brand differentiation remains vital, firms are increasingly seeking models that preserve tone of voice, align with brand identity, and can be locally adapted for regional campaigns within the UK market.

UK Generative AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on offering type, technology type, and application.

Offering Type Insights:

- Image

- Video

- Speech

- Others

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes image, video, speech, and others.

Technology Type Insights:

- Autoencoders

- Generative Adversarial Networks

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes autoencoders, generative adversarial networks, and others.

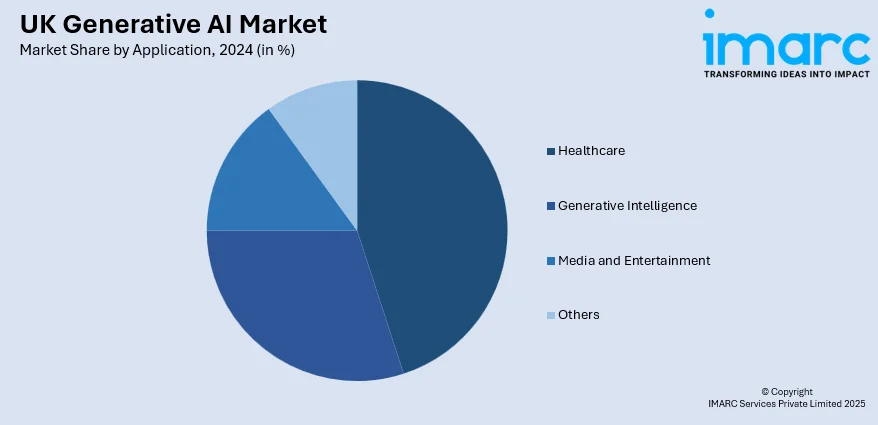

Application Insights:

- Healthcare

- Generative Intelligence

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes healthcare, generative intelligence, media and entertainment, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Generative AI Market News:

- On June 16, 2025, DISCO officially launched its generative AI-powered Auto Review tool in the European Union and the United Kingdom, enabling automated review of up to 32,000 documents per hour with precision and recall rates exceeding 90%, significantly outperforming traditional human review methods). The expansion complements its earlier 2024 deployment of the "Cecilia" generative AI suite in the region, with additional capabilities expected to roll out later in 2025. Simultaneously, DISCO has introduced a competitive new pricing structure for Auto Review aimed at increasing adoption among law firms and corporations across the EU and UK.

- On June 16, 2025, University College London (UCL) was selected as the UK’s sole academic partner in an NVIDIA-led European initiative to develop sovereign AI platforms and enhance national AI infrastructure. The collaboration will accelerate training of home-grown large language models—such as the multilingual “BritLLM”—on supercomputing resources like Isambard‑AI, aiming to improve performance, reduce cost, and ensure alignment with UK linguistic and regulatory requirements. Through joint efforts in academia and industry, the partnership will bolster the UK’s capabilities in sovereign computing, governance, and cross-sector AI innovation.

UK Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered | Image, Video, Speech, Others |

| Technology Types Covered | Autoencoders, Generative Adversarial Networks, Others |

| Applications Covered | Healthcare, Generative Intelligence, Media and Entertainment, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK generative AI market performed so far and how will it perform in the coming years?

- What is the breakup of the UK generative AI market on the basis of offering type?

- What is the breakup of the UK generative AI market on the basis of technology type?

- What is the breakup of the UK generative AI market on the basis of application?

- What is the breakup of the UK generative AI market on the basis of region?

- What are the various stages in the value chain of the UK generative AI market?

- What are the key driving factors and challenges in the UK generative AI market?

- What is the structure of the UK generative AI market and who are the key players?

- What is the degree of competition in the UK generative AI market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK generative AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK generative AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK generative AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)