UK Halal Food Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2026-2034

UK Halal Food Market Summary:

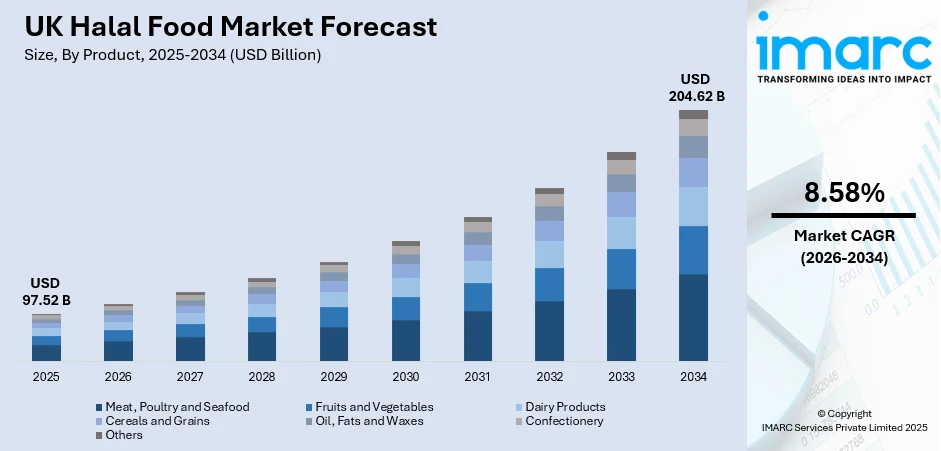

The UK halal food market size was valued at USD 97.52 Billion in 2025 and is projected to reach USD 204.62 Billion by 2034, growing at a compound annual growth rate of 8.58% from 2026-2034.

The United Kingdom halal food market is experiencing substantial expansion, propelled by the nation's growing Muslim community, heightened awareness of halal certification standards, and increasing demand for ethically sourced and high-quality food products. The market extends beyond religious consumers to attract health-conscious individuals seeking clean-label products that align with contemporary dietary preferences and values, thereby strengthening the UK halal food market share.

Key Takeaways and Insights:

-

By Product: Meat, poultry and seafood dominates the market with a share of 50.3% in 2025, driven by the essential dietary needs of the Muslim community and adherence to Islamic dietary laws requiring halal-certified protein sources for daily consumption.

-

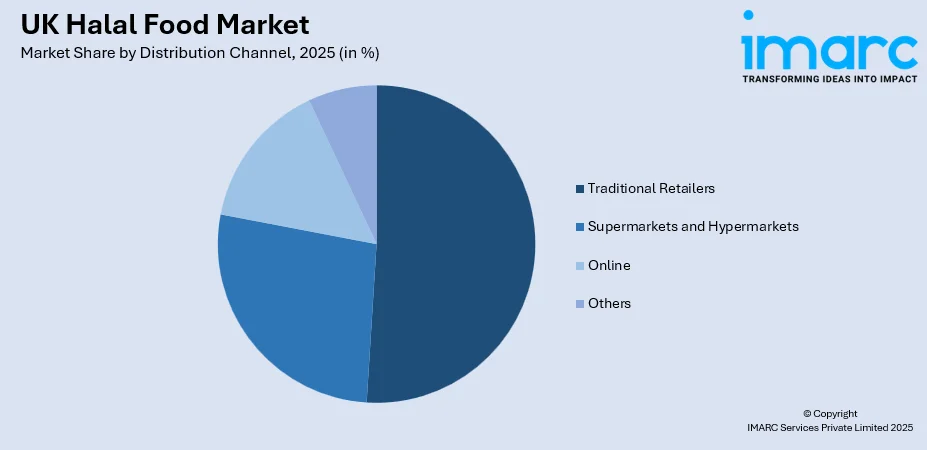

By Distribution Channel: Traditional retailers lead the market with a share of 51.7% in 2025, owing to established consumer trust, personalized service, cultural familiarity, and the preference for freshly cut meat from specialist halal butchers.

-

Key Players: The UK halal food market exhibits a fragmented competitive landscape with traditional specialist butchers competing alongside major supermarket chains and emerging e-commerce platforms. Market participants range from family-owned ethnic food stores to multinational retailers expanding dedicated halal offerings.

To get more information on this market Request Sample

The UK halal food industry is undergoing significant transformation, driven by demographic shifts and evolving consumer preferences. According to the Muslim Council of Britain's 2025 Census Report, the Muslim population now exceeds 4 million, representing approximately 6% of the UK population of 67 million. This demographic expansion, combined with younger Muslims' emphasis on ethical and sustainable products, is reshaping market dynamics. Major supermarkets have expanded their halal offerings, with dedicated halal sections and counters becoming increasingly common. The Agriculture and Horticulture Development Board (AHDB) research in 2024 revealed that Muslims account for 30% of England's lamb consumption, underscoring the sector's economic significance and the growing influence of halal consumers on the broader UK food market landscape.

UK Halal Food Market Trends:

Premiumization and Diversification of Halal Food Products

The UK halal food market is witnessing a pronounced shift towards premium and diverse product offerings. Second and third-generation British Muslims are driving demand for value-added options including halal-certified organic meats, gluten-free products, plant-based alternatives, and fusion cuisine that combines global flavours with halal compliance, reflecting evolving tastes that blend religious adherence with contemporary culinary preferences and lifestyle choices.

E-Commerce and Digital Transformation in Halal Food Retail

Online platforms are fundamentally transforming halal food accessibility across the United Kingdom. The proliferation of specialized halal e-commerce sites, subscription services, and home delivery options has democratized access to halal-certified products, particularly in areas with limited local halal retail presence. In October 2024, Totalee Halal launched its innovative food delivery application at the Global Peace and Unity Festival in London, featuring a new initiative supporting women entrepreneurs in the food industry in collaboration with the Shahid Afridi Foundation.

Sustainability and Ethical Production Practices

Sustainability is emerging as a cornerstone of the UK halal industry's growth trajectory. Producers are increasingly adopting eco-friendly practices including anaerobic digesters that convert slaughterhouse waste into biogas, significantly reducing operational energy costs. Compostable packaging initiatives and regenerative agriculture practices are gaining traction, aligning with evolving national recyclability requirements. British Muslim consumers demonstrate growing willingness to pay premiums for sustainable goods, driving producers to integrate renewable energy solutions and smart monitoring technologies in processing facilities to reduce environmental impact.

Market Outlook 2026-2034:

The UK halal food market is poised for sustained expansion, supported by demographic momentum, increasing mainstream adoption, and continuous product innovation. Research from the Halal Monitoring Committee UK and the University of Huddersfield indicates that halal represents approximately 15% of the nation's overall meat and poultry sector at £1.7 billion, with projections suggesting growth to £2 billion by 2028. The mainstreaming of halal products is accelerating, with a 2024 survey indicating that 35% of UK non-Muslims have tried halal products, citing health and ethics as primary motivations. The market generated a revenue of USD 97.52 Billion in 2025 and is projected to reach a revenue of USD 204.62 Billion by 2034, growing at a compound annual growth rate of 8.58% from 2026-2034.

UK Halal Food Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Meat, Poultry and Seafood | 50.3% |

| Distribution Channel | Traditional Retailers | 51.7% |

Product Insights:

- Meat, Poultry and Seafood

- Fruits and Vegetables

- Dairy Products

- Cereals and Grains

- Oil, Fats and Waxes

- Confectionery

- Others

The meat, poultry and seafood segment dominates with a market share of 50.3% of the total UK halal food market in 2025.

The meat, poultry and seafood segment commands the largest share of the UK halal food market, reflecting the centrality of protein sources in Islamic dietary culture. The AHDB's 2024 consumer research revealed that chicken remains the most popular protein among UK Muslims, with 92% consuming it weekly compared to 69% of the general population. Lamb consumption is equally significant while only 6% of people in the UK eat lamb on a weekly basis. The demand for fresh, halal-certified meat products continues to drive market growth, with consumers increasingly seeking traceability and ethical sourcing credentials.

The segment's growth is driven by continuous innovation in product formats and retail experiences that align with contemporary consumer expectations. Halal meat providers are increasingly adapting their service models to accommodate busy lifestyles while maintaining strict compliance with Islamic dietary requirements. The expansion of halal-certified ready-to-eat meat products, marinated offerings, and convenient meal solutions appeals to time-pressed consumers seeking quality and religious adherence without compromising on convenience. This evolution reflects the broader transformation of traditional halal retail toward modern, accessible formats.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Traditional Retailers

- Supermarkets and Hypermarkets

- Online

- Others

The traditional retailers segment leads with a share of 51.7% of the total UK halal food market in 2025.

Traditional retailers, including specialist halal butchers and ethnic food stores, maintain market dominance due to deeply rooted consumer trust and cultural connections. The AHDB's 2024 research indicates that 57% of halal consumers prefer purchasing from specialist butchers compared to supermarkets, valuing the personalized service, ability to request custom cuts, and confidence in halal authenticity. Pre-packed halal meat from supermarkets attracts only 35% of consumers, with many expressing reservations about cross-contamination risks and certification reliability.

The traditional retail segment benefits from the cultural significance of community-based shopping experiences that foster strong connections between retailers and consumers. Independent halal supermarkets and ethnic food stores continue to thrive by emphasizing quality, accessibility, and responsiveness to diverse local community needs. This ongoing vitality of traditional retail formats reflects their unique ability to combine halal meat counters with broader ethnic grocery offerings, serving as community hubs that reinforce consumer loyalty, cultural identity, and trust through personalized service and familiar shopping environments.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents one of the largest UK halal food market with the highest Muslim population concentration. The capital hosts majority of the Muslims, creating robust demand across traditional retailers, supermarkets, and halal-certified restaurants serving diverse cuisines.

The South East Region represents a significant market with substantial Muslim communities in urban centres. The region benefits from proximity to London, established distribution networks, and growing demand from diverse ethnic populations seeking halal-certified products across multiple food categories.

Manchester serves as the halal food hub for the North West Region with a concentrated Muslim population. The area features numerous traditional halal butchers, ethnic supermarkets, and an expanding halal restaurant scene, supporting strong retail demand and foodservice growth.

The East of England demonstrates growing halal food consumption supported by expanding Muslim communities in urban areas. The region benefits from improved distribution infrastructure and increasing mainstream retailer participation in halal product offerings.

The South West represents an emerging market with smaller but growing Muslim populations in cities like Bristol. The region sees increasing demand for halal products through both traditional retailers and supermarket channels serving dispersed communities.

Scotland's halal food market centres on Glasgow and Edinburgh with approximately 2.2% Muslim population share. The region features established halal butchers and ethnic stores, with growing mainstream retailer participation responding to demographic diversity.

Birmingham anchors the West Midlands halal market as a major consumption hub with significant Muslim demographics. The region hosts numerous halal establishments from traditional butchers to Michelin-recognized restaurants, reflecting strong cultural diversity and consumer demand.

Yorkshire and the Humber features substantial Muslim populations in Bradford and Leeds, driving robust halal food demand. The region has established traditional retail networks and growing presence of halal-certified products in mainstream supermarkets.

The East Midlands demonstrates steady halal market growth with notable Muslim communities in Leicester and Nottingham. The region benefits from strong traditional retailer presence and increasing product availability through mainstream distribution channels.

Market Dynamics:

Growth Drivers:

Why is the UK Halal Food Market Growing?

Rising Muslim Population and Growing Religious Adherence

The steady rise in the UK's Muslim population represents a primary driver of halal food market expansion. The Muslim community continues to grow across England, Scotland, Wales, and Northern Ireland, with demographic projections indicating sustained expansion driven by higher birth rates and continued immigration from predominantly Muslim countries including Pakistan, Bangladesh, and Middle Eastern nations. Younger generations of British Muslims are increasingly assertive about halal lifestyle choices, influencing food preferences across educational institutions, workplaces, and broader social settings.

Expansion of Mainstream Retail Halal Offerings

Major UK supermarket chains have significantly expanded their halal product portfolios, driving market accessibility and growth. Several chains now offer halal-certified products throughout the year, with expanded offerings during Ramadan and Eid festivals. In September 2024, Tesco and Sainsbury's boosted their halal offerings with new branded meat fixtures responding to growing consumer demand. Furthermore, in September 2024, Perwyn's halal meat portfolio company Isla Délice acquired Takul, a British halal brand supplying Tesco and Sainsbury's, demonstrating investor confidence in the UK halal market's growth potential.

E-Commerce Growth and Digital Platform Proliferation

The proliferation of online platforms and e-commerce channels is accelerating UK halal food market expansion. The UK e-commerce market size is projected to reach USD 1,483.7 Billion by 2033, exhibiting a growth rate (CAGR) of 18.1% during 2025-2033, driven by tech-savvy millennials and Generation Z consumers prioritizing convenience and product traceability. Specialized platforms offer extensive halal-certified product ranges including groceries, snacks, and ready-to-eat foods accessible nationwide. Subscription services and home delivery options have enhanced consumer convenience, particularly benefiting those in areas with limited local halal retail availability. Major supermarket online platforms now feature dedicated halal filters, further democratizing access to compliant products.

Market Restraints:

What Challenges the UK Halal Food Market is Facing?

Lack of Standardized Halal Certification and Consumer Confusion

The absence of a centralized UK halal certification system creates market challenges. Multiple private organizations maintain different standards, causing consumer confusion regarding stunning practices and compliance definitions. This fragmentation undermines confidence, complicates retailer decision-making, and creates inconsistencies that hinder market growth and consumer trust.

Supply Chain Transparency and Trust Issues

Supply chain transparency remains a significant concern affecting consumer trust. Post-Brexit trade barriers have increased operational costs and documentation requirements, limiting smaller producers' competitive capacity. Concerns about cross-contamination and halal integrity throughout distribution channels continue driving consumers toward traditional specialist retailers offering greater assurance.

Cost Pressures and Premium Pricing Challenges

Halal-certified products often carry price premiums, creating accessibility challenges amid cost-of-living pressures. Ethically sourced, sustainable halal products command higher prices than conventional alternatives, potentially alienating budget-conscious consumers and limiting market expansion into price-sensitive segments where affordability remains the primary purchasing consideration.

Competitive Landscape:

The UK halal food market exhibits a fragmented competitive landscape characterized by diverse participant categories. Traditional specialist halal butchers and ethnic food stores maintain significant market presence, leveraging established consumer trust and community relationships. Major supermarket chains compete through dedicated halal sections and expanded product ranges. The market has witnessed increased investment activity, with European investors acquiring UK halal brands to strengthen regional presence. Online platforms and delivery services represent an emerging competitive force, attracting younger consumers through convenience and expanded product accessibility. Competition centres on certification authenticity, product quality, price competitiveness, and distribution reach, with participants increasingly differentiating through premium offerings and sustainability credentials.

Recent Developments:

-

September 2024: In response to contemporary consumer needs for prompt service and convenience, Tariq Halal Meat opened the first drive-thru halal butcher shops in the UK and Dubai.

UK Halal Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Meat, Poultry, and Seafood, Fruits and Vegetables, Dairy Products, Cereals and Grains, Oil, Fats, and Waxes, Confectionery, Others |

| Distribution Channels Covered | Traditional Retailers, Supermarkets and Hypermarkets, Online, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK halal food market size was valued at USD 97.52 Billion in 2025.

The UK halal food market is expected to grow at a compound annual growth rate of 8.58% 2026-2034 to reach USD 204.62 Billion by 2034.

The meat, poultry and seafood segment dominates the UK halal food market with a 50.3% share in 2025, driven by the essential dietary requirements of the Muslim community and adherence to Islamic dietary laws for protein consumption.

Key factors driving the UK halal food market include the rising Muslim population and growing religious adherence, expansion of mainstream retail halal offerings, e-commerce growth and digital platform proliferation, and increasing demand for ethically sourced and clean-label products.

Major challenges include the lack of standardized halal certification creating consumer confusion, supply chain transparency concerns affecting trust, cost pressures and premium pricing limiting accessibility, and post-Brexit trade barriers increasing operational costs for producers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)