UK Seaweed Market Size, Share, Trends and Forecast by Environment, Product, Application, and Region, 2025-2033

UK Seaweed Market Overview:

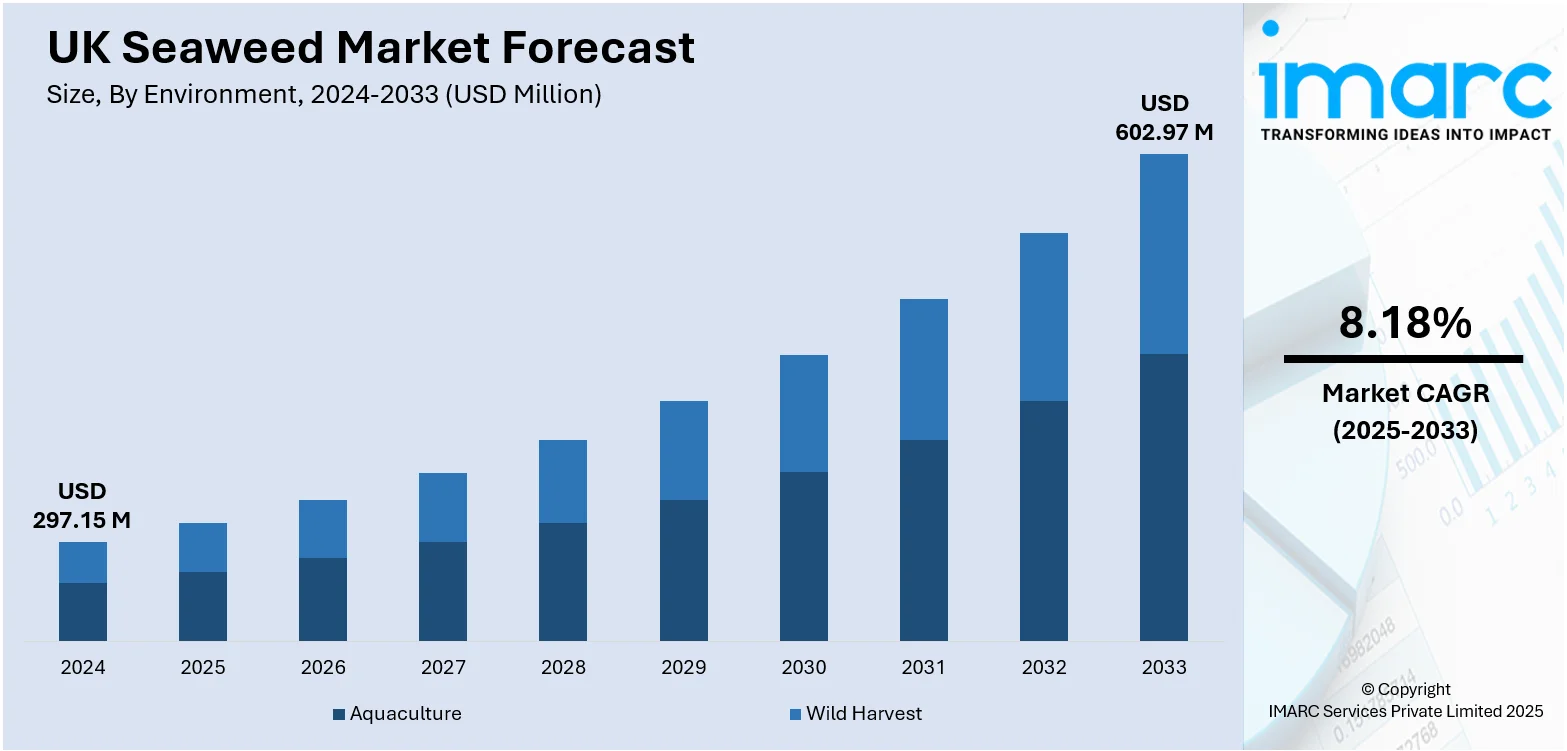

The UK seaweed market size reached USD 297.15 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 602.97 Million by 2033, exhibiting a growth rate (CAGR) of 8.18% during 2025-2033. The market is driven by increasing demand for biodegradable seaweed-based packaging, aligning with national sustainability goals and plastic reduction mandates. Rising incorporation of seaweed extracts in premium personal care products is addressing growing consumer interest in bioactive, eco-friendly skincare. Expanding adoption of seaweed-derived agricultural inputs is further augmenting the UK seaweed market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 297.15 Million |

| Market Forecast in 2033 | USD 602.97 Million |

| Market Growth Rate 2025-2033 | 8.18% |

UK Seaweed Market Trends:

Circular Economy and Sustainable Packaging Solutions

Seaweed-derived materials are increasingly being recognized as sustainable alternatives to conventional plastics in the United Kingdom. Packaging innovators are leveraging biopolymers extracted from seaweed to develop biodegradable films, containers, and wrappings suited for the food, cosmetics, and personal care sectors. This shift aligns with the United Kingdom’s legislative frameworks targeting reductions in plastic waste and supporting circular economy models. Seaweed-based packaging provides the dual advantage of environmental sustainability and product differentiation, enhancing brand positioning in competitive consumer markets. Emerging collaborations between biotechnology startups, research institutions, and packaging manufacturers are fostering accelerated development of commercial-scale solutions. Additionally, coastal cultivation operations are scaling production to support growing demand for raw materials, with particular focus on species known for optimal polysaccharide yield. Government-backed funding and environmental grants are providing essential support to early-stage ventures specializing in marine biomaterials. The UK’s Natural History Museum, supported by GBP 150 million (USD 190.35 million) funding for transformation, alongside its 400 scientists, is contributing to global conservation targets such as the 30by30 initiative, aiming to safeguard seaweed ecosystems and boost museum visitors by 1 million annually. Brands across retail sectors are beginning to pilot seaweed-based packaging solutions, emphasizing their commitment to responsible sourcing and reduced carbon footprints. The alignment of ecological responsibility with consumer preference for ethical products strengthens the long-term commercial viability of seaweed in packaging innovation. This integration of sustainable production practices is a central contributor to UK seaweed market growth.

To get more information on this market, Request Sample

Agricultural Inputs and Soil Regeneration

The agriculture sector in the United Kingdom is increasingly adopting seaweed-based inputs to promote soil health, enhance crop productivity, and support regenerative farming practices. Bioactive compounds in seaweed extracts have demonstrated their potential in stimulating plant root development, improving nutrient uptake, and increasing resistance to environmental stress factors. These benefits are critical in the context of national initiatives aimed at encouraging sustainable agriculture and reducing reliance on synthetic chemical fertilizers. Organic farming operations, in particular, are incorporating seaweed biostimulants into fertilization strategies to maintain ecological balance while optimizing yields. The agricultural supply chain is witnessing new collaborations between seaweed processors, fertilizer manufacturers, and organic certification bodies, ensuring product quality and compliance with sustainability standards. Coastal aquaculture farms are scaling up operations to meet demand, working closely with agricultural cooperatives for reliable distribution frameworks. Additionally, advancements in extraction technologies are improving the concentration and efficacy of seaweed-based agricultural products. As per a 2023 industry report, the UK seaweed sector is forecasted to generate millions of US dollars from 10 novel seaweed applications by 2030, spanning industries such as food, pharmaceuticals, and bioremediation. In 2021, around 15,000 tons (wet weight) of seaweed were harvested in the UK, supported by 74 active companies—35% in England, 34% in Scotland, 18% in Wales, 8% in Northern Ireland, and 5% of unclear location. The number of seaweed-related companies in the UK had doubled between 2016 and 2021, indicating significant industry momentum. Farmers recognize the dual value of these inputs in enhancing crop output while contributing to broader environmental restoration goals. Government-aligned sustainability programs further amplify adoption potential, reinforcing the integration of marine-derived solutions into mainstream farming practices throughout the United Kingdom.

UK Seaweed Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on environment, product, and application.

Environment Insights:

- Aquaculture

- Wild Harvest

The report has provided a detailed breakup and analysis of the market based on the environment. This includes aquaculture and wild harvest.

Product Insights:

- Red

- Brown

- Green

The report has provided a detailed breakup and analysis of the market based on the product. This includes red, brown, and green.

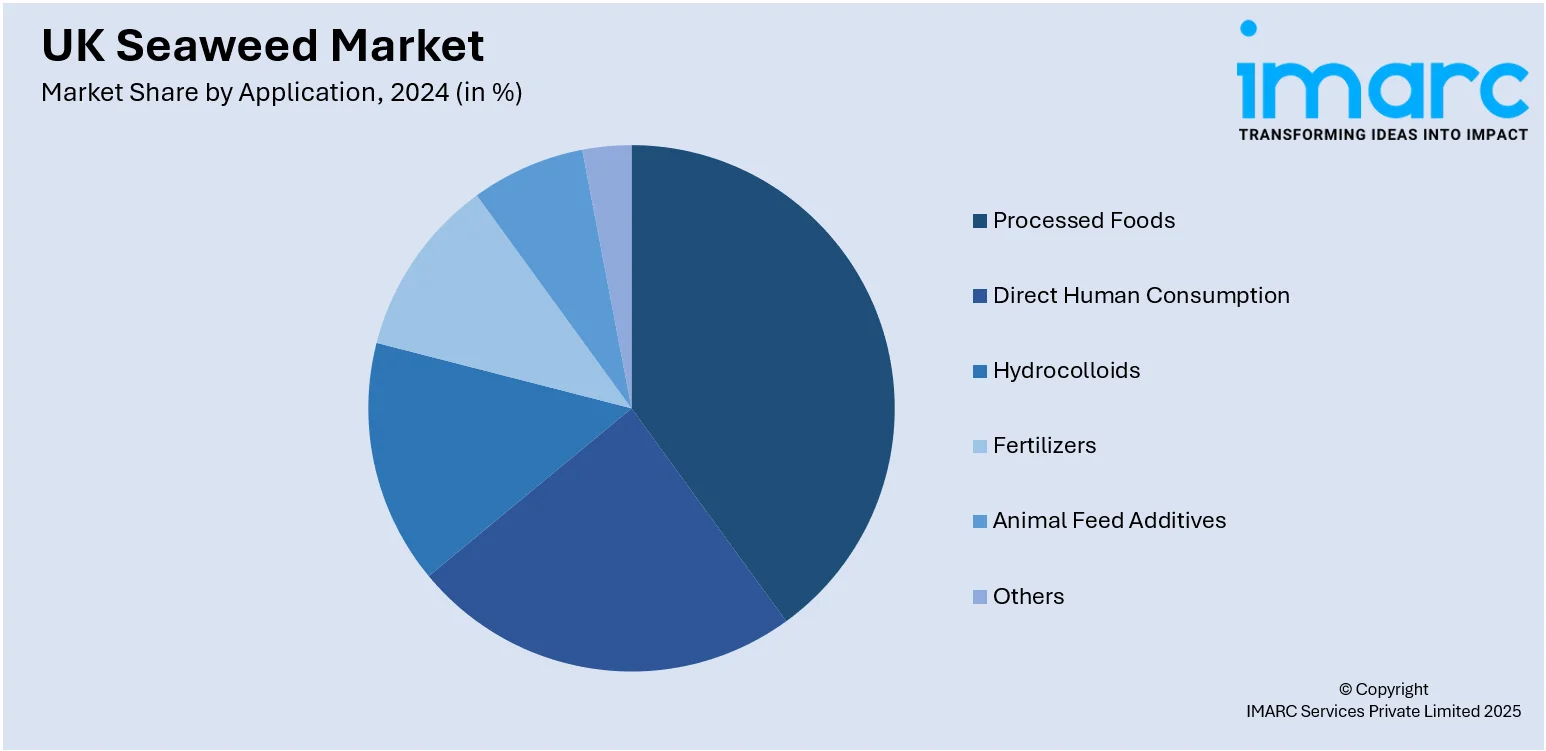

Application Insights:

- Processed Foods

- Direct Human Consumption

- Hydrocolloids

- Fertilizers

- Animal Feed Additives

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes processed foods, direct human consumption, hydrocolloids, fertilizers, animal feed additives, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Seaweed Market News:

- On April 23, 2025, the James Hutton Institute announced its participation in a new UK research project, ‘Assessing Sugar Kelp Extracts as a Nutrient Management Tool’ (SKE-NMT), aimed at improving crop fertilizer use through seaweed-derived biostimulants. Supported by Innovate UK and industry partners, the initiative will conduct large-scale trials to assess how sugar kelp extracts can enhance nutrient use efficiency (NUE) in crops by reducing reliance on nitrogen and phosphate fertilizers. Building on previous Innovate UK-funded research, this project positions cultivated seaweed biomass as a scalable, sustainable resource for improving soil health and advancing the UK seaweed market.

UK Seaweed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Environments Covered | Aquaculture, Wild Harvest |

| Products Covered | Red, Brown, Green |

| Applications Covered | Processed Foods, Direct Human Consumption, Hydrocolloids, Fertilizers, Animal Feed Additives, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK seaweed market performed so far and how will it perform in the coming years?

- What is the breakup of the UK seaweed market on the basis of environment?

- What is the breakup of the UK seaweed market on the basis of product?

- What is the breakup of the UK seaweed market on the basis of application?

- What is the breakup of the UK seaweed market on the basis of region?

- What are the various stages in the value chain of the UK seaweed market?

- What are the key driving factors and challenges in the UK seaweed market?

- What is the structure of the UK seaweed market and who are the key players?

- What is the degree of competition in the UK seaweed market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK seaweed market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK seaweed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK seaweed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)