United States 3D Cell Culture Market Report by Product, Application, End User, and Region, 2026-2034

United States 3D Cell Culture Market Size and Share:

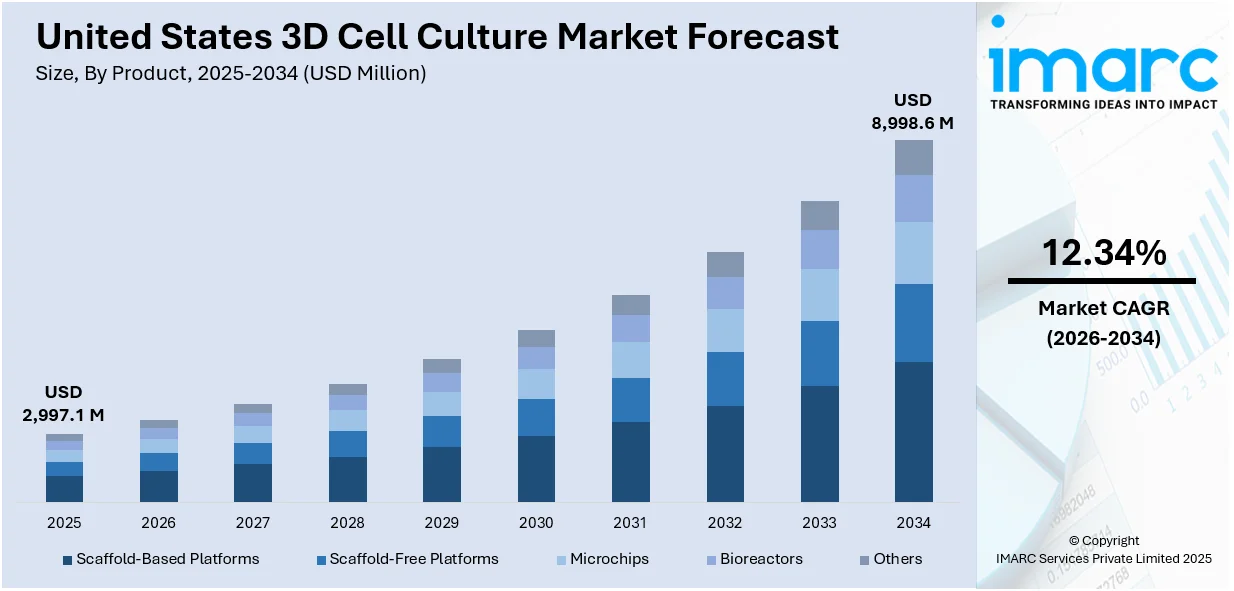

The United States 3D cell culture market size was valued at USD 2,997.1 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 8,998.6 Million by 2034, exhibiting a CAGR of 12.34% during 2026-2034. Northeast currently dominates the market in 2025. The market is driven by advancements in biomedical research and drug development, as 3D cell cultures overcome the limitations of traditional 2D models. Rising prevalence of chronic diseases, coupled with increasing investments from pharmaceutical firms in cost-effective drug testing, further accelerates adoption. Additionally, government funding for regenerative medicine and ethical shifts toward alternative testing methods are further augmenting the United States 3D cell culture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,997.1 Million |

| Market Forecast in 2034 | USD 8,998.6 Million |

| Market Growth Rate 2026-2034 | 12.34% |

The market is primarily driven by advancements in biomedical research and drug development. Traditional 2D cell cultures often fail to replicate human tissue complexity, increasing demand for 3D models that better mimic in vivo conditions. The rise in chronic diseases, such as neurological disorders and cancer, has accelerated the need for accurate preclinical testing, further propelling market growth. In 2023, nearly 76.4% of adults in the United States, approximately 194 million, were reported to have one or more chronic conditions. Of these, 51.4% or 130 million were reported to be experiencing more than one condition, including 27.1% of young adults. The growth in chronic diseases among individuals between the ages of 18 and 34 years can be explained by obesity and depression, which caused a 7-point growth from 2013 to 2023. With the trends in the prevalence of diseases such as cancer, chronic kidney disease (CKD), and diabetes on the rise, there is a growing need for predictive and human-relevant platforms, such as 3D cell culture, to enhance preclinical disease modeling and reduce research and development failures. Additionally, pharmaceutical and biotechnology companies are investing heavily in 3D technologies to reduce drug development costs and improve efficacy. Government funding for regenerative medicine and stem cell research also plays a key role in fostering innovation in this sector.

To get more information on this market Request Sample

In addition, the increasing adoption of personalized medicine and organ-on-a-chip technologies is also supporting the United States 3D cell culture market growth. 3D cell cultures enable tailored treatments by closely simulating patient-specific tissue responses, enhancing therapeutic outcomes. The growing focus on reducing animal testing due to ethical concerns and regulatory restrictions has further enhanced the demand for alternative testing methods. On April 14, 2025, the FDA announced a policy shift favoring the use of 3D human organoids, organ-on-a-chip systems, and artificial intelligence modeling in lieu of animal testing for investigational new drugs. This move aims to reduce research and development expenses, lower drug pricing, and eliminate unnecessary animal tests, especially in instances where human safety data is already available globally. The strategy emphasizes the growing reliance of the U.S. on human-relevant, lab-based models, which play a vital role in the development of the 3D cell culture market. Technological advancements, such as bioprinting and microfluidics, are expanding the applications of 3D cell cultures in tissue engineering and disease modeling. Collaborations between academic institutions and industry players are also accelerating commercialization, making 3D cell culture a vital tool in modern medical research and drug discovery.

United States 3D Cell Culture Market Trends:

Shift from 2D to 3D Cell Models for Enhanced Accuracy

A major trend in the market is the growing shift from traditional 2D models to 3D systems. Researchers and pharmaceutical companies are increasingly adopting 3D cell culture to bridge the experimental gap between in vitro and in vivo conditions. These models offer a more physiologically relevant environment that closely mimics human tissue architecture, improving the accuracy and predictive power of drug testing and disease research. This shift is driven by the limitations of 2D cultures in replicating complex cellular interactions, leading to unreliable drug efficacy and safety profiles. As a result, pharmaceutical firms are integrating 3D models early in the drug discovery process to reduce costly late-stage failures. Notably, in October 2024, a 3D cell culture study funded by MicroQuin through the ISS National Lab revealed how microgravity affects cancer cell signaling an insight that helped develop a novel cancer therapy, creating a positive United States 3D cell culture market outlook.

Technological Integration Accelerates Market Growth

The convergence of next-generation technologies with 3D cell culture is revolutionizing biomedical research in the U.S. High-throughput screening, advanced imaging, microfluidics, and automation are now integral components of 3D cell culture workflows. These advancements enable real-time monitoring of cellular behavior within 3D environments and allow for high-content screening of potential drug candidates. Such integration is streamlining workflows, improving experimental efficiency, and facilitating more complex biological studies. A significant statistical highlight comes from the U.S. National Institutes of Health (NIH), which awarded 57,422 biomedical research grants in 2022, the highest globally, according to the World Health Organization (WHO). This level of funding supports cutting-edge research using 3D models, including innovations such as TheWell Bioscience's February 2023 launch of a rapid organoid and cell harvesting solution. According to the United States 3D cell culture market forecast, these technological breakthroughs are making 3D cell culture platforms more accessible, encouraging widespread adoption and contributing to the market’s rapid expansion.

Rising Industry Adoption and Commercial Product Innovation

U.S.-based pharmaceutical and biotech sectors are increasingly embedding 3D cell culture technologies into their drug discovery pipelines. These models help reduce R&D costs, lower failure rates in late-stage trials, and provide more reliable data on drug responses. The market is also experiencing a rise in commercially available 3D cell culture kits, platforms, and assay systems. This wave of innovation is not limited to large corporations; startups are also actively developing user-friendly, standardized tools to democratize access to advanced cell culture systems. For example, the space-based 3D cell culture research led by MicroQuin in 2024 revealed critical cancer biology insights and demonstrated the potential of advanced 3D systems to support novel drug development strategies. These commercial innovations, coupled with academic-industry collaborations and strong governmental support, continue to propel the 3D cell culture sector in the U.S., fostering a highly competitive and dynamic market environment.

United States 3D Cell Culture Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States 3D cell culture market, along with forecast at the country and regional levels from 2026-2034. The market has been categorized based on product, application, and end user.

Analysis by Product:

- Scaffold-Based Platforms

- Scaffold-Free Platforms

- Microchips

- Bioreactors

- Others

Scaffold-based platforms stand as the largest component in 2025, holding around 48.1% of the market, due to their ability to closely mimic the extracellular matrix (ECM). These platforms, including hydrogels, polymeric scaffolds, and nanofiber-based matrices, are widely adopted in drug screening, cancer research, and regenerative medicine due to their versatility in replicating tissue-specific microenvironments. Their high reproducibility and compatibility with high-throughput screening make them a preferred choice for pharmaceutical and biotechnology companies. Additionally, advancements in biomaterials, such as decellularized ECM and smart hydrogels, have enhanced scaffold functionality, further driving adoption. The segment’s leadership is also reinforced by strong academic-industry collaborations and increasing R&D investments in organoid and tissue engineering applications. As demand for physiologically relevant models grows, scaffold-based platforms are expected to maintain their dominance, supported by ongoing innovations in biocompatible and tunable scaffold designs.

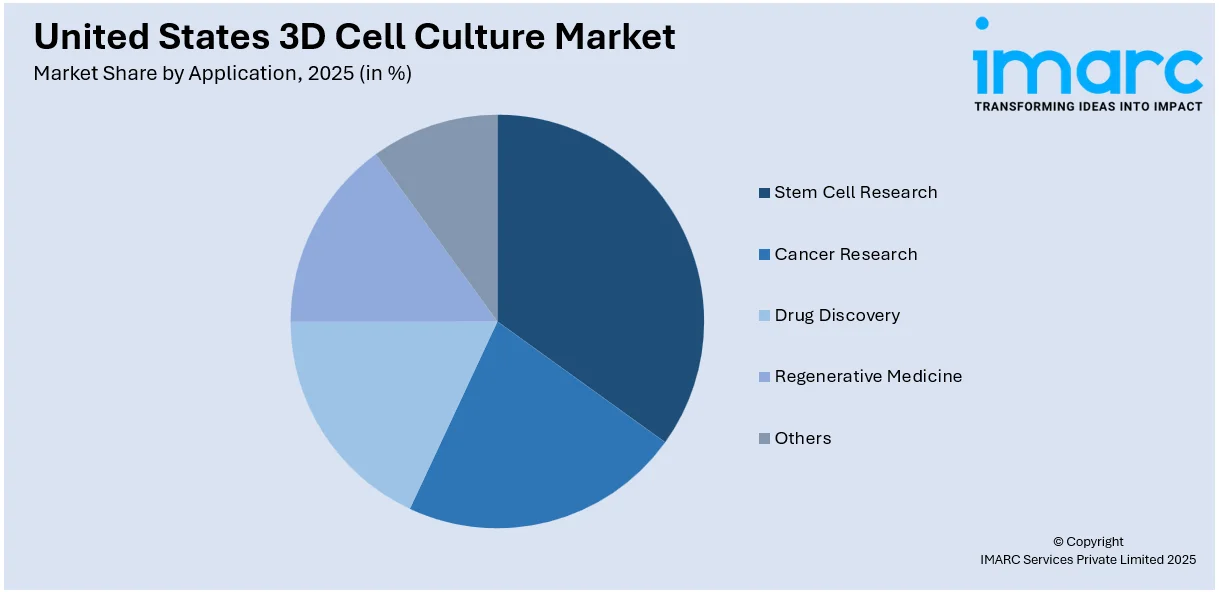

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Cancer Research

- Stem Cell Research

- Drug Discovery

- Regenerative Medicine

- Others

Stem cell research leads the market with around 34.9% of market share in 2025, driven by the critical need for advanced models that accurately replicate human physiology for regenerative medicine and disease modeling. Unlike traditional 2D cultures, 3D systems enable stem cells to self-organize into organoids and spheroids, better mimicking tissue complexity and improving differentiation studies. The growing focus on personalized medicine, coupled with rising investments in induced pluripotent stem cell (iPSC) research, has accelerated adoption. Additionally, 3D cultures enhance drug toxicity screening and developmental biology research by providing more predictive outcomes. Government funding, particularly for neurodegenerative and cardiovascular disease studies, further solidifies this segment’s dominance. With breakthroughs in CRISPR-based gene editing and organ-on-a-chip technologies integrating stem cells, the demand for 3D cultures in stem cell applications is poised to expand, reinforcing its leading position in the market.

Analysis by End User:

- Biotechnology and Pharmaceutical Companies

- Contract Research Laboratories

- Academic Institutes

- Others

Biotechnology and pharmaceutical companies lead the market with around 46.8% of market share in 2025, leveraging these advanced models to enhance drug discovery and development processes. The shift from traditional 2D cultures to 3D systems is driven by the need for more physiologically relevant data, reducing costly late-stage clinical failures. These companies prioritize 3D platforms, particularly tumor spheroids and organoids for high-throughput screening, toxicity testing, and precision medicine applications, as they better replicate human tissue responses. Rising R&D investments, coupled with pressure to accelerate drug approvals, further propel adoption. Additionally, collaborations with academic institutions and biotech startups foster innovation in scaffold-based and organ-on-a-chip technologies tailored to pharmaceutical needs. With the FDA increasingly recognizing 3D models for preclinical validation, their integration into standard workflows is expanding. As drug development grows more complex, biopharma firms will remain the primary drivers of 3D cell culture demand, solidifying their position as the largest end-user segment.

Regional Analysis:

- Northeast

- Midwest

- South

- West

In 2025, Northeast accounted for the largest market share, supported by its dense concentration of leading academic institutions, biopharma hubs, and government-funded research centers. Boston and New York’s innovation ecosystems—home to Harvard, MIT, and top-tier pharmaceutical firms drive cutting-edge advancements in organoid models and microphysiological systems. High R&D expenditure, particularly in cancer and neurodegenerative disease research, fuels demand for 3D technologies that enhance translational outcomes. The region also benefits from robust NIH funding and proximity to regulatory agencies, accelerating the commercialization of 3D-based drug screening platforms. Strategic collaborations between universities and industry players, such as the Wyss Institute’s organ-on-a-chip initiatives, further solidify the Northeast’s leadership. With Massachusetts and New York prioritizing life sciences growth through tax incentives and infrastructure investments, the region is poised to maintain its dominance as adoption of 3D cultures expands in precision medicine and regenerative therapies.

Competitive Landscape:

The competitive landscape of the 3D cell culture market is characterized by intense innovation and strategic collaborations as key players vie for dominance. Leading participants are investing heavily in R&D to develop advanced scaffold-free systems, organ-on-a-chip platforms, and bioprinting technologies to enhance physiological relevance. Strategic partnerships with academic institutions and biopharmaceutical firms are accelerating product commercialization, while acquisitions of niche startups expand technological capabilities. Companies are also focusing on regulatory compliance and scalability to meet growing demand for preclinical testing models. Customized solutions for cancer research and regenerative medicine are being prioritized to cater to specialized applications. Additionally, efforts to reduce production costs and improve automation aim to broaden market accessibility. As competition intensifies, differentiation through proprietary technologies and high-throughput compatibility will be critical for sustaining leadership in this rapidly changing sector.

The report provides a comprehensive analysis of the competitive landscape in the United States 3D cell culture market with detailed profiles of all major companies.

Latest News and Developments:

- May 2025: Amerigo Scientific introduced novel 3D electrospun polycaprolactone (PCL) scaffolds designed for 3D cell culture applications. These scaffolds, which were created to overcome the drawbacks of conventional 2D cell culture systems, will provide scientists with a biomimetic microenvironment that improves tissue engineering, drug discovery, and cellular behavior study.

- January 2025: Massachusetts-based MilliporeSigma, the Life Science division of Merck KGaA, successfully completed the acquisition of HUB Organoids B.V. (HUB). With this acquisition, researchers seeking to use organoids to better study the effects of medication response early in the development process will have a valuable resource to work with due to the combination of MilliporeSigma’s advancements in 3D cell culture and its diverse portfolio with HUB’s cutting-edge technologies.

- June 2024: Pennsylvania-based Predictive Oncology Inc. revealed that its innovative 3D cell culture model is now available to help with cancer treatment discovery and future drug development. The company’s studies showcase how important it is to incorporate more complex 3D cell uses into the global drug discovery and development processes in order to reduce the time to market and cost of new drugs.

- February 2024: Cell Microsystems established a partnership with OMNI Life Science (OLS) to introduce three groundbreaking products in the United States and Canada. This includes the CERO 3D Cell Culture Incubator & Bioreactor, an innovative device that generates an ideal cell culture environment for the development of special 2D cell culture models, which include organoids, stem cells, and tissues.

United States 3D Cell Culture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Scaffold-Based Platforms, Scaffold-Free Platforms, Microchips, Bioreactors, Others |

| Applications Covered | Cancer Research, Stem Cell Research, Drug Discovery, Regenerative Medicine, Others |

| End Users Covered | Biotechnology and Pharmaceutical Companies, Contract Research Laboratories, Academic Institutes, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States 3D cell culture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States 3D cell culture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States 3D cell culture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 3D cell culture market in the United States was valued at USD 2,997.1 Million in 2025.

The United States 3D cell culture market is projected to exhibit a CAGR of 12.34% during 2026-2034, reaching a value of USD 8,998.6 Million by 2034.

The market is driven by increasing demand for effective drug discovery models, growing investments in regenerative medicine and cancer research, advancements in 3D bioprinting technology, and rising interest in alternatives to animal testing.

Scaffold-based platforms accounted for the largest US product market share due to their replicating natural tissue environments, favored for drug development and regenerative medicine. Their dominance is sustained by material innovations and strong industry-academia partnerships driving advanced applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)