UK Identity Verification Market Size, Share, Trends and Forecast by Type, Component, Deployment Mode, Organization Size, Vertical, and Region, 2025-2033

UK Identity Verification Market Overview:

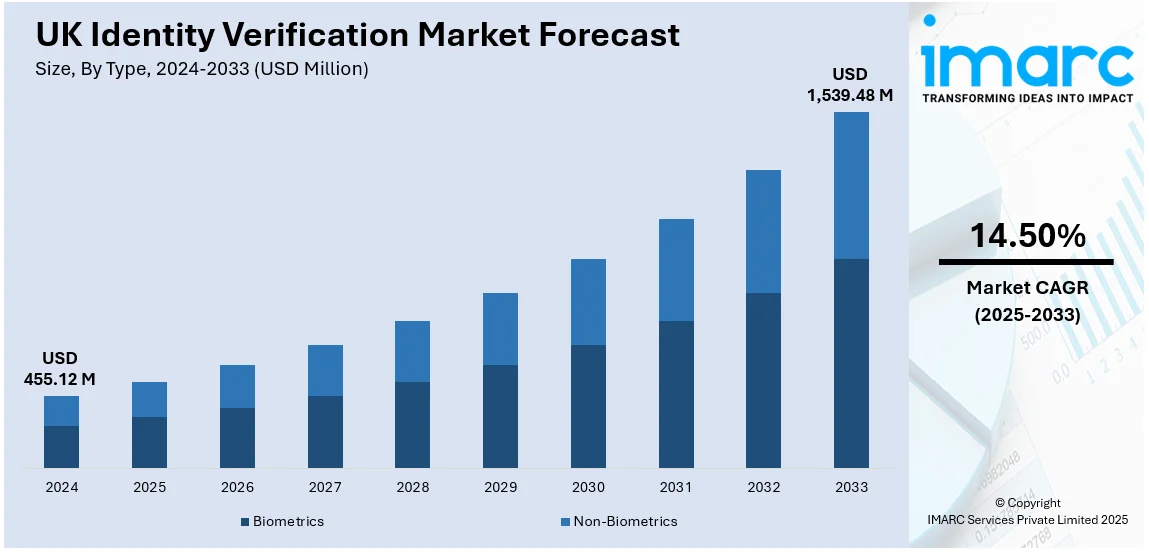

The UK identity verification market size reached USD 455.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,539.48 Million by 2033, exhibiting a growth rate (CAGR) of 14.50% during 2025-2033. The market is driven by rising government initiatives and blockchain integration in identity verification, with regulatory policies enhancing security and compliance while blockchain enables decentralized authentication, reducing fraud risks and accelerating adoption across industries through and AI-driven verification solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 455.12 Million |

| Market Forecast in 2033 | USD 1,539.48 Million |

| Market Growth Rate (2025-2033) | 14.50% |

UK Identity Verification Market Trends:

Rising Government Initiatives

The regulatory authority is actively promoting the implementation of digital identity verification via legislative and regulatory measures. Through the enactment of policies that support secure digital identities, authorities are building confidence in online transactions and reducing fraud risks. These efforts seek to simplify identity verification procedures, lower business expenses, and enhance data security. Enhancing regulatory supervision guarantees that organizations adhere to data protection regulations, promoting a more secure digital landscape. Furthermore, government-supported frameworks promote interoperability among identity verification systems, facilitating smooth authentication across various sectors. Regulatory backing also promotes innovation in identity verification technologies, such as AI-driven authentication and blockchain solutions. With the rapid advancement of digital transformation in both public and private sectors, policymakers are emphasizing secure identity management to safeguard consumers and enterprises. These initiatives not only improve cybersecurity resilience but also generate opportunities for expansion in the identity verification sector, bolstering digital trust across the country. In 2024, the UK government launched the Digital Information and Smart Data Bill, aimed at facilitating digital identity verification services to enhance online transactions. The legislation sought to lower business expenses and minimize data breaches while encouraging secure digital identities. It additionally specified reforms for data exchange and conferred greater authority to the Information Commissioner’s Office (ICO).

Integration of Blockchain in Identity Verification

Blockchain technology is transforming identity verification by offering a decentralized, secure, and transparent framework for authentication. In contrast to conventional centralized systems, blockchain allows users to manage their digital identities while reducing the risks linked to data breaches and identity theft. The implementation of blockchain-backed verification systems improves adherence to know your customer (KYC) and know your business (KYB) regulations, fostering a trust-centric environment for both individuals and companies. Intelligent contracts and cryptographic protection enhance authentication methods, decreasing dependence on intermediaries and improving efficiency. With the growth of digital finance, decentralized applications, and Web3 ecosystems, blockchain-based identity verification is increasingly crucial for secure transactions and preventing fraud. Companies utilizing blockchain for identity verification experience enhanced security, greater operational efficiency, and adherence to regulations. The growing use of decentralized identity solutions is fueling innovation and investment in blockchain-based verification technologies in a range of industries. In 2025, Pi Network initiated its Open Network phase, allowing secure transactions on the blockchain with verified identities. The updated ecosystem mandates KYC verification for individuals and KYB verification for companies, ensuring compliance and building trust. With more than 19 million KYC-verified users, Pi seeks to improve security and create business opportunities in the cryptocurrency industry.

UK Identity Verification Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on type, component, deployment mode, organization size, and vertical.

Type Insights:

- Biometrics

- Non-Biometrics

The report has provided a detailed breakup and analysis of the market based on the type. This includes biometrics and non-biometrics.

Component Insights:

- Solutions

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes solutions and services.

Deployment Mode Insights:

- On-premises

- Cloud-base

A detailed breakup and analysis of the market based on the deployment mode have also been provided in the report. This includes on-premises and cloud-base.

Organization Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes small and medium-sized enterprises and large enterprises.

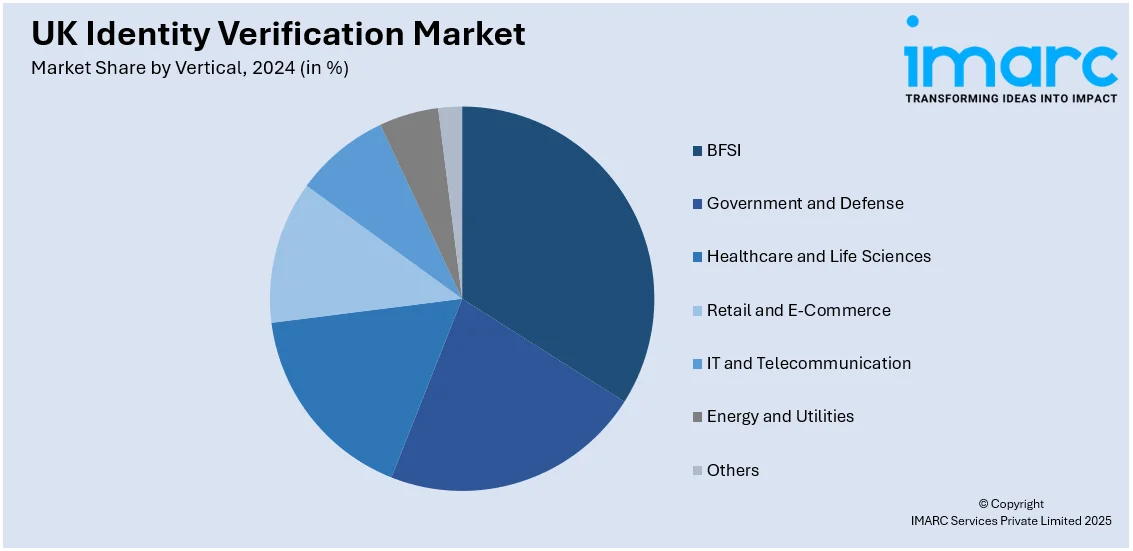

Vertical Insights:

- BFSI

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-Commerce

- IT and Telecommunication

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, government and defense, healthcare and life sciences, retail and e-commerce, IT and telecommunication, energy and utilities, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Identity Verification Market News:

- In February 2025, UK-based OneID secured $20 million to improve its bank-verified digital identity platform. The funding will assist in broadening its product range and market presence, concentrating on secure, document-free digital validation. OneID's solution enhances customer onboarding, reduces fraud, and guarantees regulatory compliance for companies.

- In January 2025, the UK government revealed the introduction of the GOV.UK Wallet app, enabling citizens to digitize documents issued by the government, such as driver's licenses and veteran cards. The application, utilizing smartphone security functions, intends to provide users with greater oversight of their data. It is set to be accessible later in 2025, aiming to provide digital versions of all government-issued documents by 2027.

UK Identity Verification Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Biometrics, Non-Biometrics |

| Components Covered | Solutions, Services |

| Deployment Modes Covered | On-premises, Cloud-base |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Verticals Covered | BFSI, Government and Defense, Healthcare and Life Sciences, Retail and E-Commerce, IT and Telecommunication, Energy and Utilities, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK identity verification market performed so far and how will it perform in the coming years?

- What is the breakup of the UK identity verification market on the basis of type?

- What is the breakup of the UK identity verification market on the basis of component?

- What is the breakup of the UK identity verification market on the basis of deployment mode?

- What is the breakup of the UK identity verification market on the basis of organization size?

- What is the breakup of the UK identity verification market on the basis of vertical?

- What is the breakup of the UK identity verification market on the basis of region?

- What are the various stages in the value chain of the UK identity verification market?

- What are the key driving factors and challenges in the UK identity verification market?

- What is the structure of the UK identity verification market and who are the key players?

- What is the degree of competition in the UK identity verification market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK identity verification market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK identity verification market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK identity verification industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)