UK Green Finance Market Size, Share, Trends, and Forecast by Type, Sector, Investment Strategy, Maturity, and Region, 2026-2034

UK Green Finance Market Overview:

The UK green finance market size reached USD 145.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 295.5 Billion by 2034, exhibiting a growth rate (CAGR) of 8.19% during 2026-2034. The market is primarily driven by the increasing issuance of green bonds, the growing integration of ESG criteria into investment strategies, the expanding focus on climate risk assessment, and the rising demand for sustainable finance solutions, aligning with the UK's commitment to achieving net-zero carbon emissions and supporting regulatory frameworks.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 145.5 Billion |

| Market Forecast in 2034 | USD 295.5 Billion |

| Market Growth Rate (2026-2034) | 8.19% |

UK Green Finance Market Trends:

Growth of Green Bonds

The UK green finance market is witnessing a surge in the issue of green bonds, fueled by the rising demand for sustainable investment. Financial institutions and corporations are adopting green bonds to finance green projects, including sustainable infrastructure and renewable energy. Government support, including schemes like the UK Sovereign Green Bond programme, is also enhancing the growth in the market. For instance, as per industry reports, the UK government announced plans to issue £10 Billion in green gilts for 2024-25, representing 0.37% of 2023 GDP. Additionally, investors are showing heightened interest in bonds that offer both financial returns and positive environmental impacts. The increased focus on sustainability by institutional investors, including pension funds and asset managers, is propelling the expansion of green bonds, positioning the UK as a leader in the global green bond market. This trend highlights the alignment of financial markets with the UK's commitment to achieving net-zero carbon emissions by 2050.

Integration of ESG Criteria

Integration of Environmental, Social, and Governance (ESG) factors into investment choices is becoming a prominent trend in the UK market. Investors are progressively taking ESG factors into consideration when assessing possible investments, pointing towards responsible and sustainable investing. Financial institutions are creating ESG-oriented products, such as green loans and sustainability-linked credit facilities for the increasing interest from retail as well as institutional investors. Stringent regulatory developments, such as the Financial Conduct Authority’s (FCA) sustainability disclosure requirements, are pushing market participants to prioritize transparency around ESG performance. For instance, in February 2024, the UK Financial Conduct Authority (FCA) introduced a new anti-greenwashing rule effective 31 May 2024, where firms must make sure that their products' sustainability claims are not misleading, clear, and accurate. This trend is shaping the landscape of investment products as well as influencing corporate behavior, as companies face greater pressure to improve their ESG credentials to attract investment and maintain competitiveness in the market.

UK Green Finance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, sector, investment strategy, and maturity.

Type Insights:

- Green Bonds

- Green Loans

- Green Sukuk

- Green Infrastructure Bonds

- Green Project Finance

The report has provided a detailed breakup and analysis of the market based on the type. This includes green bonds, green loans, green sukuk, green infrastructure bonds, and green project finance.

Sector Insights:

- Renewable Energy

- Energy Efficiency

- Sustainable Transportation

- Water and Wastewater Management

- Agriculture and Forestry

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes renewable energy, energy efficiency, sustainable transportation, water and wastewater management, and agriculture and forestry.

Investment Strategy Insights:

- Impact Investing

- Environmental, Social, and Governance (ESG) Investing

- Thematic Investing

- Value-Based Investing

- Climate Change Mitigation

The report has provided a detailed breakup and analysis of the market based on the investment strategy. This includes impact investing, environmental, social, and governance (ESG) investing, thematic investing, value-based investing, and climate change mitigation.

Maturity Insights:

- Short-Term

- Medium-Term

- Long-Term

A detailed breakup and analysis of the market based on the maturity have also been provided in the report. This includes short-term, medium-term, and long-term.

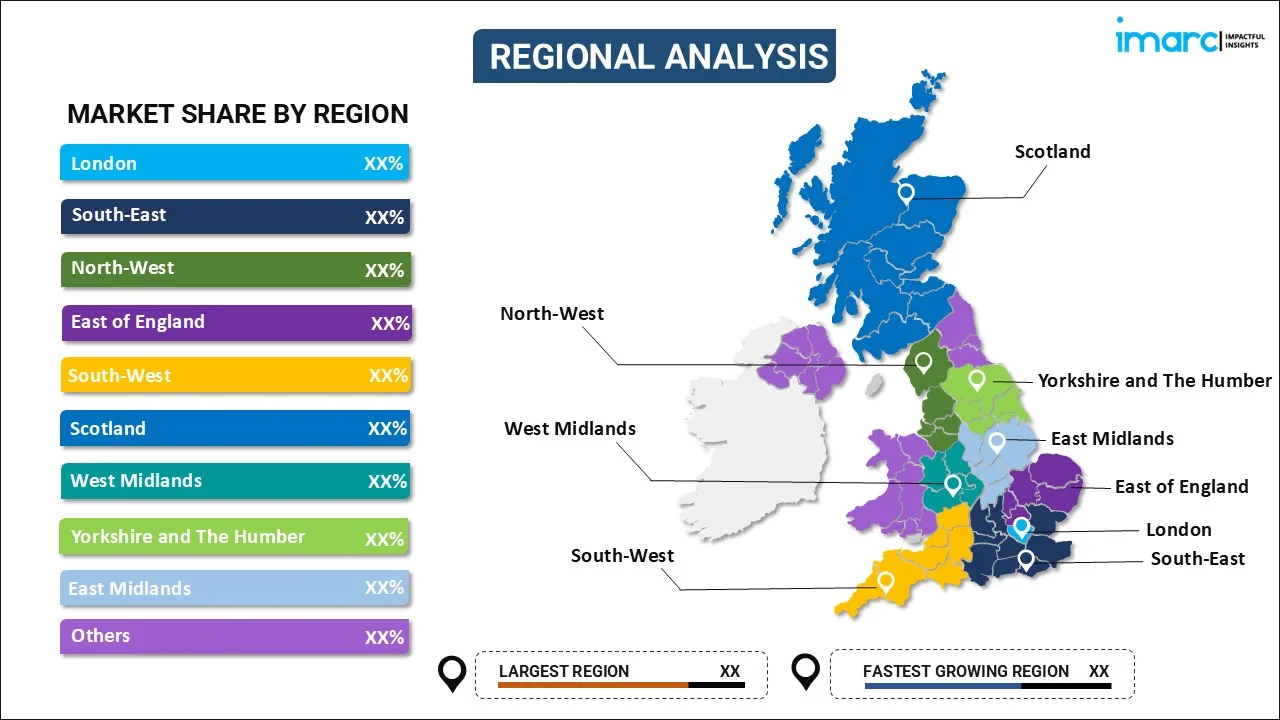

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Green Finance Market News:

- In December 2023: The government of UK announced over £1.6 billion in climate aid to help developing countries access finance and attract private investment. Key initiatives include the CIF Capital Market Mechanism, raising £7.5 billion, and Climate Resilient Debt Clauses for crisis-hit nations. The UK also supports the Global Climate Finance Framework, mobilizes private finance for adaptation, and advocates for integrity in carbon markets. Additionally, the UK launched the Net Zero Export Credit Agencies Alliance to achieve net-zero by 2050 and will assess transition finance through a new Transition Finance Market Review.

- In March 2023: The UK Centre for Greening Finance and Investment announced the establishment of a new Transition Finance Centre of Excellence in collaboration with the University of Oxford and funding from Banco Santander. This initiative is a part of the UK's 2023 Green Finance Strategy and aims to set standards for transition finance, develop sector-specific transition plans, and enhance skills for practitioners. The Centre also supports the UK's goal to become a Net Zero-aligned Financial Centre, collaborating closely with the Transition Plan Taskforce.

UK Green Finance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Green Bonds, Green Loans, Green Sukuk, Green Infrastructure Bonds, Green Project Finance |

| Sectors Covered | Renewable Energy, Energy Efficiency, Sustainable Transportation, Water and Wastewater Management, Agriculture and Forestry |

| Investment Strategies Covered | Impact Investing, Environmental, Social, and Governance (ESG) Investing, Thematic Investing, Value-Based Investing, Climate Change Mitigation |

| Maturities Covered | Short-Term, Medium-Term, Long-Term |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK green finance market performed so far and how will it perform in the coming years?

- What is the breakup of the UK green finance market on the basis of type?

- What is the breakup of the UK green finance market on the basis of sector?

- What is the breakup of the UK green finance market on the basis of investment strategy?

- What is the breakup of the UK green finance market on the basis of maturity?

- What is the breakup of the UK green finance market on the basis of region?

- What are the various stages in the value chain of the UK green finance market?

- What are the key driving factors and challenges in the UK green finance market?

- What is the structure of the UK green finance market and who are the key players?

- What is the degree of competition in the UK green finance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK green finance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK green finance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK green finance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)