UK Plant-Based Food Market Size, Share, Trends and Forecast by Type, Source, Distribution Channel, and Region, 2025-2033

UK Plant-Based Food Market Overview:

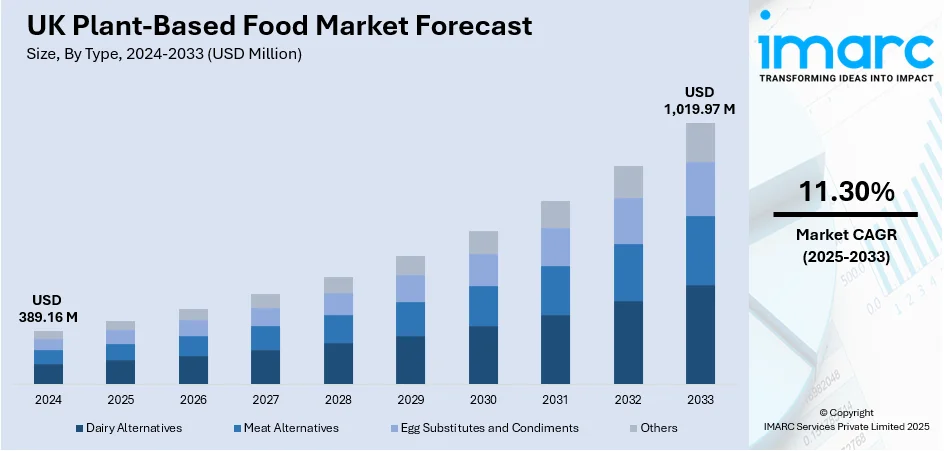

The UK plant-based food market size reached USD 389.16 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,019.97 Million by 2033, exhibiting a growth rate (CAGR) of 11.30% during 2025-2033. The increasing health and wellness trends, growing environmental sustainability, ethical and animal welfare concerns, innovations and product development, favorable government and policy support, increasing preference for vegetarian and flexitarian lifestyles, and rising product availability across retail stores and restaurants are some of the major factors positively impacting the UK plant-based food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 389.16 Million |

| Market Forecast in 2033 | USD 1,019.97 Million |

| Market Growth Rate (2025-2033) | 11.30% |

UK Plant-Based Food Market Trends:

Health and Wellness Trends

Awareness among consumers about health and wellness is a key factor fueling the UK plant-based food market growth. In the last ten years, there has been a significant increase in health-conscious individuals looking for substitutions for animal-based products, typically due to worries about cholesterol, saturated fats, and processed foods that are associated with heart disease, obesity, and specific types of cancer. Plant-based foods, such as dairy and meat alternatives, are commonly seen as healthier due to their lower fat content and higher levels of fiber, vitamins, and antioxidants. The flexitarian diet trend is growing as individuals see plant-based choices as a simple way to enhance their health, reducing meat consumption without eliminating it. According to AHDB, 16% of British individuals follow a flexitarian diet. Increased media coverage and the impact of documentaries and books emphasizing the health advantages of plant-based diets have also helped speed up this movement. Furthermore, the growing accessibility of plant-based foods high in protein and nutrients, such as soy, legumes, and quinoa, offers consumers a practical option to animal proteins, simplifying the transition to these diets while still meeting nutritional requirements. This shift strongly supports the UK plant based food market, encouraging steady growth and wider acceptance.

To get more information on this market, Request Sample

Environmental Sustainability

Environmental sustainability is a strong influence on the food industry. The animal agriculture sector plays a large role in worldwide emissions of greenhouse gases, water consumption, deforestation, and destruction of habitats, leading more consumers to acknowledge the serious environmental impact of eating meat. This awareness is driving growth in the plant based meat market UK, as more people look for eco-friendly alternatives. Several research projects, including the Intergovernmental Panel on Climate Change's (IPCC) studies, have highlighted the importance of decreasing animal agriculture to achieve global climate targets. The UK government is advancing policies that support sustainable food options, aligning with its strategy to reduce England’s farmland by over 10% by 2050. This initiative aims to balance infrastructure development with environmental goals by significantly reducing grasslands used for livestock, encouraging lower meat consumption, and repurposing frequently flooded agricultural areas for nature restoration. These measures are strengthening the move toward plant-based substitutes and raising awareness of the effects that food production has on the environment. Additionally, the availability of sustainable options for environmentally conscious customers has increased due to the growing popularity of plant-based substitutes in restaurants and supermarkets, boosting the plant based milk market UK as more people choose dairy alternatives.

Ethical and Animal Welfare Concerns

Changing ethical concerns, particularly those concerning the welfare of animals, is positively influencing the UK plant-based food market outlook. According to a recent industry report, about 6.4 million people in the UK, or 2% of the population, follow a no meat diet. An another 14.6% of the population, or around 7.8 million adults, plan to give up meat by 2025. Widespread concerns and advocacy for more humane treatment of animals has been ignited by public awareness about the frequently harsh conditions in factory farming, including overcrowding, confinement, and animal mistreatment. Prominent initiatives and groups such as PETA and The Vegan Society have played a key role in promoting the idea that plant-based diets support compassionate living and the alleviation of animal suffering. Furthermore, numerous undercover investigations and reports from the media have revealed instances of cruelty in the meat, egg, and dairy sectors, leading to a shift in public support for cruelty-free products. Consequently, numerous consumers are opting for plant-based diets to distance themselves from industries that support animal exploitation, which is helping expand the plant-based food market size UK.

Product Innovation and Development

In the UK, companies in the plant-based food sector are working hard to bring fresh ideas to store shelves. Many brands are putting money into research to create foods that look and taste more like traditional meat and dairy but use plants as their main source. New recipes and better use of plant proteins are helping producers match the texture and flavour that customers want, strengthening the UK meat alternative segment. Producers are also exploring more convenient ready meals, snacks, and drinks that appeal to busy shoppers who still want healthier options. Smaller start-ups are teaming up with well-known names to bring better-quality items to market faster. New releases help keep shoppers interested and give them more reasons to pick up something new during their weekly shop. Better packaging and clear labels help build trust and make it easy for people to understand what they are buying. Together, these steps make innovation a big part of how this market keeps growing, including the UK plant based beverages market which benefits from fresh product ideas and wider consumer appeal.

Growing Preference for Vegetarian and Flexitarian Lifestyles

Changing eating habits in the UK are giving the plant-based food market fresh momentum. More people are cutting back on meat without fully giving it up, often choosing a flexitarian lifestyle. This shift has come from growing concern for health, the environment, and animal welfare. Flexitarians are looking for substitutes that fit well with their usual meals but are lighter and greener. This change is also backed by well-known campaigns and strong support from public figures who encourage people to think about how their food choices affect the planet. Restaurants and stores now offer a wider choice of plant-based meals and ingredients, making it easier for people to try something different without changing everything at once. Families and younger generations, in particular, are open to new tastes and like seeing trusted brands offer plant-based versions of their favorites. This change in habits means more steady demand for producers, supporting UK plant-based food market growth 2025 and encouraging continued product development.

Increased Product Availability

Wider access to plant-based options has made a real difference in growing the UK market. Today, shoppers can easily find meat-free and dairy-free choices in the same aisles as traditional foods. Many large supermarkets have dedicated spaces for these products, which helps them stand out and makes it simple for people to add them to their basket. Shops often team up with specialist producers to offer new and exclusive items, giving customers even more variety. Online shopping has made it even easier to pick up plant-based foods, with delivery services offering convenient ways to try different products at home. Special offers and in-store tastings encourage shoppers to give these foods a chance, even if they are new to plant-based eating. Suppliers are working to make sure shelves stay stocked so people can rely on finding what they need. With wider availability, more people include these foods in their weekly shops, helping the market stay strong and adding to the growth of the UK healthy food sector by promoting better daily choices.

UK Plant-Based Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source and distribution channel.

Type Insights:

- Dairy Alternatives

- Meat Alternatives

- Egg Substitutes and Condiments

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes diary alternatives, meat alternatives, egg substitutes and condiments, and others.

Source Insights:

- Soy

- Almond

- Wheat

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes soy, almond, wheat, and others.

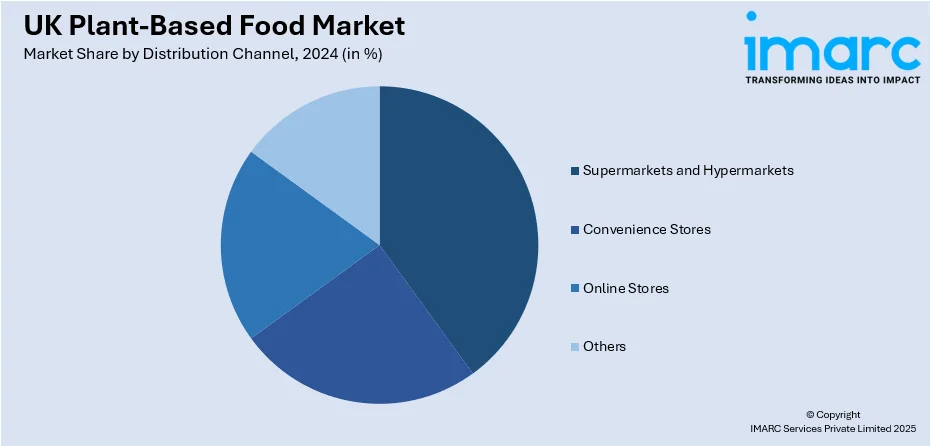

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

UK Plant Based Food Companies:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Plant-Based Food Market News:

- June 2025: Violife launched Supreme Cheddarton, a protein-rich, plant-based cheddar alternative in the UK. With 30% less fat and free from top allergens, this launch expanded healthier cheese options, boosted innovation, and strengthened consumer trust in the plant-based food sector.

- January 2025: Lidl introduced 28 new affordable plant-based products in the UK under its Vemondo range, with prices starting at £1.09. This move widened access to budget-friendly vegan choices, supported mainstream adoption, and strengthened the UK’s plant-based food market appeal.

- November 2023: Tesco, a British multinational groceries and general merchandise retailer, has launched a new plant-based product range, Root & Soul. The range aims to inspire consumers to eat more vegetable-based meals that are easy to prepare and packed with quality ingredients.

- June 19, 2024: UK-based plant-based meat company THIS secured EUR 20 Million in Series C funding, led by Planet First Partners, to expand its product range and enhance profitability. The investment will support the development of new health-focused products and strengthen the company's position in the UK market. Additionally, THIS plans to introduce a tofu-like superfood with superior nutritional value compared to existing market offerings.

UK Plant-Based Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Dairy Alternatives, Meat Alternatives, Egg Substitutes and Condiments, Others |

| Sources Covered | Soy, Almond, Wheat, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK plant-based food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK plant-based food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK plant-based food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The plant-based food market in UK was valued at USD 389.16 Million in 2024.

The UK plant-based food market is projected to exhibit a CAGR of 11.30% during 2025-2033, reaching a value of USD 1,019.97 Million by 2033.

In the UK, more people are eating plant-based meals to support health, animal welfare, and the environment. Many now follow vegan or vegetarian routines or reduce meat gradually. Better access to tasty alternatives and growing awareness keep this trend strong across all age groups.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)