UK Meat Market Report by Type (Raw, Processed), Product (Chicken, Beef, Pork, Mutton, and Others), Distribution Channel (Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores), and Region 2025-2033

UK Meat Market Overview:

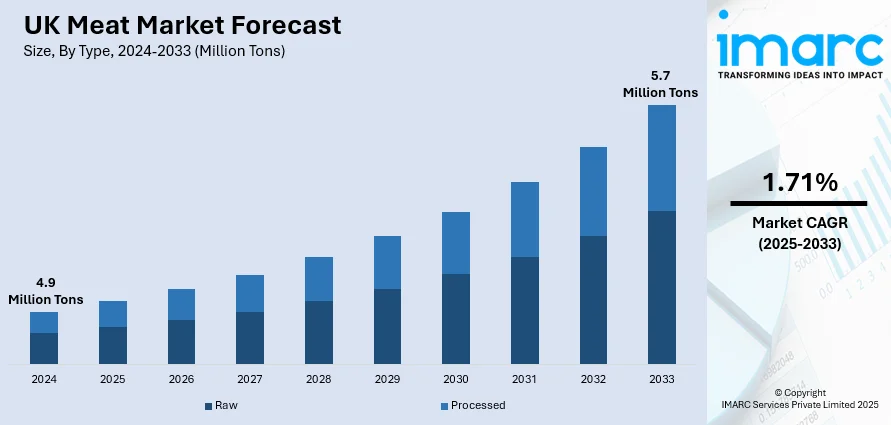

The UK meat market size reached 4.9 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 5.7 Million Tons by 2033, exhibiting a growth rate (CAGR) of 1.71% during 2025-2033. The market is expanding significantly due to rising protein consumption, increased use of convenience meat products, burgeoning consumer health and wellness trends, the country's expanding meat export sector, and rapid technical improvements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 4.9 Million Tons |

| Market Forecast in 2033 | 5.7 Million Tons |

| Market Growth Rate (2025-2033) | 1.71% |

UK Meat Market Trends:

Increased Demand for Protein

The growing preference for high-protein diets has significantly influenced the UK meat market. Health-conscious consumers are driving the demand for protein-rich foods, particularly meat products. This trend is influenced by various factors, including the rise in fitness culture and the popularity of diets like keto and paleo, which emphasize protein consumption for muscle building and weight management. Meat is seen as an essential source of complete protein, providing all the essential amino acids the body needs. In response, meat producers have capitalized on this shift by offering a wider range of high-protein options, including lean cuts, organic meats, and processed protein-rich snacks like beef jerky and protein bars made from meat derivatives.

To get more information on this market, Request Sample

Rising Convenience Food Consumption

The increasing prevalence of busy lifestyles have led to the growing popularity of convenience foods, including ready-to-eat (RTE) and processed meat products, which are becoming more prominent in the UK market. Consumers are seeking quick and easy meal options that still provide nutritional value, making pre-packaged meats, ready meals, and frozen meat products particularly attractive. Furthermore, the rise in dual-income households, urbanization, and longer working hours has shifted consumer preferences towards products that save time in meal preparation. This demand has encouraged meat producers to innovate by offering pre-cooked, portioned, or marinated meats that require minimal preparation.

Health-Conscious Options

The demand for health-conscious meat options has played a pivotal role in driving the growth of the UK meat market. As consumers become more aware of the health implications of their diets, they are increasingly seeking out meats that are lower in fat, cholesterol, and additives. This shift has led to a growing preference for lean meats, such as chicken and turkey, over traditionally fattier options like pork and beef. Additionally, the rise of organic and free-range meats, perceived as healthier and more ethically sourced, has further driven market growth. Organic meats, which are free from antibiotics and hormones, cater to a segment of consumers concerned with both personal health and environmental sustainability.

UK Meat Market News:

- In June 2024, UK-based startup THIS, which makes plant-based meat alternative products has raised 20 million pounds in Series C funding from impact investor Planet First Partners.

- In July 2024, Meatly, a London-based startup, has been granted permission to sell farmed meat throughout Europe after getting approval from UK regulators. This marks the first time a farmed pet food product has been approved for sale anywhere in the world.

UK Meat Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, product, and distribution channel.

Type Insights:

- Raw

- Processed

The report has provided a detailed breakup and analysis of the market based on the type. This includes raw and processed.

Product Insights:

- Chicken

- Beef

- Pork

- Mutton

- Others

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes chicken, beef, pork, mutton, and others.

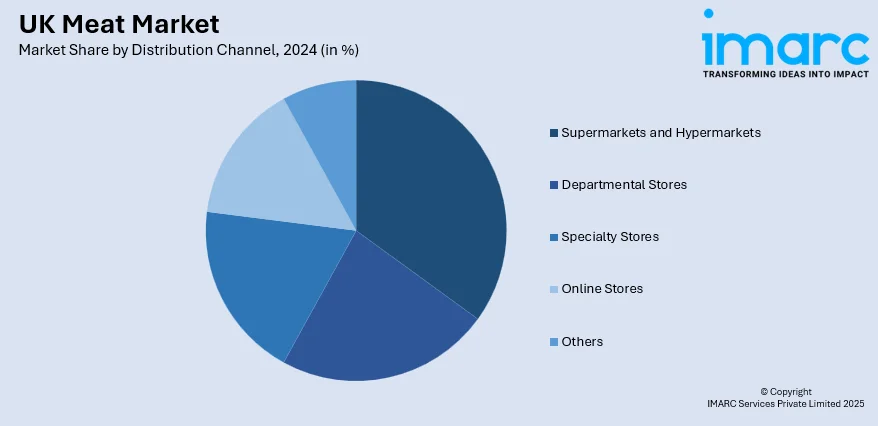

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Departmental Stores

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, departmental stores, specialty stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Meat Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Raw, Processed |

| Products Covered | Chicken, Beef, Pork, Mutton, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Specialty Stores, Online Stores |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK meat market performed so far and how will it perform in the coming years?

- What is the breakup of the UK meat market on the basis of type?

- What is the breakup of the UK meat market on the basis of product?

- What is the breakup of the UK meat market on the basis of distribution channel?

- What are the various stages in the value chain of the UK meat market?

- What are the key driving factors and challenges in the UK meat?

- What is the structure of the UK meat market and who are the key players?

- What is the degree of competition in the UK meat market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK meat market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK meat market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK meat industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)