UK Glamping Market Size, Share, Trends and Forecast by Age Group, Accommodation Type, Booking Mode, and Region, 2025-2033

UK Glamping Market Overview:

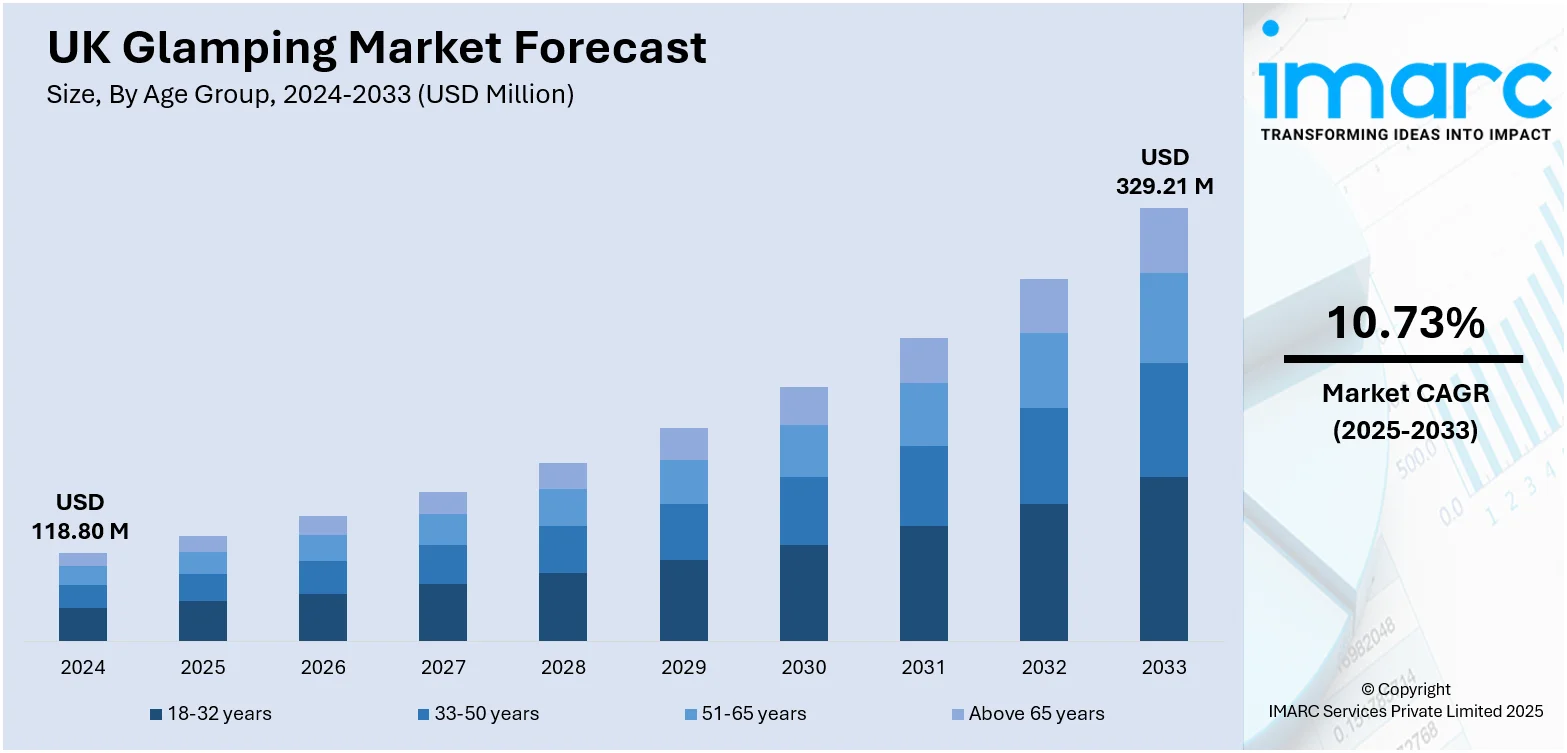

The UK glamping market size reached USD 118.80 Million in 2024. The market is projected to reach USD 329.21 Million by 2033, exhibiting a growth rate (CAGR) of 10.73% during 2025-2033. The market is fueled by increasing consumer demand for distinctive, outdoor experiences that offer comfort blended with nature. The market is also accelerated by increasing disposable incomes and domestic travel trends, as people want affordable, nature-based breaks within the UK. Besides this, heightened awareness of eco-tourism and sustainable travel packages has contributed to a spate in glamping popularity among travelers who are eco-friendly, which is augmenting the UK glamping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 118.80 Million |

| Market Forecast in 2033 | USD 329.21 Million |

| Market Growth Rate 2025-2033 | 10.73% |

UK Glamping Market Trends:

Rising Disposable Incomes

Increased disposable incomes have made a significant impact on the market, promoting greater spending on recreation and high-end travel experiences. According to an industry report, among 56 cities in the UK analyzed, residents of Aberdeen, Scotland, reported the highest monthly disposable income, averaging around EUR 1,240 (about USD 1,575), which is 133% above the UK average of EUR 532 (about USD 675). They were closely followed by residents of Carlisle, with an average disposable income of EUR 1,186 (about USD 1,507), and Derby, where the average stood at EUR 1,163 (about USD 1,477). Increased spending power is the result of the burgeoning middle class in the UK coupled with a change in consumer trends. With increased disposable income, more households and individuals are ready to spend on rare, exclusive experiences like glamping, which retains the comfort of home-like accommodations yet remains close to nature. Glamping is now a reachable luxury for most, with an alternative that exists between budget camping and luxury accommodations. As individuals look for means to break from the monotony of day-to-day life, glamping has become a sought-after choice for weekend breaks, family holidays, and romantic escapes. Also, with the pressure of inflation on standard hotel tariffs, glamping provides an affordable option that still guarantees an unconventional and unforgettable experience, which is a major factor propelling the UK glamping market growth.

To get more information on this market, Request Sample

Growth in Online Booking Platforms

One of the most significant trends in the market is the rise of online booking platforms, making it easier for customers to search, compare, and book glamping experiences. With the ongoing digitalization of the travel sector, online platforms have emerged as indispensable tools for both site owners and glampers alike. For example, on 27 March 2025, Campsites.co.uk unveiled its new site, GlampingPods.com, which is exclusively geared towards the discovery and reservation of glamping and camping pods throughout the UK. The site takes advantage of Campsites.co.uk's existing reputation, tapping into its database of more than 3,000 sites to provide a specialized service for pod-style outdoor accommodation. This strategic expansion demonstrates a focused effort to capitalize on the increasing consumer demand for unique, comfort-driven outdoor stays. These platforms provide a broad range of choices, from yurts to treehouses, allowing customers to choose accommodations that suit their tastes. Additionally, these platforms also include smooth payment processing, immediate booking confirmation, and customer reviews, which improve the customer experience. From the perspective of site owners, the presence online is more visible and exposed to a worldwide customer base, thereby increasing bookings. This trend has been especially effective in the post-pandemic period, with several travelers opting to organize vacations from home. In addition, sophisticated algorithms and recommended options have simplified the ability of travelers to find glamping solutions that meet their preferences, enhancing the conversion rate for companies in the industry.

UK Glamping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on age group, accommodation type, and booking mode.

Age Group Insights:

- 18-32 years

- 33-50 years

- 51-65 years

- Above 65 years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 18-32 years, 33-50 years, 51-65 years, and above 65 years.

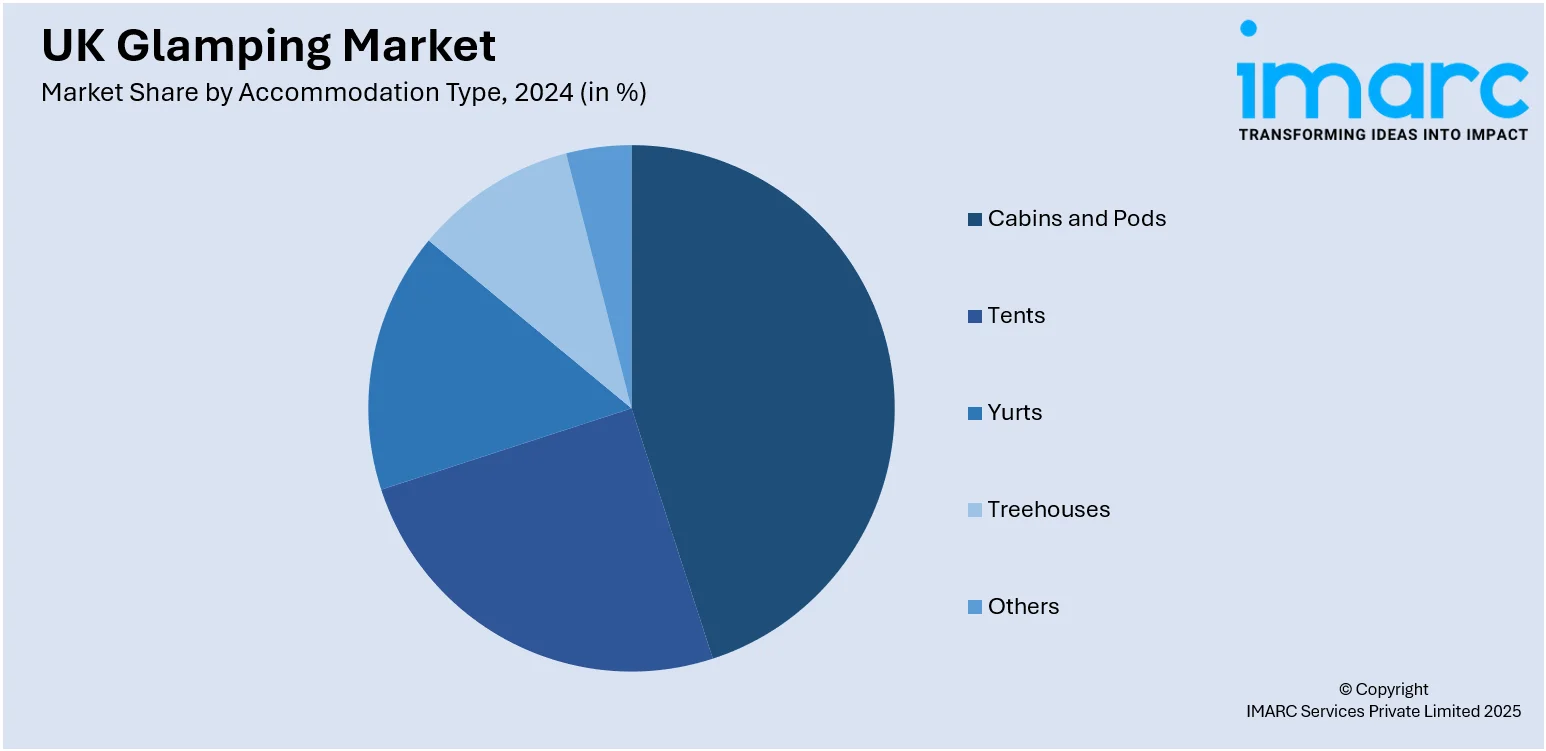

Accommodation Type Insights:

- Cabins and Pods

- Tents

- Yurts

- Treehouses

- Others

A detailed breakup and analysis of the market based on the accommodation type have also been provided in the report. This includes cabins and pods, tents, yurts, treehouses, and others.

Booking Mode Insights:

- Direct Booking

- Travel Agents

- Online Travel Agencies

The report has provided a detailed breakup and analysis of the market based on the booking mode. This includes direct booking, travel agents, and online travel agencies.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Glamping Market News:

- On May 7, 2025, a planning application was submitted to erect two glamping pods on a garden site in Backmuir of Pitfirrane, Crossford, near Dunfermline. The proposal, by Gregor Wylie, includes decking, secure bicycle storage, recycling and refuse facilities, and three parking spaces while retaining existing road access. A decision on the application is expected by June 9, reflecting continued growth and interest in small‑scale, rural outdoor stays within the region.

- On May 29, 2025, Modern Campground reported the opening of a new glamping site in Worcestershire, emphasizing sustainable practices. The development features solar-powered pods, rainwater harvesting systems, and locally sourced materials, underscoring an eco-conscious approach to luxury outdoor accommodation. This initiative positions the site as a forward-thinking model in the glamping sector, aligning environmental stewardship with premium guest experiences.

UK Glamping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Age Groups Covered | 18-32 years, 33-50 years, 51-65 years, Above 65 years |

| Accommodation Types Covered | Cabins and Pods, Tents, Yurts, Treehouses, Others |

| Booking Modes Covered | Direct Booking, Travel Agents, Online Travel Agencies |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK glamping market performed so far and how will it perform in the coming years?

- What is the breakup of the UK glamping market on the basis of age group?

- What is the breakup of the UK glamping market on the basis of accommodation type?

- What is the breakup of the UK glamping market on the basis of booking mode?

- What is the breakup of the UK glamping market on the basis of region?

- What are the various stages in the value chain of the UK glamping market?

- What are the key driving factors and challenges in the UK glamping market?

- What is the structure of the UK glamping market and who are the key players?

- What is the degree of competition in the UK glamping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK glamping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK glamping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK glamping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)