UK Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2026-2034

UK Steel Market Summary:

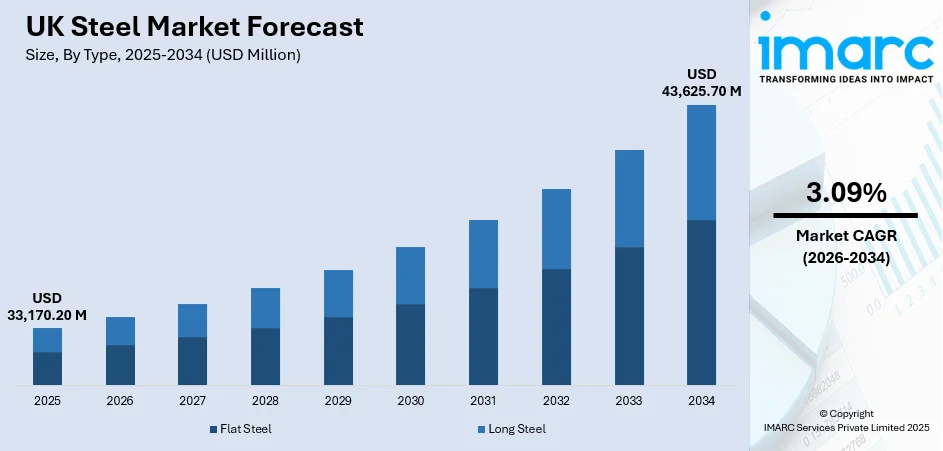

The UK steel market size was valued at USD 33,170.20 Million in 2025 and is projected to reach USD 43,625.70 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034.

The United Kingdom's steel market is driven by sustained government investment in infrastructure projects, including high-speed rail and renewable energy installations, alongside robust demand from construction, automotive, and manufacturing sectors. The industry is undergoing significant transformation with the transition toward electric arc furnaces and green steel production technologies, supported by substantial government funding and policy frameworks aimed at achieving net-zero carbon emissions.

Key Takeaways and Insights:

-

By Type: Flat Steel dominated the market with approximately 45.12% revenue share in 2025, driven by extensive applications in automotive body panels, construction cladding, household appliances, and packaging industries requiring versatile sheet and coil products across diverse manufacturing sectors.

-

By Product: Structural Steel leads the market with a share of 40.23% in 2025, owing to its essential role in building and infrastructure construction, including commercial buildings, bridges, industrial facilities, and major government infrastructure projects such as high-speed rail developments.

-

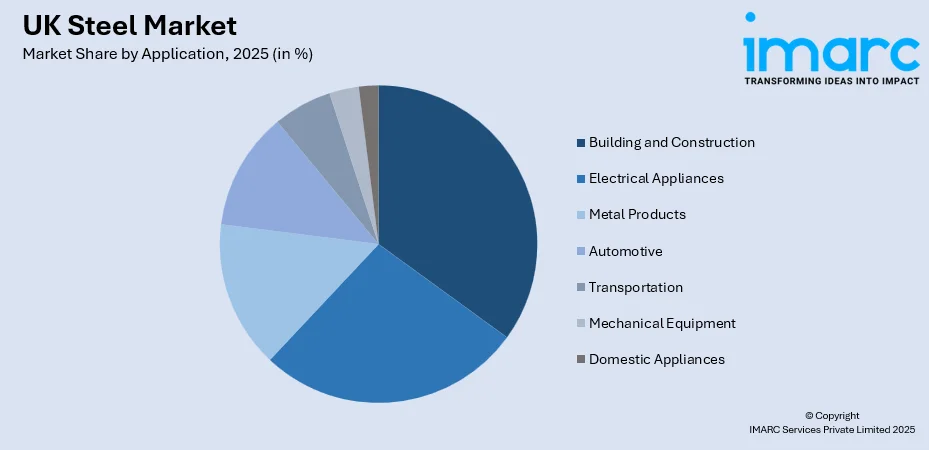

By Application: Building and Construction represents the largest segment with 35.28% market share in 2025, supported by ongoing residential housing initiatives, commercial property developments, urban regeneration schemes, and major transportation infrastructure investments across the United Kingdom.

-

Key Players: The UK steel market exhibits a concentrated competitive landscape with major domestic producers transitioning toward electric arc furnace technology, alongside international players supplying specialized steel products to meet diverse industrial requirements.

To get more information on this market Request Sample

The United Kingdom's steel industry is experiencing transformative change as producers transition from traditional blast furnace operations to electric arc furnace technology to reduce carbon emissions. In 2025, Tata Steel UK began construction of a £1.25 billion EAF facility at its Port Talbot steelworks, backed by £500 million of UK government support to cut emissions. This underlines how government investment supports this decarbonization agenda through dedicated funding mechanisms and industry-specific support packages. The construction sector remains the primary steel consumer, benefiting from major infrastructure projects including high-speed rail development. Public procurement policies increasingly favour domestically produced steel, with government departments sourcing significant proportions from UK manufacturers. The industry's strategic importance is recognized through legislative measures ensuring continued operation of critical steelmaking facilities.

UK Steel Market Trends:

Transition to Electric Arc Furnace Technology

The UK steel industry is undergoing fundamental transformation with major producers transitioning from traditional blast furnace operations to electric arc furnace technology. British Steel, which operates the historic steelworks at Scunthorpe Steelworks, has secured planning permission to install a new EAF at Scunthorpe, part of a £1.25 billion decarbonisation plan. This shift represents a significant decarbonization effort as electric arc furnaces utilizing scrap steel can achieve substantially lower carbon emissions compared to conventional steelmaking methods. Government investment supports this transition, enabling facilities to construct modern electric steelmaking capabilities aligned with national net-zero carbon emission targets.

Government Investment in Infrastructure Driving Demand

Major government-funded infrastructure projects continue stimulating steel demand across the United Kingdom. High-speed rail projects represent substantial construction undertakings employing workers across numerous construction sites. In 2025, under the updated PPN 022 Procuring Steel in Government Contracts (2025), publicsector buyers are now required to explicitly consider UK-produced steel for procurement of infrastructure and construction works, a move designed to channel more publicspending demand into domestic steel supply chains. Additional infrastructure investments in renewable energy installations, transport networks, and urban regeneration schemes create sustained demand for structural steel products. Public procurement policies increasingly prioritize domestically manufactured steel for government-funded projects.

Rising Focus on Sustainable and Green Steel Production

Environmental sustainability considerations increasingly influence UK steel market dynamics as manufacturers explore hydrogen-based steelmaking technologies and carbon capture solutions. The government's steel strategy outlines substantial investment supporting the sector's transition to sustainable production methods. The government’s new framework, through the Department for Business and Trade (DBT) and the recently formed Steel Council, supports such initiatives under its 2025 Steel Strategy package. Industry participants recognize that decarbonization presents both challenges and opportunities, with early adopters of green steel technologies potentially gaining competitive advantages as global demand for low-carbon materials intensifies.

Market Outlook 2026-2034:

The UK steel market demonstrates promising growth prospects driven by continued infrastructure investment, construction sector recovery, and the ongoing transition toward sustainable production technologies. Government commitment to maintaining domestic steelmaking capacity through legislative measures and financial support packages ensures industry stability. The completion of electric arc furnace installations at major facilities will enhance production capabilities while reducing environmental impact. Growing demand from renewable energy sectors presents significant opportunities. The market generated a revenue of USD 33,170.20 Million in 2025 and is projected to reach a revenue of USD 43,625.70 Million by 2034, growing at a compound annual growth rate of 3.09% from 2026-2034.

UK Steel Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Flat Steel | 45.12% |

| Product | Structural Steel | 40.23% |

| Application | Building and Construction | 35.28% |

Type Insights:

- Flat Steel

- Long Steel

The flat steel dominates with a market share of 45.12% of the total UK steel market in 2025.

Flat steel products maintain market leadership owing to their extensive applications across automotive manufacturing, construction cladding systems, household appliance production, and packaging industries. In 2025, UK Steel and the Steel Council introduced a procurement framework requiring public buyers to consult the “Digital Steel Catalogue,” directing more infrastructure and construction demand to domestically produced steel. The automotive sector utilizes flat steel for vehicle body panels and structural components, while construction applications include roofing sheets, wall cladding, and flooring systems. Manufacturers serving diverse end-use industries require consistent supplies of sheet, plate, and coil products meeting stringent quality specifications for their fabrication processes.

The segment benefits from technological advancements in coating technologies and surface treatments enhancing corrosion resistance and aesthetic properties. UK manufacturers supply galvanized, pre-painted, and specialty coated flat steel products meeting specific customer requirements. Growing demand from renewable energy sectors for wind turbine components and solar panel mounting systems presents expansion opportunities. The transition to electric arc furnace production maintains domestic flat steel manufacturing capabilities while reducing environmental impact.

Product Insights:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

The structural steel leads with a share of 40.23% of the total UK steel market in 2025.

Structural steel maintains dominant market position driven by essential applications in building construction, infrastructure development, and industrial facility creation. The product category encompasses beams, columns, channels, and sections utilized in commercial buildings, residential constructions, bridges, and transportation infrastructure. Major government-funded projects including high-speed rail construction require substantial structural steel quantities for station buildings, viaducts, and support structures across extensive construction sites.

In 2024, the British Constructional Steelwork Association survey found structural steel remains the top choice for framing UK nonresidential and industrial buildings, accounting for 46.7% of the market with 855,000 tonnes erected, surpassing all alternative materials. The segment benefits from steel's superior strength-to-weight ratio enabling innovative architectural designs and large-span structures. Prefabrication and modular construction methodologies increasingly utilize structural steel components manufactured off-site for rapid on-site assembly. UK fabricators supply certified structural sections meeting British Standards specifications for construction applications. Growing emphasis on sustainable building practices recognizes structural steel's recyclability, with the majority of construction steel recovered and reused at end of building life.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

The building and construction dominate with a market share of 35.28% of the total UK steel market in 2025.

The building and construction sector represents the largest steel consumption application driven by residential housing development, commercial property construction, and infrastructure investment programmes. In 2025, UK Steel highlighted that public-sector construction projects, including hospitals, schools, and transport infrastructure, are expected to consume millions of tonnes of domestic steel over the next decade, underlining the sector’s critical demand for structural and reinforcement steel. Government initiatives targeting housing delivery create sustained demand for construction materials including structural steel, reinforcement bar, and cladding products. Urban regeneration projects in major metropolitan areas utilize significant steel quantities for new developments and building refurbishments.

Major infrastructure projects significantly contribute to construction steel demand, with high-speed rail development representing one of Europe's largest construction undertakings. The construction sector demonstrates recovery across most segments following challenging periods. Steel's versatility enables applications ranging from high-rise commercial buildings to industrial warehouses and distribution centres supporting e-commerce expansion. Sustainable construction practices increasingly specify steel for its recyclability and potential for reuse.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

London represents a major steel consumption hub driven by commercial construction, residential developments, and significant infrastructure investments including high-speed rail terminus and station developments. The capital's continuous urban regeneration and high-rise construction projects generate sustained structural steel demand from fabricators serving prestigious development schemes.

South East England demonstrates substantial steel consumption supported by proximity to London's construction activity and regional infrastructure developments including transportation upgrades and commercial developments. The region's strong economic base sustains demand across construction, manufacturing, and automotive sectors requiring diverse steel products from distributors and fabricators.

North West England's steel market benefits from the region's industrial heritage and manufacturing base, with Manchester and Liverpool metropolitan areas driving construction demand. The region's ongoing regeneration projects and logistics infrastructure developments create consistent steel requirements while proximity to offshore wind developments presents emerging opportunities.

East of England's steel consumption reflects the region's growing economic significance with technology sector expansion and freeport developments stimulating construction activity. Agricultural and food processing industries contribute to specialized steel demand while coastal locations benefit from offshore energy installation requirements.

South West England's steel market serves diverse regional requirements including construction, aerospace manufacturing, and marine industries. The region's nuclear energy developments represent significant steel consumption opportunities while tourism-driven property development sustains construction sector demand across coastal areas.

Scotland's steel market demonstrates distinct characteristics driven by offshore oil and gas infrastructure, renewable energy developments including significant wind farm installations, and construction activities in Edinburgh and Glasgow metropolitan areas. The region's energy sector transition creates opportunities for specialized steel products serving emerging green energy applications.

West Midlands represents a critical steel market driven by automotive manufacturing heritage in Birmingham and Coventry, combined with high-speed rail construction activity at major station developments. The region's manufacturing base sustains demand for diverse steel products while infrastructure investments stimulate structural steel consumption.

Yorkshire and The Humber hosts significant steel production facilities alongside substantial steel consumption from construction and manufacturing sectors. The region's ports support offshore wind industry development creating demand for specialized steel components while traditional manufacturing industries maintain steady steel requirements.

East Midlands' steel market serves the region's diverse manufacturing base including automotive components, aerospace, and logistics infrastructure supporting the region's central location. Warehouse and distribution centre construction driven by e-commerce growth generates sustained structural steel demand across the region.

Other UK regions including Wales, Northern Ireland, and North East England contribute to national steel consumption through regional construction activities, manufacturing operations, and specialized industrial applications. Wales notably hosts major steel production facilities undergoing transition to electric arc furnace technology.

Market Dynamics:

Growth Drivers:

Why is the UK Steel Market Growing?

Major Infrastructure Investment Programmes

The UK government's sustained commitment to infrastructure investment drives substantial steel demand across transportation, energy, and urban development projects. In 2025, the Department for Business and Trade (DBT) highlighted that government-funded infrastructure projects, including transport, energy, and public buildings, would rely heavily on domestically produced steel, reinforcing the role of UK steelmakers in major public works. High-speed rail projects represent major infrastructure undertakings, employing workers across construction sites and supporting additional employment throughout supply chains. Government steel procurement pipelines indicate significant quantities required for infrastructure projects over the coming decade. Public procurement policies increasingly specify domestically produced steel, with government departments sourcing considerable proportions from UK manufacturers. National procurement policy statements strengthen frameworks supporting local steel producers in government-funded projects.

Construction Sector Recovery and Housing Initiatives

The UK construction sector demonstrates recovery patterns following challenging periods, with residential housing starts increasing from previous cycle low points. Government housing delivery targets create sustained demand for construction materials including structural steel, reinforcement products, and cladding systems. Commercial construction activities in major metropolitan areas utilize significant steel quantities for office developments, retail facilities, and mixed-use schemes. Urban regeneration programmes transform former industrial sites into modern developments requiring substantial steel inputs. Warehouse and logistics centre construction supporting e-commerce expansion generates consistent structural steel demand across regions.

Renewable Energy Sector Expansion

The United Kingdom's ambitious renewable energy targets create significant steel demand opportunities, particularly from offshore wind farm development around coastal waters. The UK renewable energy market size reached USD 31,690.2 Million in 2024, and is projected to grow to USD 69,512.7 Million by 2033, reflecting strong expansion and increased demand for infrastructure over the coming decade. Industry estimates indicate substantial steel quantities required for offshore wind installations over coming decades, presenting major opportunities for domestic producers. Wind turbine towers, foundation structures, and substation platforms require specialized steel products manufactured to demanding specifications. The transition to clean energy aligns with steel industry decarbonization efforts, creating potential for green steel applications in renewable energy infrastructure. Government policies supporting domestic content in energy projects encourage investment in UK-based steel manufacturing capabilities.

Market Restraints:

What Challenges the UK Steel Market is Facing?

High Energy Costs Affecting Competitiveness

UK steel producers face significantly higher electricity costs compared to European competitors, impacting manufacturing competitiveness and investment decisions. Industrial electricity prices substantially exceed those in continental European countries, affecting production economics particularly for energy-intensive electric arc furnace operations representing the industry's future direction.

Transition Challenges and Production Capacity Reductions

The industry's transition from blast furnace to electric arc furnace technology creates temporary capacity reductions and operational challenges. Crude steel production has declined as traditional facilities close ahead of new installations becoming operational. This transition period increases reliance on imported steel to meet domestic consumption requirements.

Import Competition and Trade Dynamics

UK steel producers face competitive pressure from imported steel products, with foreign supplies capturing substantial market share. Trade policies, tariffs, and anti-dumping measures influence competitive dynamics while post-Brexit arrangements affect traditional European trading relationships. Ensuring domestic producers can compete effectively remains an ongoing policy priority.

Competitive Landscape:

The UK steel market exhibits a concentrated competitive landscape dominated by major integrated producers alongside specialized manufacturers serving specific market segments. The industry structure is undergoing significant transformation as traditional blast furnace operations transition to electric arc furnace technology with government financial support. Major producers receive substantial investment packages supporting decarbonization while maintaining domestic production capabilities. Foreign ownership characterizes significant portions of UK steelmaking capacity, with international groups operating major facilities. Steel fabricators, distributors, and service centres complement primary producers, creating value-added products and services for construction and manufacturing customers. Legislative measures protect strategically important facilities while procurement policies increasingly favour domestically produced steel for government-funded projects.

Recent Developments:

-

In January 2025, British Steel inaugurated a £26 million manufacturing and service centre in Skinningrove, North East England, its largest investment in over 30 years, producing steel profiles for construction, mining, and shipbuilding. The company also launched the £22 million IGNITE project to advance green steel, enhance scrap recycling, and reduce emissions.

UK Steel Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The UK steel market size was valued at USD 33,170.20 Million in 2025.

The UK steel market is expected to grow at a compound annual growth rate of 3.09% from 2026-2034 to reach USD 43,625.70 Million by 2034.

Flat steel dominated the market with a 45.12% share, driven by extensive applications across automotive manufacturing, construction cladding, household appliances, and packaging industries.

Key factors driving the UK steel market include major infrastructure investment programmes, construction sector recovery and housing initiatives, renewable energy sector expansion, government support for domestic production, and the transition toward sustainable green steel technologies.

Major challenges include high industrial energy costs affecting competitiveness, transition challenges during the shift to electric arc furnace technology, import competition from lower-cost producers, skilled labour shortages in technical roles, and the substantial investment requirements for decarbonization.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)