UK Watch Market Size, Share, Trends and Forecast by Type, Price Range, Distribution Channel, End User, and Region, 2025-2033

UK Watch Market Overview:

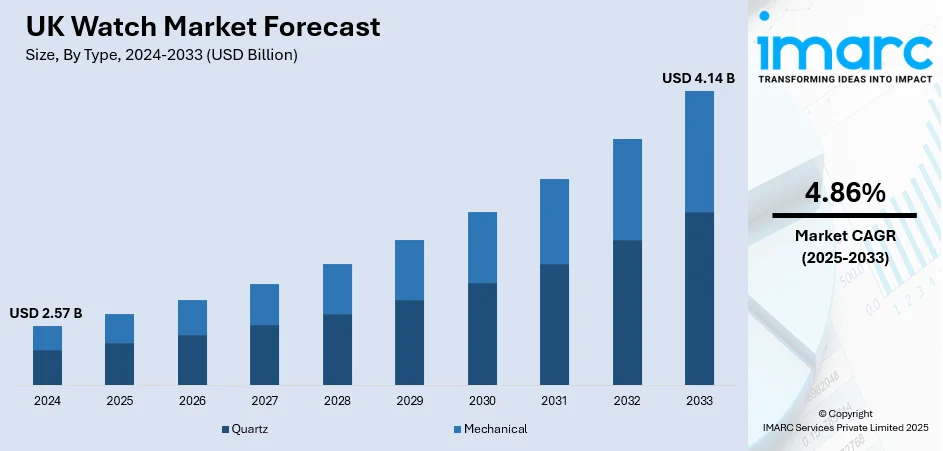

The UK watch market size reached USD 2.57 Billion in 2024. The market is projected to reach USD 4.14 Billion by 2033, exhibiting a growth rate (CAGR) of 4.86% during 2025-2033. The market is driven by rising consumer interest in luxury timepieces, growing demand for smartwatches, and increased online retail penetration. Sustainability trends and brand collaborations also influence purchasing behavior. Both heritage and tech-savvy brands are leveraging digital channels to reach wider audiences. These factors collectively shape the evolving UK watch market share landscape.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.57 Billion |

| Market Forecast in 2033 | USD 4.14 Billion |

| Market Growth Rate 2025-2033 | 4.86% |

UK Watch Market Trends:

Vintage and pre-owned valuation resurgence

The UK watch market has witnessed a pronounced resurgence in vintage and pre-owned timepieces. Collectors are increasingly prioritising historical provenance, condition, and collector appeal often favouring mid‑century mechanical models over contemporary designs. This renewed interest is underpinned by the fact that by April 2024, values of quality vintage pieces remained significantly above pre‑2020 levels. As a result, dealers across London, Manchester, Edinburgh, and Birmingham report sustained demand for classic models with unpolished cases and original documentation. This trend highlights a shift from fleeting fashion towards durable craftsmanship, positioning quality timepieces as both personal companions and tangible assets. As consumer focus gravitates towards authenticity and longevity, the UK watch market growth is being propelled by informed buyers seeking generational value rather than speculative gains. The reusable nature of mechanical watches, paired with a maturing collector base, ensures the secondary market remains vibrant and respected within the broader horological ecosystem. Continued emphasis on heritage and condition is expected to strengthen interest in curated, premium vintage selections.

To get more information on this market, Request Sample

Digital integration and expanded online platforms

By April 2024, leading UK watch platforms reported a significant rise in online enquiries and completed transactions, demonstrating the accelerated consumer shift toward digital purchasing channels. E-commerce sites are now enhancing their offerings with virtual try-on technologies, influencer-led storytelling, and blockchain-based proof-of-authenticity systems to build stronger consumer trust in remote transactions. This digital transformation improves convenience and confidence, particularly as luxury watches increasingly blend wearable tech features with traditional craftsmanship. Virtual storefronts, live-streamed product launches, and interactive pre-owned marketplaces provide consumers with exclusive yet accessible shopping experiences. These innovations extend the market reach far beyond traditional high-street retailers, attracting a growing segment of tech-savvy and younger collectors. As buyers demand more immersive browsing and rigorous authentication processes, brands and dealers continue to invest in robust digital infrastructure. Collectively, these developments are redefining how watches are discovered, evaluated, and purchased. This evolution is central to shaping current UK watch market trends, where digital convenience and authenticity have become indispensable pillars of the modern collector’s journey.

Hybrid Innovation Meets Timeless Appeal

In the UK, the convergence of wearable tech and classic watchmaking has become a defining theme, as consumers seek devices that balance tradition with utility. Manufacturers are answering demand through hybrid models, which pair mechanical movement aesthetics with embedded health sensors, NFC payments, and extended battery life, all within finely crafted cases. These designs cater to professionals who desire refined wristwear without sacrificing modern functionality. A UK industry outlook from March 2025 highlighted this synthesis, noting a marked shift in consumer metrics: sales of hybrid watches rose notably in comparison to fully digital wearables over the preceding year. This underscores the growing importance of preserving artisanal value while delivering connected capabilities. As a result, brands are increasingly partnering with tech firms to integrate seamless firmware updates and ensure compatibility across mobile platforms. This alignment of engineering disciplines ensures that smart‑enablement enhances rather than overshadows the intrinsic craftsmanship. Ultimately, the UK watch market stands at a crossroads where heritage mid-century aesthetics and forward‑looking connectivity co‑exist, opening new avenues for wristwatch relevance in a digital age.

UK Watch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, price range, distribution channel, and end user.

Type Insights:

- Quartz

- Mechanical

The report has provided a detailed breakup and analysis of the market based on the type. This includes quartz and mechanical.

Price Range Insights:

- Low-Range

- Mid-Range

- Luxury

A detailed breakup and analysis of the market based on the price range have also been provided in the report. This includes low-range, mid-range, and luxury.

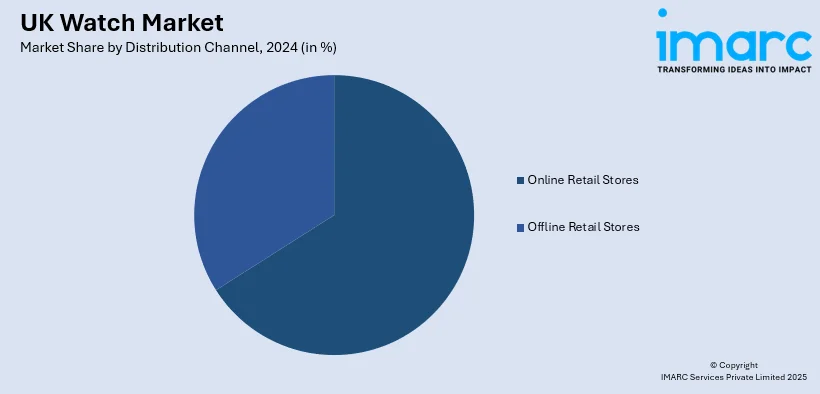

Distribution Channel Insights:

- Online Retail Stores

- Offline Retail Stores

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online retail stores and offline retail stores.

End User Insights:

- Men

- Women

- Unisex

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes men, women, and unisex.

Regional Insights:

- London

- South East

- North West

- East of England

- South West

- Scotland

- West Midlands

- Yorkshire and The Humber

- East Midlands

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

UK Watch Market News:

- July 2025: Bremont, the acclaimed British watchmaker, has unveiled a commemorative edition Supermarine 300m diving watch to mark its position as the Official Timekeeper of the Henley Royal Regatta. The partnership is a first for the high-profile UK rowing event. The watch demonstrates Bremont's dedication to craftsmanship and heritage, with design considerations inspired by the Regatta. Retailing in restricted quantities, the timepiece emphasizes Bremont's continued presence within the UK luxury watch arena and its commitment to sponsoring iconic national events.

- June 2025: Bonhams' latest London Fine Watches auction, held at their Bond Street premises, will feature a remarkable trio of vintage Rolex watches with notable British military history. Highlighting the sale is a rare 1975 Rolex 'MilSub' Submariner, previously owned by Royal Navy diver Russell Paxman. Also, up for auction is a 1948 Rolex ‘Oyster Speedking’ chronometer, gifted to Sir Frederick Brundrett, and a Rolex Day-Date with a Khanjar dial, presented to Lieutenant General Sir Michael Stuart Gray. These extraordinary pieces showcase both military and horological heritage.

UK Watch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Quartz, Mechanical |

| Price Ranges Covered | Low-Range, Mid-Range, Luxury |

| Distribution Channels Covered | Online Retail Stores, Offline Retail Stores |

| End Users Covered | Men, Women, Unisex |

| Regions Covered | London, South East, North West, East of England, South West, Scotland, West Midlands, Yorkshire and The Humber, East Midlands, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the UK watch market performed so far and how will it perform in the coming years?

- What is the breakup of the UK watch market on the basis of type?

- What is the breakup of the UK watch market on the basis of price range?

- What is the breakup of the UK watch market on the basis of distribution channel?

- What is the breakup of the UK watch market on the basis of end users?

- What is the breakup of the UK watch market on the basis of the region?

- What are the various stages in the value chain of the UK watch market?

- What are the key driving factors and challenges in the UK watch market?

- What is the structure of the UK watch market and who are the key players?

- What is the degree of competition in the UK watch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the UK watch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the UK watch market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the UK watch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)