UK Health and Wellness Market Size, Share, Trends and Forecast by Product Type, Functionality, and Region, 2025-2033

UK Health and Wellness Market Overview:

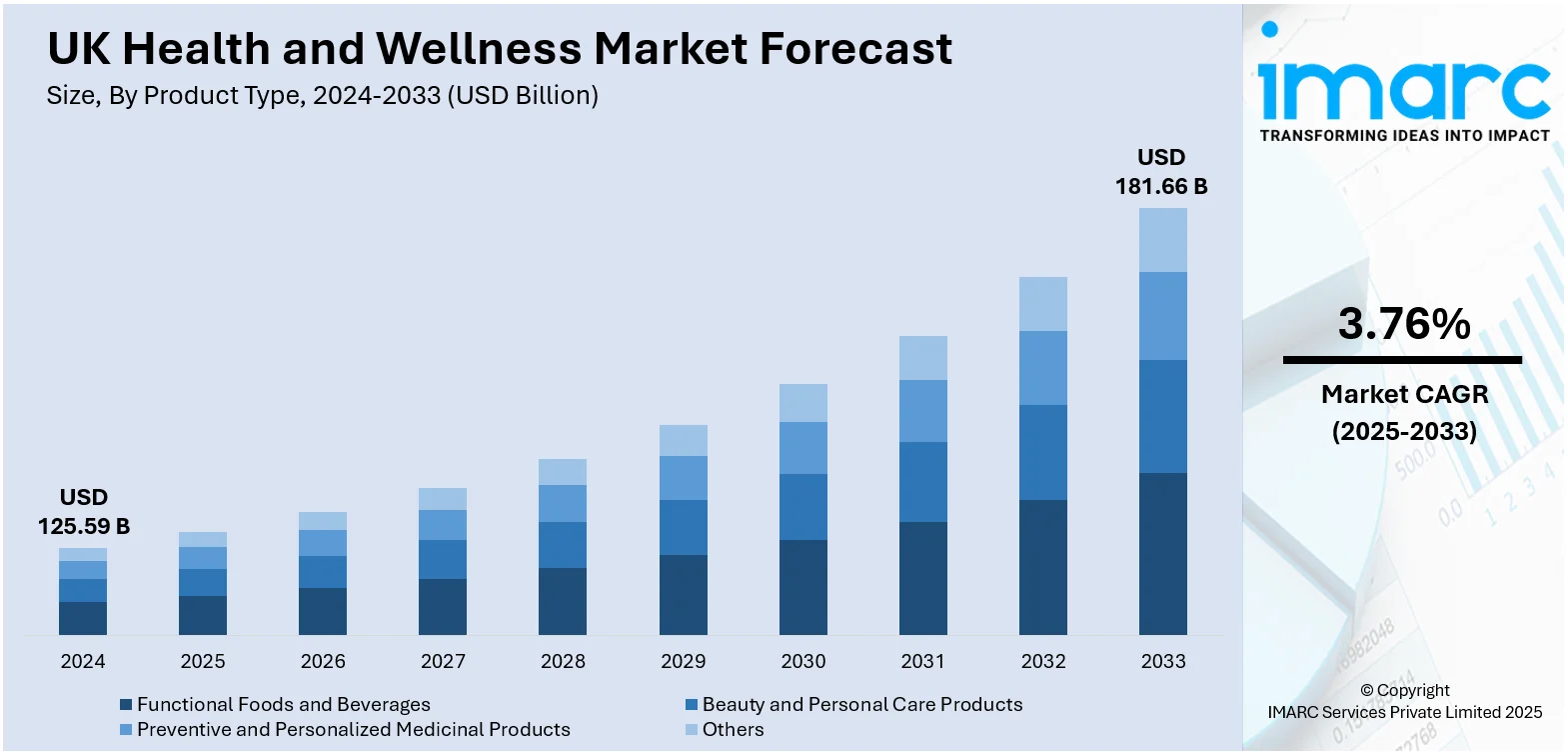

The UK health and wellness market size reached USD 125.59 Billion in 2024. Looking forward, the market is expected to reach USD 181.66 Billion by 2033, exhibiting a growth rate (CAGR) of 3.76% during 2025-2033. The market is fueled by rising consumer interest in mental wellbeing, healthy nutrition, and sustainable lifestyles; public health policy; and NHS-supported digital solutions. Expanding demand for plant-based offerings, digital health solutions, and tailored wellness programs also indicates a move toward active self-care. Cultural acceptance of talking about mental health and increasing interest in fitness, mindfulness, and clean-label goods add to changing consumer behavior, which further continues to reinforce the UK health and wellness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 125.59 Billion |

| Market Forecast in 2033 | USD 181.66 Billion |

| Market Growth Rate 2025-2033 | 3.76% |

UK Health and Wellness Market Trends:

Plant-Based and Functional Foods

The UK wellness and health market has witnessed a shift toward functional and plant-based foods, driven by a mix of consumer health consciousness, ecological concerns, and evolving eating patterns. Meat alternatives, enriched fruits and vegetables, and nutritionally enhanced snacks are preferred by UK consumers. Supermarkets and health food outlets prominently display products such as fortified plant milks, protein-enhanced yogurt, and gut-friendly fermented foods. The regulatory environment within the UK allows for such innovation through strong yet adaptable labeling regulations, enabling consumers to make informed decisions. It is not just a case of dieting; it is linked to wider lifestyle needs. Ethical supply chains and environmental footprint are important to UK consumers, and brands are choosing to emphasize traceable ingredients and sustainable farming. Apart from this, food tech startups in places such as Cambridge and London are creating new functional blends from UK-sourced botanicals. Thus, the UK is creating a unique pathway in health-oriented nutrition where plants, science, and consumer values converge to forge an ever-changing wellness food space, which further contributes to the UK health and wellness market growth.

To get more information on this market, Request Sample

Integration of Digital Health and Tele Wellness

The UK has adopted digital health and tele wellness at scale, merging tech-led solutions into daily health habits. With its superior broadband networks and increasing digital literacy, the UK enables various online health websites with remote consulting, mental well-being apps, and bespoke programming. Startups and incumbent healthcare providers alike commoditize everything from guided mindfulness software to AI-powered fitness coaching. The digital-first NHS approach has also stimulated private innovation, creating frictionless patient journeys for mental health care, nutrition counseling, and exercise routines. Significantly, apps tend to connect directly to wearable devices and health monitors, allowing all-round monitoring and round-the-clock care. Platforms offer uniquely British levels of patient confidentiality and data security, and they collaborate closely with universities through schemes in Manchester and Edinburgh to provide scientific validity. The combination of clinical accuracy, safe digital regulation, and intuitive styling positions the UK as a world leader in tele wellness, by providing the convenience of easy access to medical care at home.

Mental Health and Emotional Wellness as Top Priority

Mental health and emotional well-being have taken center stage over recent years in the UK's health sector, in line with changing social attitudes and policy changes. Mental health is no longer an afterthought; it is now part of workplace culture, school programs, and public health initiatives. More employers provide mental health days, mindfulness classes, and online counseling access as key to productivity, recognizing emotional resilience. Volunteer services driven by local communities, peer support networks, and neighborhood wellness centers—particularly throughout London boroughs and Northern England communities—have made more emotional support accessible. Wellness breaks in the countryside such as the Lake District or Scottish Highlands provide intensive programs that integrate therapy, outdoor pursuits, and mindfulness and that are sensitive to British cultural values of discretion and self-care identification with nature. This focus on mental health has spawned expansion in services such as online counselling, stress-management classes, and self-directed resources, reflecting a long-term investment in emotional health. The UK's emphasis on mental health sets its overall health market apart, with equal value on psychological and physiological elements of health.

Industry reports indicate that in 2025, spending on gym memberships in the UK increased by 11% during the Christmas season, accompanied by a 4% rise in January, suggesting a proactive attitude toward fitness even before the year started. Examining demographics, individuals aged 18-34 experienced the most significant growth as younger generations prefer active living to late-night outings and drinking. Individuals between 35 and 44 years old also raised their fitness-related expenditures by 7%, as they also value their health. Early January recorded a 6% increase in spending on specialty grocery goods and an 11% increase in Home Meal Services, indicating a shift toward healthier options. over generations are driving this surge; consumers 65 and over increased their expenditure by 9%, demonstrating their increased use of the internet for purchasing.

UK Health and Wellness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and functionality.

Product Type Insights:

- Functional Foods and Beverages

- Beauty and Personal Care Products

- Preventive and Personalized Medicinal Products

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes functional foods and beverages, beauty and personal care products, preventive and personalized medicinal products, and others.

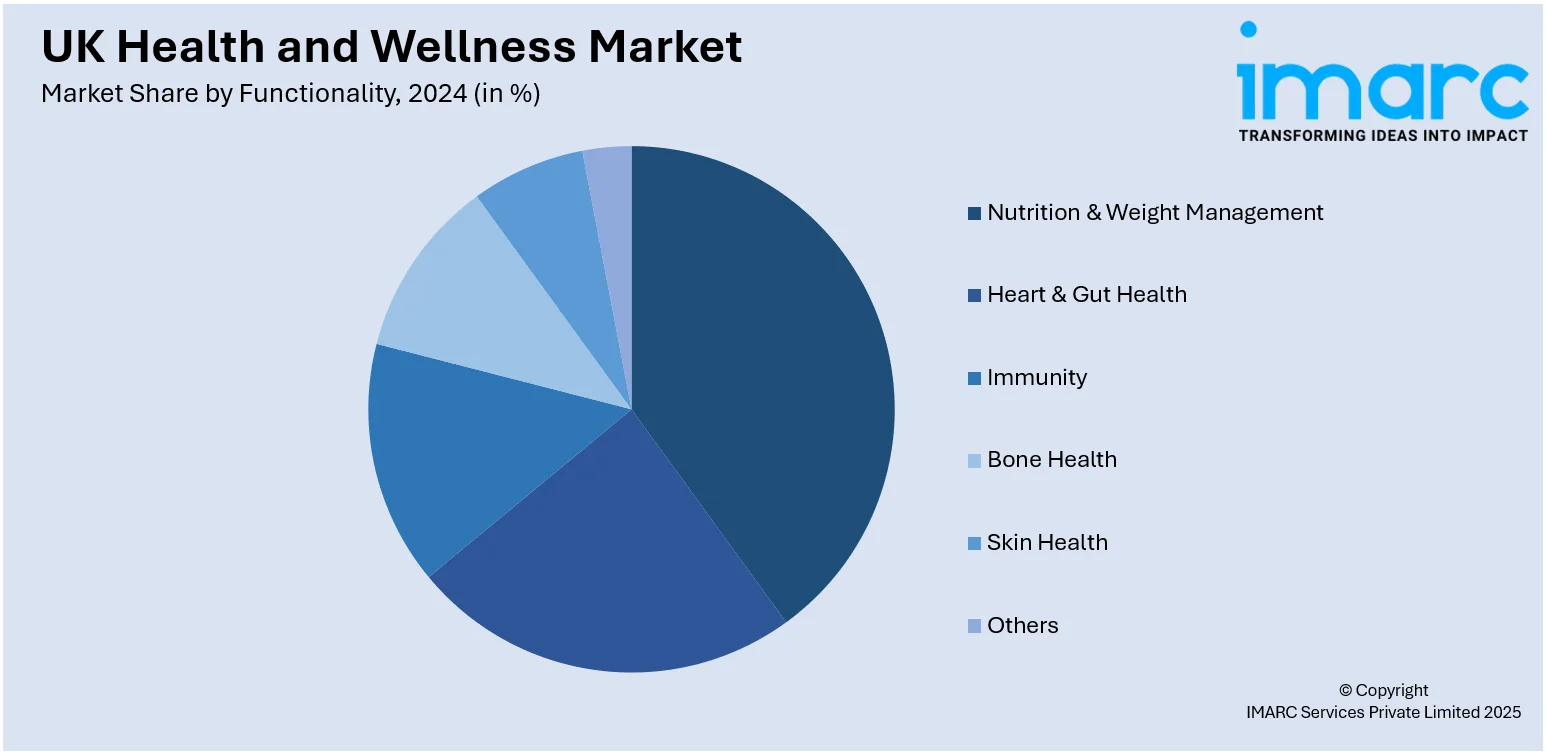

Functionality Insights:

- Nutrition & Weight Management

- Heart & Gut Health

- Immunity

- Bone Health

- Skin Health

- Others

A detailed breakup and analysis of the market based on the functionality has also been provided in the report. This includes nutrition and weight management, heart & gut health, immunity, bone health, skin health, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Health and Wellness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Functional Foods and Beverages, Beauty and Personal Care Products, Preventive and Personalized Medicinal Products, Others |

| Functionalities Covered | Nutrition and Weight Management, Heart & Gut Health, Immunity, Bone Health, Skin Health, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK health and wellness market performed so far and how will it perform in the coming years?

- What is the breakup of the UK health and wellness market on the basis of product type?

- What is the breakup of the UK health and wellness market on the basis of functionality?

- What is the breakup of the UK health and wellness market on the basis of region?

- What are the various stages in the value chain of the UK health and wellness market?

- What are the key driving factors and challenges in the UK health and wellness market?

- What is the structure of the UK health and wellness market and who are the key players?

- What is the degree of competition in the UK health and wellness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK health and wellness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK health and wellness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK health and wellness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)