UK Real Estate Market Report by Property (Residential, Commercial, Industrial, Land), Business (Sales, Rental), Mode (Online, Offline), and Region 2026-2034

UK Real Estate Market Overview:

The UK real estate market size reached USD 256.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 396.5 Billion by 2034, exhibiting a growth rate (CAGR) of 4.97% during 2026-2034. The market is experiencing steady growth, driven by affordable mortgages due to low interest rates, impactful government policies such as higher stamp duty rates for non-residents, and overseas capital, especially in luxury and commercial real estate.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 256.3 Billion |

|

Market Forecast in 2034

|

USD 396.5 Billion |

| Market Growth Rate 2026-2034 | 4.97% |

Access the full market insights report Request Sample

UK Real Estate Market Trends:

Smart Real Estate

According to the UK real estate market overview, smart real estate is rapidly evolving from a niche luxury to an integral necessity. This is driven by the intersection of technological advancements and the growing customer demand for efficiency, convenience, and sustainability. There is a dramatic surge in IoT-based buildings, where devices and sensors control functions like lighting, HVAC, and security, lessening energy consumption and enhancing occupant comfort. AI-based predictive maintenance is on the rise, reducing downtime and expenses by identifying problems before they emerge. Additionally, the focus on "green living" has led to smart homes being increasingly equipped with features like solar panels, charging ports for electric vehicles, and smart meters that monitor and reduce environmental footprints. These are aspects that developers and realtors highlight as key features and selling points, as buyers are willing to pay extra for technologically advanced and green homes that are cost-effective over the long term and reflect prevailing values.

Digital Platforms

Digital platforms are profoundly changing every aspect of the UK property industry, from initial search to deal completion and ongoing administration. AI-powered platforms are boosting property search with hyper-personalization, connecting buyers to houses based on their preferences and browsing habits. Virtual reality (VR) and augmented reality (AR) tours are increasingly routine, allowing for immersive remote viewings while greatly lowering the need for actual visits. Beyond marketing, digital platforms simplify difficult processes: AI-powered valuation methods produce accurate and timely property evaluations, whilst blockchain technology is evolving to give unrivaled transparency and security in transactions, potentially decreasing paperwork and expenses. Automated communication systems and mobile applications for property management enhance tenant experiences by managing queries, maintenance requests, and payments, resulting in increased efficiency and satisfaction for both landlords and tenants. This digital shift is democratizing information access and improving the accessibility and efficiency of the UK property market.

Economic Stability

Economic stability is a key driver in the UK housing market, affecting buyer confidence and investor activity. A stable economy is frequently associated with low unemployment rates, consistent income growth, and strong consumer confidence, all of which promote spending and investment in housing. When people feel safe about their financial future, they are more inclined to commit to buying a home, resulting in increased demand and higher property prices. Furthermore, economic stability usually results in a low-interest rate environment. Low interest rates make mortgages more accessible, boosting the number of potential homeowners on the market. This element not only boosts demand but also contributes to rising UK housing price as more individuals borrow money to acquire real estate. The relationship between economic stability and real estate dynamics demonstrates the property market's susceptibility to larger economic trends. For example, during economic downturns, the real estate market slows owing to higher unemployment and lower consumer confidence, indicating the direct influence of economic health on real estate activity. Furthermore, favorable government initiatives such as "Help to Buy" and "Shared Ownership" have a significant impact on the dynamics of the UK real estate market outlook 2025. Various measures, ranging from tax breaks to housing projects, have a direct impact on market trends and drive growth.

Foreign Investment

Foreign investment continues to have a significant impact on the UK real estate market outlook, particularly in top categories like London's luxury property and commercial real estate markets. Foreign investors are attracted to the UK market because of its political stability, solid legal framework for property rights, and perceived economic security. This flood of foreign cash raises property values, particularly in high-demand locations, causing market prices to rise faster than local income growth. This practice can cause affordability concerns for people while also contributing to the vitality and liquidity of the real estate market. Furthermore, the UK government has periodically acted to slow the rate of price increase caused by foreign investment, such as by imposing higher stamp duty rates on non-resident buyers. These initiatives seek to mitigate the impact of foreign investment on the market while keeping the housing market accessible to local purchasers, demonstrating the delicate balance necessary to regulate external capital inflows in the UK real estate market 2025.

UK Real Estate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on property, business, and mode.

Property Insights:

To get detailed segment analysis of this market Request Sample

- Residential

- Commercial

- Industrial

- Land

The report has provided a detailed breakup and analysis of the market based on the property. This includes residential, commercial, industrial, and land.

Business Insights:

- Sales

- Rental

A detailed breakup and analysis of the market based on the business have also been provided in the report. This includes sales and rental.

Mode Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the mode. This includes online and offline.

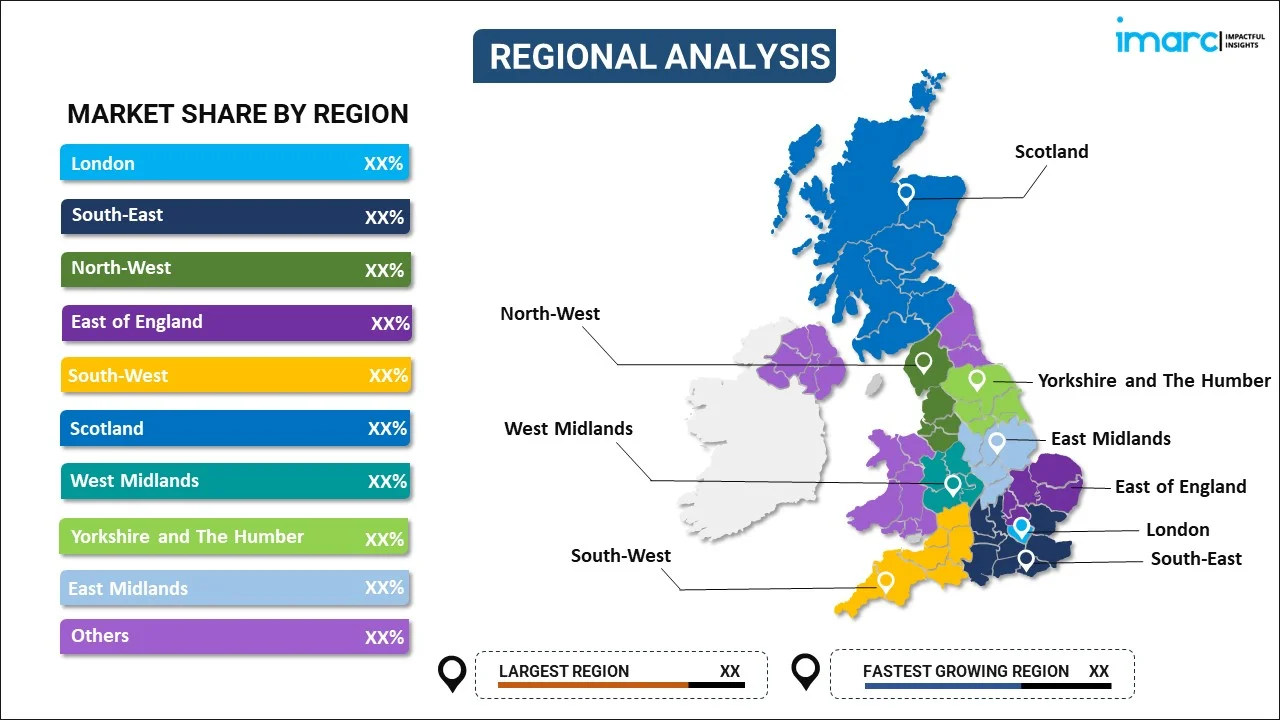

Regional Insights:

To get detailed regional analysis of this market Request Sample

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Top Real Estate Companies in United Kingdom:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Real Estate Market News:

- In June 2025, the UK government launched a new National Housing Bank, a subsidiary of Homes England, backed by GBP 16 Billion in public funds. This initiative aims to unlock over GBP 53 Billion in private investment to deliver more than 500,000 new homes. The bank would provide flexible, long-term capital, including loans, equity, and guarantees, to accelerate housebuilding, support SMEs, and enable complex site development.

- In April 2025, Homes England and Octopus Real Estate launched "Greener Homes Alliance 2," a GBP 150 Million initiative to boost the construction of high-quality, energy-efficient homes in England. Homes England contributed GBP 42 Million from its Home Building Fund. This phase expands on the successful first phase (2021), which funded over 550 sustainable homes, with more than 40% achieving an EPC A rating and 100% exceeding a SAP score of 86 (significantly higher than the UK averages of EPC D and SAP 67). The alliance aims to provide crucial loan finance to small and medium-sized (SME) housebuilders and promote greener building practices.

- In October 2024, the Canada Pension Plan Investment Board (CPPIB) announced plans to invest GBP 500 Million in a new UK single-family rental housing joint venture, which would contribute GBP 56 Million for a 10% stake. This initiative aims to address the UK's housing undersupply by deploying private capital into high-quality rental properties, aligning with CPPIB's strategy for scalable investments in assets with growing cash flows.

- In May 2024, Bellway and Latimer, in a joint venture to develop Springstead Village in Cherry Hinton, unveiled archaeological discoveries of prehistoric, Anglo-Saxon, and Medieval artifacts at an open day event. The project plans for 1,200 new homes, community facilities, and educational institutions were shared with residents on May 11. Archaeologists from the Cambridge Archaeological Unit led the investigation, uncovering the site's rich history.

- In April 2024, St George and SEGRO opened SEGRO V-Park Grand Union, a six-story, sustainable industrial development in Alperton, as part of the larger 22-acre Grand Union regeneration project. The building offers 134,500 sq ft of floorspace on a 1.7-acre site, aligning with the London Plan to intensify industrial land use, and is expected to support 250 jobs and apprenticeships. This development is part of a broader transformation of a former brownfield site into a vibrant neighborhood with 3,350 homes, 35% affordable, and public green spaces.

UK Real Estate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Properties Covered | Residential, Commercial, Industrial, Land |

| Businesses Covered | Sales, Rental |

| Modes Covered | Online, Offline |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK real estate market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK real estate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK real estate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The real estate market in UK was valued at USD 256.3 Billion in 2025.

The UK real estate market is projected to exhibit a CAGR of 4.97% during 2026-2034, reaching a value of USD 396.5 Billion by 2034.

The UK real estate market is driven by strong demand for housing, ongoing urban development, and increased interest from both domestic and international buyers. Lifestyle changes, population growth, and the appeal of property as a long-term investment also contribute to steady activity across residential and commercial segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)