UK Soft Skills Training Market Size, Share, Trends and Forecast by Soft Skill Type, Channel Provider, Sourcing, Delivery Mode, End Use Industry, and Region, 2025-2033

UK Soft Skills Training Market Overview:

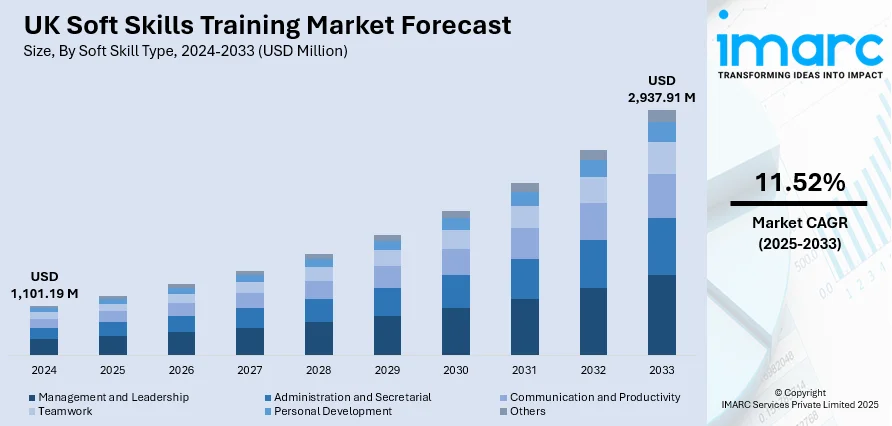

The UK soft skills training market size reached USD 1,101.19 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,937.91 Million by 2033, exhibiting a growth rate (CAGR) of 11.52% during 2025-2033. The market is driven by increased emphasis on emotional intelligence, remote work adaptability, and demand for leadership development across sectors. Employers prioritize interpersonal communication and critical thinking to navigate hybrid work dynamics and evolving client expectations. These factors are significantly contributing to the rising UK soft skills training market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,101.19 Million |

| Market Forecast in 2033 | USD 2,937.91 Million |

| Market Growth Rate 2025-2033 | 11.52% |

UK Soft Skills Training Market Trends:

Integration of AI-Enabled Personalized Learning

One of the significant trends shaping the UK soft skills training market growth is the increasing adoption of AI-driven personalized learning platforms. These systems analyze individual learning styles, performance metrics, and professional goals to deliver tailored content that enhances user engagement and training effectiveness. Companies are leveraging AI tools to optimize employee upskilling by addressing specific gaps in communication, time management, and leadership. For instance, a June 2025 industry report shows 60% of employers now value soft skills more than five years ago. Among 1,000+ U.S. and UK hiring decision-makers, 85% use skills-based hiring, and 78% reported poor performance from technically skilled hires lacking soft skills. AI use in hiring rose to 70%. This shift ensures that learning is not only scalable but also relevant to each learner’s professional development. Moreover, AI-powered feedback and adaptive assessments foster continuous improvement. As employers seek cost-efficient and data-informed solutions to human capital development, AI-enhanced personalization is poised to become a central feature in the expanding UK soft skills training market.

To get more information on this market, Request Sample

Government Initiatives and Workforce Reskilling Programs

Government-supported initiatives and workforce reskilling schemes are fueling momentum in the UK soft skills training market growth. Programs such as the National Skills Fund and partnerships with training providers aim to enhance employability across age groups and industries, particularly in response to technological displacement and economic restructuring post-Brexit. These initiatives emphasize transferable soft skills like adaptability, critical thinking, and digital collaboration, enabling jobseekers to remain competitive in a fluid labour market. Moreover, local enterprise partnerships and councils are funding training grants and online learning platforms to broaden access to soft skills education. This public-private collaboration ensures sustained investment in human capital, positioning soft skills as a key pillar of national workforce resilience and stimulating robust demand in the UK soft skills training market. For instance, in July 2024, the UK government launched Skills England, a new body aimed at unifying the fragmented post-16 skills system to address rising skills shortages and drive long-term economic growth. The initiative will involve employers, unions, training providers, and local authorities to align education with labour market needs. Skills England will also reform levy spending, reduce reliance on overseas workers, and support local workforce development—particularly in healthcare and construction—boosting opportunity and growth nationwide.

UK Soft Skills Training Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on soft skill type, channel provider, sourcing, delivery mode, and end use industry.

Soft Skill Type Insights:

- Management and Leadership

- Administration and Secretarial

- Communication and Productivity

- Teamwork

- Personal Development

- Others

The report has provided a detailed breakup and analysis of the market based on the soft skill type. This includes management and leadership, administration and secretarial, communication and productivity, teamwork, personal development, and others.

Channel Provider Insights:

- Corporate/Enterprise

- Academic/Education

- Government

A detailed breakup and analysis of the market based on the channel provider have also been provided in the report. This includes corporate/enterprise, academic/education, and government.

Sourcing Insights:

- In-House

- Outsourced

A detailed breakup and analysis of the market based on the sourcing have also been provided in the report. This includes in-house and outsourced.

Delivery Mode Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the delivery mode have also been provided in the report. This includes online and offline.

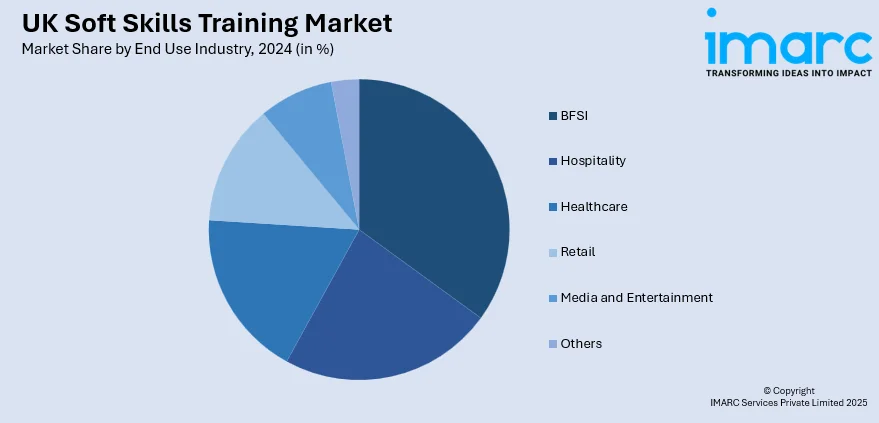

End Use Industry Insights:

- BFSI

- Hospitality

- Healthcare

- Retail

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes BFSI, hospitality, healthcare, retail, media and entertainment, and others.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Soft Skills Training Market News:

- In June 2025, the UK government launched a major AI upskilling initiative with tech giants like Amazon, Microsoft, and Google to train 7.5 million UK workers by 2030. The programme aims to equip a fifth of the UK workforce with essential AI skills to support economic growth and boost productivity. Microsoft alone plans to upskill 1 million workers by year-end. The initiative also reflects £44 Billion in AI investment and 13,250 jobs created since the AI Opportunities Action Plan began.

UK Soft Skills Training Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Soft Skill Types Covered | Management and Leadership, Administration and Secretarial, Communication and Productivity, Teamwork, Personal Development, Others |

| Channel Providers Covered | Corporate/ Enterprise, Academic/ Education, Government |

| Sourcings Covered | In-house, Outsourced |

| Delivery Modes Covered | Online, Offline |

| End Use Industries Covered | BFSI, Hospitality, Healthcare, Retail, Media and Entertainment, Others |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK soft skills training market performed so far and how will it perform in the coming years?

- What is the breakup of the UK soft skills training market on the basis of soft skill type?

- What is the breakup of the UK soft skills training market on the basis of channel provider?

- What is the breakup of the UK soft skills training market on the basis of sourcing?

- What is the breakup of the UK soft skills training market on the basis of delivery mode?

- What is the breakup of the UK soft skills training market on the basis of end use industry?

- What is the breakup of the UK soft skills training market on the basis of region?

- What are the various stages in the value chain of the UK soft skills training market?

- What are the key driving factors and challenges in the UK soft skills training market?

- What is the structure of the UK soft skills training market and who are the key players?

- What is the degree of competition in the UK soft skills training market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK soft skills training market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK soft skills training market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK soft skills training industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)