UK Menswear Market Size, Share, Trends and Forecast by Product Type, Season, Distribution Channel, and Region, 2026-2034

UK Menswear Market Summary:

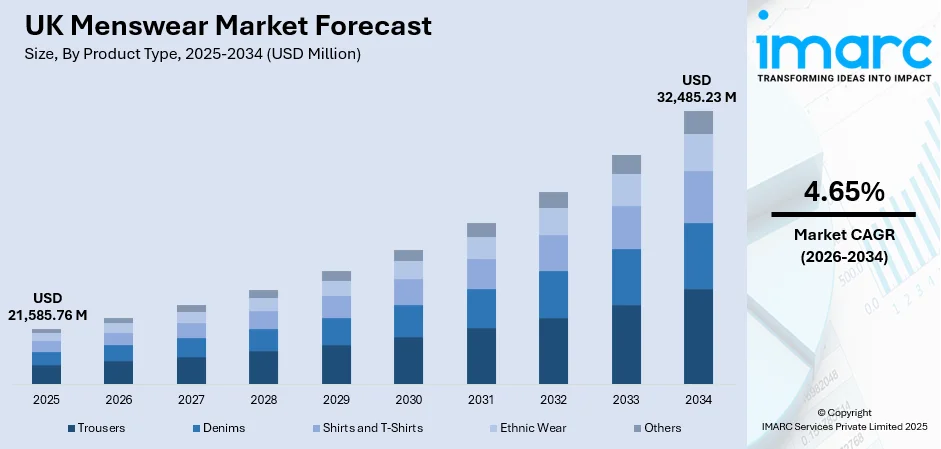

The UK menswear market size was valued at USD 21,585.76 Million in 2025 and is projected to reach USD 32,485.23 Million by 2034, growing at a compound annual growth rate of 4.65% from 2026-2034.

The market is driven by evolving fashion preferences, increasing demand for casual and formal attire, and expanding online retail penetration across the country. Consumer inclination toward stylish, comfortable, and versatile clothing continues shaping product offerings significantly. The growing emphasis on sustainable and premium fashion choices influences purchasing behavior remarkably. Rising disposable incomes and urbanization further accelerate sector expansion, while innovation in fabric technology enhances product appeal, contributing to the expanding UK menswear market share.

Key Takeaways and Insights:

- By Product Type: Shirts and T-Shirts dominate the market with a share of 38.5% in 2025, driven by their versatility across casual and semi-formal occasions, widespread consumer preference for comfortable everyday wear, and continuous design innovations meeting diverse style requirements.

- By Season: Summer Wear leads the market with a share of 40.35% in 2025, owing to the extended warmer months driving demand for lightweight breathable fabrics, increased outdoor activities, and consumer preference for comfortable seasonal apparel options.

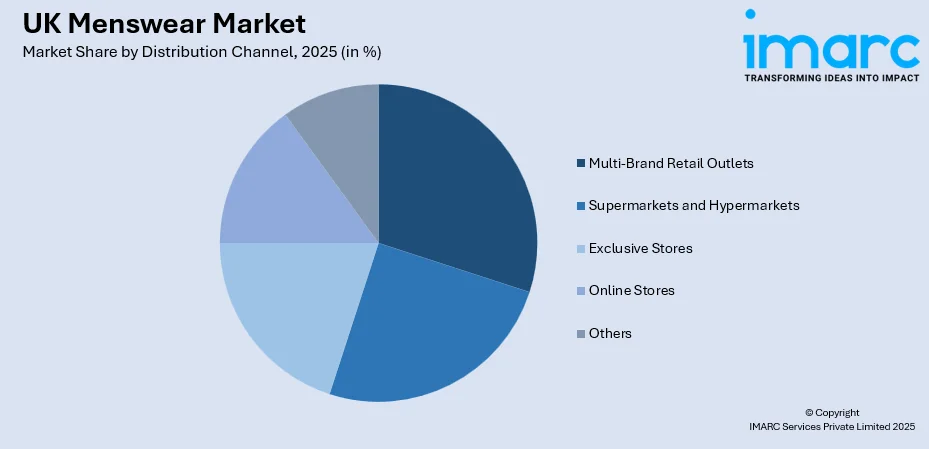

- By Distribution Channel: Multi-Brand Retail Outlets represents the largest segment with a market share of 28.65% in 2025, driven by product variety availability, comparative shopping convenience, competitive pricing strategies, and enhanced customer service experiences attracting diverse consumer demographics.

- Key Players: The market exhibits a dynamic competitive landscape with established fashion houses competing alongside emerging domestic brands across multiple price segments. Market participants differentiate through product quality, design innovation, sustainability initiatives, and omnichannel retail strategies to capture consumer attention.

To get more information on this market Request Sample

The UK menswear market continues experiencing sustained expansion propelled by fundamental shifts in consumer behavior and lifestyle patterns. Increasing urbanization and growing workforce participation drive consistent demand for both professional and casual attire options. The cultural shift toward self-expression through fashion has elevated menswear from functional necessity to lifestyle statement, with consumers actively seeking garments reflecting personal identity. Enhanced purchasing power enables investment in quality wardrobe essentials while digital connectivity expands brand awareness. Additionally, the blurring boundaries between formal and casual dress codes create opportunities for versatile clothing categories. Social media influence significantly impacts purchasing decisions, accelerating trend adoption cycles and broadening style consciousness among male consumers seeking contemporary fashion solutions. In May 2025, COS was named one of Lyst’s “hottest brands” of Q1, with menswear demand rising 44%, driven by its luxury-adjacent basics and new unisex fragrance line.

UK Menswear Market Trends:

Growing Preference for Sustainable Fashion

Environmental consciousness increasingly influences purchasing decisions within the menswear sector as consumers prioritize eco-friendly apparel options. Demand for garments manufactured using organic materials, recycled fabrics, and sustainable production methods continues rising substantially. Buyers demonstrate heightened awareness regarding supply chain transparency, ethical labor practices, and environmental footprint reduction. This shift encourages adoption of natural fibers, low-impact dyeing techniques, and circular fashion concepts. In October 2024, Good Guys Clothing launched in London, offering GOTS-certified organic cotton menswear and supporting environmental and social causes, including tree planting, ocean plastic removal, and men’s mental health initiatives. Younger demographics particularly embrace sustainable choices, viewing fashion purchases as expressions of environmental values and supporting brands demonstrating genuine commitment to ecological responsibility through verifiable sustainability initiatives.

Casualization of Workplace Attire

Traditional formal dress codes continue evolving toward relaxed professional standards, fundamentally reshaping menswear consumption patterns. The widespread acceptance of smart-casual attire in corporate environments drives demand for versatile garments bridging professional and leisure contexts. For instance, in July 2025, 3.3% of UK job postings mentioned casual dress, smart casual, or “dress for your day,” over ten times higher than pre-pandemic levels, reflecting evolving workplace attire norms. Moreover, consumers increasingly seek comfortable yet polished clothing suitable for transitioning between work settings and social occasions. This trend favors breathable fabrics, flexible tailoring, and adaptable designs accommodating multiple styling possibilities. The emphasis on functionality without sacrificing sophistication creates opportunities for innovative product categories combining traditional craftsmanship with contemporary comfort expectations across professional demographics.

Digital-First Shopping Experiences

Online retail platforms fundamentally transform how consumers discover, evaluate, and purchase menswear products throughout the purchasing journey. In October 2025, ASOS launched ASOS Live, a video shopping feature combining creator-led content with instant purchases, enhancing menswear mobile shopping engagement and trend discovery in the UK market. Furthermore, advanced digital technologies including virtual try-on capabilities, personalized recommendations, and comprehensive sizing tools enhance customer confidence when shopping remotely. Social media integration enables seamless product discovery while influencer partnerships accelerate brand awareness and trend adoption. Mobile commerce optimization addresses evolving consumer preferences for convenient purchasing experiences accessible anywhere. Direct-to-consumer models leverage digital channels building stronger customer relationships through personalized communications, loyalty programs, and community engagement strategies fostering brand advocacy among digitally connected male consumers.

Market Outlook 2026-2034:

The market demonstrates promising revenue growth prospects throughout the forecast period driven by evolving fashion consciousness and expanding retail infrastructure. Sustained demand for contemporary casual wear alongside traditional formal categories supports continued market expansion. Digital commerce advancement enables broader consumer reach while sustainability initiatives attract environmentally conscious buyers. Product innovation incorporating advanced fabrics and versatile designs addresses changing lifestyle requirements effectively. Regional retail development combined with premiumization trends positions the market for substantial revenue generation, with online channels capturing increasing transaction volumes as omnichannel strategies mature across the competitive landscape. The market generated a revenue of USD 21,585.76 Million in 2025 and is projected to reach a revenue of USD 32,485.23 Million by 2034, growing at a compound annual growth rate of 4.65% from 2026-2034.

UK Menswear Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Shirts and T-Shirts | 38.5% |

| Season | Summer Wear | 40.35% |

| Distribution Channel | Multi-Brand Retail Outlets | 28.65% |

Product Type Insights:

- Trousers

- Denims

- Shirts and T-Shirts

- Ethnic Wear

- Others

The shirts and t-shirts dominate with a market share of 38.5% of the total UK menswear market in 2025.

Shirts and t-shirts maintain market leadership owing to their fundamental role in everyday wardrobes across demographic segments. These versatile garments serve multiple occasions ranging from casual outings to semi-formal settings, ensuring consistent demand throughout the year. Consumer preference for comfortable, easy-care fabrics sustains category dominance while design innovations introduce contemporary styling elements appealing to fashion-conscious buyers seeking wardrobe essentials combining practicality with aesthetic appeal.

The segment benefits substantially from continuous product development incorporating performance fabrics, sustainable materials, and trend-responsive designs. In October 2025, John Lewis launched its first designer menswear collaboration in 10 years with Labrum London, featuring 38 premium pieces including shirts and T‑shirts across UK stores and online. Manufacturers address diverse consumer preferences through varied collar styles, fabric weights, and fit options accommodating different body types. The accessibility of shirts and T-shirts across price points ensures broad market penetration while premium offerings attract quality-conscious consumers willing to invest in durable, well-crafted garments representing wardrobe staples suitable for numerous styling combinations.

Season Insights:

- Summer Wear

- Winter Wear

- All-Season Wear

The summer wear leads with a share of 40.35% of the total UK menswear market in 2025.

Summer wear dominates seasonal consumption patterns reflecting the extended warm weather periods driving demand for lightweight, breathable apparel options. Consumers prioritize comfort-focused garments featuring natural fibers and moisture-management properties suitable for warmer temperatures. In October 2025, Marks & Spencer launched its Autograph Performance menswear collection, featuring moisture-wicking shirts, quick-dry chinos, and 360 Flex suits, addressing modern hybrid work and active lifestyle needs. Additionally, the segment encompasses diverse product categories including shorts, lightweight shirts, and casual trousers designed specifically for seasonal requirements while maintaining style considerations appealing to contemporary male consumers.

Outdoor activity participation during warmer months further accelerates summer wear demand as consumers seek appropriate attire for leisure pursuits. Holiday and vacation periods generate additional purchasing occasions while casual dress codes prevalent during summer months reduce reliance on formal attire categories. Innovation in fabric technologies enhances product performance through improved breathability, UV protection, and quick-drying properties addressing functional requirements while design evolution ensures alignment with prevailing fashion preferences.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Exclusive Stores

- Multi-Brand Retail Outlets

- Online Stores

- Others

The multi-brand retail outlets exhibit a clear dominance with a 28.65% share of the total UK menswear market in 2025.

Multi-brand retail outlets command significant market share by offering consumers comprehensive product assortments enabling comparative shopping within single destinations. In April 2025, the Cotswolds Designer Outlet opened with 44 brands pre-leased, including BOSS, M&S, Adidas, and Levi’s, highlighting strong consumer demand and continued growth of multi-brand retail in the UK. Moreover, these establishments provide access to diverse brands, styles, and price points satisfying varied consumer preferences efficiently. The physical retail experience facilitates garment evaluation including fit assessment, fabric quality inspection, and styling consultation unavailable through alternative channels, enhancing purchase confidence among discerning buyers.

Retail outlet environments create engaging shopping experiences through curated merchandising, seasonal displays, and promotional activities driving customer traffic consistently. Strategic locations in commercial centers ensure convenient accessibility while knowledgeable staff provide personalized assistance guiding purchase decisions effectively. Multi-brand formats accommodate evolving consumer tastes through regularly refreshed inventory reflecting current trends while loyalty programs and exclusive offers encourage repeat patronage among established customer bases valuing variety and convenience.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the dominant regional market driven by its substantial population concentration, elevated disposable income levels, and position as the national fashion capital. The city hosts flagship retail destinations, premium shopping districts, and diverse consumer demographics embracing contemporary fashion trends while supporting both luxury and accessible price segments throughout metropolitan areas.

South East England maintains significant market presence supported by affluent suburban populations and proximity to London's fashion influence. Strong retail infrastructure serving commuter communities drives consistent demand while higher household incomes enable premium product purchases. The region demonstrates balanced consumption across casual and formal categories reflecting diverse professional demographics.

North West England contributes substantially to national menswear consumption through major metropolitan centers featuring developed retail networks. Urban population concentrations support diverse fashion preferences while competitive retail environments ensure product accessibility across price segments. Cultural identity and regional style preferences influence distinctive consumption patterns within the market.

East of England demonstrates steady growth potential through expanding suburban populations and improving retail accessibility. Growing communities with increasing purchasing power support market development while regional shopping destinations attract consumers seeking comprehensive product offerings. The region shows strong affinity for practical, quality-focused apparel meeting everyday requirements.

South West England maintains consistent market participation driven by tourism-influenced retail activity and established residential populations. Coastal and rural lifestyle preferences shape product demand emphasizing casual, outdoor-appropriate apparel categories while regional urban centers provide access to contemporary fashion offerings meeting diverse consumer requirements across the territory.

Scotland represents a distinct regional market with strong cultural identity influencing fashion preferences and consumption patterns. Major urban centers provide developed retail infrastructure while traditional and contemporary styles coexist within consumer wardrobes. Climate considerations drive demand for appropriate seasonal apparel while local pride supports regional retail participation.

West Midlands contributes meaningfully to national consumption through significant urban population centers and diverse demographic composition. Established retail infrastructure serves varied consumer segments while regeneration initiatives enhance shopping environments attracting broader audiences. The region demonstrates balanced demand across product categories reflecting diverse lifestyle requirements.

Yorkshire and The Humber maintains important regional market share through major urban centers featuring comprehensive retail offerings. Strong regional identity influences purchasing preferences while competitive retail environments ensure accessibility across price segments. The region demonstrates appreciation for quality craftsmanship alongside value-conscious consumption patterns.

East Midlands provides stable market contribution through distributed urban centers and growing suburban communities. Improving retail accessibility expands consumer reach while balanced demographic composition supports diverse product category demand. The region shows consistent consumption patterns emphasizing practical wardrobe essentials suitable for varied lifestyle requirements.

Other UK regions collectively contribute to national market volume through distributed population centers and evolving retail accessibility. Rural and smaller urban communities demonstrate increasing fashion engagement supported by digital commerce expansion enabling product access previously limited to metropolitan areas while maintaining regional preference distinctions.

Market Dynamics:

Growth Drivers:

Why is the UK Menswear Market Growing?

Rising Fashion Consciousness Among Male Consumers

Contemporary male consumers demonstrate unprecedented interest in personal appearance and fashion expression, fundamentally transforming menswear consumption patterns. In December 2025, ASOS expanded its premium menswear range with new brands including Pompeii, True Religion, Double A by Wood Wood, and No Problemo, enhancing style variety and cultural relevance for male consumers. Moreover, social media exposure and celebrity influence elevate style awareness, encouraging investment in curated wardrobes reflecting individual personality and lifestyle aspirations. This cultural shift extends fashion consciousness beyond traditional demographics, engaging consumers across age groups and socioeconomic segments previously less attentive to clothing choices. Men increasingly view fashion as self-expression rather than merely functional necessity, driving demand for diverse product categories spanning casual, formal, and athleisure segments. Enhanced interest in grooming and appearance maintenance creates complementary growth opportunities while establishing fashion-forward purchasing behaviors sustaining long-term market expansion.

Expansion of E-Commerce Infrastructure

Digital retail infrastructure development dramatically expands market accessibility while introducing convenience-focused shopping experiences attracting technology-comfortable consumers. Advanced platform capabilities enable seamless product discovery, detailed specifications review, and secure transaction processing eliminating traditional purchasing barriers effectively. Enhanced logistics networks ensure reliable delivery services meeting consumer expectations for speed and flexibility while simplified return policies reduce online purchasing hesitation. According to report, UK online sales rose 5.4% year-on-year in March 2025, with internet retail reaching 26.3% of total sales, highlighting growing e-commerce adoption and logistics importance. Furthermore, virtual fitting technologies and detailed sizing guides address fit concerns historically limiting online apparel purchases. Mobile optimization ensures purchasing accessibility through preferred devices while personalized recommendation algorithms surface relevant products efficiently, streamlining customer journeys and accelerating conversion rates across digital commerce platforms.

Premiumization and Quality Focus

Consumer preference shifts toward higher-quality garments offering enhanced durability, superior construction, and refined aesthetics drive premiumization trends benefiting established and emerging brands alike. Buyers increasingly recognize value propositions emphasizing longevity over disposability, supporting investment in well-crafted wardrobe essentials expected to withstand extended wear cycles. This quality consciousness encourages spending on premium fabrics, superior tailoring, and distinctive design elements differentiating products within competitive retail environments. Brand heritage and craftsmanship narratives resonate with discerning consumers seeking authentic connections with their clothing choices while elevated product positioning supports healthier margin structures across value chains. The premiumization trajectory aligns with sustainability values promoting reduced consumption through durable purchases.

Market Restraints:

What Challenges the UK Menswear Market is Facing?

Intense Price Competition

Aggressive pricing strategies across retail channels compress margins throughout the value chain, pressuring brand positioning and profitability. Discount-focused retail formats and promotional activities condition consumer expectations around reduced pricing, complicating efforts to maintain premium positioning. Fast-fashion alternatives offering trend-responsive products at accessible price points intensify competitive pressures while increasing consumer sensitivity to pricing differentials between comparable products.

Shifting Consumer Spending Priorities

Discretionary spending patterns fluctuate based on broader economic conditions, affecting non-essential purchase categories including fashion apparel. Consumer budget allocation increasingly prioritizes experiences, technology, and essential services potentially reducing clothing expenditure proportionally. Competing discretionary spending categories attract consumer attention and financial resources previously directed toward wardrobe enhancement and fashion consumption.

Seasonal Demand Variability

Inherent seasonality creates demand fluctuations requiring careful inventory management and merchandising strategies. Weather unpredictability affects seasonal product performance while timing mismatches between inventory positioning and actual weather conditions impact sell-through rates adversely. Extended seasons or unseasonable conditions disrupt purchasing patterns established around traditional retail calendars creating forecasting complexities.

Competitive Landscape:

The UK menswear market features a diverse competitive structure encompassing heritage fashion houses, contemporary lifestyle brands, and value-oriented retailers competing across distinct market segments. Established participants leverage brand recognition, retail network strength, and product development capabilities maintaining market positions while newer entrants differentiate through digital-native operations, sustainability credentials, and targeted demographic appeals. Competition intensifies around product innovation, customer experience enhancement, and omnichannel capability development as market participants pursue consumer engagement across evolving retail touchpoints. Strategic emphasis on direct-to-consumer models enables relationship building while wholesale partnerships extend distribution reach. Sustainability initiatives increasingly influence competitive positioning as environmental consciousness shapes consumer preferences, encouraging investments in responsible sourcing, transparent manufacturing, and circular business models differentiating brands within crowded retail landscapes.

Recent Developments:

- In October 2024, British menswear brand Represent announced the opening of its first UK flagship store in Manchester, marking a strategic shift from digital-first retail to omnichannel expansion. The 5,419 sq ft store will feature the performance line 247 by Represent, with a second UK site planned in Soho, London.

UK Menswear Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Trousers, Denims, Shirts and T-Shirts, Ethnic Wear, Others |

| Seasons Covered | Summer Wear, Winter Wear, All-Season Wear |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Exclusive Stores, Multi-Brand Retail Outlets, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK menswear market size was valued at USD 21,585.76 Million in 2025.

The UK menswear market is expected to grow at a compound annual growth rate of 4.65% from 2026-2034 to reach USD 32,485.23 Million by 2034.

Shirts and t-shirts dominated the market, fueled by their versatility for casual and semi-formal occasions, widespread consumer preference, and consistent demand across diverse age groups and fashion segments.

Key factors driving the UK menswear market include rising fashion consciousness among male consumers, expanding e-commerce infrastructure, growing preference for sustainable fashion, casualization of workplace attire, and premiumization trends emphasizing quality over quantity.

Major challenges include intense price competition compressing margins, shifting consumer spending priorities toward experiences and technology, seasonal demand variability affecting inventory management, evolving consumer expectations, and economic uncertainties influencing discretionary purchasing decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)