UK Pet Care Market Size, Share, Trends and Forecast by Product Type, Pet Type, Distribution Channel, and Region, 2025-2033

UK pet care Market Size and Share:

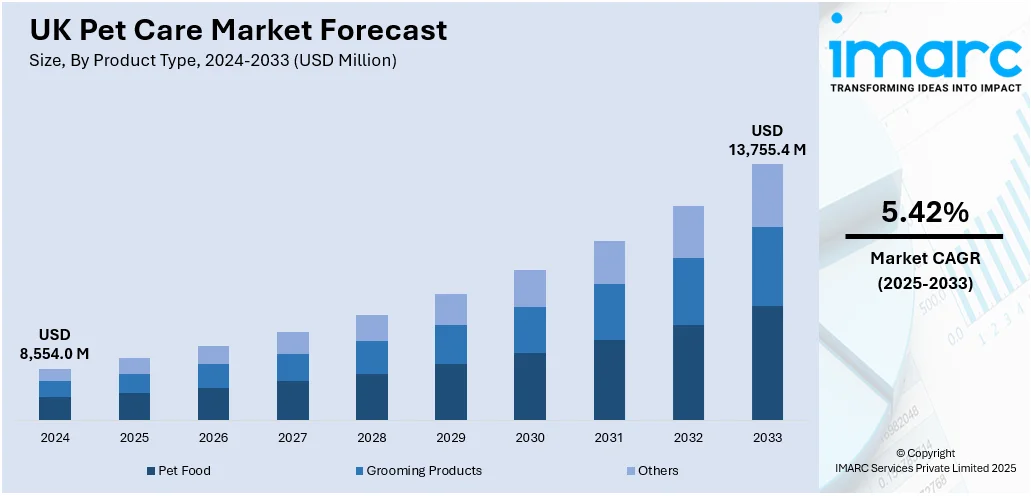

The UK pet care market size was valued at USD 8,553.95 Million in 2024. Looking forward, the market is projected to reach USD 13,755.42 Million by 2033, exhibiting a CAGR of 5.42% from 2025-2033. The market is expanding steadily, supported by increasing number of pet owners, higher expenditures on high-quality pet food, and a rising interest in health, grooming, and wellness products. The market is further driven by the humanization of pets and the availability of innovative, specialized products. E-commerce platforms are also boosting accessibility and variety, enhancing consumer reach in the UK pet care market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,553.95 Million |

| Market Forecast in 2033 | USD 13,755.42 Million |

| Market Growth Rate 2025-2033 | 5.42% |

The UK pet care market is driven by several factors including lifestyle changes, increased disposable incomes, and the emotional connection people have with their pets. There is a growing recognition of the importance of pet health and nutrition leading to higher demand for specialized diets, supplements, and veterinary care. For instance, in May 2025, VETIQ launched two new supplement chews for dogs: Joint Care and Serene Calming. These scientifically formulated chews support joint health and alleviate anxiety featuring natural ingredients like Green Lipped Mussel and Tryptophan. Designed for palatability they cater to the growing demand for effective preventative pet health solutions. Additionally, urban living and smaller home environments are prompting the purchase of compact pet products and indoor care solutions. Seasonal and holiday spending on pet accessories, toys, and treats also contributes to the UK pet care market growth, reflecting the changing role of pets within families.

Further expansion of the UK pet care market is bolstered by the ongoing diversification of products and services. Innovations range from eco-friendly grooming supplies to advanced tracking devices, addressing various consumer preferences. For instance, in March 2024, Nutravet launched a new range of veterinary strength grooming products under the brand Pet’s Choice at Crufts 2024. The products include shampoo, wipes, deodorizing spray, and conditioner, designed to nourish and soothe pet skin and coat health. Formulated with Aloe Vera and Oatmeal, they are vegan and hypoallergenic. An increasing interest in pet insurance, daycare, and training services demonstrates the market’s broadening scope. Enhanced availability through supermarkets, specialty pet shops, and online channels ensures a wider distribution. Marketing strategies that emphasize personalized experiences and customer loyalty programs are also key factors in maintaining the market's momentum.

UK Pet Care Market Trends:

Increasing Pet Ownership

The increasing pet ownership in the United Kingdom is one of the major factors driving the expansion of the UK pet care market size in 2024. The number of pets in the country increased by 9% between 2022 and 2023. An industry survey revealed that 57% of UK households have pets. According to UK Pet Food, 17.2 million households about 60%, own one of the UK’s 36 million pets, reflecting a strong and growing pet culture. Along with this, the heightened pet ownership is creating a greater need for a variety of pet care items, including pet food and grooming services. For example, pet owners spend £1.2 Billion per year on pet grooming items and approximately £500 on pet treats. Furthermore, individuals and families regard pets as essential members of the home, resulting in long-term investments in their health and well-being, which are reflected in pet industry statistics UK.

To get more information on this market, Request Sample

Growing Focus on Pet Health and Wellness

There is a growing focus on pet health and wellness, which is boosting the pet care market in the UK. Moreover, the rising consciousness among pet owners of their pets' nutrition, exercise, and overall well-being is fueling the market growth. In line with this, the increasing demand for products such as organic pet food, supplements, and fitness-related pet accessories is accelerating the market expansion. Furthermore, veterinary services are evolving to offer advanced treatments and preventive care, contributing to the market growth. It has been found that pet owners spend a total of nearly £5 Billion a year in veterinary bills for their pets. Besides this, the increasing availability of pet insurance in the UK, specifically within the UK pet insurance distribution market, is supporting this trend, as pet insurance pays out £1 Billion a year in the country. This enables pet owners to afford a wider range of treatments, further creating a positive UK pet care market outlook.

Rapid Technological Advancements

The introduction of smart feeders, global positioning system (GPS) trackers, and innovative products that make pet care easier and more convenient for owners is boosting the growth of the UK home and pet care market. Automated feeders allow pet owners to monitor and manage their pets' feeding schedules remotely. These devices can be connected to smartphones, enabling owners to control portions, set feeding times, and track their pets' eating habits in real time. Additionally, GPS-enabled pet trackers help owners monitor the location and activity levels of their pets. These devices offer peace of mind to owners who worry about their pets wandering off while also encouraging more active lifestyles for animals. Moreover, the rise of pet-related apps for booking grooming services or virtual vet consultations is fostering the market growth. Additionally, the increasing utilization of e-commerce platforms by owners in the country to access a wider variety of products is contributing to the UK pet care market demand.

E-commerce Growth

The UK pet care market is experiencing significant growth in e-commerce, as more pet owners shift toward online shopping for convenience and better prices. Specialized platforms are leading this trend, offering a wide range of pet products, from food to grooming tools. According to recent surveys, 58% of pet owners now prefer shopping online, which has led to increased competition and innovation among pet care retailers. A recent report highlights that 30.7% of all retail spending in the UK will be conducted online by 2025, indicating further potential for pet-related digital retail. E-commerce allows businesses to reach a broader audience, providing convenience and access to niche products. This shift has also enabled retailers to offer personalized services, such as subscription boxes for pet food and accessories. As consumer preference continues to tilt toward online shopping, the UK pet care market trends in 2025 suggest the e-commerce sector will keep expanding.

Cat vs. Dog

In the UK, cats are the largest revenue-generating pet type, contributing significantly to the pet food market UK. Despite this, dogs continue to hold a significant place in the sector. Cats, with their lower maintenance needs and popularity as indoor pets, drive demand for a variety of products, including food, litter, and toys. However, dogs, known for their higher grooming and care requirements, also represent a lucrative segment of the market. In 2024, the UK is home to approximately 13.5 million dogs and 12.5 million cats, an increase of 1.5 million for each species, according to UK Pet Food. The growing trend of pet humanization, where pets are treated like family members, has increased spending on both cats and dogs. The distinct needs of each pet type have spurred product innovation tailored specifically for cats and dogs, fueling their respective market growths.

Premiumization and Specialty Products

As pet ownership in the UK continues to rise, there is an increasing demand for premium products, particularly in pet food, grooming supplies, and accessories. Consumers are increasingly willing to spend more on high-quality, specialized products that meet their pets' specific health and wellness needs. For instance, British pet owners spend around USD 650 annually on pet treats. Premium pet food options, such as organic, raw, and grain-free diets, are gaining popularity as pet owners seek healthier, more nutritious meals for their animals. Alongside this, luxury grooming products and accessories, including specialized shampoos, collars, and pet wearables, are also seeing a surge in demand. This premiumization trend reflects a growing awareness of pet health, with owners treating their pets to the same level of care they would expect for themselves. This UK pet care market trend is expected to significantly impact the United Kingdom pet grooming market in the coming years.

UK Pet Care Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the UK pet care market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on product type, pet type, and distribution channel.

Analysis by Product Type:

- Pet Food

- Dry

- Wet

- Grooming Products

- Shampoos and Conditioners

- Combs and Brushes

- Clippers and Scissors

- Others

- Others

Pet food stands as the largest category in the UK pet care market, essential for ensuring pets' health and well-being. Growing awareness of balanced nutrition has led to an increased demand for high-quality dry and wet food options, with many pet owners choosing premium, organic, and grain-free varieties. This segment benefits from ongoing innovation, including customized diets tailored for specific breeds, ages, and health conditions. Packaging that emphasizes convenience and portion control is also attractive to busy pet owners. Furthermore, marketing initiatives that focus on natural ingredients and their functional benefits have reinforced consumer preferences, establishing pet food as the primary revenue source in the market.

Analysis by Pet Type:

- Dog

- Cat

- Others

Dog leads the market with 36.5% of market share in 2024. This dominance is driven by widespread dog ownership, a strong emotional bond between owners and their pets, and the increasing availability of specialized products designed for dogs. There is a high demand for premium food, health supplements, grooming supplies, and accessories, fueled by trends in pet humanization and wellness. Services like veterinary care, training, and daycare also contribute to the growth of this segment. According to UK pet care market forecast, marketing efforts and product innovations aimed at dog owners will continue to enhance the position of this segment within the overall market.

Analysis by Distribution Channel:

- Offline

- Online

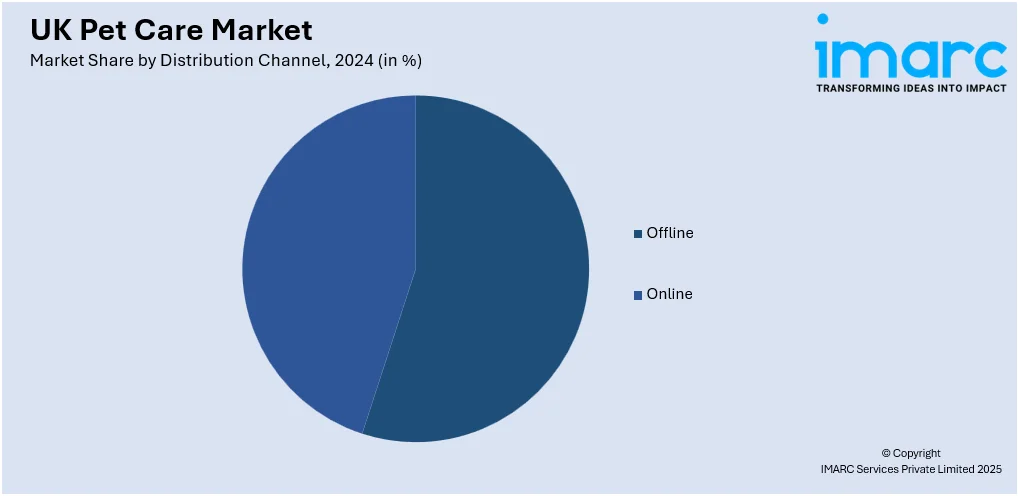

Offline leads the market with around 72.8% of market share in 2024. Physical retail outlets such as pet specialty stores, supermarkets, and veterinary clinics are preferred by consumers for the trust, variety, and personalized service they provide. Shoppers appreciate the opportunity to physically inspect products, seek expert advice, and enjoy immediate availability. Promotional strategies, in-store discounts, and bundled deals further engage customers in offline environments. Additionally, the integration of grooming salons, veterinary services, and pet accessory stores within these retail spaces adds to convenience, making offline channels a vital and reliable choice for pet owners throughout the UK.

Regional Analysis:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London holds a significant portion of the UK pet care market, backed by high levels of pet ownership in urban homes and a strong demand for premium offerings. The city's affluent consumers drive expenditure on luxury pet food, grooming, and accessories. The increasing use of online delivery services and boutique pet care shops further boosts market growth in the area.

The South East plays a vital role in the UK pet care market, benefiting from a considerable population and high disposable incomes. Pet owners in this region prefer high-quality nutrition, grooming services, and veterinary care. The well-established retail networks and the presence of specialty pet stores support robust market activity across both urban and rural settings.

The North West maintains a solid position in the UK pet care market, encouraged by heightened awareness of pet health and wellness. This region boasts a well-developed retail structure that provides a mix of premium and affordable options. The increasing demand for grooming services, pet accessories, and specialized food products drives steady market growth among various customer segments.

The pet care market in the East of England enjoys a balanced combination of urban and rural pet ownership, creating a demand for diverse products and services. Pet owners here are increasingly opting for premium food, organic grooming products, and veterinary care. The availability of both large retail stores and independent pet shops enhances market accessibility and product variety.

The South West's pet care market thrives on a strong pet culture, particularly among rural and suburban communities. Demand encompasses essential food products, grooming supplies, and pet healthcare services. Tourism-related pet facilities and outdoor-friendly accessories are popular, reflecting the lifestyle of the region. Local pet events and specialty shops also contribute to market growth in the South West.

Scotland's pet care market is driven by a rising focus on animal welfare and health-oriented products. Pet owners here actively invest in nutritious food, quality grooming supplies, and veterinary services. The region benefits from a blend of modern retail chains and local pet shops, with rural areas showing a demand for durable, outdoor-oriented pet accessories and equipment.

The West Midlands exhibits steady growth in the pet care market, fueled by varied consumer needs across urban and suburban regions. There is a rising demand for premium food, grooming products, and accessories, coupled with pet health services. Retail expansion, featuring supermarkets and specialty outlets, enhances accessibility while local events and promotions help foster community engagement and market awareness.

Yorkshire and The Humber have a strong pet care market, influenced by high pet ownership rates and an increasing interest in specialized products. There is consistent demand for nutritious food, grooming services, and healthcare solutions. Retailers cater to both urban and rural preferences, offering a range of premium, functional, and cost-effective options.

The pet care market in the East Midlands enjoys steady demand across both essential and premium product categories. Pet owners are increasingly investing in quality food, grooming tools, and healthcare services. The retail presence is robust, with supermarkets, pet stores, and veterinary clinics enhancing accessibility. Additionally, the growing interest in eco-friendly and locally sourced products is shaping purchasing trends.

Competitive Landscape:

The UK pet care market features a competitive environment with a combination of long-established companies, up-and-coming brands, and specialized niche players across various product and service categories. These businesses emphasize innovation in pet food recipes, environmentally friendly grooming items, and tech-oriented accessories to align with shifting consumer demands. Pricing approaches span from premium to economical options, targeting different income brackets. Distribution channels are broadening, incorporating both in-store and online platforms, with a focus on seamless integration to boost customer convenience. Marketing strategies underscore quality, sustainability, and personalization to foster brand loyalty. The fierce competition drives ongoing product differentiation, service enhancement, and strategic collaborations to ensure that companies are agile in adapting to evolving trends and consumer needs in the ever-changing pet care market.

The report provides a comprehensive analysis of the competitive landscape in the UK pet care market with detailed profiles of all major companies.

Latest News and Developments:

- July 2025: Pets at Home leveraged its brand strength and pet health data to launch a disruptive pet insurance offering. Aimed at removing customer pain points using AI, the company expected to break even by FY 2028 and projected insurance to contribute around 10% of its group profits over time.

- May 2025: Mars introduced AI-driven digital tools, including GREENIES™ Canine Dental Check, allowing pet owners to assess dog dental health via smartphone photos. As part of a USD 1 Billion digital investment, the tools reflected Mars’ push to enhance real-time pet care and broadened its digital health portfolio across the UK.

- May 2025: Mud™ launched an award-winning, unscented dog wash emphasising instinct, interaction, and ethics. Developed over 18 months, the product avoided artificial fragrances and featured a recyclable nozzle. The brand challenged conventional pet grooming by honouring dogs’ natural behaviour and sensory needs, aiming for a culturally conscious shift in pet care.

- April 2025: Rover entered Ireland and Denmark through the acquisition of Gudog, strengthening its European footprint. The move followed its 2024 acquisition of Cat in a Flat. With 20,000 sitters in eight countries, Rover planned further growth into Switzerland, Poland, and others, targeting a $6.5 Billion long-term regional opportunity.

- February 2025: Meatly introduced the world’s first cultivated meat dog treats in the UK via Pets at Home and The Pack. Called Chick Bites, the treats used lab-grown chicken to offer a sustainable, nutritious option. The innovation addressed environmental concerns, as UK pets consumed 22% of the nation’s total meat.

UK Pet Care Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Pet Types Covered | Dog, Cat, Others |

| Distribution Channels Covered | Offline, Online |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK pet care market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the UK pet care market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK pet care industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The UK pet care market size reached USD 8,553.95 Million in 2024.

The UK pet care market is expected to reach USD 13,755.42 Million by 2033, exhibiting a CAGR of 5.42% during 2025-2033.

The UK pet care market is driven by rising pet ownership, increasing humanization of pets, and growing demand for premium food, grooming, and healthcare products. Expanding e-commerce, innovation in product offerings, and heightened focus on pet wellness further support market growth.

Pet food accounts for the largest share in the UK pet care market, driven by its essential role in pet health and continuous innovation in nutrition-focused, premium, and specialized diet products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)