UK Mushroom Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, End-Use, and Region, 2025-2033

UK Mushroom Market Overview:

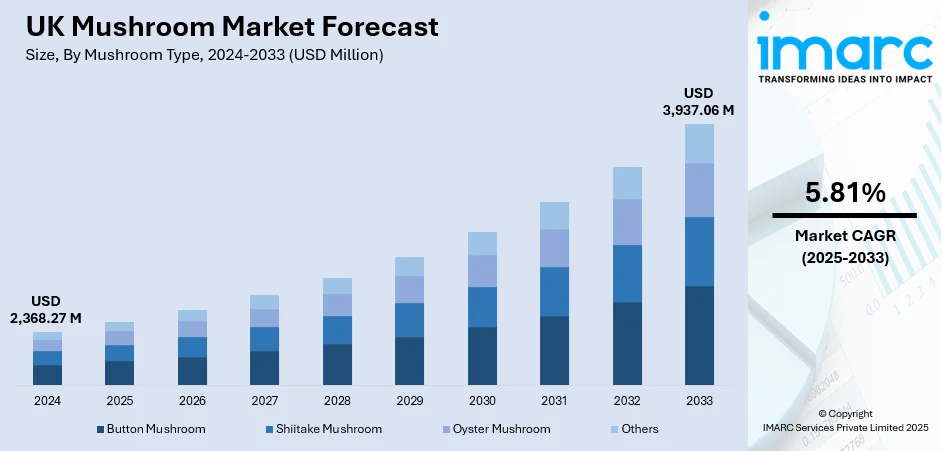

The UK mushroom market size reached USD 2,368.27 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,937.06 Million by 2033, exhibiting a growth rate (CAGR) of 5.81% during 2025-2033. The growing focus on sustainable production, eco-friendly methods, and responsible sourcing strengthens consumer trust in the mushroom market in UK. Furthermore, product innovation, convenient formats, improved packaging, and creative branding keep mushrooms relevant, attract new buyers, and contribute to the expansion of the UK mushroom market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,368.27 Million |

| Market Forecast in 2033 | USD 3,937.06 Million |

| Market Growth Rate 2025-2033 | 5.81% |

UK Mushroom Market Trends:

Sustainable Production and Environmental Responsibility

Commitment to sustainable practices continues to strengthen the UK mushroom market by aligning production with national climate goals and consumer expectations for environmentally responsible food. Producers adopt methods that reduce reliance on traditional, resource-intensive inputs, minimizing their environmental footprint. By shifting to peat-free substrates and alternative growing mediums, growers help protect valuable peatlands, which are critical carbon sinks, and support broader sustainability goals. These changes not only address regulatory and corporate sustainability commitments but also appeal to shoppers who prioritize eco-friendly sourcing when choosing fresh produce. Improvements in production standards often enhance product quality, offering mushrooms with better texture and shelf life, which further benefits both retailers and end consumers by reducing spoilage and waste. Retailers actively promote these greener products, using sustainability as a point of differentiation in a competitive fresh produce aisle. Additionally, sustainable production also opens opportunities for producers to collaborate with retailers on marketing initiatives that highlight local and low-impact supply chains, ensuring mushrooms remain relevant to modern buying habits focused on responsible consumption. This environmental alignment helps secure long-term market resilience and consumer loyalty. In 2024, Sainsbury’s became the first UK supermarket to launch peat-free mushrooms, reducing peat usage by 20,465 tons annually to support sustainability and Net Zero goals. These mushrooms were firmer, last longer, and available in over 200 stores.

To get more information on this market, Request Sample

Product Innovation and Value-Added Offerings

Product innovation is a crucial factor influencing the UK mushroom market growth by consistently broadening how mushrooms are delivered to consumers. Producers and brands acknowledge that conventional loose mushrooms alone cannot maintain long-term sales growth, leading them to invest in a variety of product formats that match evolving consumer habits. Fresh options like pre-sliced packs, marinated mushrooms, and ready-to-cook mushroom meal kits enhance convenience, catering to the increasing demand for quick, healthy meals among busy families and younger consumers. Improvements in packaging, such as resealable containers and extended shelf-life options, contribute to lowering household food waste, appealing to eco-aware consumers. Branding approaches are progressively incorporating recipe suggestions, partnerships with other fresh produce, and exclusive flavor profiles to foster repeat buying and enhance brand loyalty. A significant instance of this trend is the 2024 debut of Zooz, a soft drink made from mushrooms created by ex-personal trainer Daniel Soos. Aiming at the no-and-low alcohol market, Zooz blended Cordyceps and Lion’s Mane mushrooms with flavors akin to Italian bitters, containing only 26.25 calories per serving, being sugar-free, and marketed as an environmentally conscious option for health-oriented, sober, or curious drinkers. Such innovative products demonstrate how mushrooms are moving beyond traditional culinary uses, creating entirely new categories and consumption occasions that support market growth and attract diverse consumer segments.

UK Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, form, distribution channel, and end-use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

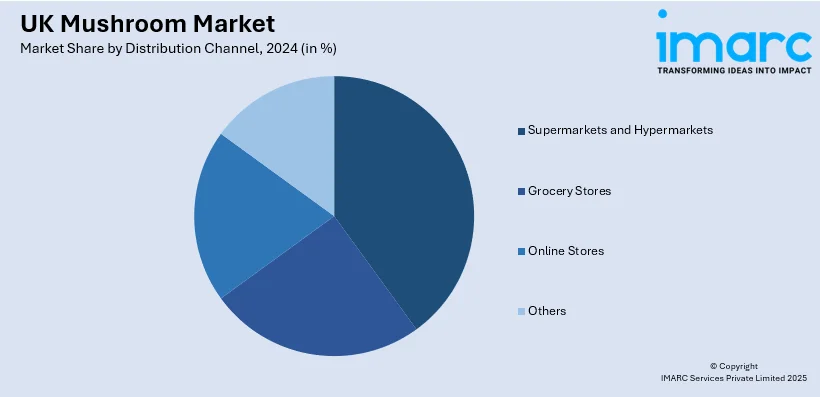

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End-Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end-use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Mushroom Market News:

- In April 2025, plant-based brand Happiee launched the UK’s first ready-to-cook Lion’s Mane mushroom product in Original and Teriyaki flavors. Aimed at providing a natural, meat-free alternative, it caters to the rising demand for less processed vegan options.

- In December 2024, Shropshire’s first mushroom cafe, Shrooma, opened in Oswestry, England, offering coffee alongside medicinal mushroom teas, powders, and fresh mushrooms grown onsite. Co-owners Paul and Alex Murray also provided educational tours of their 120 sq m mushroom-growing "fruiting room."

UK Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End-Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the UK mushroom market on the basis of mushroom type?

- What is the breakup of the UK mushroom market on the basis of form?

- What is the breakup of the UK mushroom market on the basis of distribution channel?

- What is the breakup of the UK mushroom market on the basis of end-use?

- What is the breakup of the UK mushroom market on the basis of region?

- What are the various stages in the value chain of the UK mushroom market?

- What are the key driving factors and challenges in the UK mushroom market?

- What is the structure of the UK mushroom market and who are the key players?

- What is the degree of competition in the UK mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)