UK Online Dating Market Size, Share, Trends and Forecast by Platform, Revenue Generation, and Region, 2026-2034

UK Online Dating Market Summary:

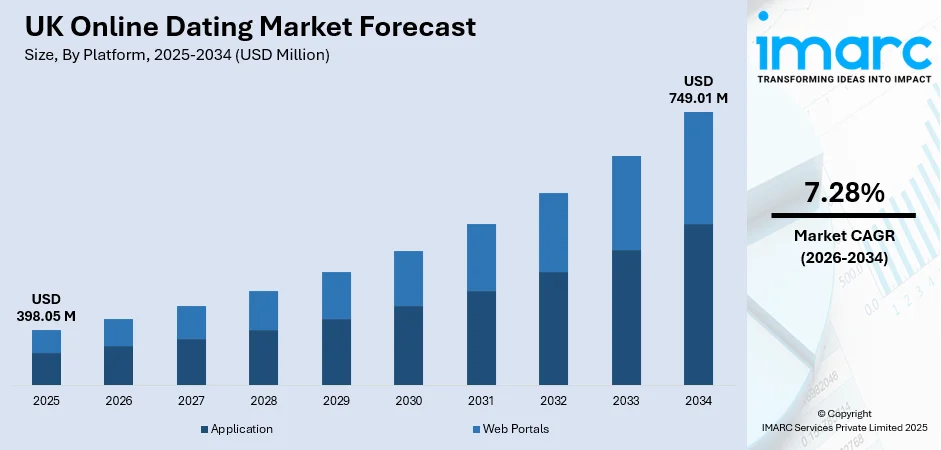

The UK online dating market size was valued at USD 398.05 Million in 2025 and is projected to reach USD 749.01 Million by 2034, growing at a compound annual growth rate of 7.28% from 2026-2034.

The UK online dating market is experiencing sustained expansion driven by rising smartphone penetration, widespread 5G network availability enabling enhanced video calling and real-time interactions, and evolving social attitudes toward digital matchmaking. The convergence of artificial intelligence integration for personalized matching, growing acceptance of virtual dating experiences, and diversification of niche platforms catering to specific demographics is reshaping competitive dynamics and creating substantial opportunities for UK online dating market share growth.

Key Takeaways and Insights:

- By Platform: Application dominates the market with a share of 70% in 2025, driven by the convenience of mobile access, gamified swiping features, and seamless integration with smartphone functionalities that enhance user engagement.

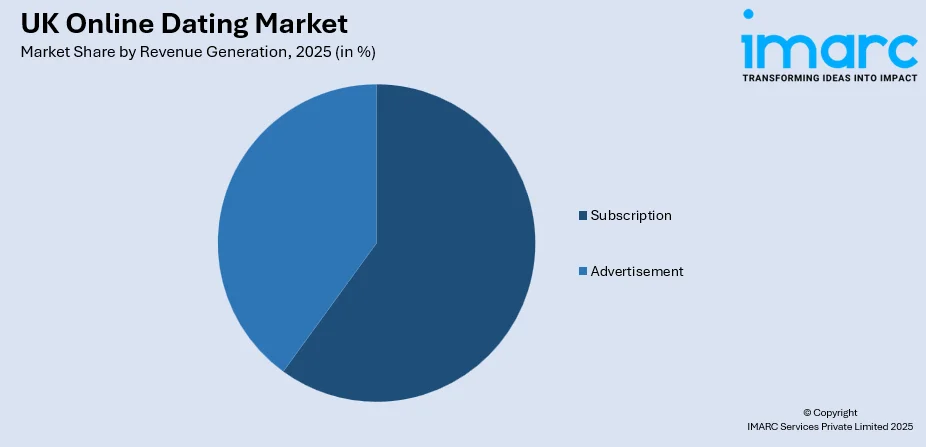

- By Revenue Generation: Subscription leads the market with a share of 62% in 2025, attributed to users seeking premium features including unlimited swipes, advanced matching algorithms, and enhanced profile visibility options.

- Key Players: The UK online dating market exhibits intense competitive dynamics with multinational platforms competing alongside niche regional services. Major operators leverage AI-powered matchmaking, safety verification systems, and subscription tiers while emerging players differentiate through specialized demographics, faith-based communities, and alternative relationship formats.

To get more information on this market, Request Sample

The UK market for online dating services represents one of the largest and most dynamic segments within the broader European digital services industry. According to the Office for National Statistics (ONS), 18.5 Million adults in England and Wales (36.8% of population aged 16+) have never been married or civil partnered in 2024, an increase from 15.8 Million (33.9%) in 2014, representing an expanding pool of potential dating service users. As internet penetration continues to exceed expectations and smartphone ownership becomes ubiquitous across demographic groups, the nation is experiencing a fundamental transformation in how individuals approach romantic connections. Cultural acceptance of digital matchmaking has reached unprecedented levels, with busy professionals, young adults, and increasingly mature demographics embracing technology-enabled relationship formation. The market benefits from sophisticated digital payment infrastructure, strong regulatory frameworks protecting user data, and a technologically literate population comfortable with subscription-based service models.

UK Online Dating Market Trends:

Rise of AI-Powered Matchmaking and Personalization

The UK online dating landscape is undergoing significant transformation through artificial intelligence integration. Major platforms are deploying advanced algorithms that analyze user behavior, communication patterns, and preference signals to deliver more compatible matches. A 2024 Match Group survey found that 26% of singles in the US and UK use AI to enhance their dating experience, representing a substantial year-over-year increase. Platforms are implementing AI-driven features including automated profile optimization suggestions, conversation coaching tools, and safety screening mechanisms that detect suspicious activity patterns.

Proliferation of Niche and Purpose-Driven Dating Platforms

The market is witnessing substantial growth in specialized dating platforms catering to specific communities, values, and relationship preferences. Faith-based services including Christian Connection and Muzmatch continue expanding their UK user bases, while LGBTQ+ platforms like Grindr and HER maintain strong engagement. Interest-based platforms such as Feeld for alternative relationship dynamics and Thursday, which focuses dating activity on a single weekly day, are gaining traction among users seeking differentiated experiences. This diversification reflects growing user demand for personalized environments that align with individual lifestyles and beliefs.

Virtual Dating and Video-First Interaction Features

Virtual dating has become a permanent feature of the UK online dating ecosystem, particularly among digitally native Gen Z and millennial users. Dating platforms have incorporated video profiles, virtual speed dating events, and in-app video calling as standard offerings. The widespread availability of 5G networks across the UK enables high-quality video interactions that reduce latency and improve streaming quality. This trend reflects changing user preferences toward pre-meeting virtual connections that allow assessment of chemistry and conversational compatibility before committing to in-person dates.

Market Outlook 2026-2034:

The UK online dating market demonstrates robust growth potential throughout the forecast period, supported by continued digital transformation of romantic relationship formation and evolving societal acceptance of app-based matchmaking. The market generated a revenue of USD 398.05 Million in 2025 and is projected to reach a revenue of USD 749.01 Million by 2034, growing at a compound annual growth rate of 7.28% from 2026-2034. Regulatory developments including the Digital Markets, Competition and Consumers Act 2024 and Online Safety Act 2023 are introducing enhanced consumer protections that may increase user trust and platform accountability.

UK Online Dating Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Platform | Application | 70% |

| Revenue Generation | Subscription | 62% |

Platform Insights:

- Application

- Web Portals

The application segment dominates the UK online dating market with a 70% share in 2025.

Mobile dating applications have become the predominant platform for UK singles seeking romantic connections, driven by smartphone ubiquity and the convenience of accessing dating services on-the-go. The gamified swiping interface pioneered by early platforms has evolved into sophisticated user experiences incorporating video profiles, audio prompts, and real-time messaging capabilities. According to Ofcom's Online Nation 2024 report, every age group spent significantly more time online via their smartphones than on other devices, with 18-24 year-olds averaging over 6 hours and 1 minute daily on mobile internet.

The application segment continues capturing market share from traditional web portals due to superior user engagement metrics and seamless integration with smartphone functionalities including location services, camera access for profile creation, and push notifications that maintain user activity. Dating applications benefit from app store visibility and social sharing features that facilitate organic user acquisition. The segment's growth is further accelerated by 5G network expansion, which enables bandwidth-intensive features such as video dating and live streaming events.

Revenue Generation Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Subscription

- Age

- 18-25 years

- 26-34 years

- 35-50 years

- Above 50 years

- Gender

- Male

- Female

- Type

- Annually

- Quarterly

- Monthly

- Age

- Advertisement

The subscription segment leads the UK online dating market with a 62% revenue share in 2025.

Subscription-based revenue models have emerged as the dominant monetization strategy within the UK online dating ecosystem, reflecting user willingness to pay for enhanced features that improve matching outcomes. Premium tiers typically offer unlimited profile views, advanced filtering options, visibility boosts, and access to features such as seeing who has liked one's profile. Major platforms have implemented tiered subscription structures with weekly, monthly, quarterly, and annual payment options catering to different commitment levels.

The subscription segment's dominance reflects a strategic industry shift toward recurring revenue models that provide predictable cash flows and encourage long-term user retention. Platforms including Tinder, Bumble, and Hinge have introduced progressively premium tiers with features designed to accelerate matching success. App Intelligence data from 2024 indicates that subscription pricing across major UK platforms has increased significantly, with operators implementing weekly subscription options that deliver higher per-user revenue despite lower initial commitment thresholds.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the largest regional market for online dating services in the UK, characterized by the highest concentration of young professionals, diverse multicultural demographics, and premium urban lifestyles that align with digital dating adoption patterns. The capital's fast-paced professional environment drives demand for convenient mobile-first dating solutions that accommodate busy schedules and enable connections across the metropolitan area's extensive geography.

The South East region constitutes a significant market segment driven by high population density, above-average disposable incomes, and strong digital infrastructure including extensive 5G coverage. The region's commuter population and proximity to London creates overlap with metropolitan dating pools while maintaining distinct local demand. Suburban and semi-rural areas within the South East benefit from improved mobile connectivity that enables dating app functionality comparable to urban centers.

The North West market anchored by Manchester and Liverpool demonstrates robust online dating adoption supported by thriving urban centers with vibrant nightlife cultures and substantial young adult populations. The region benefits from ongoing digital infrastructure investment and growing tech sector presence that correlates with dating app usage. Manchester's status as a major regional hub creates concentrated demand for premium dating services and niche platforms catering to specific communities.

The East of England region presents growing market opportunities driven by expanding urban centers, proximity to London creating commuter populations, and strong economic fundamentals supporting discretionary spending on dating services. The region's mix of university towns and technology corridors contributes to a demographic profile favorable for online dating adoption. Cambridge's concentration of educated professionals creates demand for platforms emphasizing intellectual compatibility and serious relationship intentions.

The South West region demonstrates steady market growth supported by tourism-driven population seasonality, substantial retiree demographics interested in companionship, and urban hubs including Bristol and Exeter with active young professional populations. The region's geographical dispersion creates particular utility for location-based dating applications that connect users across larger distances. Coastal and rural communities benefit from improving mobile connectivity that reduces historical barriers to digital dating participation.

Scotland represents a distinct regional market with concentrated demand in Edinburgh and Glasgow metropolitan areas alongside geographically dispersed populations in the Highlands and Islands. The region demonstrates strong engagement with both mainstream dating applications and niche platforms catering to specific cultural identities. Scottish users show preference for platforms facilitating genuine connections, aligning with regional dating cultures that emphasize authenticity over casual interactions.

The West Midlands region anchored by Birmingham demonstrates significant market potential driven by the UK's second-largest city's diverse demographics, substantial student populations, and ongoing urban regeneration attracting young professionals. The region's multicultural composition creates demand for faith-based and ethnicity-specific dating platforms alongside mainstream services. Birmingham's improving digital infrastructure and growing tech sector correlate with increasing online dating adoption rates across demographic segments.

Yorkshire and The Humber presents growing market opportunities centered on Leeds and Sheffield urban corridors with substantial university populations and expanding professional services sectors. The region demonstrates increasing digital engagement across demographic groups with particular growth among users seeking relationship-focused platforms over casual dating alternatives. Local dating events and hybrid online-offline experiences have gained traction in major urban centers seeking differentiated connection opportunities.

The East Midlands region demonstrates steady market development supported by growing urban centers including Nottingham and Leicester with diverse demographic profiles and strong student populations. The region has witnessed increasing romance fraud reports according to Action Fraud data, highlighting both market activity and associated risks requiring enhanced platform safety measures. Improving mobile network coverage across the region enables broader dating app accessibility in previously underserved areas.

Remaining UK regions including Wales, Northern Ireland, and smaller geographic segments collectively contribute to overall market growth with adoption patterns reflecting local demographic characteristics and infrastructure development. These regions demonstrate growing engagement with mainstream dating platforms while maintaining demand for locally-focused services that address specific community needs. Continued mobile network expansion and digital literacy improvements support market penetration in historically underserved areas.

Market Dynamics:

Growth Drivers:

Why is the UK Online Dating Market Growing?

Widespread 5G Network Deployment Enhancing User Experience

The extensive rollout of 5G mobile networks across the UK is fundamentally transforming online dating experiences by enabling bandwidth-intensive features that were previously impractical on older network generations. According to Ofcom statistics from 2024, approximately 92% of UK premises now receive 5G signals, providing the connectivity infrastructure necessary for high-quality video dating, live streaming events, and real-time interactive features. This network advancement enables smoother video calls, faster photo uploads, and reduced latency in messaging interactions that collectively enhance user satisfaction and platform engagement. The improved connectivity particularly benefits virtual dating features that have become permanent fixtures of the online dating landscape following their popularization during pandemic-era restrictions.

Integration of Artificial Intelligence for Enhanced Matchmaking

The integration of sophisticated artificial intelligence technologies is revolutionizing matchmaking capabilities within UK dating platforms, moving beyond simple preference filters toward behavioral analysis and emotional compatibility assessment. AI systems now analyze communication patterns, response times, and interaction styles to identify potentially compatible matches with higher success probability. Major platforms including Hinge have announced plans to deploy AI for smarter matchmaking, personalized algorithms, and dating coaching functionality. Bumble has implemented AI tools that blur explicit images and detect fake profiles, addressing safety concerns that previously deterred user adoption. A 2024 survey by Match Group found significant year-over-year increases in singles using AI to enhance their dating experience. This technological evolution addresses user frustration with overwhelming choice and low-quality matches that have historically contributed to dating app fatigue.

Shifting Social Norms and Increased Acceptance of Digital Dating

Evolving societal attitudes toward online dating have normalized digital matchmaking as a mainstream path to relationship formation, removing historical stigma that previously suppressed market growth. This cultural transformation extends across demographic segments, with substantial adoption growth among older adults seeking companionship alongside continued youth dominance of dating app usage. The normalization of online dating has encouraged platform operators to invest in marketing campaigns featuring authentic user experiences, further reinforcing social acceptability and driving new user acquisition across previously hesitant populations.

Market Restraints:

What Challenges the UK Online Dating Market is Facing?

User Fatigue and Declining Engagement with Traditional Swipe Mechanics

Growing dissatisfaction with repetitive swiping interfaces and superficial profile-based judgments is creating measurable fatigue that threatens platform retention rates. Many users now describe the constant scrolling and decision-making as mentally draining, especially when long sessions lead to limited connection outcomes. The gap between time spent and meaningful results is pushing people to reconsider how much effort they invest in traditional dating apps.

Privacy Concerns and Data Protection Regulatory Requirements

Heightened awareness of personal data collection practices and increasingly strict regulatory frameworks, including GDPR, create notable compliance challenges for dating platforms operating in the United Kingdom. Users are speaking more openly about worries around how intimate details and behavioral patterns are stored, processed, and used. These concerns often influence their willingness to remain active on platforms that handle sensitive information.

Fraudulent Profiles and Safety Trust Concerns

The persistence of fake profiles, romance scams, and catfishing behavior continues to weaken user trust and discourage adoption among safety-conscious individuals. Even with expanded verification tools, operators struggle to fully prevent deceptive accounts from resurfacing in new forms. This ongoing issue shapes public perception of online dating safety and limits confidence in the reliability of digital interactions.

Competitive Landscape:

The UK online dating market exhibits intense competitive dynamics characterized by the presence of multinational platform operators alongside emerging niche services and specialized dating applications. Match Group maintains significant market presence through its portfolio of brands including Tinder, Hinge, and OkCupid, with Hinge achieving market leadership in several European countries including the UK. Bumble Inc operates as a major competitor emphasizing female-first engagement models, while numerous independent platforms target specific demographics, religious communities, and relationship preferences. The competitive landscape is increasingly shaped by artificial intelligence capabilities, safety verification innovations, subscription pricing strategies, and the ability to deliver meaningful connection outcomes that differentiate premium services from free alternatives.

Recent Developments:

- In September 2025, Chapter 2 Dating Ltd, founded by Manchester entrepreneur Nicky Wake, acquired the M14 white-label dating and social app platform, securing ownership of the technology behind its portfolio of niche dating applications including Soberlove, Chapter 2 Dating, and Widows Fire.

UK Online Dating Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Application, Web Portals |

| Revenue Generation Covered |

|

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK online dating market size was valued at USD 398.05 Million in 2025.

The UK online dating market is expected to grow at a compound annual growth rate of 7.28% from 2026-2034 to reach USD 749.01 Million by 2034.

The application segment dominated the UK online dating market with a 70%, driven by mobile device ubiquity, gamified user interfaces, and seamless smartphone integration that enables location-based matching and real-time notifications.

Key factors driving the UK online dating market include widespread 5G network deployment enabling enhanced video dating features, integration of AI-powered matchmaking algorithms improving match quality, shifting social norms normalizing digital dating, and growing smartphone penetration across all demographic segments.

Major challenges include rising romance fraud losses, dating app fatigue among core user demographics, stringent data protection regulations imposing compliance costs, safety concerns deterring potential users, and declining engagement metrics among major platform operators.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)