United States 5G Chipset Market Size, Share, Trends and Forecast by Chipset Type, Operational Frequency, End User, and Region, 2025-2033

United States 5G Chipset Market Size and Share:

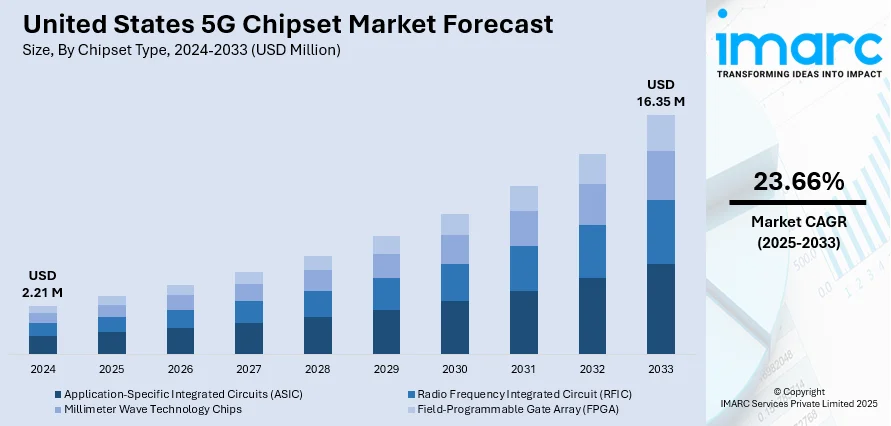

The United States 5G chipset market size was valued at USD 2.21 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 16.35 Million by 2033, exhibiting a CAGR of 23.66% from 2025-2033. Northeast is currently witnessing strong growth fueled by national infrastructure expansion and accelerating demand for edge computing capability. Government-sponsored initiatives are increasing 5G coverage, while technology growth in edges is expediting real-time data processing across industries. These developments are promoting extensive use of high-performance chipsets, facilitating innovation in various sectors like healthcare, manufacturing, and smart cities, contributing to United States 5G chipset market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.21 Million |

|

Market Forecast in 2033

|

USD 16.35 Million |

| Market Growth Rate 2025-2033 | 23.66% |

The United States 5G chipset market is picking up considerable steam thanks to strong government support and smart investments in nationwide telecommunications infrastructure. Federal plans to enhance broadband availability throughout rural and underserved communities are driving the implementation of 5G-compatible infrastructure at a faster rate, which, in turn, raises the need for sophisticated chipsets. Public funding initiatives and deregulatory policies are stimulating quick buildup of base stations, small cells, and network densification projects. This system support lowers entry barriers for the market and stimulates innovation for chipset vendors. Furthermore, cooperative efforts between private developers and public agencies to release high-frequency spectrum for 5G utilization are facilitating more efficient and responsive chipsets. Such measures cumulatively build a healthy climate conducive to the adoption of technology, precipitating a boom in applications that are dependent on 5G connectivity. With the growth in infrastructure, the requirement for chipsets that can smoothly support varied network conditions will be on the rise steadily. For instance, in July 2024, Qualcomm released the Snapdragon 4s Gen 2 chipset, offering 1Gbps 5G connectivity, greater power efficiency, and better multimedia features; Xiaomi will begin releasing devices based on this chip by the end of the year.

To get more information on this market, Request Sample

Heightened focus on edge computing is propelling significant demand for sophisticated 5G chipsets in the United States. For example, in December 2024, Apple revealed rolling out its own cellular modem chips starting in 2025, with the goal of replacing Qualcomm components and fully competing by 2027, starting with the iPhone SE refresh. Moreover, as services and industries transition toward edge computing models, the demand for chipsets that can process data in real time at the network edge is on the rise. This reduces latency and decongests centralized data centers, facilitating rapid decision-making in mission-critical applications, such as autonomous systems, telemedicine, and smart cities. The exponential growth of data-intensive technologies, which span from high-definition video analytics to sensor networks powered by artificial intelligence (AI) needs chipsets that can execute computationally demanding tasks locally without hindering connectivity. 5G chipsets are being designed with enhanced processing, thermal performance, and edge-specific feature support, such as low power modes and better security protocols. This trend toward edge-centric infrastructure not only enhances performance but even increases the scalability of new applications. As edge computing expands, so will the strategic value of robust and flexible 5G chipsets.

United States 5G Chipset Market Trends:

Growth of 5G Adoption and Network Rollout

The U.S. 5G chipset market is experiencing strong momentum fueled by the quick uptake of emerging connectivity. More than 40% of wireless connections in 2023 were 5G, with coverage reaching over 330 million individuals, according to CTIA. Such broad adoption of 5G networks is generating unprecedented levels of demand for specialized chipsets for high-speed and low-latency communications. Such chipsets, critical to facilitating smooth data transfer, are being improved through advancements in integration technology. Modems, processors, and RF components are now designed as integrated systems, minimizing hardware complexity but maximizing performance. Service providers such as T-Mobile are also constantly evolving their infrastructure, with latency reducing from 55 milliseconds in Q1 2022 to 46 milliseconds in Q1 2024. These advancements are crucial in providing a seamless and effective user experience, and they all point towards the increasing influence of chipset technology in maintaining the speed and quality of the 5G rollout throughout the country.

Technological Innovation in Integrated 5G Chipsets

With the maturing of the 5G ecosystem, chipset innovation is fast becoming the foundation for United States 5G chipset market growth. There is a shift among manufacturers towards the development of highly integrated chipsets that merge the processing unit, modem, and RF components into smaller form factors. Such integration provides maximum power efficiency, improves signal processing, and accommodates sophisticated network features, making the product appropriate for various applications. In addition to supporting quicker mobile connectivity, these chipsets are performing a critical role in advancing network responsiveness, lowering latency, and providing secure, dependable communications. The revolution is fueled by an acute need for increased data throughput as well as the capacity to deal with complicated communication tasks simultaneously. With these developments, the American market is creating chipsets not only meeting existing needs but also scalable for future network expansions such as 5G Advanced and ultimately 6G. This development points to the extent to which integrated silicon solutions are defining the next era of telecommunication.

Enlargement of Use Cases Throughout Major Industry Segments

The impact of 5G chipsets is quickly expanding beyond smartphones into general industry segments throughout the American economy. Chief among drivers of such growth is the growth in Internet of Things (IoT) applications, for which low-latency, high-performance connections are essential. It has been reported that 33% of total world-wide Internet of Things (IoT) solution expenditure now originates with U.S. purchasers, reflecting home-country leadership in this market. Advanced chipsets are being designed to enable such applications as connected health devices and autonomous vehicles through to industrial automation and virtual reality streaming media. These abilities facilitate real-time response, predictive maintenance, and remote monitoring—functions vital for current-day digital infrastructure. In the entertainment space, blazing data processing speeds driven by 5G chipsets are changing the user experience for virtual reality and 4K streaming. With these uses spreading far and wide, the requirement for custom, power-efficient, and high-performance chipsets will only grow stronger, solidifying their position as enabler technologies of the nation's digital and economic evolution.

United States 5G Chipset Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the United States 5G chipset market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on chipset type, operational frequency, and end user.

Analysis by Chipset Type:

- Application-Specific Integrated Circuits (ASIC)

- Radio Frequency Integrated Circuit (RFIC)

- Millimeter Wave Technology Chips

- Field-Programmable Gate Array (FPGA)

Radio Frequency Integrated Circuits (RFICs) dominate the chipset type market with a substantial 47.3% market share in 2024. RFICs are essential in contemporary wireless communication systems because they combine several radio frequency functions in one compact and efficient chipset. RFICs support devices in transmitting and receiving signals through multiple wireless standards including 4G, 5G, Wi-Fi, and Bluetooth. The increased use of intelligent devices and the demand for more rapid data transfer have boosted the evolution and implementation of RFICs. Development in semiconductor technology has enabled the manufacturing of RFICs with reduced power consumption, compact footprint, and better performance. They are especially well suited for smartphones, IoT devices, and wearables. The miniaturization and multifunctional trend further solidifies RFICs' dominance among chipset types because they address the changing wireless connectivity requirements with greater efficiency and scalability.

Analysis by Operational Frequency:

- Sub 6 GHz

- Between 26 and 39 Ghz

- Above 39 Ghz

Sub 6 GHz frequencies provide wide coverage with robust penetration through buildings and barriers, rendering them well-suited for wide-area 5G deployment. They are well-balanced between range and capacity, enabling uniform connectivity in urban and rural areas, which is essential for mass-market traction and varied consumer and industrial wireless use cases.

The 26 to 39 GHz band, which is in the millimeter-wave range, provides ultra-high data speeds and low latency, ideal for dense city and indoor use. It offers improved applications such as augmented reality and autonomous systems but is of short range and suffers more signal loss than lower bands.

Frequencies of 39 GHz and above offer very high bandwidth and low latency, which can support futuristic 5G use cases like holographic communication and exact remote control. Though their coverage is limited by atmospheric absorption, these bands are worth it for high-capacity, managed deployments in specialized settings like stadiums, industrial campuses, and innovation centers.

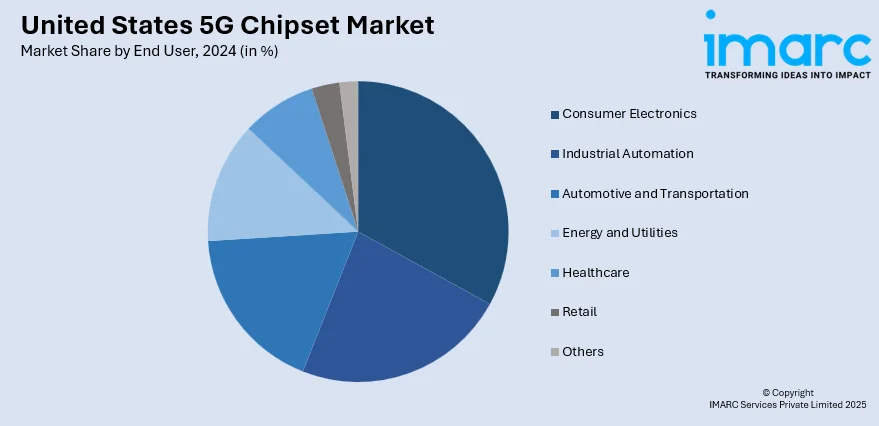

Analysis by End User:

- Consumer Electronics

- Industrial Automation

- Automotive and Transportation

- Energy and Utilities

- Healthcare

- Retail

- Others

Consumer Electronics has a 35.3% share of the end-user market in 2024, as it is the largest demand sector for radio frequency integrated circuits. Consumer Electronics includes consumer devices like smartphones, tablets, laptops, wearables, and smart home devices that all depend on sophisticated RF technology to connect wirelessly. The fast rollout of 5G and Wi-Fi 6 technologies has increased consumer demands for smooth, high-speed communication, compelling manufacturers to add more advanced RF components. Consumer usage patterns—such as the rise of remote work, streaming services, and connected smart devices—also accelerate demand for power-efficient and space-saving RFICs. Advances in power efficiency, miniaturization, and multifunctionality enable consumer electronics to accommodate higher data rates and improved battery life. As such, the consumer electronics business remains a key driver of RFIC market growth with consistent investments in R&D and new product development targeted at keeping pace with changing connectivity needs.

Regional Analysis:

- Northeast

- Midwest

- South

- West

The Northeast region is dominant United States 5G chipset market outlook due to its dense population of urban agglomerations, high-end telecommunication infrastructure, and technology penetration rates. Major urban centers in the Northeast have experienced the high-speed 5G network deployments, driven by massive investments in network upgrades and spectrum. The high population and commercial centers drive high demand for better mobile broadband services, pushing the requirement for advanced 5G chipsets that allow more data speed and less latency. Also, the Northeast's mature ecosystem of tech firms, research institutions, and early adopters speeds the take-up of next-generation smart devices and IoT applications that are dependent on sophisticated chipsets. The regional momentum makes the Northeast a strategic market, where repeated 5G expansions and chipset tech innovations continue to propel growth, making it a major participant in the overall national 5G chipset market.

Competitive Landscape:

United States 5G chipset market forecast is dominated by fierce innovation and strategic investment in semiconductor design of the future. Players are positioning themselves to develop high-performance, low-energy chipsets to support an increasing variety of 5G-enabled devices such as smartphones, industrial sensors, smart home applications, and autonomous vehicles. The competition is driven by ongoing improvements in processing capabilities, multi-band frequency support, and incorporation of artificial intelligence (AI) capabilities within chipsets. Investment in miniaturizing components and enhancing functionality has resulted in the evolution of system-on-chip (SoC) architectures, rationalizing 5G connectivity for consumer as well as enterprise applications. Also, players are focusing on scalable and modular designs to cater to varied applications in public as well as private networks. Focus on research and development (R&D), intellectual property building, and strategic collaborations is driving the future growth of the market. This vibrant and highly specialized ecosystem supports the United States leadership in future wireless technology, making it a center for 5G chipset innovation and development.

The report provides a comprehensive analysis of the competitive landscape in the United States 5G chipset market with detailed profiles of all major companies.

Latest News and Developments:

- April 2025: Orbic North America and GCT Semiconductor entered into a letter of intent to produce and deliver Orbic-branded mobile hotspots and FWA gateways based on GCT's Verizon-certified 5G module. The partnership will accelerate wireless connectivity with a specific focus on Verizon and other global network operators.

- April 2025: T-Mobile US extended a partnership with Nokia to improve its 5G network. Nokia will deliver hardware, software, and support, including its AirScale RAN portfolio and AI-driven MantaRay Self-Organising Networks. The partnership is designed to enhance performance, efficiency, and scalability in support of T-Mobile's 5G network evolution.

- March 2025: Ericsson, Qualcomm, and Thales Alenia Space completed a landmark in combining satellite mobile networks with 5G technology. Their success in testing a 5G NTN call by using 5G chipsets and a LEO satellite channel highlights the prospects of world-wide connectivity, marking the beginning of seamless integration of satellite and terrestrial networks.

- February 2025: SEALSQ Corp. progressed its Quantum ASIC development under its Quantum Roadmap. Its program across countries such as the USA is for augmenting semiconductor security using post-quantum cryptographic algorithms.

- November 2024: Vodafone and AMD teamed up to build next-generation mobile base stations. They are validating AMD's Zynq UltraScale+ RFSoC devices in order to boost 5G capacity, minimize antenna size, and decrease power consumption. The partnership is intended to enable AI-driven algorithms, energy-saving networks, and Open RAN integration for enhanced 5G services.

United States 5G Chipset Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Chipset Types Covered | Application-Specific Integrated Circuits (ASIC), Radio Frequency Integrated Circuit (RFIC), Millimeter Wave Technology Chips, Field-Programmable Gate Array (FPGA) |

| Operational Frequencies Covered | Sub 6 GHz, Between 26 and 39 Ghz, Above 39 Ghz |

| End Users Covered | Consumer Electronics, Industrial Automation, Automotive and Transportation, Energy and Utilities, Healthcare, Retail, Others |

| Regions Covered | Northeast, Midwest, South, West |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the United States 5G chipset market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the United States 5G chipset market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the United States 5G chipset industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The 5G chipset market in the United States was valued at USD 2.21 Million in 2024.

The United States 5G chipset market is projected to exhibit a CAGR of 23.66% during 2025-2033, reaching a value of USD 16.35 Million by 2033.

The United States 5G chipset industry is propelled by large-scale 5G network deployments and growing demand for intelligent devices. The need for greater connectivity in applications, such as IoT, autonomous vehicles, and enhanced reality drives chipset development. Energy efficiency, greater data speeds, and low latency requirements further drive the industry, spurring chipset development for various consumer and industrial applications.

Consumer electronics is the leading market share with 35.3% sector in the United States 5G chipset industry. Smartphones, wearables, and smart home products lead demand for sophisticated 5G chipsets, demanding fast data speeds and dependable connectivity. Increased uptake of connected devices and changing wireless standards support this segment's dominance, creating ongoing growth and development in chipset technology.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)