UK Online Retail Market Size, Share, Trends and Forecast by Product Type, Device, Gender, Mode of Payment, and Region, 2026-2034

UK Online Retail Market Summary:

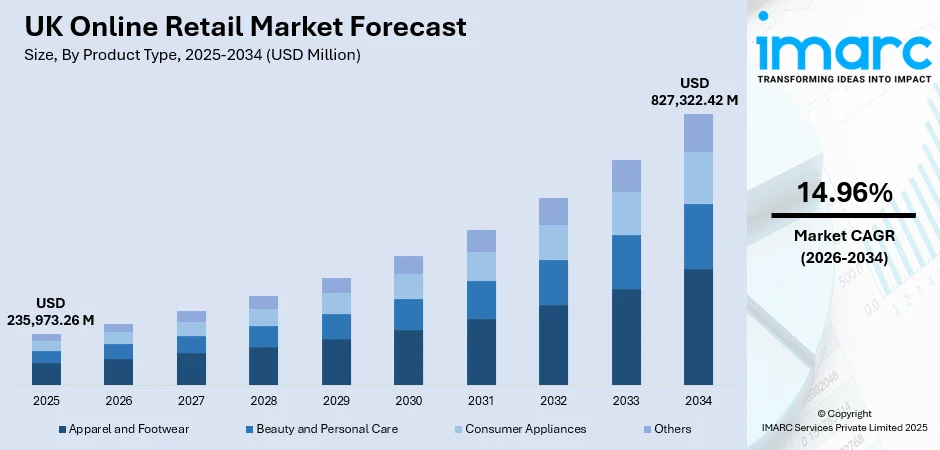

The UK online retail market size was valued at USD 235,973.26 Million in 2025 and is projected to reach USD 827,322.42 Million by 2034, growing at a compound annual growth rate of 14.96% from 2026-2034.

The market is driven by the widespread adoption of mobile commerce, increasing digital payment infrastructure, and evolving consumer preferences toward convenient shopping experiences. Rising smartphone penetration and improved internet connectivity across urban and rural regions are enabling seamless transactions. Additionally, the growing demand for diverse product categories, particularly apparel and lifestyle goods, is accelerating sector expansion. Enhanced logistics networks and same-day delivery services are further strengthening consumer confidence in digital purchasing channels, positioning the UK as a leading contributor to the global online retail market share.

Key Takeaways and Insights:

- By Product Type: Apparel and Footwear dominate the market with a share of 38% in 2025, driven by the extensive availability of fashion merchandise across digital platforms, strong consumer preference for online clothing purchases due to ease of comparison shopping, flexible return policies, and the proliferation of fashion-focused e-commerce platforms offering personalized style recommendations.

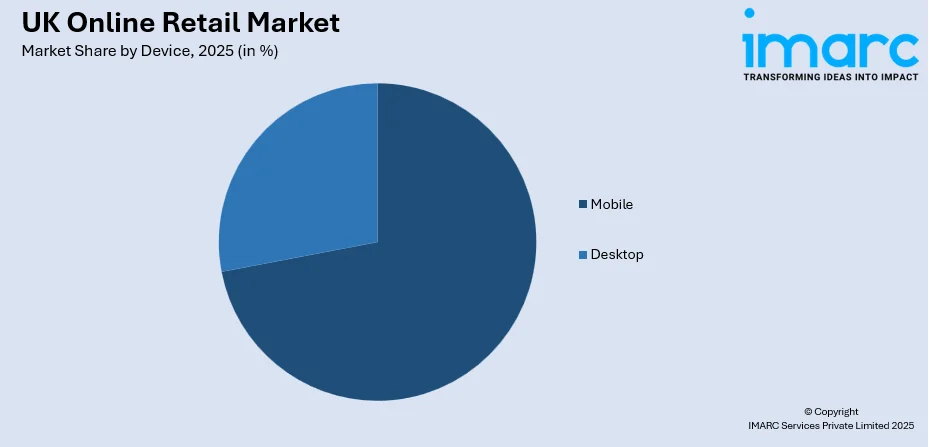

- By Device: Mobile leads the market with a share of 72% in 2025, owing to the widespread smartphone adoption across all demographics, superior mobile application experiences offered by leading retailers, one-click purchasing capabilities, and the convenience of shopping anytime and anywhere through optimized mobile interfaces and responsive website designs.

- By Mode of Payment: Debit+credit card dominates the market with a share of 53% in 2025, driven by established consumer trust in card-based transactions, widespread acceptance across all retail platforms, enhanced security features including fraud protection, and seamless integration with digital wallets enabling faster checkout experiences.

- Key Players: The market exhibits a dynamic competitive environment, with established multinational e-commerce corporations competing alongside traditional brick-and-mortar retailers expanding their digital presence. Market participants are differentiating through enhanced delivery options, loyalty programs, and personalized shopping experiences across diverse product categories.

To get more information on this market Request Sample

The UK online retail market represents one of the most sophisticated digital commerce ecosystems globally, characterized by advanced technological infrastructure and highly engaged consumers. The proliferation of high-speed internet connectivity and widespread smartphone penetration has fundamentally transformed purchasing behaviors, enabling seamless transactions across diverse product categories. According to sources, in November 2025, the UK ecommerce market reached £286 billion, reflecting robust digital adoption, with nearly 62.1 Million online shoppers and mobile commerce accounting for 70% of transactions. Moreover, increasing consumer confidence in digital payment systems has accelerated the shift from traditional retail channels toward online platforms. The market benefits from a well-established logistics network that enables efficient last-mile delivery solutions, meeting consumer expectations for rapid fulfillment. Additionally, the growing emphasis on personalized shopping experiences through artificial intelligence and machine learning technologies is reshaping customer engagement strategies. Sustainability considerations are increasingly influencing purchasing decisions, with consumers prioritizing eco-friendly products and retailers implementing green delivery initiatives to meet evolving environmental expectations across the nation.

UK Online Retail Market Trends:

Expansion of Social Commerce Integration

The convergence of social media platforms and e-commerce functionality is reshaping how consumers discover and purchase products online. Retailers are increasingly leveraging interactive content, influencer partnerships, and shoppable posts to engage audiences directly within their preferred social environments. This trend enables seamless purchasing journeys without requiring users to navigate away from entertainment platforms. Live shopping events and interactive product demonstrations are gaining momentum, creating immersive experiences that replicate in-store consultations. The integration of user-generated content and peer reviews within social commerce ecosystems is building trust and authenticity, particularly among younger demographic segments seeking genuine product recommendations. According to reports, in December 2025, Unbox and Retail Economics reported that UK annual non-food social commerce sales are expected to reach £9.1 billion, driven by Gen Z’s growing reliance on creators and social platforms for purchases.

Advancement of Personalization Technologies

Retailers are deploying sophisticated artificial intelligence and machine learning algorithms to deliver highly customized shopping experiences tailored to individual preferences and browsing behaviors. These technologies analyze purchase history, demographic information, and real-time interactions to generate relevant product recommendations and personalized marketing communications. Virtual try-on features utilizing augmented reality are enabling consumers to visualize products before purchasing, reducing uncertainty and return rates. In June 2025, DHL Ecommerce reported that 60% of UK shoppers expect AI-driven tools, with 77% prioritizing virtual try-ons, 76% AI shopping assistants, and 72% voice-enabled product search. Furthermore, dynamic pricing strategies and targeted promotions based on customer segmentation are optimizing conversion rates while enhancing consumer satisfaction. The evolution toward hyper-personalization is creating differentiated value propositions that strengthen brand loyalty and drive repeat purchases.

Rise of Sustainable and Ethical Commerce

Environmental consciousness is increasingly influencing consumer purchasing decisions, driving demand for sustainable products and eco-friendly retail practices. Retailers are responding by implementing carbon-neutral delivery options, recyclable packaging solutions, and transparent supply chain communications. For instance, in November 2025, fifty-five founding organisations, including ASDA, Tesco, and Lidl, joined the UK Packaging Pact, committing to sustainable, recyclable, and reusable packaging ahead of its April 2026 launch. Moreover, the growing preference for ethically sourced merchandise and locally produced goods reflects shifting consumer values toward responsible consumption. Circular economy initiatives including resale platforms, rental services, and product refurbishment programs are gaining traction as alternatives to traditional ownership models. This sustainability-focused transformation is compelling retailers to reassess their operational practices while presenting opportunities for brands demonstrating genuine environmental commitment.

Market Outlook 2026-2034:

The UK online retail market is positioned for substantial expansion throughout the forecast period, with revenue projected to demonstrate robust growth driven by continued digital transformation across the retail sector. The integration of emerging technologies including artificial intelligence (AI), augmented reality (AR), and voice commerce will create enhanced shopping experiences that further accelerate online adoption. Investments in logistics infrastructure and fulfillment capabilities will enable faster and more reliable delivery services, strengthening consumer confidence in digital channels. The market revenue trajectory reflects sustained consumer migration toward online platforms across all product categories and demographic segments. The market generated a revenue of USD 2,35,973.26 Million in 2025 and is projected to reach a revenue of USD 827,322.42 Million by 2034, growing at a compound annual growth rate of 14.96% from 2026-2034.

UK Online Retail Market Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Apparel and Footwear | 38% |

| Device | Mobile | 72% |

| Mode of Payment | Debit+Credit Card | 53% |

Product Type Insights:

- Apparel and Footwear

- Beauty and Personal Care

- Consumer Appliances

- Others

The apparel and footwear dominate with a market share of 38% of the total UK online retail market in 2025.

The apparel and footwear category maintains its position as the dominant product segment within the UK online retail market, reflecting strong consumer preference for fashion merchandise across digital channels. This segment benefits from extensive product variety, competitive pricing, and the convenience of browsing multiple brands within unified platforms. Advanced sizing technologies and virtual fitting tools are addressing historical barriers related to fit uncertainty, enhancing purchase confidence among online shoppers. The seasonal nature of fashion consumption drives consistent engagement throughout the year, with promotional events generating significant transaction volumes. According to sources, in December 2025, UK online shoppers spent £3.8 billion over the Black Friday–Cyber Monday period, a 4.6% increase from 2024, with apparel among the top-selling categories.

Fashion retailers have cultivated sophisticated digital experiences that replicate and enhance traditional shopping journeys through high-quality imagery, detailed product descriptions, and customer reviews. The integration of social proof elements and influencer collaborations strengthens consumer trust and purchase intent across diverse style categories. Flexible return policies and free shipping thresholds have reduced perceived risks associated with online apparel purchases. The democratization of fashion through accessible pricing tiers enables broad market participation while premium segments cater to discerning consumers seeking exclusive merchandise.

Device Insights:

Access the comprehensive market breakdown Request Sample

- Desktop

- Mobile

The mobile leads with a share of 72% of the total UK online retail market in 2025.

Mobile devices have emerged as the predominant platform for online retail transactions, reflecting fundamental shifts in consumer digital behavior and the optimization of shopping experiences for smaller screens. The ubiquity of smartphones enables convenient browsing and purchasing opportunities during commutes, leisure time, and throughout daily routines. Retailers have invested substantially in developing intuitive mobile applications featuring streamlined navigation, secure payment integration, and personalized content delivery optimized for touch interfaces.

The mobile commerce ecosystem benefits from integration with device-native functionalities including biometric authentication, location services, and push notifications that enhance engagement and security. One-click purchasing capabilities and saved payment credentials minimize friction during checkout, improving conversion rates compared to desktop experiences. The proliferation of mobile payment solutions and digital wallets has accelerated adoption among consumers seeking seamless transaction experiences. In October 2025, UK Finance reported that 57% of UK adults used mobile wallets in 2024, with cash accounting for under 10% of all payments as digital transactions continued rising. Additionally, progressive web applications and responsive design standards ensure consistent functionality across diverse device specifications and operating systems.

Gender Insights:

- Male

- Female

Male consumers represent a significant segment within the UK online retail market, demonstrating strong engagement with electronics, technology products, sports equipment, and gaming merchandise. This demographic exhibit preference for efficient, straightforward purchasing experiences with minimal browsing time. Mobile commerce adoption is particularly pronounced among younger male shoppers seeking convenience and competitive pricing. Brand loyalty and product specifications heavily influence purchasing decisions across key categories.

Female consumers constitute the dominant demographic segment within UK online retail, driving substantial transaction volumes across apparel, beauty, personal care, and home décor categories. This segment demonstrates higher browsing engagement, comparison shopping behaviors, and responsiveness to personalized recommendations. Social commerce and influencer-driven product discovery significantly impact purchasing decisions. Female shoppers exhibit strong preference for flexible return policies, detailed product reviews, and loyalty reward programs when selecting retail platforms.

Mode of Payment Insights:

- Debit+Credit Card

- Net Banking and M-Wallets

- Cash on Delivery

The debit+credit card dominates with a market share of 53% of the total UK online retail market in 2025.

Debit+credit card payment methods maintain their leadership position within the UK online retail payment landscape, benefiting from established consumer familiarity, universal merchant acceptance, and robust security infrastructure. According to reports, in April 2025, UK Finance reported that UK debit and credit cards registered over £1 trillion in transactions during 2024, supported by 31.4 billion payments and rising contactless usage. Moreover, debit and credit cards offer transaction protection mechanisms including chargeback rights and fraud monitoring that provide consumers with confidence when purchasing from unfamiliar retailers. The integration of tokenization technologies and secure payment gateways has strengthened data protection standards across e-commerce platforms.

Financial institutions continue enhancing card functionality through contactless capabilities, virtual card numbers for online transactions, and real-time transaction notifications that improve security awareness. Reward programs and cashback incentives associated with card usage encourage continued adoption despite emerging alternative payment methods. The seamless integration of card credentials within digital wallets and one-click checkout systems maintains relevance within evolving payment ecosystems. Regulatory frameworks including Strong Customer Authentication requirements have reinforced security standards while maintaining transaction convenience for verified users.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents the largest regional market for online retail, benefiting from exceptional digital infrastructure, high population density, and substantial disposable income levels. The capital's diverse demographics and cosmopolitan consumer preferences drive demand across all product categories. Advanced logistics networks enable rapid fulfillment, while concentrated retail innovation hubs foster competitive e-commerce development. In December 2025, Tesco announced plans for a green high-tech distribution hub at London Gateway, partnering with Witron to enhance supply chain efficiency and support growing online retail demand.

The South East region demonstrates strong online retail adoption supported by affluent suburban populations and excellent connectivity infrastructure. High smartphone penetration and digital literacy rates among residents contribute to elevated transaction volumes. The region benefits from proximity to major distribution centers enabling efficient delivery services across residential and commercial areas.

The North West exhibits dynamic online retail growth driven by major urban centers and evolving digital consumption patterns among diverse population segments. Improving internet infrastructure across metropolitan and surrounding areas is expanding market accessibility. The region demonstrates strong engagement with fashion and lifestyle categories alongside growing demand for convenience-oriented purchasing solutions.

The East of England represents a significant regional market characterized by mixed urban and rural demographics requiring diverse fulfillment strategies. Growing digital adoption among suburban populations supports consistent market expansion. The region benefits from strategic logistics positioning enabling efficient distribution from major warehouse facilities serving broader national networks.

The South West demonstrates distinctive online retail characteristics shaped by dispersed population distribution and tourism-influenced consumption patterns. Digital commerce provides essential access to diverse product ranges for communities distant from traditional retail centers. The region shows strong engagement with lifestyle, outdoor, and home improvement categories reflecting regional consumer interests.

Scotland exhibits robust online retail adoption driven by improving digital infrastructure and consumer preference for convenient access to diverse merchandise. Geographic considerations make e-commerce particularly valuable for remote communities seeking product variety. The region demonstrates strong loyalty to retailers offering reliable delivery services across challenging logistical environments.

The West Midlands represents a substantial regional market anchored by major urban populations and evolving digital commerce behaviors. The region benefits from central geographic positioning supporting efficient distribution network connectivity. Growing consumer confidence in online purchasing drives expansion across diverse product categories including fashion, electronics, and household goods.

Yorkshire and The Humber demonstrates growing online retail engagement supported by digital infrastructure development across urban and rural communities. The region exhibits strong value-consciousness driving demand for competitive pricing and promotional offerings. Improving logistics coverage is enhancing delivery reliability and expanding accessible product ranges for regional consumers.

The East Midlands represents an emerging online retail market benefiting from substantial logistics infrastructure supporting national distribution operations. Regional consumers demonstrate increasing digital commerce adoption across diverse product categories. The area's strategic positioning within supply chain networks enables efficient fulfillment and competitive delivery timeframes.

Other regions collectively contribute meaningful transaction volumes reflecting nationwide digital commerce penetration across diverse geographic and demographic contexts. Continued infrastructure investment and expanding delivery networks are enabling broader market accessibility. These areas demonstrate growth potential as digital adoption accelerates among previously underserved populations.

Market Dynamics:

Growth Drivers:

Why is the UK Online Retail Market Growing?

Accelerating Digital Payment Infrastructure Development

The continuous advancement of digital payment ecosystems is significantly strengthening the UK online retail market by enhancing transaction security, speed, and convenience. Financial technology innovations have introduced diverse payment options catering to varied consumer preferences, from traditional card transactions to emerging buy-now-pay-later solutions. According to sources, in April 2025, Barclays partnered with Brookfield to transform its UK payment acceptance business, enhancing digital payment infrastructure and supporting billions of pounds in transactions for merchants and corporate clients. The regulatory environment supporting open banking has enabled seamless integration between financial institutions and retail platforms, facilitating frictionless checkout experiences. Enhanced authentication mechanisms including biometric verification provide consumers with confidence when conducting online transactions while satisfying regulatory security requirements. The proliferation of digital wallets and contactless payment technologies has normalized electronic transactions across demographic segments previously hesitant about online purchasing. These payment infrastructure developments collectively reduce barriers to online commerce adoption while improving merchant conversion rates.

Expansion of Logistics and Fulfillment Capabilities

Substantial investments in logistics infrastructure and last-mile delivery networks are fundamentally transforming online retail accessibility and consumer expectations throughout the United Kingdom. The development of strategically positioned fulfillment centers enables rapid order processing and reduced delivery timeframes across urban and rural geographies. In 2025, Amazon opened a new state-of-the-art fulfilment centre in Hull as part of its £40 billion UK investment plan, enhancing nationwide logistics and accelerating online retail delivery capabilities. Innovations in route optimization and delivery scheduling are enhancing operational efficiency while providing consumers with flexible receipt options matching their preferences. The emergence of alternative delivery solutions including locker networks, click-and-collect services, and same-day options expands convenience offerings beyond traditional home delivery models. Partnerships between retailers and logistics providers are creating differentiated service propositions that strengthen competitive positioning. These fulfillment capabilities establish online retail as genuinely convenient alternatives to physical shopping journeys.

Growing Consumer Preference for Convenience and Choice

Evolving lifestyle patterns and time constraints are driving sustained consumer migration toward online retail channels offering superior convenience and extensive product selection. Digital platforms provide access to merchandise ranges exceeding traditional retail limitations, enabling consumers to discover products unavailable in local markets. In September 2025, Ocado revealed its AIpowered “Smart Platform” optimises supplychain and warehouse operations across UK online grocery, boosting order accuracy and accelerating fulfilment for digital shoppers. The ability to compare prices, read reviews, and research purchases before committing appeals to informed consumers seeking optimal value. Subscription services and automated replenishment programs address routine purchasing needs while freeing consumer attention for other priorities. The integration of customer service channels including live chat and video consultation replicates personalized assistance traditionally associated with physical retail environments. These convenience-oriented value propositions are establishing online retail as the preferred channel for increasing transaction categories.

Market Restraints:

What Challenges the UK Online Retail Market is Facing?

Cybersecurity and Data Privacy Concerns

Consumer apprehension regarding data security and privacy protection continues presenting challenges for online retail adoption and trust development. High-profile data breaches and fraud incidents receive substantial media coverage, influencing consumer risk perceptions regarding digital transactions. Retailers must invest significantly in security infrastructure and compliance measures while communicating protection commitments effectively to concerned audiences. Balancing personalization capabilities with privacy expectations requires sophisticated data governance frameworks.

Delivery Logistics and Environmental Impact

The environmental footprint associated with e-commerce logistics and packaging presents growing concerns among sustainability-conscious consumers. Failed delivery attempts and the carbon emissions from transportation networks contribute to environmental criticisms of online retail models. Retailers face pressure to develop greener fulfillment solutions while maintaining service levels and cost competitiveness. Packaging waste reduction requirements add operational complexity and expense to distribution processes.

Product Experience Limitations in Digital Environments

Certain product categories remain challenging for online retail due to consumer preferences for physical evaluation before purchasing. The inability to touch, try, or directly assess merchandise creates uncertainty that inhibits conversion for specific product types. Returns processing associated with expectation mismatches adds operational costs and environmental impact to online retail models. Technological solutions including augmented reality partially address these limitations but cannot fully replicate physical product interactions.

Competitive Landscape:

The UK online retail market features a sophisticated competitive environment characterized by diverse participant categories pursuing differentiated strategic approaches. Established e-commerce platforms leverage extensive product catalogs, advanced logistics networks, and loyalty programs to maintain market leadership positions. Traditional retailers with omnichannel capabilities compete through integrated shopping experiences connecting digital and physical touchpoints. Pure-play specialists differentiate through category expertise, curated selections, and personalized service propositions targeting specific consumer segments. Competition intensifies around delivery speed, pricing transparency, and customer experience quality as consumers exhibit decreasing tolerance for service deficiencies. Technology investments in artificial intelligence, personalization engines, and mobile optimization represent critical competitive factors. The market demonstrates consolidation tendencies as larger participants acquire innovative capabilities while maintaining competitive pricing.

Recent Developments:

- In September 2025, Boots partnered with Deliveroo and UberEats to expand on-demand deliveries across nearly 500 UK stores, offering over 10,000 health and beauty products. Customers can now receive urgent healthcare items, beauty products, or last-minute gifts in as little as 30 minutes, reflecting growing demand for convenience.

- In May 2025, China’s largest retailer JD.com launched its online supermarket Joybuy in London, UK, offering furniture, food, big-name brands, and unique imported items. The platform emphasizes same- or next-day delivery, catering to UK consumers’ growing preference for convenience and extensive product choice across categories.

UK Online Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Apparel and Footwear, Beauty and Personal Care, Consumer Appliances, Others |

| Devices Covered | Desktop, Mobile |

| Genders Covered | Male, Female |

| Mode of Payments Covered | Debit+Credit Card, Net Banking and M-Wallets, Cash on Delivery |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK online retail market size was valued at USD 235,973.26 Million in 2025.

The UK online retail market is expected to grow at a compound annual growth rate of 14.96% from 2026-2034 to reach USD 827,322.42 Million by 2034.

Apparel and footwear dominated the market with the largest revenue share, driven by extensive product variety, competitive pricing, established consumer preference for online fashion purchasing, and advanced virtual fitting technologies.

Key factors driving the UK online retail market include expanding mobile commerce adoption, advancing digital payment infrastructure, improving logistics capabilities, growing consumer preference for convenience, and increasing smartphone penetration across demographics.

Major challenges include cybersecurity and data privacy concerns, environmental sustainability pressures related to delivery logistics and packaging, product experience limitations in digital environments, delivery reliability expectations, and intense price competition affecting margins.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)