UK Renewable Energy Certificates Market Size, Share, Trends and Forecast by Energy Type, Capacity, End Use, and Region, 2025-2033

UK Renewable Energy Certificates Market Overview:

The UK renewable energy certificates market size reached USD 586.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,686.60 Million by 2033, exhibiting a growth rate (CAGR) of 23.10% during 2025-2033. The market is experiencing steady growth driven by substantial government incentives focusing on renewable energy sources, continual technological advancements in renewable energy, and robust corporate commitment to sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 586.00 Million |

| Market Forecast in 2033 | USD 4,686.60 Million |

| Market Growth Rate (2025-2033) | 23.10% |

UK Renewable Energy Certificates Market Trends:

Increasing government support and incentives

Strong government support and incentives for renewable energy sources are significantly strengthening the market. Several policies have been implemented, which encourage investment in renewable energy and make such an investment worthwhile for businesses and individuals to invest in renewable energy. Along with this, incentives offered in the form of grants, tax rebates, and feed-in tariffs make renewable energy projects financially viable. Therefore, this is propelling the market growth significantly. Moreover, the commitment of the UK government to its pledge of reducing carbon emissions by 2050 undergirds a legislative framework that encourages renewable energy technologies, thus providing a stable and supportive environment for growth within the RECs market. For instance, in October 2024, the UK government unveiled a plan to create energy storage infrastructure, backing long-duration storage schemes. This will enhance energy security, reduce reliance on gas, and attract investment for clean energy and job creation. These government initiatives, in effect, provide an incentive for current investments and project long-term commitment to renewable energy, hence making the sector increasingly attractive to investors and stakeholders alike, and creating a positive market outlook.

Corporate commitment to sustainability

Corporate commitment toward sustainability and carbon neutrality targets is also an important driver for the market. Numerous business groups in such diversified industries have committed to minimizing their carbon footprint and achieving net-zero emissions. For instance, according to industry reports, the UK’s net zero sector is growing three times faster than the economy, growing 10% in 2024 and contributing £83 billion to GVA, while creating high-wage jobs and enhancing energy security. This is influenced by government policies but also by the consumer demand for environmentally responsible action. RECs are, therefore, critical tools through which businesses must comply with their aims of sustainability: it is the mark signifying that the energy business is using originates from renewable sources. This rising corporate demand for renewable energy solutions thus is expanding the RECs market as companies are aggressively seeking to subscribe to green energy programs and prove their commitment to the environment through accredited purchases of certified renewable energy. This increasing demand for RECs is prompting and fueling more businesses to become sustainable, where the use of renewable energy across the UK.

UK Renewable Energy Certificates Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on energy type, capacity, and end use.

Energy Type Insights:

- Solar Energy

- Wind Power

- Hydro-electric Power

- Gas Power

The report has provided a detailed breakup and analysis of the market based on the energy type. This includes solar energy, wind power, hydro-electric power, and gas power.

Capacity Insights:

- 0-1000KWh

- 1100-5000KWh

- More than 5000KWh

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes 0-1000KWh, 1100-5000KWh, and more than 5000KWh.

End Use Insights:

- Voluntary

- Compliance

The report has provided a detailed breakup and analysis of the market based on the end use. This includes voluntary and compliance.

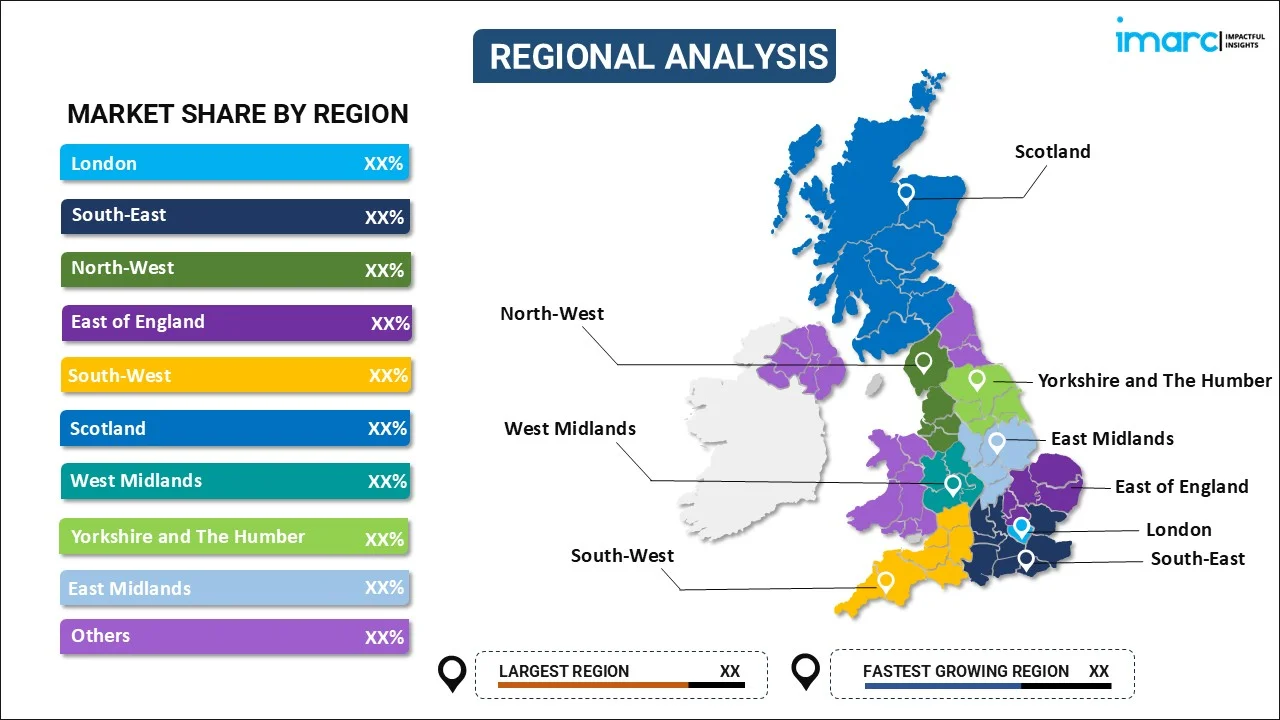

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Renewable Energy Certificates Market News:

- In October 2023, GoNetZeroTM announced the expansion of its services to the European and UK markets, following its success in Asia. Its digital marketplace provides verified RECs and carbon credits, sourced from Sembcorp’s renewable energy projects and a network of accredited partners. The platform offers access to various environmental attributes, including i-RECs, REGOs, NFCs, J-Credits, and certified carbon credits.

- In January 2023, the Crown Estate finalized agreements for six offshore wind projects, expected to generate around 8GW of renewable electricity by the end of the decade. These projects will supply power to over seven million homes and strengthen the UK’s position as the world’s second-largest offshore wind energy producer. The projects are located off the coasts of North Wales, Cumbria, Lancashire, Yorkshire, and Lincolnshire.

UK Renewable Energy Certificates Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Energy Types Covered | Solar Energy, Wind Power, Hydro-electric Power, Gas Power |

| Capacities Covered | 0-1000KWh, 1100-5000KWh, More than 5000KWh |

| End Uses Covered | Voluntary, Compliance |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK renewable energy certificates market performed so far and how will it perform in the coming years?

- What is the breakup of the UK renewable energy certificates market on the basis of energy type?

- What is the breakup of the UK renewable energy certificates market on the basis of capacity?

- What is the breakup of the UK renewable energy certificates market on the basis of end use?

- What is the breakup of the UK renewable energy certificates market on the basis of region?

- What are the various stages in the value chain of the UK renewable energy certificates market?

- What are the key driving factors and challenges in the UK renewable energy certificates market?

- What is the structure of the UK renewable energy certificates market and who are the key players?

- What is the degree of competition in the UK renewable energy certificates market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK renewable energy certificates market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK renewable energy certificates market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK renewable energy certificates industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)