UK Luxury Fashion Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, End User, and Region, 2025-2033

UK Luxury Fashion Market Overview:

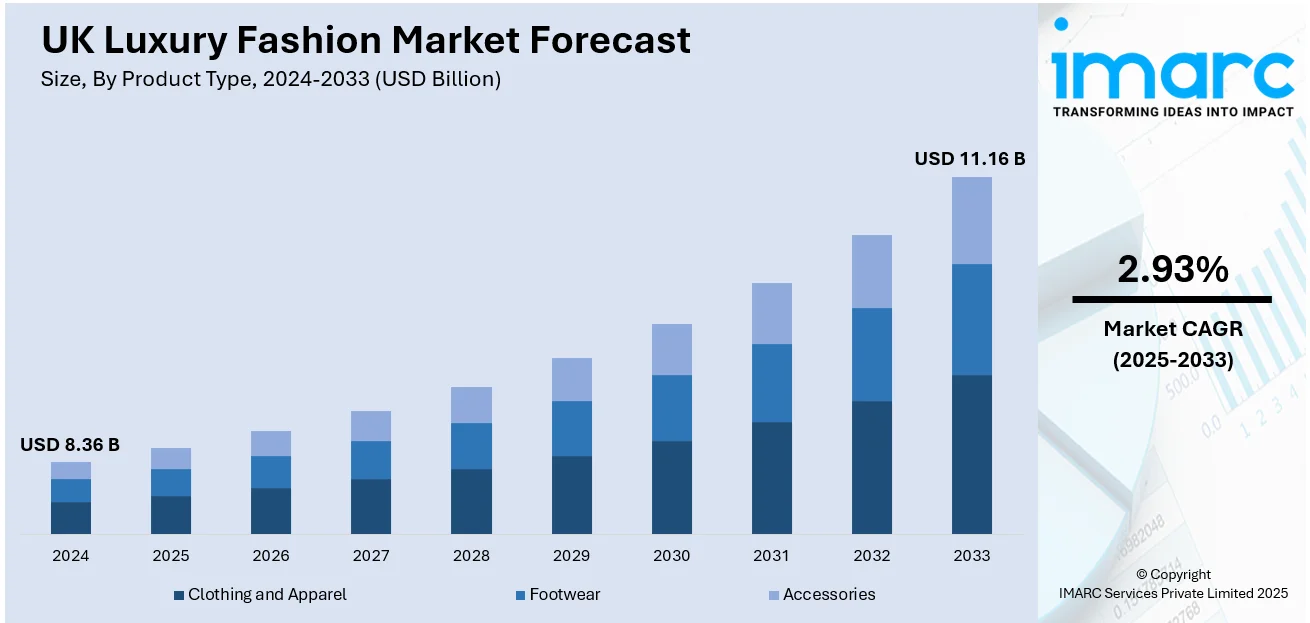

The UK luxury fashion market size reached USD 8.36 Billion in 2024. The market is projected to reach USD 11.16 Billion by 2033, exhibiting a growth rate (CAGR) of 2.93% during 2025-2033. The market is propelled by the growing demand for high-end designer brands, exclusive craftsmanship, and limited-series collections that attract high-end consumers. Furthermore, international visitors also account for bulk sales, particularly in destinations such as London, where heritage brands and new-generation designers gain exposure globally. Additionally, growing disposable incomes and high-net-worth individuals' expenditures on luxury items are key drivers significantly augmenting the UK luxury fashion market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.36 Billion |

| Market Forecast in 2033 | USD 11.16 Billion |

| Market Growth Rate 2025-2033 | 2.93% |

UK Luxury Fashion Market Trends:

Rising Disposable Income and Aspirational Spending

The market is experiencing a consistent uptrend in demand fueled by growing disposable income, especially among professionals and double-income families. According to industry reports, during the financial year 2024, the UK median household disposable income experienced a slight increase of 0.8% over the preceding year to EUR 36,700 (approximately USD 43,067). As economic recovery grows stronger and living standards continue to rise post-pandemic, consumers are spending more of their income on luxury garments and accessories. Apart from this, luxury fashion, which for many years has been a status symbol and badge of success, is increasingly an aspirational spending outlet. The desire for exclusivity and uniqueness continues to drive this trend as consumers opt for products that set them apart from mass-market options. Moreover, younger consumers, particularly those in their late 20s to 40s, are adopting high-end fashion as a lifestyle indicator and investment in self-branding. In addition, wealth growth in areas outside of London, such as cities like Manchester, Edinburgh, and Birmingham, is increasing the luxury customer base. The increased affluence is converting into greater foot traffic in designer stores, better interest in luxury e-commerce sites, and a higher propensity to spend on heritage brands and quality craftsmanship. This trend is significantly contributing to the UK luxury fashion market growth.

To get more information on this market, Request Sample

Ethical Sourcing and Sustainability as Core Values

Sustainability and ethical sourcing have emerged as foundational expectations in the market. Consumers are growing more aware of the environmental and social consequences of their purchases, encouraging brands to move away from conventional linear models toward more responsible and transparent practices. Moreover, shoppers are demanding traceability in supply chains, fair labor practices, and environmentally friendly materials, especially among Gen Z and Millennial cohorts who prioritize purpose alongside style. In response, luxury brands are integrating organic fabrics, low-impact dyes, and eco-certifications into their collections while actively communicating their sustainability commitments. Notably, on May 14, 2025, Positive Luxury launched its “Good Supplier Programme” to enhance responsible sourcing practices within the luxury industry. The initiative is designed to independently verify suppliers based on stringent environmental, social, and governance (ESG) standards, enabling brands to streamline due diligence and strengthen supply chain transparency. Building on the organization’s existing Butterfly Mark certification, the programme is now active and accessible through the Positive Luxury platform, offering a trusted network of pre-vetted suppliers for luxury brands committed to sustainability. The shift is also reflected in growing interest in circular fashion, including pre-owned luxury, repair services, and rental models. Ethical sourcing is no longer an optional brand attribute but a competitive necessity that influences purchase decisions and brand loyalty. As legislation around environmental disclosures and carbon footprints gains traction in the UK, luxury labels are proactively aligning with these values to future-proof their reputation and reinforce their positioning among value-driven consumers.

UK Luxury Fashion Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and end user.

Product Type Insights:

- Clothing and Apparel

- Jackets and Coats

- Skirts

- Shirts and T-Shirts

- Dresses

- Trousers and Shorts

- Denim

- Underwear and Lingerie

- Others

- Footwear

- Accessories

- Gems and Jewellery

- Belts

- Bags

- Watches

The report has provided a detailed breakup and analysis of the market based on the product type. This includes clothing and apparel (jackets and coats, skirts, shirts and T-shirts, dresses, trousers and shorts, denim, underwear and lingerie, and others), footwear, and accessories (gems and jewellery, belts, bags, and watches).

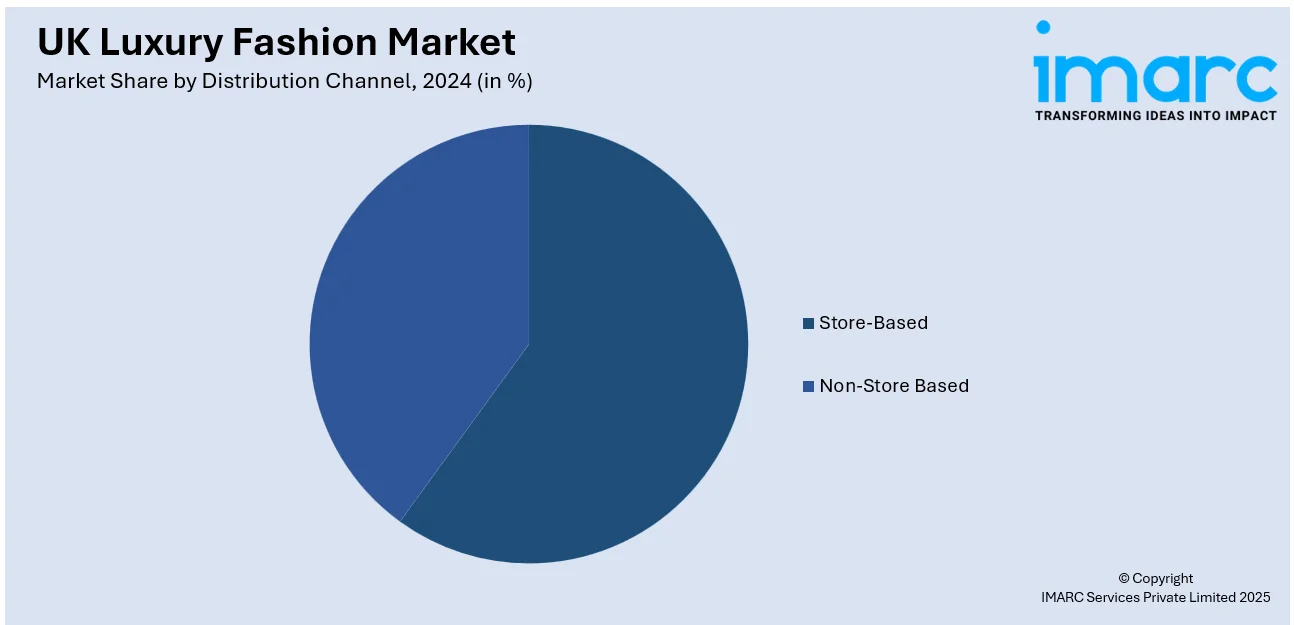

Distribution Channel Insights:

- Store-Based

- Non-Store Based

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes store-based and non-store based.

End User Insights:

- Men

- Women

- Unisex

The report has provided a detailed breakup and analysis of the market based on the end user. This includes men, women, and unisex.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Luxury Fashion Market News:

- On May 2, 2025, ASOS officially welcomed luxury British womenswear brand House of CB onto its platform, offering shoppers 60 curated styles, including glam maxi and floral midi dresses featuring the brand’s signature corset silhouettes. This collaboration leverages ASOS Fulfilment Services (AFS) to streamline supply chain efficiency across ASOS.com and other distribution channels, ensuring responsive inventory management that aligns with consumer demand. The partnership underscores ASOS’s strategy to enhance its premium brand assortment and provide customers with elevated, high-quality fashion options through the integration of this cult-favorite label.

UK Luxury Fashion Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Distribution Channels Covered | Store-Based, Non-Store Based |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK luxury fashion market performed so far and how will it perform in the coming years?

- What is the breakup of the UK luxury fashion market on the basis of product type?

- What is the breakup of the UK luxury fashion market on the basis of distribution channel?

- What is the breakup of the UK luxury fashion market on the basis of end user?

- What is the breakup of the UK luxury fashion market on the basis of region?

- What are the various stages in the value chain of the UK luxury fashion market?

- What are the key driving factors and challenges in the UK luxury fashion market?

- What is the structure of the UK luxury fashion market and who are the key players?

- What is the degree of competition in the UK luxury fashion market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK luxury fashion market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK luxury fashion market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK luxury fashion industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)